Key Insights

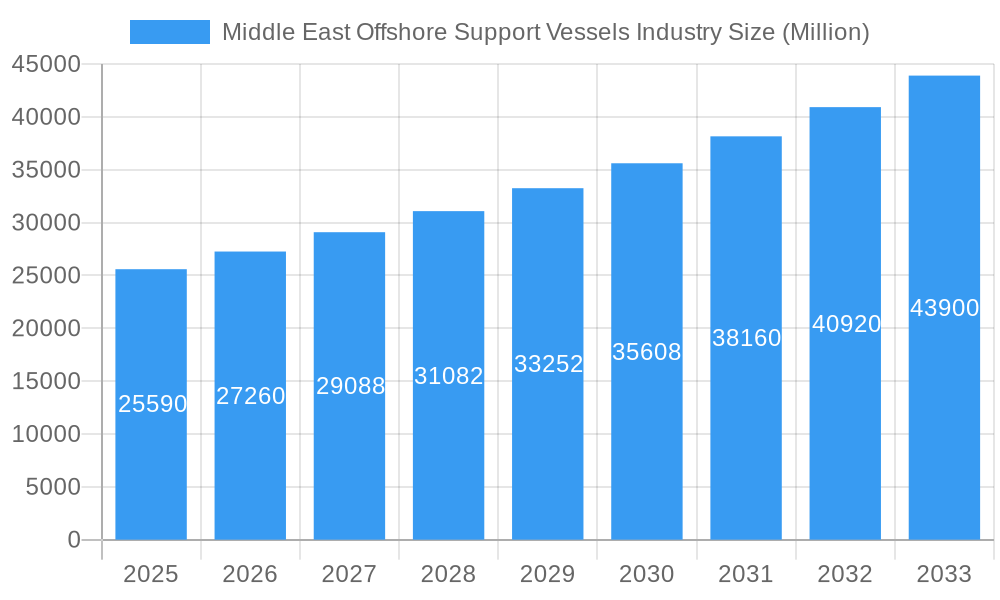

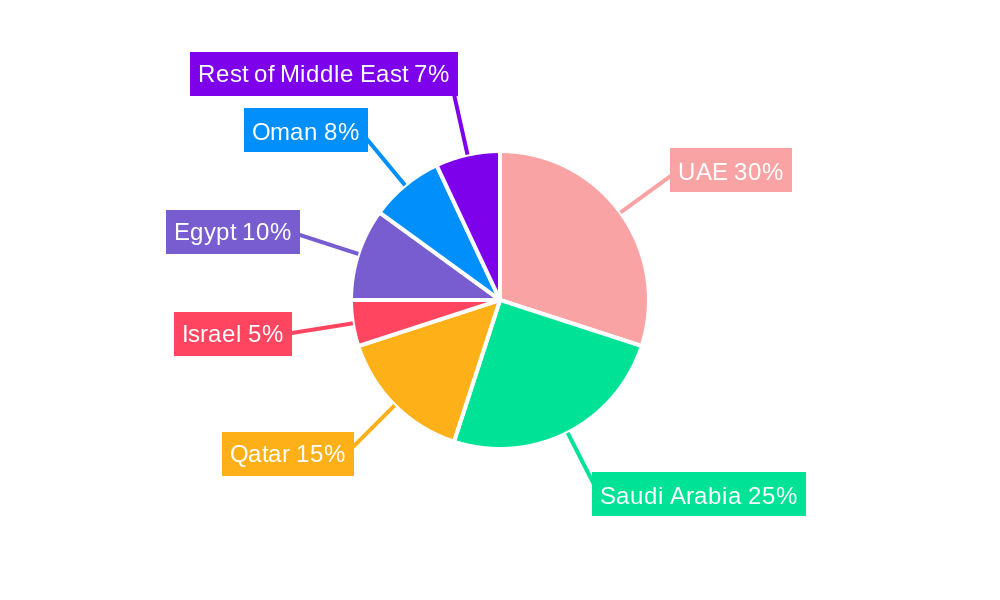

The Middle East Offshore Support Vessels (OSV) market, valued at $25.59 billion in 2025, is projected to experience robust growth, driven by the region's significant investments in oil and gas exploration and production, coupled with the burgeoning offshore wind energy sector. The Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033 signifies considerable expansion opportunities. Key drivers include increasing demand for sophisticated vessels like Anchor Handling Tug Supply Vessels (AHT/AHTS) and Platform Supply Vessels (PSV) to support offshore operations in challenging environments. The expansion of offshore wind farms across the region, particularly in countries like Saudi Arabia and the UAE, further fuels market growth. While potential regulatory hurdles and fluctuating oil prices represent constraints, the overall outlook remains positive, bolstered by government initiatives to diversify energy sources and attract foreign investment in energy infrastructure projects. Major players like Maersk AS, Tidewater Inc., and Seacor Marine Holdings Inc. are actively participating, contributing to increased competition and technological advancements within the sector. The regional segmentation, with significant contributions from the UAE, Saudi Arabia, and Qatar, reflects the concentration of oil and gas activities and renewable energy development in these countries.

Middle East Offshore Support Vessels Industry Market Size (In Billion)

The market's segmentation highlights the dominance of AHT/AHTS and PSVs, reflecting their crucial role in supporting offshore operations. Oil and gas exploration and production currently constitute the largest application segment, although the offshore wind farm development segment is predicted to witness significant growth over the forecast period, attracting substantial investment and creating new demand for specialized OSVs. This shift towards renewable energy will reshape the OSV landscape, demanding vessels equipped to handle the unique requirements of wind farm construction and maintenance. The "Other Types" segment, which may encompass smaller support vessels or specialized units, will likely exhibit a steady growth trajectory, mirroring the overall market expansion. Competition within the Middle East OSV market is expected to remain intense, with both established international players and regional companies vying for market share. This competitive landscape should foster innovation and efficiency improvements within the industry.

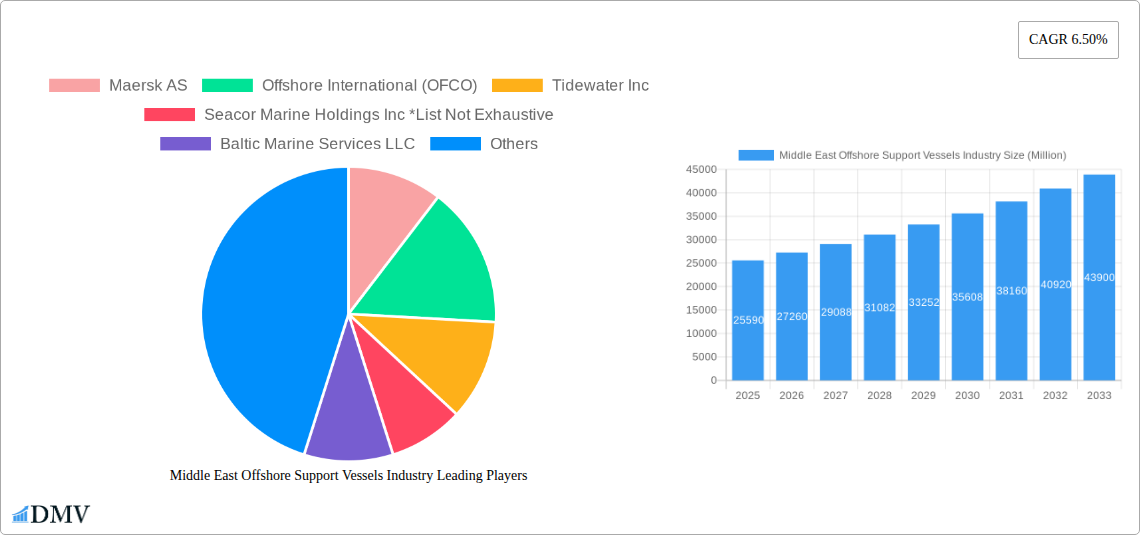

Middle East Offshore Support Vessels Industry Company Market Share

Middle East Offshore Support Vessels Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East Offshore Support Vessels (OSV) industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a focus on the period 2019-2033, this study examines market trends, technological advancements, and key players, projecting significant growth driven by substantial investments in offshore oil and gas exploration and renewable energy projects. The report's comprehensive approach covers market sizing, segmentation, competitive analysis, and future opportunities, making it an essential resource for strategic decision-making.

Middle East Offshore Support Vessels Industry Market Composition & Trends

This section offers a comprehensive analysis of the Middle East Offshore Support Vessels (OSV) market, scrutinizing its competitive dynamics, innovation landscape, regulatory environment, and key market influencers. We evaluate market concentration, the pace of innovation, governing regulations, potential substitute offerings, the profiles of primary end-users, and the prevalence of merger and acquisition (M&A) activities. Our analysis spans the historical period from 2019 to 2024, uses 2025 as the base year for current assessment, and provides forecasts extending to 2033.

Market Concentration & M&A Activity: The Middle East OSV market is characterized by a moderately concentrated structure, with established players like Maersk AS, Offshore International (OFCO), Tidewater Inc, Seacor Marine Holdings Inc, Baltic Marine Services LLC, Abu Dhabi National Oil Company (ADNOC), and Bourbon Corporation SA holding substantial market shares. However, this landscape is dynamically evolving, significantly influenced by strategic M&A initiatives. A prime example is the ADNOC Logistics & Services acquisition of Zakher Marine International in July 2022. This landmark deal substantially reshaped market dynamics by integrating 24 jack-up barges and 38 OSVs into ADNOC's fleet, potentially elevating its total fleet size to over 300 vessels. Further consolidation is evident in the Shuaa Capital acquisition of Allianz Marine and Logistics Services in March 2022. The cumulative value of these M&A transactions is estimated at approximately $XX Million. The distribution of market share among key participants is subject to ongoing shifts driven by these corporate activities and the securing of new contracts; an in-depth breakdown is available in the full market report.

Innovation & Regulation: The industry is actively embracing continuous innovation, particularly in vessel design. This includes the integration of cutting-edge technologies aimed at enhancing operational efficiency, bolstering safety standards, and ensuring stringent environmental compliance. Furthermore, the market's trajectory is significantly shaped by increasingly rigorous regulatory frameworks that prioritize emission reduction targets and operational safety protocols. Emerging substitute products, such as advanced drones and remotely operated vehicles (ROVs), are beginning to influence specific segments of the OSV market. The principal end-users remain dominant oil and gas companies, including major entities like Saudi Aramco and ADNOC, alongside a growing presence of offshore wind farm developers and specialized marine engineering and construction firms.

Middle East Offshore Support Vessels Industry Industry Evolution

This section meticulously charts the evolutionary path of the Middle East OSV industry, detailing its growth trajectory from 2019 through to projections for 2033. It incorporates significant technological advancements and the impact of evolving market demands, offering specific data points on historical and projected growth rates, alongside adoption metrics for new technologies and vessel types.

The Middle East OSV market experienced a period of volatility between 2019 and 2024, largely attributed to fluctuations in global oil prices and a temporary dip in exploration activities. However, the market is anticipated to undergo a substantial growth phase from 2025 to 2033, propelled by a confluence of powerful drivers. Foremost among these is Saudi Aramco's ambitious plan to significantly increase its oil production capacity by 2027, with a substantial focus on offshore fields, which will inevitably escalate the demand for OSVs. Concurrently, escalating investments in offshore wind farm development across the region are creating new avenues of opportunity for specialized OSVs. Ongoing large-scale marine engineering and construction projects further bolster the market's growth prospects. We project a Compound Annual Growth Rate (CAGR) of approximately XX% for the period between 2025 and 2033, with the market size anticipated to reach $XX Million by 2033. Technological advancements, including the widespread adoption of automation and digitalization in OSV operations, are proving instrumental in enhancing efficiency and profitability, thereby fueling market expansion. The escalating demand for environmentally sustainable vessels also acts as a catalyst for necessary technological upgrades across the fleet.

Leading Regions, Countries, or Segments in Middle East Offshore Support Vessels Industry

This section identifies the preeminent regions, countries, and market segments within the Middle East OSV industry, providing an in-depth analysis of the underlying factors contributing to their leadership positions.

Dominant Region: The United Arab Emirates (UAE) and Saudi Arabia are strategically positioned to retain their leading regional status. This dominance is underpinned by their extensive oil and gas reserves and substantial ongoing investments in offshore energy infrastructure and project development.

Dominant Vessel Types: Anchor Handling Tug/Supply Vessels (AHTS) and Platform Supply Vessels (PSV) are expected to maintain their leadership. Their versatility and consistent high demand in the oil and gas exploration and production sectors ensure their continued market prominence.

Dominant Application: Oil and gas exploration and production activities remain the core application driving demand for OSVs, fueled by planned capacity expansions and the development of new offshore fields. However, the burgeoning offshore wind farm development sector is rapidly emerging as a significant and growing driver for specialized OSV services.

Key Drivers:

Massive Investments: The substantial capital investments being channeled by national oil companies, such as ADNOC and Saudi Aramco, into expanding their offshore oil and gas production and exploration capabilities are a primary catalyst for market growth.

Government Support: Favorable regulatory frameworks and consistent government support for both renewable energy initiatives and the development of critical offshore infrastructure provide a crucial impetus to the market.

Technological Advancements: Innovations in vessel design, the integration of advanced automation systems, and the development of environmentally conscious technologies are collectively enhancing the operational efficiency and overall appeal of OSVs.

Dominance Factors: The leadership of the UAE and Saudi Arabia in the OSV market is a direct consequence of the high concentration of oil and gas reserves within their territories, significant investments in vital offshore infrastructure, and supportive government policies that actively encourage both domestic and international investments within the energy sector.

Middle East Offshore Support Vessels Industry Product Innovations

Recent innovations in OSVs focus on enhanced fuel efficiency, reduced emissions, improved safety features, and increased operational capabilities. Advanced dynamic positioning systems, automated mooring systems, and remote monitoring technologies are being integrated into new vessels. These features reduce operational costs, enhance safety, and contribute to environmentally sustainable operations. Unique selling propositions (USPs) include specialized vessel designs tailored to specific operational requirements, such as those designed for harsh environments or deep-water operations.

Propelling Factors for Middle East Offshore Support Vessels Industry Growth

The Middle East OSV market's growth is propelled by several factors, including substantial investments in offshore oil and gas projects, the burgeoning offshore wind energy sector, ongoing marine construction activities, and supportive government policies aimed at diversifying energy sources. Saudi Aramco's planned increase in oil production capacity to 13 Million barrels per day by 2027, with a significant offshore component, is a significant growth catalyst. Simultaneously, the region's growing commitment to renewable energy is driving demand for specialized OSVs needed for offshore wind farm construction and maintenance.

Obstacles in the Middle East Offshore Support Vessels Industry Market

The Middle East OSV market faces several significant challenges. Fluctuations in global oil prices can directly impact investment decisions within the oil and gas sector, consequently affecting the demand for OSVs. Supply chain disruptions, particularly concerning the procurement of advanced technologies and specialized skilled labor, pose risks to project timelines and can escalate operational costs. Furthermore, the intensely competitive landscape among OSV providers necessitates the continuous implementation of cost optimization strategies and robust differentiation initiatives to maintain market share and profitability.

Future Opportunities in Middle East Offshore Support Vessels Industry

Emerging opportunities lie in the expansion of offshore wind energy projects, the development of innovative vessel designs with enhanced capabilities, and the adoption of digitalization and automation to improve efficiency and reduce operational costs. Moreover, opportunities exist in providing specialized support services for subsea construction and maintenance, as well as in expanding into new markets within the region.

Major Players in the Middle East Offshore Support Vessels Industry Ecosystem

- Maersk AS

- Offshore International (OFCO)

- Tidewater Inc

- Seacor Marine Holdings Inc

- Baltic Marine Services LLC

- Abu Dhabi National Oil Company (ADNOC)

- Bourbon Corporation SA

Key Developments in Middle East Offshore Support Vessels Industry Industry

May 2023: Saudi Aramco's announcement to increase oil production capacity to 13 Million bopd by 2027, significantly boosting demand for OSVs.

July 2022: ADNOC Logistics & Services' acquisition of Zakher Marine International, expanding its OSV fleet substantially and altering market dynamics.

March 2022: Shuaa Capital's acquisition of Allianz Marine and Logistics Services, signifying significant M&A activity in the sector.

Strategic Middle East Offshore Support Vessels Industry Market Forecast

The Middle East OSV market is strategically poised for robust and sustained growth throughout the forecast period from 2025 to 2033. This projected expansion is underpinned by significant ongoing investments in energy infrastructure and the region's unwavering commitment to diversifying its energy portfolio beyond traditional fossil fuels. The continued expansion and intensification of offshore oil and gas operations, coupled with the rapidly increasing prominence of renewable energy projects, will act as powerful drivers for the demand for a diverse range of OSVs. The strategic adoption of innovative technologies and the ongoing trend of consolidation within the industry will further refine and shape the market's trajectory. Projections indicate that the market will reach an estimated value of $XX Million by 2033, presenting substantial and promising opportunities for both established market participants and new entrants.

Middle East Offshore Support Vessels Industry Segmentation

-

1. Type

- 1.1. Anchor H

- 1.2. Platform Supply Vessels (PSV)

- 1.3. Other Types

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Qatar

- 2.4. Iran

- 2.5. Rest of Middle East

Middle East Offshore Support Vessels Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Iran

- 5. Rest of Middle East

Middle East Offshore Support Vessels Industry Regional Market Share

Geographic Coverage of Middle East Offshore Support Vessels Industry

Middle East Offshore Support Vessels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Offshore Exploration and Production Activities4.; Development of Offshore Wind Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Demand for Dynamic Positioning (DP) Drilling Rigs

- 3.4. Market Trends

- 3.4.1. Platform Supply Vessels (PSVs) are Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Anchor H

- 5.1.2. Platform Supply Vessels (PSV)

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Qatar

- 5.2.4. Iran

- 5.2.5. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Iran

- 5.3.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Anchor H

- 6.1.2. Platform Supply Vessels (PSV)

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Qatar

- 6.2.4. Iran

- 6.2.5. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Anchor H

- 7.1.2. Platform Supply Vessels (PSV)

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Qatar

- 7.2.4. Iran

- 7.2.5. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Qatar Middle East Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Anchor H

- 8.1.2. Platform Supply Vessels (PSV)

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Qatar

- 8.2.4. Iran

- 8.2.5. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Iran Middle East Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Anchor H

- 9.1.2. Platform Supply Vessels (PSV)

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Qatar

- 9.2.4. Iran

- 9.2.5. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Middle East Middle East Offshore Support Vessels Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Anchor H

- 10.1.2. Platform Supply Vessels (PSV)

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. United Arab Emirates

- 10.2.3. Qatar

- 10.2.4. Iran

- 10.2.5. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Maersk AS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Offshore International (OFCO)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tidewater Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Seacor Marine Holdings Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baltic Marine Services LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abu Dhabi National Oil Company (ADNOC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bourbon Corporation SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Maersk AS

List of Figures

- Figure 1: Middle East Offshore Support Vessels Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Offshore Support Vessels Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle East Offshore Support Vessels Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Offshore Support Vessels Industry?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Middle East Offshore Support Vessels Industry?

Key companies in the market include Maersk AS, Offshore International (OFCO), Tidewater Inc, Seacor Marine Holdings Inc *List Not Exhaustive, Baltic Marine Services LLC, Abu Dhabi National Oil Company (ADNOC), Bourbon Corporation SA.

3. What are the main segments of the Middle East Offshore Support Vessels Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.59 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Offshore Exploration and Production Activities4.; Development of Offshore Wind Energy.

6. What are the notable trends driving market growth?

Platform Supply Vessels (PSVs) are Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Demand for Dynamic Positioning (DP) Drilling Rigs.

8. Can you provide examples of recent developments in the market?

In May 2023, Saudi Aramco announced that by 2027, it plans to enhance the production capacity of the Middle East's oil fields from 12 million to 13 million barrels of oil per day (bopd). Notably, a significant portion of this increased production will come from offshore sources, including expanding fields like Marjan, Berri, and Safaniya. As a result, there will likely be considerable demand for offshore construction activities. Consequently, there may be a necessity to augment the fleet of various vessels, including jack-up barges, crew boats, platform supply boats, offshore subsea construction vessels (OSCVs), and offshore support vessels (OSVs). Thus, the fleet's expansion is underway to accommodate the anticipated requirements for offshore operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Offshore Support Vessels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Offshore Support Vessels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Offshore Support Vessels Industry?

To stay informed about further developments, trends, and reports in the Middle East Offshore Support Vessels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence