Key Insights

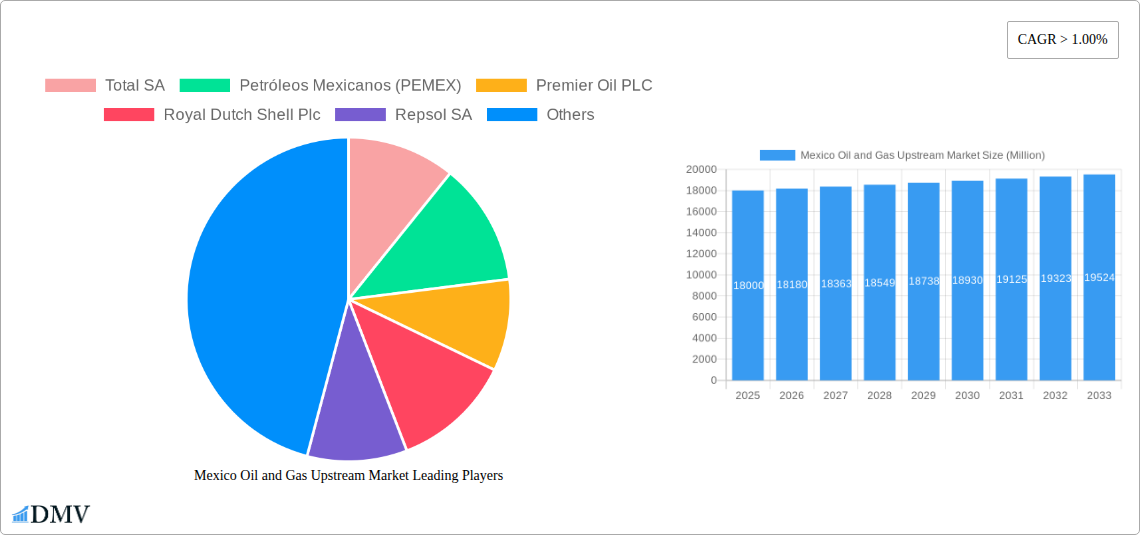

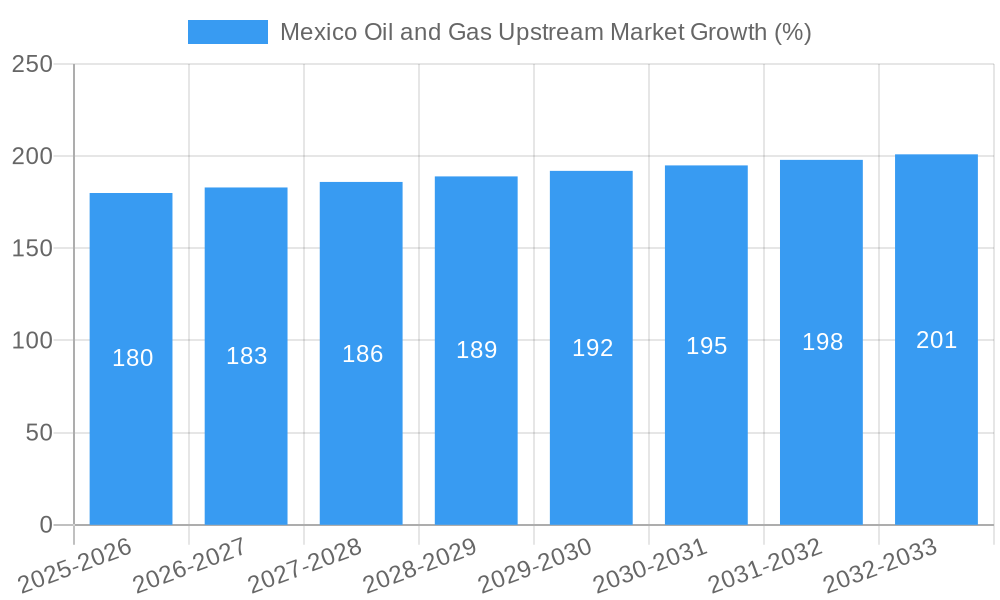

The Mexico Oil and Gas Upstream Market, spanning 2019-2033, exhibits a Compound Annual Growth Rate (CAGR) exceeding 1.00%, indicating steady expansion. While the precise market size for 2025 (the base year) is not provided, considering the presence of major international players like Total SA, Shell, and Repsol, alongside the national oil company PEMEX, a reasonable estimate for the 2025 market size would be in the range of $15-20 billion USD, given the significant investment and production in the region. Key drivers include Mexico's substantial oil and gas reserves, ongoing efforts to attract foreign investment, and increasing domestic energy demand. However, challenges exist, such as declining production from mature fields, regulatory complexities, and the global transition towards renewable energy sources. The market segmentation between onshore and offshore operations reflects differing levels of investment and production capabilities. Onshore operations, given their existing infrastructure, likely dominate the market share, while the offshore segment holds potential for future growth, depending on further exploration and technological advancements. The forecast period (2025-2033) suggests continued, albeit moderate, expansion, primarily fueled by strategic investments in exploration and production, technological innovation in extraction techniques, and efforts to enhance operational efficiency. Competition among established players and potentially new entrants will shape market dynamics, along with government policies that aim to balance energy security with sustainability goals.

The strategic focus of major players like Total SA, PEMEX, Premier Oil, Royal Dutch Shell, and Repsol will continue to be pivotal in shaping the market trajectory. These companies are strategically positioned to leverage existing infrastructure while pursuing new exploration opportunities, and their success will be influenced by regulatory frameworks, technological improvements, and global energy prices. A sustained CAGR above 1.00% for the next decade indicates a robust though not explosive, market with potential for substantial revenue growth for companies involved. The long-term outlook depends on several interconnected variables, including global energy demand, geopolitical factors, investment climates, and the pace of the global energy transition.

Mexico Oil and Gas Upstream Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Mexico oil and gas upstream market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The study meticulously analyzes market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, and future prospects. Key players like Petróleos Mexicanos (PEMEX), Total SA, Royal Dutch Shell Plc, Repsol SA, and Premier Oil PLC are profiled, providing a 360-degree view of the competitive landscape. The report is enriched with data-driven insights, forecasts, and strategic recommendations, making it a crucial tool for informed decision-making. The total market value in 2025 is estimated at $xx Million.

Mexico Oil and Gas Upstream Market Composition & Trends

The Mexico oil and gas upstream market exhibits a moderately concentrated structure, with PEMEX holding a significant market share (estimated at xx% in 2025). However, increasing international participation, driven by energy reforms, is fostering competition. Innovation is catalyzed by technological advancements in exploration and extraction, particularly in deepwater offshore operations. The regulatory landscape, while evolving, presents both opportunities and challenges for market participants. Substitute products, such as renewable energy sources, exert a growing influence, although oil and gas remain crucial for Mexico's energy needs. The end-user profile comprises primarily domestic power generation and industrial users, with exports playing a secondary role. M&A activity has been relatively moderate in recent years, with deal values totaling approximately $xx Million between 2019 and 2024.

- Market Share Distribution (2025): PEMEX (xx%), Total SA (xx%), Royal Dutch Shell Plc (xx%), Repsol SA (xx%), Others (xx%).

- M&A Deal Value (2019-2024): $xx Million

- Key Regulatory Changes: [Insert specific regulatory changes and their impact]

- Innovation Catalysts: Deepwater drilling technologies, Enhanced Oil Recovery (EOR) techniques.

Mexico Oil and Gas Upstream Market Industry Evolution

The Mexico oil and gas upstream market has witnessed fluctuating growth trajectories over the historical period (2019-2024), influenced by global oil price volatility and domestic policy changes. Technological advancements, particularly in horizontal drilling and hydraulic fracturing, have significantly boosted production in certain areas, primarily onshore. However, the market's evolution is also shaped by shifting consumer demands, with a growing emphasis on cleaner energy sources. This transition presents both challenges and opportunities for existing players, necessitating diversification and investments in sustainable energy technologies. The compound annual growth rate (CAGR) during 2019-2024 was approximately xx%, with projections suggesting a CAGR of xx% from 2025-2033, driven largely by offshore exploration and production. The adoption rate of new technologies, such as AI-driven exploration and automation in production, is gradually increasing.

Leading Regions, Countries, or Segments in Mexico Oil and Gas Upstream Market

The dominant segment in the Mexico oil and gas upstream market is the onshore sector. This dominance stems from several key drivers:

- Established Infrastructure: Existing pipeline networks and processing facilities facilitate cost-effective production.

- Regulatory Approvals: Onshore projects generally face less stringent regulatory hurdles compared to offshore ventures.

- Investment Focus: Historically, a significant portion of investment has been channeled towards onshore exploration and development.

However, the offshore sector, particularly in deepwater areas, holds substantial potential for future growth due to significant untapped reserves and technological advancements enabling exploration and production in challenging environments.

Mexico Oil and Gas Upstream Market Product Innovations

Recent innovations focus on improving efficiency and reducing environmental impact. This includes advancements in Enhanced Oil Recovery (EOR) techniques to maximize extraction from mature fields and the adoption of digital technologies for real-time monitoring and optimization of production processes. Companies are also investing in technologies to reduce methane emissions and improve water management during operations, demonstrating a commitment to environmental sustainability. These innovations provide significant advantages in terms of operational efficiency, resource optimization, and environmental responsibility.

Propelling Factors for Mexico Oil and Gas Upstream Market Growth

Several factors contribute to the growth of the Mexican oil and gas upstream market. Government initiatives to attract foreign investment, coupled with the discovery of new reserves, particularly offshore, are driving exploration and production activities. Furthermore, growing domestic energy demand and increasing industrialization provide a strong impetus for growth. Technological advancements such as improved drilling techniques and enhanced recovery methods also play a significant role.

Obstacles in the Mexico Oil and Gas Upstream Market

The market faces challenges, including regulatory uncertainty, particularly regarding environmental regulations and licensing procedures. Supply chain disruptions, especially during periods of global instability, can impact production costs and timelines. Furthermore, intense competition from both domestic and international players contributes to price pressure and necessitates constant innovation. These factors collectively impact project profitability and investment decisions.

Future Opportunities in Mexico Oil and Gas Upstream Market

The Mexican oil and gas upstream market presents significant opportunities. Further exploration and development of deepwater reserves, especially in the Gulf of Mexico, offer immense potential. The adoption of advanced technologies like AI and machine learning in exploration, drilling and production will significantly improve efficiency and reduce costs. Finally, opportunities exist in the development of carbon capture and storage (CCS) technologies to mitigate environmental impacts.

Major Players in the Mexico Oil and Gas Upstream Market Ecosystem

- Total SA

- Petróleos Mexicanos (PEMEX)

- Premier Oil PLC

- Royal Dutch Shell Plc

- Repsol SA

Key Developments in Mexico Oil and Gas Upstream Market Industry

- 2022 Q4: PEMEX announced a significant investment in deepwater exploration.

- 2023 Q1: New regulatory framework for offshore drilling implemented.

- 2024 Q2: Total SA and PEMEX formed a joint venture for a major offshore project.

- [Add more specific developments with dates]

Strategic Mexico Oil and Gas Upstream Market Forecast

The future of the Mexican oil and gas upstream market is promising, driven by continued exploration and technological innovation. Deepwater projects and investments in EOR technologies will play a key role in driving growth. While challenges related to regulation and global energy transitions remain, the country's substantial reserves and growing domestic demand ensure a dynamic and evolving market with considerable potential for investment and expansion in the coming years. The market is projected to reach $xx Million by 2033.

Mexico Oil and Gas Upstream Market Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

Mexico Oil and Gas Upstream Market Segmentation By Geography

- 1. Mexico

Mexico Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Petróleos Mexicanos (PEMEX)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Premier Oil PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Dutch Shell Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Repsol SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Mexico Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Location 2019 & 2032

- Table 5: Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 7: Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 9: Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Location 2019 & 2032

- Table 11: Mexico Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Oil and Gas Upstream Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Mexico Oil and Gas Upstream Market?

Key companies in the market include Total SA, Petróleos Mexicanos (PEMEX), Premier Oil PLC, Royal Dutch Shell Plc, Repsol SA.

3. What are the main segments of the Mexico Oil and Gas Upstream Market?

The market segments include Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Mexico Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence