Key Insights

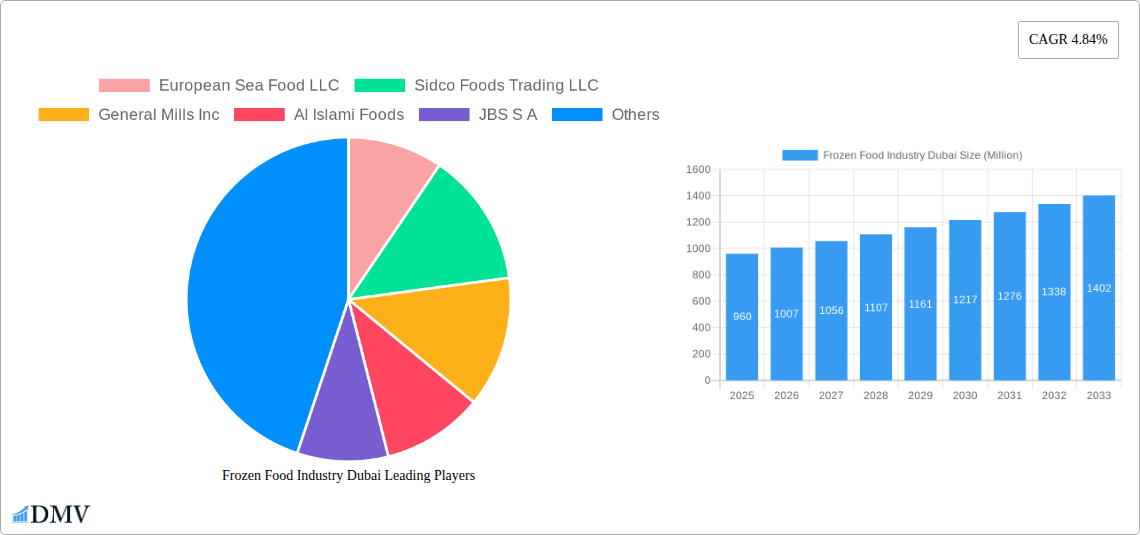

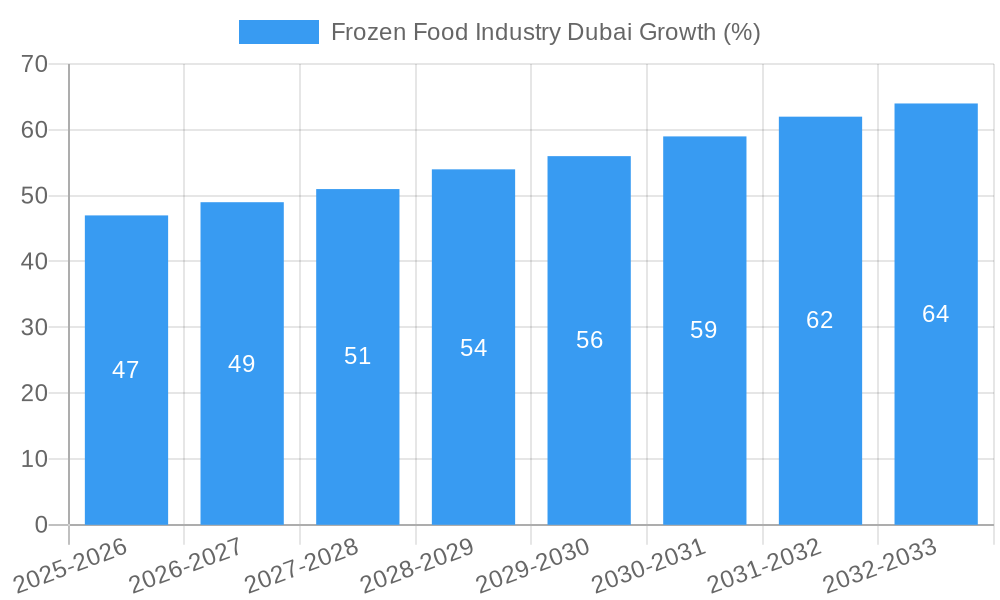

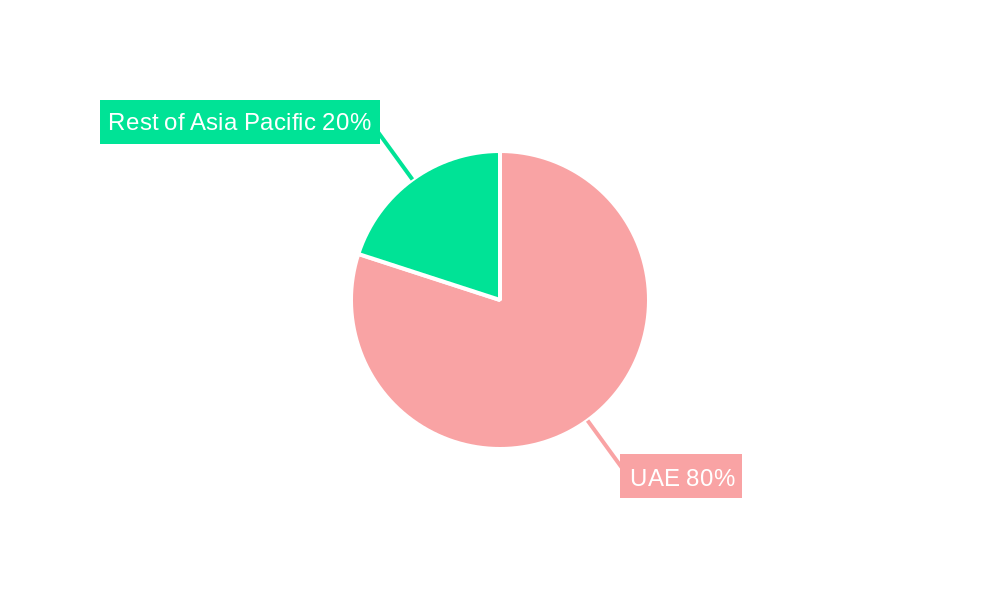

The Dubai frozen food market, valued at $0.96 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.84% from 2025 to 2033. This growth is fueled by several key factors. The rising popularity of convenient ready-to-eat meals aligns perfectly with Dubai's fast-paced lifestyle, driving demand for frozen ready meals and snacks. Furthermore, the increasing prevalence of health-conscious consumers seeking nutritious options contributes to the growth of frozen fruits, vegetables, and seafood. The expansion of supermarkets and hypermarkets, coupled with the burgeoning online retail sector, provides ample distribution channels for frozen food products. While logistical challenges and fluctuating raw material prices pose some constraints, the strong tourism sector and a significant expatriate population contribute to a high demand for diverse frozen food options. The market is segmented by distribution channel (supermarkets/hypermarkets dominating, followed by convenience stores and a rapidly growing online segment) and product type (frozen meat and ready meals holding significant shares, with frozen fruits and vegetables showing considerable growth). Major players like European Sea Food LLC, Al Islami Foods, and Americana Group compete in a market marked by both established brands and emerging local players. The Asia-Pacific region, particularly within the UAE, plays a crucial role in this market's dynamism.

The continued growth trajectory of the Dubai frozen food market is expected to be driven by increasing disposable incomes, evolving consumer preferences toward convenience and health, and strategic investments in cold-chain infrastructure to enhance product quality and shelf-life. The market will likely see increased innovation in product offerings, such as healthier and more diverse ready meals and sustainable sourcing of raw materials, to cater to changing consumer demands and environmental concerns. The competition among existing players will likely intensify, with new entrants emerging, leading to innovative marketing strategies and potentially influencing pricing dynamics. Specific focus will likely remain on enhancing the online retail channel to reach a broader consumer base.

Frozen Food Industry Dubai: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Frozen Food Industry in Dubai, covering market size, trends, key players, and future growth potential. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the dynamic Dubai frozen food market. The market is projected to reach xx Million by 2033, showcasing significant growth opportunities.

Frozen Food Industry Dubai Market Composition & Trends

This section delves into the competitive landscape of Dubai's frozen food market, evaluating market concentration, innovation, regulatory factors, and market dynamics. We analyze the market share distribution amongst key players, including European Sea Food LLC, Sidco Foods Trading LLC, General Mills Inc, Al Islami Foods, JBS S.A, Americana Group, Unilever PLC, BRF S.A, Al Kabeer Group ME, IFFCO Group, and Mars Incorporated (list not exhaustive). The report also examines the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible, and assessing their influence on market consolidation. We analyze various segments including Frozen Meat, Frozen Fruits and Vegetables, Frozen Ready Meals, Frozen Desserts, Frozen Snacks, Frozen Seafood, and other product types distributed across Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, and other channels. The evolving regulatory landscape and its impact on market participants are also discussed, along with substitute products and their competitive threat. Finally, end-user profiles are examined to provide a granular view of consumer preferences and purchasing behaviour.

- Market Concentration: Analysis of market share held by top players, including quantification of top 5 players' combined market share (xx%).

- Innovation Catalysts: Detailed examination of R&D investment and emerging technologies driving product innovation.

- Regulatory Landscape: Assessment of existing regulations and their potential impact on market expansion.

- M&A Activity: Analysis of recent M&A deals, including deal values (xx Million) and their implications for market structure.

Frozen Food Industry Dubai Industry Evolution

This section provides a detailed analysis of the evolution of the Dubai frozen food industry from 2019 to 2024, projecting trends through to 2033. We explore historical growth trajectories, pinpointing key growth rates during specific periods (e.g., 2019-2024: xx% CAGR). Technological advancements impacting production, distribution, and consumption are discussed, along with the impact of these advancements on market dynamics. The report will also analyze the shifting consumer demands shaping market trends, including changing preferences regarding health, convenience, and ethical sourcing. The influence of evolving lifestyles and demographics on consumption patterns will also be explored. Specific data points regarding adoption rates of new technologies and changes in consumer preferences will be provided.

Leading Regions, Countries, or Segments in Frozen Food Industry Dubai

This section identifies the dominant distribution channels and product types within the Dubai frozen food market. We analyze market share across various segments, highlighting factors driving the dominance of particular regions, countries, or segments. Key drivers, such as investment trends, regulatory support, and consumer preferences, will be elaborated with supporting data and insightful commentary.

- Distribution Channels: Dominance analysis of Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, and Other Distribution Channels; pinpointing the leading channel and its key drivers.

- Product Types: Detailed analysis of market share for Frozen Meat, Frozen Fruits and Vegetables, Frozen Ready Meals, Frozen Desserts, Frozen Snacks, and Frozen Seafood, identifying the most prominent category and its contributing factors.

Frozen Food Industry Dubai Product Innovations

This section highlights recent product innovations within the Dubai frozen food industry. It analyzes novel product applications, their performance metrics (e.g., sales figures, market acceptance), and unique selling propositions that contribute to their success. Emerging technologies impacting product development and innovation are also discussed, focusing on their potential impact on market growth and consumer preferences.

Propelling Factors for Frozen Food Industry Dubai Growth

This section identifies key growth drivers for the Dubai frozen food market. We discuss the technological advancements, economic factors, and regulatory support fueling market expansion. Specific examples of technological innovation and policy initiatives driving growth will be provided.

Obstacles in the Frozen Food Industry Dubai Market

This section analyzes the challenges and constraints affecting the Dubai frozen food market. We discuss regulatory hurdles, supply chain disruptions (quantifying their impact on market growth), and the intensity of competitive pressures (e.g., price wars, market share battles).

Future Opportunities in Frozen Food Industry Dubai

This section outlines emerging opportunities for growth in the Dubai frozen food market. We examine potential new markets, technological advancements (e.g., improved packaging, freezing techniques), and evolving consumer trends that could drive future market expansion.

Major Players in the Frozen Food Industry Dubai Ecosystem

- European Sea Food LLC

- Sidco Foods Trading LLC

- General Mills Inc

- Al Islami Foods

- JBS S.A

- Americana Group

- Unilever PLC

- BRF S.A

- Al Kabeer Group ME

- IFFCO Group

- Mars Incorporated *List Not Exhaustive

Key Developments in Frozen Food Industry Dubai Industry

- April 2021: Al Islami Foods launched a new frozen paratha dough category, expanding product variety and brand visibility.

- February 2022: JBS's Seara brand introduced Shawaya chicken, a halal 'freezer to oven' product catering to local preferences.

- September 2022: General Mills' Häagen-Dazs opened a new café at Dubai Hills Mall, expanding its café presence in Dubai's premium malls (The Dubai Mall, Ibn Battuta Mall, Mall of the Emirates).

Strategic Frozen Food Industry Dubai Market Forecast

This section summarizes the key growth catalysts identified in the report, offering a concise forecast of the Dubai frozen food market's future trajectory. It focuses on the opportunities and untapped potential, underscoring the factors that will drive market expansion during the forecast period (2025-2033). The section projects a positive outlook, emphasizing the market's robust growth prospects based on the aforementioned analysis.

Frozen Food Industry Dubai Segmentation

-

1. Product Type

- 1.1. Frozen Meat and Fish

- 1.2. Frozen Fruits and Vegetables

- 1.3. Frozen-cooked Ready Meals

- 1.4. Frozen Desserts

- 1.5. Frozen Snacks

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

Frozen Food Industry Dubai Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Frozen Food Industry Dubai REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Escalating Demand for Ready-to-Eat and Convenience Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Frozen Meat and Fish

- 5.1.2. Frozen Fruits and Vegetables

- 5.1.3. Frozen-cooked Ready Meals

- 5.1.4. Frozen Desserts

- 5.1.5. Frozen Snacks

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Frozen Meat and Fish

- 6.1.2. Frozen Fruits and Vegetables

- 6.1.3. Frozen-cooked Ready Meals

- 6.1.4. Frozen Desserts

- 6.1.5. Frozen Snacks

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Frozen Meat and Fish

- 7.1.2. Frozen Fruits and Vegetables

- 7.1.3. Frozen-cooked Ready Meals

- 7.1.4. Frozen Desserts

- 7.1.5. Frozen Snacks

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Frozen Meat and Fish

- 8.1.2. Frozen Fruits and Vegetables

- 8.1.3. Frozen-cooked Ready Meals

- 8.1.4. Frozen Desserts

- 8.1.5. Frozen Snacks

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Frozen Meat and Fish

- 9.1.2. Frozen Fruits and Vegetables

- 9.1.3. Frozen-cooked Ready Meals

- 9.1.4. Frozen Desserts

- 9.1.5. Frozen Snacks

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Frozen Meat and Fish

- 10.1.2. Frozen Fruits and Vegetables

- 10.1.3. Frozen-cooked Ready Meals

- 10.1.4. Frozen Desserts

- 10.1.5. Frozen Snacks

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. China Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 12. Japan Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 13. Australia Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 14. Vietnam Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 15. India Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia Pacific Frozen Food Industry Dubai Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 European Sea Food LLC

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Sidco Foods Trading LLC

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 General Mills Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Al Islami Foods

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 JBS S A

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Americana Group

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Unilever PLC

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 BRF S A

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Al Kabeer Group ME

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 IFFCO Group

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Mars Incorporated*List Not Exhaustive

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 European Sea Food LLC

List of Figures

- Figure 1: Global Frozen Food Industry Dubai Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Frozen Food Industry Dubai Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Frozen Food Industry Dubai Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Frozen Food Industry Dubai Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Frozen Food Industry Dubai Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Frozen Food Industry Dubai Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America Frozen Food Industry Dubai Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America Frozen Food Industry Dubai Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Frozen Food Industry Dubai Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Frozen Food Industry Dubai Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Frozen Food Industry Dubai Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Frozen Food Industry Dubai Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America Frozen Food Industry Dubai Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America Frozen Food Industry Dubai Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Frozen Food Industry Dubai Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Frozen Food Industry Dubai Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Frozen Food Industry Dubai Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Frozen Food Industry Dubai Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe Frozen Food Industry Dubai Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe Frozen Food Industry Dubai Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Frozen Food Industry Dubai Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Frozen Food Industry Dubai Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Frozen Food Industry Dubai Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Frozen Food Industry Dubai Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa Frozen Food Industry Dubai Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa Frozen Food Industry Dubai Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Frozen Food Industry Dubai Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Frozen Food Industry Dubai Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Frozen Food Industry Dubai Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Frozen Food Industry Dubai Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific Frozen Food Industry Dubai Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific Frozen Food Industry Dubai Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Frozen Food Industry Dubai Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Frozen Food Industry Dubai Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Frozen Food Industry Dubai Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Frozen Food Industry Dubai Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Frozen Food Industry Dubai Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Frozen Food Industry Dubai Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Australia Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Vietnam Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia Pacific Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Frozen Food Industry Dubai Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global Frozen Food Industry Dubai Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global Frozen Food Industry Dubai Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Frozen Food Industry Dubai Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Frozen Food Industry Dubai Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global Frozen Food Industry Dubai Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Frozen Food Industry Dubai Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global Frozen Food Industry Dubai Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 26: Global Frozen Food Industry Dubai Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Kingdom Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: France Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Italy Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Spain Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Russia Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Benelux Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Nordics Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Europe Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Frozen Food Industry Dubai Revenue Million Forecast, by Product Type 2019 & 2032

- Table 37: Global Frozen Food Industry Dubai Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 38: Global Frozen Food Industry Dubai Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Turkey Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Israel Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: GCC Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: North Africa Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East & Africa Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Frozen Food Industry Dubai Revenue Million Forecast, by Product Type 2019 & 2032

- Table 46: Global Frozen Food Industry Dubai Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 47: Global Frozen Food Industry Dubai Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Frozen Food Industry Dubai Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frozen Food Industry Dubai?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Frozen Food Industry Dubai?

Key companies in the market include European Sea Food LLC, Sidco Foods Trading LLC, General Mills Inc, Al Islami Foods, JBS S A, Americana Group, Unilever PLC, BRF S A, Al Kabeer Group ME, IFFCO Group, Mars Incorporated*List Not Exhaustive.

3. What are the main segments of the Frozen Food Industry Dubai?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Escalating Demand for Ready-to-Eat and Convenience Food Products.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

September 2022: General Mill's ice cream brand Häagen-Dazs launched a new café at the Dubai Hills Mall. In the United Arab Emirates, NTDE Group, an exclusive distributor, operates more than 15 Häagen-Dazs cafés, some of which are in prestigious buildings like The Dubai Mall, Ibn Battuta Mall, and Mall of the Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Frozen Food Industry Dubai," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Frozen Food Industry Dubai report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Frozen Food Industry Dubai?

To stay informed about further developments, trends, and reports in the Frozen Food Industry Dubai, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence