Key Insights

The Middle East and Africa (MEA) food safety testing market is experiencing robust growth, driven by increasing consumer awareness of foodborne illnesses, stringent government regulations, and the rising demand for safe and high-quality food products. The market's expansion is fueled by factors such as the increasing prevalence of food contamination, growing food processing industries, and a surge in exports, particularly within the region and to international markets. The expanding pet food and animal feed sectors are also contributing significantly to market growth, necessitating comprehensive safety testing protocols. Technological advancements in testing methodologies, particularly the adoption of advanced techniques like LC-MS/MS and HPLC, are enhancing accuracy and efficiency, further propelling market expansion. However, challenges such as a lack of awareness and infrastructure in certain regions, high testing costs, and a shortage of skilled professionals could potentially restrain market growth to some extent. The market is segmented by contaminant type (pathogen, pesticide residue, GMO, and other contaminants), application (pet food/animal feed, food), and technology (HPLC, LC-MS/MS, immunoassay, and others). Major players in the MEA region include international companies with established presence, as well as regional laboratories. The forecast period suggests a continuation of this positive growth trajectory, driven by ongoing investments in food safety infrastructure and technology. Future growth will depend on factors such as strengthening regulatory frameworks, increasing consumer pressure for transparency, and continued advancements in analytical techniques to detect emerging food safety threats.

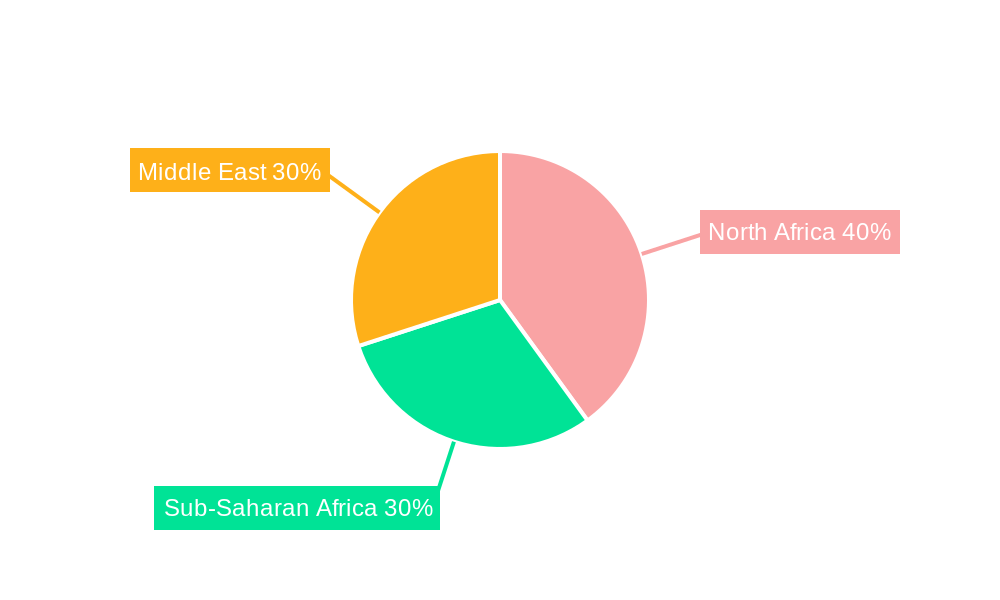

The African sub-region, while currently showing lower market penetration than other parts of MEA, presents significant growth potential due to increasing urbanization, rising disposable incomes, and the expansion of food processing and retail sectors. South Africa, with its relatively developed economy and regulatory environment, is likely to be a key market driver within Africa. Further expansion across the continent will depend on successful investment in laboratory infrastructure, training of personnel, and building consumer trust in local food safety standards. Considering the overall market trends and regional variations, the MEA food safety testing market is expected to remain a dynamic and expanding sector in the coming years, offering attractive opportunities for both established players and emerging companies.

Middle East & Africa Food Safety Testing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East and Africa Food Safety Testing Market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is projected to reach xx Million by 2033, exhibiting significant growth driven by factors detailed within.

Middle East and Africa Food Safety Testing Market Market Composition & Trends

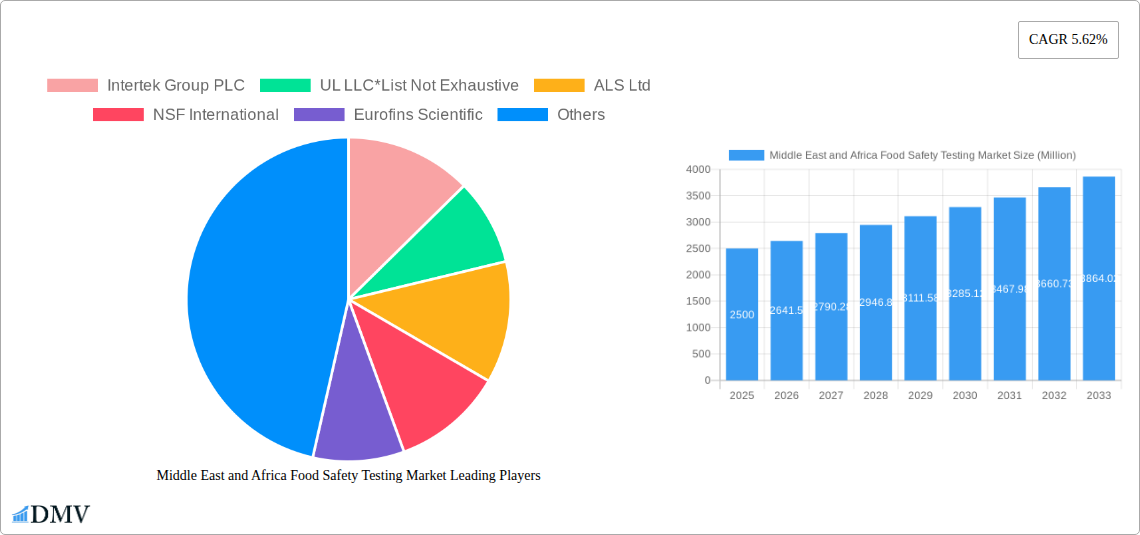

The Middle East and Africa Food Safety Testing market is characterized by a moderately concentrated landscape, with key players like Intertek Group PLC, UL LLC, ALS Ltd, NSF International, Eurofins Scientific, Bureau Veritas Group, SGS SA, INSTITUT Mérieux, AsureQuality Limited, and TUV SUD holding significant market share. However, the market also features a number of smaller, regional players, creating a diverse competitive environment. Market share distribution fluctuates, with larger players often engaging in mergers and acquisitions (M&A) to consolidate their position and expand their service offerings. Recent M&A activity has involved significant investments, with deals valued in the tens of Millions.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% of the market share.

- Innovation Catalysts: Stringent regulatory frameworks, increasing consumer awareness of food safety, and technological advancements in testing methodologies.

- Regulatory Landscape: Varied across different countries, impacting testing standards and compliance requirements. Harmonization efforts are underway, but inconsistencies remain.

- Substitute Products: Limited availability of readily substitutable products; most testing services are specialized and require specific expertise.

- End-User Profiles: Primarily food producers, processors, retailers, and regulatory agencies. The increasing involvement of pet food and animal feed companies is a notable trend.

- M&A Activities: Significant activity observed in recent years, driven by the pursuit of market consolidation, geographic expansion, and technological enhancement. Examples include Eurofins Scientific's acquisition of a majority stake in Ajal for Laboratories in 2022 and Mérieux NutriSciences' acquisition of Hortec (Pty) Ltd in the same year. These deals collectively represent hundreds of Millions in investment.

Middle East and Africa Food Safety Testing Market Industry Evolution

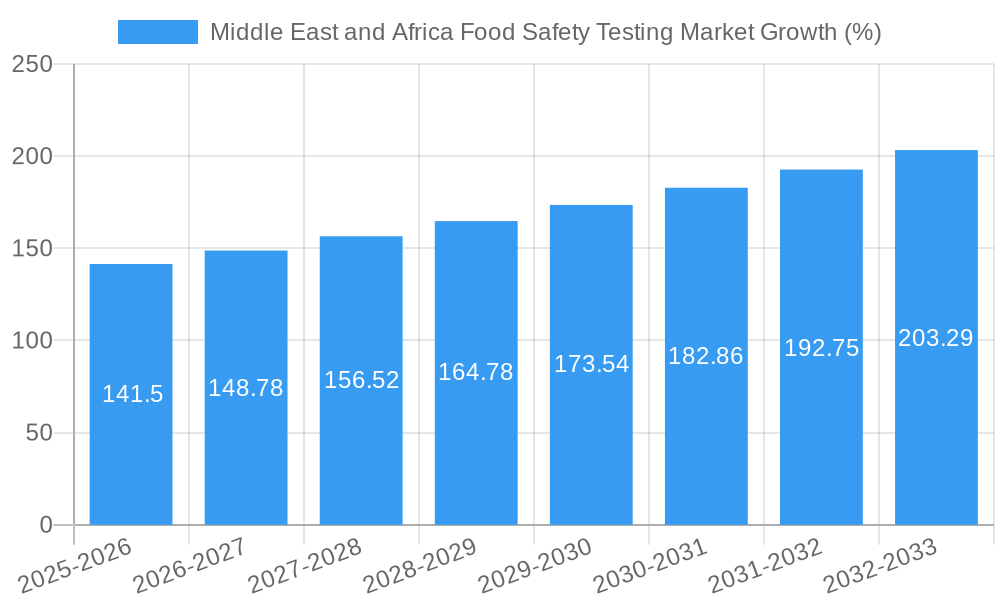

The Middle East and Africa Food Safety Testing market has witnessed robust growth over the historical period (2019-2024), driven by increasing consumer demand for safe and high-quality food products, stricter government regulations, and rising investments in food safety infrastructure. The market's Compound Annual Growth Rate (CAGR) during this period is estimated at xx%, with expectations of continued, albeit potentially moderated, growth in the forecast period (2025-2033). This growth is further fueled by technological advancements, such as the adoption of advanced analytical techniques like LC-MS/MS, and shifting consumer preferences towards healthier and safer food options. Increasing awareness of foodborne illnesses and outbreaks is also a significant driver. The market is also experiencing a gradual shift from traditional testing methods towards more sophisticated and rapid techniques, enabling faster turnaround times and more efficient analysis. This ongoing technological evolution, coupled with rising consumer consciousness and increasingly stringent regulatory measures, positions the Middle East and Africa Food Safety Testing market for continued expansion in the coming years. The adoption rate of advanced technologies like LC-MS/MS is projected to increase by xx% annually during the forecast period.

Leading Regions, Countries, or Segments in Middle East and Africa Food Safety Testing Market

The Middle East and Africa Food Safety Testing market shows significant regional variations. While specific market share data requires further analysis, countries with robust food processing industries and stricter regulations are expected to dominate. Within segment analysis:

- By Contaminant Type: Pathogen testing constitutes the largest segment due to the prevalence of foodborne illnesses. Pesticide and residue testing is another significant segment, driven by the widespread use of agricultural chemicals and consumer concerns regarding their potential impact.

- By Application: The food segment holds the largest market share, followed by pet food and animal feed, reflecting the extensive applications of food safety testing across the food value chain.

- By Technology: LC-MS/MS-based testing is gaining traction due to its high sensitivity and versatility, while HPLC-based methods remain prominent.

Key Drivers:

- Increased Government Regulations: Stricter food safety regulations across the region are driving demand for testing services.

- Investment in Infrastructure: Significant investments in food processing and distribution infrastructure are creating a need for robust food safety testing capabilities.

- Consumer Awareness: Growing consumer awareness of food safety issues is fueling demand for safer and higher-quality food products.

The dominance of specific segments is attributed to a combination of factors including the prevalence of specific contaminants, the level of regulatory scrutiny, and the adoption rate of advanced testing technologies. These drivers contribute to the continued expansion of these segments in the years ahead.

Middle East and Africa Food Safety Testing Market Product Innovations

Recent product innovations in the Middle East and Africa Food Safety Testing market include the development of rapid and highly sensitive testing kits for pathogens, pesticides, and GMOs. These advancements allow for faster results and more efficient analysis, improving the overall speed and accuracy of food safety assessments. Furthermore, portable and on-site testing devices are gaining popularity, enabling faster and more convenient testing across the food supply chain. These new technologies are increasing accessibility and reducing the costs associated with traditional lab-based testing methods, driving further adoption across the region.

Propelling Factors for Middle East and Africa Food Safety Testing Market Growth

Several factors are driving the growth of the Middle East and Africa Food Safety Testing market. Firstly, increasing government regulations and stricter food safety standards are mandating food safety testing across various sectors. Secondly, the growing awareness among consumers about foodborne illnesses and the potential health risks associated with contaminated food is pushing the demand for enhanced food safety measures. Finally, advancements in testing technologies, offering rapid, accurate, and cost-effective solutions, are also significantly propelling market growth. The rising adoption of advanced technologies such as LC-MS/MS reflects this trend.

Obstacles in the Middle East and Africa Food Safety Testing Market Market

Challenges facing the market include inconsistencies in regulatory frameworks across different countries, leading to fragmentation and varying compliance requirements. Furthermore, supply chain disruptions can impact the availability and cost of testing equipment and reagents. The competitive landscape, characterized by both large multinational companies and smaller local laboratories, can also pose challenges for market players. These factors influence the overall growth trajectory of the market.

Future Opportunities in Middle East and Africa Food Safety Testing Market

Emerging opportunities lie in the increasing demand for specialized testing services, such as allergen testing and mycotoxin analysis. The expansion of the pet food and animal feed sectors presents additional growth avenues. The adoption of innovative technologies such as blockchain for traceability and AI for data analysis presents significant opportunities for improving the efficiency and effectiveness of food safety management systems across the region.

Major Players in the Middle East and Africa Food Safety Testing Market Ecosystem

- Intertek Group PLC

- UL LLC

- ALS Ltd

- NSF International

- Eurofins Scientific

- Bureau Veritas Group

- SGS SA

- INSTITUT Mérieux

- AsureQuality Limited

- TUV SUD

Key Developments in Middle East and Africa Food Safety Testing Market Industry

- June 2022: Eurofins Scientific acquires a majority stake in Ajal for Laboratories in Saudi Arabia, expanding its presence in the region.

- March 2022: Mérieux NutriSciences South Africa acquires Hortec (Pty) Ltd, strengthening its pesticide residue testing capabilities.

- February 2022: 836 additional food outlets join the Sharjah Food Safety Program (SFSP), underscoring the commitment to enhance food safety standards in the UAE.

Strategic Middle East and Africa Food Safety Testing Market Market Forecast

The Middle East and Africa Food Safety Testing market is poised for continued growth, driven by the aforementioned factors. The increasing focus on food safety regulations, coupled with advancements in testing technologies, creates a favorable environment for market expansion. Emerging opportunities in specialized testing and innovative technologies will further shape the market landscape in the coming years. The market's consistent growth trajectory indicates significant potential for investors and stakeholders involved in this critical sector.

Middle East and Africa Food Safety Testing Market Segmentation

-

1. Contaminant Type

- 1.1. Pathogen Testing

- 1.2. Pesticide and Residue Testing

- 1.3. GMO Testing

- 1.4. Other Contaminant Testing

-

2. Application

- 2.1. Pet Food and Animal Feed

- 2.2. Meat and Poultry

- 2.3. Dairy

- 2.4. Fruits and Vegetables

- 2.5. others

-

3. Technology

- 3.1. HPLC-based

- 3.2. LC-MS/MS-based

- 3.3. Immunoassay-based

- 3.4. Other Technologies

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Qatar

- 4.4. Egypt

- 4.5. South Africa

- 4.6. Rest of Middle East and Africa

Middle East and Africa Food Safety Testing Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Egypt

- 5. South Africa

- 6. Rest of Middle East and Africa

Middle East and Africa Food Safety Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. Consumer Interest in Food Safety Testing and Quality is Growing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 5.1.1. Pathogen Testing

- 5.1.2. Pesticide and Residue Testing

- 5.1.3. GMO Testing

- 5.1.4. Other Contaminant Testing

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pet Food and Animal Feed

- 5.2.2. Meat and Poultry

- 5.2.3. Dairy

- 5.2.4. Fruits and Vegetables

- 5.2.5. others

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. HPLC-based

- 5.3.2. LC-MS/MS-based

- 5.3.3. Immunoassay-based

- 5.3.4. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Egypt

- 5.4.5. South Africa

- 5.4.6. Rest of Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Qatar

- 5.5.4. Egypt

- 5.5.5. South Africa

- 5.5.6. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 6. Saudi Arabia Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 6.1.1. Pathogen Testing

- 6.1.2. Pesticide and Residue Testing

- 6.1.3. GMO Testing

- 6.1.4. Other Contaminant Testing

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pet Food and Animal Feed

- 6.2.2. Meat and Poultry

- 6.2.3. Dairy

- 6.2.4. Fruits and Vegetables

- 6.2.5. others

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. HPLC-based

- 6.3.2. LC-MS/MS-based

- 6.3.3. Immunoassay-based

- 6.3.4. Other Technologies

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Qatar

- 6.4.4. Egypt

- 6.4.5. South Africa

- 6.4.6. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 7. United Arab Emirates Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 7.1.1. Pathogen Testing

- 7.1.2. Pesticide and Residue Testing

- 7.1.3. GMO Testing

- 7.1.4. Other Contaminant Testing

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pet Food and Animal Feed

- 7.2.2. Meat and Poultry

- 7.2.3. Dairy

- 7.2.4. Fruits and Vegetables

- 7.2.5. others

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. HPLC-based

- 7.3.2. LC-MS/MS-based

- 7.3.3. Immunoassay-based

- 7.3.4. Other Technologies

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Qatar

- 7.4.4. Egypt

- 7.4.5. South Africa

- 7.4.6. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 8. Qatar Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 8.1.1. Pathogen Testing

- 8.1.2. Pesticide and Residue Testing

- 8.1.3. GMO Testing

- 8.1.4. Other Contaminant Testing

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pet Food and Animal Feed

- 8.2.2. Meat and Poultry

- 8.2.3. Dairy

- 8.2.4. Fruits and Vegetables

- 8.2.5. others

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. HPLC-based

- 8.3.2. LC-MS/MS-based

- 8.3.3. Immunoassay-based

- 8.3.4. Other Technologies

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Qatar

- 8.4.4. Egypt

- 8.4.5. South Africa

- 8.4.6. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 9. Egypt Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 9.1.1. Pathogen Testing

- 9.1.2. Pesticide and Residue Testing

- 9.1.3. GMO Testing

- 9.1.4. Other Contaminant Testing

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pet Food and Animal Feed

- 9.2.2. Meat and Poultry

- 9.2.3. Dairy

- 9.2.4. Fruits and Vegetables

- 9.2.5. others

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. HPLC-based

- 9.3.2. LC-MS/MS-based

- 9.3.3. Immunoassay-based

- 9.3.4. Other Technologies

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Qatar

- 9.4.4. Egypt

- 9.4.5. South Africa

- 9.4.6. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 10. South Africa Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 10.1.1. Pathogen Testing

- 10.1.2. Pesticide and Residue Testing

- 10.1.3. GMO Testing

- 10.1.4. Other Contaminant Testing

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pet Food and Animal Feed

- 10.2.2. Meat and Poultry

- 10.2.3. Dairy

- 10.2.4. Fruits and Vegetables

- 10.2.5. others

- 10.3. Market Analysis, Insights and Forecast - by Technology

- 10.3.1. HPLC-based

- 10.3.2. LC-MS/MS-based

- 10.3.3. Immunoassay-based

- 10.3.4. Other Technologies

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Qatar

- 10.4.4. Egypt

- 10.4.5. South Africa

- 10.4.6. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 11. Rest of Middle East and Africa Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 11.1.1. Pathogen Testing

- 11.1.2. Pesticide and Residue Testing

- 11.1.3. GMO Testing

- 11.1.4. Other Contaminant Testing

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Pet Food and Animal Feed

- 11.2.2. Meat and Poultry

- 11.2.3. Dairy

- 11.2.4. Fruits and Vegetables

- 11.2.5. others

- 11.3. Market Analysis, Insights and Forecast - by Technology

- 11.3.1. HPLC-based

- 11.3.2. LC-MS/MS-based

- 11.3.3. Immunoassay-based

- 11.3.4. Other Technologies

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Saudi Arabia

- 11.4.2. United Arab Emirates

- 11.4.3. Qatar

- 11.4.4. Egypt

- 11.4.5. South Africa

- 11.4.6. Rest of Middle East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Contaminant Type

- 12. South Africa Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 13. Sudan Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 14. Uganda Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 15. Tanzania Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 16. Kenya Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Africa Middle East and Africa Food Safety Testing Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Intertek Group PLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 UL LLC*List Not Exhaustive

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 ALS Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 NSF International

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Eurofins Scientific

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Bureau Veritas Group

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 SGS SA

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 INSTITUT Mérieux

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 AsureQuality Limited

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 TUV SUD

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Intertek Group PLC

List of Figures

- Figure 1: Middle East and Africa Food Safety Testing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Food Safety Testing Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 3: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 5: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Middle East and Africa Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Middle East and Africa Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Middle East and Africa Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Middle East and Africa Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Middle East and Africa Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Middle East and Africa Food Safety Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 15: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 20: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 25: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 27: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 30: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 32: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 35: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 37: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Contaminant Type 2019 & 2032

- Table 40: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 42: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 43: Middle East and Africa Food Safety Testing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Food Safety Testing Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the Middle East and Africa Food Safety Testing Market?

Key companies in the market include Intertek Group PLC, UL LLC*List Not Exhaustive, ALS Ltd, NSF International, Eurofins Scientific, Bureau Veritas Group, SGS SA, INSTITUT Mérieux, AsureQuality Limited, TUV SUD.

3. What are the main segments of the Middle East and Africa Food Safety Testing Market?

The market segments include Contaminant Type, Application, Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

Consumer Interest in Food Safety Testing and Quality is Growing.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

In June 2022, Eurofins Scientific partnered with the owners of Saudi Ajal to successfully complete the acquisition of a majority investment in the business in Ajal for Laboratories, a food testing laboratory based in Riyadh, Kingdom of Saudi Arabia (KSA). Ajal for Laboratories is a leading food and pharmaceutical testing laboratory in the KSA and the Gulf Cooperation Council area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Food Safety Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Food Safety Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Food Safety Testing Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Food Safety Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence