Key Insights

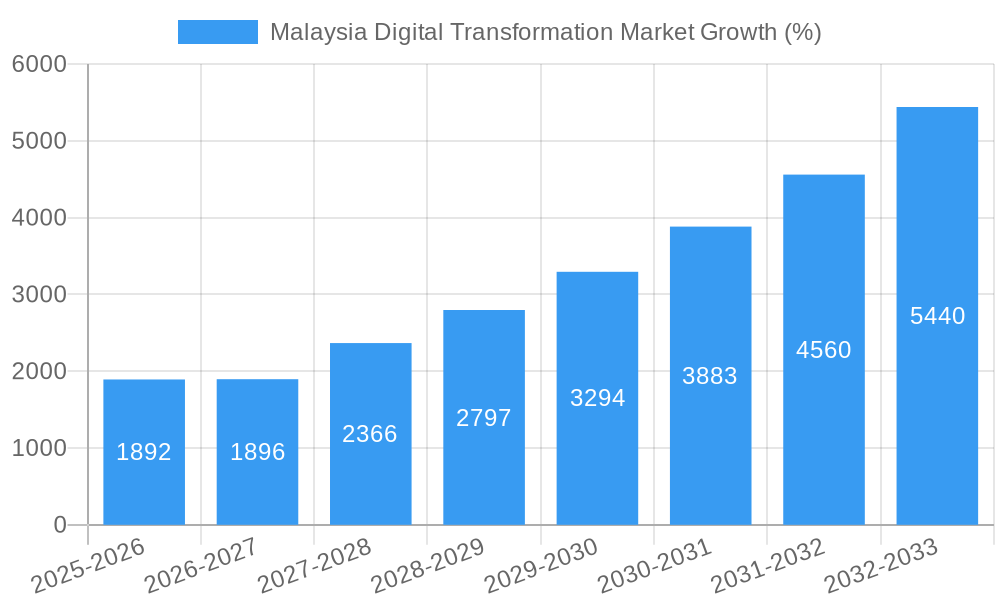

The Malaysia Digital Transformation Market, valued at $8.98 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 18.92% from 2025 to 2033. This robust expansion is driven by several key factors. The Malaysian government's strong push for digitalization across various sectors, including healthcare, finance, and education, is a primary catalyst. Increased internet penetration and smartphone adoption among the population are fueling demand for digital solutions and services. Furthermore, the rising adoption of cloud computing, big data analytics, and artificial intelligence (AI) is creating lucrative opportunities for technology providers. Businesses are increasingly investing in digital transformation to enhance operational efficiency, improve customer experience, and gain a competitive edge. This market’s growth trajectory is further supported by the proactive efforts of major players like IBM, Microsoft, and Google, who are actively investing in research and development, partnerships, and expansion strategies within the Malaysian market.

However, challenges remain. Data security concerns and the need for robust cybersecurity infrastructure represent significant restraints. Addressing the digital skills gap through targeted training and education initiatives is crucial for sustained growth. The cost of implementation and integration of new technologies can also act as a barrier for smaller businesses. Despite these challenges, the long-term outlook for the Malaysia Digital Transformation Market remains positive. The continuous evolution of technology, coupled with government support and increasing private sector investment, will ensure significant expansion in the coming years, creating new opportunities for technology providers and stimulating overall economic growth. Segment-specific analysis (e.g., cloud services, cybersecurity, AI) would provide a more granular understanding of the market's dynamics. Future growth projections would also benefit from a deeper analysis of regional variations within Malaysia.

Malaysia Digital Transformation Market Market Composition & Trends

The Malaysia Digital Transformation Market showcases a dynamic landscape shaped by market concentration, innovation catalysts, regulatory environments, substitute products, end-user profiles, and M&A activities. The market is characterized by a moderate concentration, with leading players like IBM Corporation, Microsoft Corporation, and Google LLC holding significant market shares. These companies drive innovation through strategic investments in AI, cloud computing, and cybersecurity solutions, positioning Malaysia as a hub for digital advancement. Regulatory frameworks such as the Malaysia Digital Economy Blueprint and the Personal Data Protection Act influence market dynamics by promoting digital inclusivity and data security.

- Market Share Distribution: IBM Corporation commands a xx% market share, followed closely by Microsoft Corporation at xx%, and Google LLC at xx%.

- Innovation Catalysts: Investments in AI and IoT technologies, with government initiatives like the Malaysia Digital Catalyst Program, spur innovation.

- Regulatory Landscapes: The introduction of the Cybersecurity Act 2019 and the Data Protection Act 2020 have set stringent guidelines, fostering a secure digital ecosystem.

- Substitute Products: Traditional IT services face competition from emerging cloud-based solutions, driving a shift towards digital platforms.

- End-User Profiles: Predominantly, enterprises in sectors like finance, healthcare, and manufacturing are leading the adoption of digital transformation solutions.

- M&A Activities: Notable M&A deals in 2023 included the acquisition of Kliqxe by GrandTech Cloud Services Inc for xx Million, reflecting consolidation trends.

Malaysia Digital Transformation Market Industry Evolution

The Malaysia Digital Transformation Market has experienced a dynamic and accelerated evolution, particularly since 2020. The base year of 2025 served as a critical inflection point, with a significant surge in digital transformation initiatives across a broad spectrum of industries. In 2025, the market demonstrated a growth rate of approximately XX%, primarily fueled by the widespread adoption of cloud computing, artificial intelligence (AI), and the Internet of Things (IoT). Looking ahead, the forecast period from 2025 to 2033 is projected to witness a Compound Annual Growth Rate (CAGR) of around XX%. This sustained growth is underpinned by strong governmental backing, notably through flagship programs such as the Malaysia Digital Economy Blueprint and the National 4IR Policy, which are actively shaping the nation's digital future.

Technological advancements have been instrumental in this transformation. The widespread deployment of 5G networks has paved the way for faster, more reliable, and ubiquitous digital services. Concurrently, evolving consumer expectations for personalized, seamless, and highly efficient digital solutions are compelling businesses to engage in continuous innovation. The historical period from 2019 to 2024 marked a significant transition from traditional IT infrastructures to robust digital platforms. This era saw a marked increase in digital literacy across the population and a substantial growth in e-commerce activities. Consequently, Malaysia has solidified its position as a competitive force in the global digital transformation arena, with both the private and public sectors enthusiastically embracing digital tools to amplify productivity and elevate service delivery standards.

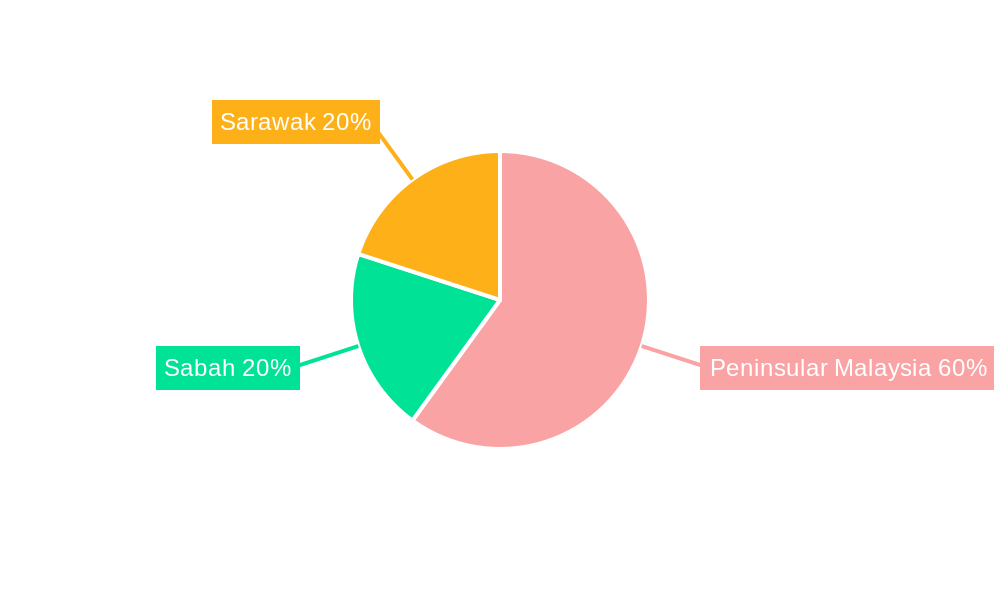

Leading Regions, Countries, or Segments in Malaysia Digital Transformation Market

Kuala Lumpur stands out as the undisputed leader within the Malaysia Digital Transformation Market. Its prominence is attributed to its established role as a premier business and technology hub, boasting a well-developed infrastructure and a proactive approach to investing in cutting-edge digital initiatives, thereby creating an exceptionally conducive environment for digital transformation to flourish.

- Key Catalysts in Kuala Lumpur's Ascendancy:

- Investment Ecosystem: A robust influx of investments, particularly in ambitious smart city projects and the expansion of digital infrastructure.

- Supportive Governance: Favorable government policies, exemplified by the Kuala Lumpur Smart City Master Plan, actively promote and incentivize digital innovation.

- Abundant Talent Pool: Access to a highly skilled and dynamic workforce specializing in technology and digital disciplines.

Kuala Lumpur's market dominance is further amplified by its strategic position as a regional nexus for multinational corporations (MNCs). These global entities leverage the city's vibrant digital ecosystem to strategically expand their operational footprints. The presence of leading technology giants such as IBM, Microsoft, and Google has significantly stimulated the growth of digital transformation services. These companies have established prominent regional headquarters and advanced innovation centers within the city, fostering a collaborative and forward-thinking environment. Moreover, the unwavering commitment of the Malaysian government to digitalization, visibly demonstrated through the initiatives spearheaded by the Malaysia Digital Economy Corporation (MDEC), provides a powerful and comprehensive framework empowering businesses to readily adopt advanced digital technologies. This confluence of influential factors has firmly positioned Kuala Lumpur at the vanguard of Malaysia's digital transformation journey, with projections indicating its continued leadership throughout the forecast period.

Malaysia Digital Transformation Market Product Innovations

In the Malaysia Digital Transformation Market, product innovations focus on enhancing digital capabilities across various sectors. Companies like IBM and Microsoft have introduced AI-driven solutions that streamline business processes and improve customer engagement. For instance, IBM's Watson AI platform offers advanced analytics and machine learning capabilities, while Microsoft's Azure cloud services provide scalable and secure digital infrastructure. These innovations are characterized by their ability to integrate seamlessly with existing systems, offering high performance and reliability. The unique selling propositions of these products lie in their adaptability and the potential to drive significant efficiency gains.

Propelling Factors for Malaysia Digital Transformation Market Growth

The Malaysia Digital Transformation Market is propelled by several key factors:

- Technological Advancements: The rapid adoption of 5G, AI, and IoT technologies facilitates innovative digital solutions.

- Economic Growth: Malaysia's economic development fuels demand for digital services across industries.

- Regulatory Support: Government initiatives like the Malaysia Digital Economy Blueprint create a favorable environment for digital transformation.

These factors, combined with the country's strategic location and skilled workforce, position Malaysia as a burgeoning hub for digital innovation.

Obstacles in the Malaysia Digital Transformation Market Market

Despite its considerable growth trajectory, the Malaysia Digital Transformation Market encounters several significant obstacles that warrant strategic attention:

- Regulatory Hurdles: The presence of stringent data protection and privacy laws, while crucial for trust, can inadvertently create complexities and delays in the adoption of novel technologies.

- Supply Chain Volatility: Global supply chain disruptions, exacerbated by geopolitical factors and logistical challenges, continue to impact the timely and cost-effective availability of essential digital infrastructure components.

- Intense Competitive Landscape: The market is characterized by fierce competition, not only among established global tech behemoths but also from agile local players. This dynamic can lead to aggressive pricing strategies, potentially impacting profit margins for all stakeholders.

Navigating these challenges effectively demands meticulous strategic planning, robust contingency measures, and a commitment to fostering resilience to ensure sustained market expansion and capitalize on the inherent opportunities.

Future Opportunities in Malaysia Digital Transformation Market

The Malaysia Digital Transformation Market is ripe with a multitude of promising future opportunities, indicating a strong potential for continued innovation and market penetration:

- Untapped Sectoral Potential: Significant opportunities exist for tailoring and implementing digital solutions in traditionally underserved sectors, such as agriculture and education, to enhance efficiency and accessibility.

- Pioneering New Technologies: Emerging technologies like blockchain, quantum computing, and advanced edge computing present novel avenues for groundbreaking innovation and the creation of entirely new digital services and business models.

- Evolving Consumer Demands: The increasing consumer appetite for highly personalized digital experiences, coupled with a growing emphasis on sustainability and ethical digital practices, opens doors for businesses that can align their offerings with these evolving preferences.

These burgeoning opportunities underscore the market's capacity for sustained growth and diversification, positioning Malaysia to further solidify its digital leadership in the region.

Major Players in the Malaysia Digital Transformation Market Ecosystem

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Telefonaktiebolaget LM Ericsson

- NTT Data

- Netpluz

- GrandTech Cloud Services Inc

- Kliqxe

- Oracle Corporation

- Dell Technologies

- Cisco Systems Inc

Key Developments in Malaysia Digital Transformation Market Industry

- March 2024: Google collaborated with the Government of Malaysia to launch two strategic initiatives aimed at enhancing Malaysia's digital competitiveness. The first initiative focuses on equipping Malaysian youth with AI skills, while the second aims to improve public service delivery using cloud-native, AI-driven tools, in line with Malaysia's MADANI Economy Framework. The second initiative will equip 445,000 public officers with Google Workspace tools to boost productivity across the public sector. This effort is in partnership with Jabatan Digital Negara (JDN), the government agency responsible for coordinating and implementing national and public sector digitalization projects under the Ministry of Digital.

- March 2024: BlackBerry Limited inaugurated its Cybersecurity Center of Excellence (CCoE) in Kuala Lumpur. This new facility is dedicated to providing premier cybersecurity training and intelligence, aiming to enhance Malaysia and its regional partners' capabilities in addressing cyber threats prevalent in the Indo-Pacific region.

These developments underscore the market's commitment to fostering digital skills and enhancing cybersecurity, contributing to a robust digital ecosystem.

Strategic Malaysia Digital Transformation Market Market Forecast

The strategic forecast for the Malaysia Digital Transformation Market paints a picture of robust and sustained growth extending through the forecast period of 2025-2033. The primary catalysts for this expansion include the ongoing and accelerated adoption of sophisticated technologies such as AI and IoT across industries, unwavering government support manifested through crucial initiatives like the Malaysia Digital Economy Blueprint, and a continuously escalating demand for comprehensive digital solutions across diverse economic sectors. The market is strategically positioned to leverage emerging opportunities within nascent markets and capitalize on advancements in new technologies, thereby reinforcing Malaysia's status as a preeminent leader in digital transformation within the Southeast Asian region. With a projected CAGR of approximately XX%, the market's potential is substantial, driven by a potent synergy of technological innovation, strategic investments, and a forward-looking national digital agenda.

Malaysia Digital Transformation Market Segmentation

-

1. Type

-

1.1. Analytic

- 1.1.1. Current

- 1.1.2. Key Grow

- 1.1.3. Use Case Analysis

- 1.1.4. Market Outlook

- 1.2. Extended Reality (XR)

- 1.3. IoT

- 1.4. Industrial Robotics

- 1.5. Blockchain

- 1.6. Additive Manufacturing/3D Printing

- 1.7. Cybersecurity

- 1.8. Cloud Edge Computing

-

1.9. Others (digital twin, mobility and connectivity)

- 1.9.1. Market B

-

1.1. Analytic

-

2. End-User Industry

- 2.1. Manufacturing

- 2.2. Oil, Gas and Utilities

- 2.3. Retail & e-commerce

- 2.4. Transportation and Logistics

- 2.5. Healthcare

- 2.6. BFSI

- 2.7. Telecom and IT

- 2.8. Government and Public Sector

- 2.9. Others (

Malaysia Digital Transformation Market Segmentation By Geography

- 1. Malaysia

Malaysia Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the adoption of big data analytics and other technologies in the country; The rapid proliferation of mobile devices and apps

- 3.3. Market Restrains

- 3.3.1. Increase in the adoption of big data analytics and other technologies in the country; The rapid proliferation of mobile devices and apps

- 3.4. Market Trends

- 3.4.1. Cloud Edge Computing to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Digital Transformation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytic

- 5.1.1.1. Current

- 5.1.1.2. Key Grow

- 5.1.1.3. Use Case Analysis

- 5.1.1.4. Market Outlook

- 5.1.2. Extended Reality (XR)

- 5.1.3. IoT

- 5.1.4. Industrial Robotics

- 5.1.5. Blockchain

- 5.1.6. Additive Manufacturing/3D Printing

- 5.1.7. Cybersecurity

- 5.1.8. Cloud Edge Computing

- 5.1.9. Others (digital twin, mobility and connectivity)

- 5.1.9.1. Market B

- 5.1.1. Analytic

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.2. Oil, Gas and Utilities

- 5.2.3. Retail & e-commerce

- 5.2.4. Transportation and Logistics

- 5.2.5. Healthcare

- 5.2.6. BFSI

- 5.2.7. Telecom and IT

- 5.2.8. Government and Public Sector

- 5.2.9. Others (

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telefonaktiebolaget LM Ericsson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NTT Data

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Netpluz

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GrandTech Cloud Services Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kliqxe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dell Technologies

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cisco Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Malaysia Digital Transformation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Digital Transformation Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Malaysia Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Malaysia Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Malaysia Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Malaysia Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: Malaysia Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Malaysia Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Malaysia Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Malaysia Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Malaysia Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Malaysia Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: Malaysia Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Malaysia Digital Transformation Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Digital Transformation Market?

The projected CAGR is approximately 18.92%.

2. Which companies are prominent players in the Malaysia Digital Transformation Market?

Key companies in the market include IBM Corporation, Microsoft Corporation, Google LLC, Telefonaktiebolaget LM Ericsson, NTT Data, Netpluz, GrandTech Cloud Services Inc, Kliqxe, Oracle Corporation, Dell Technologies, Cisco Systems Inc.

3. What are the main segments of the Malaysia Digital Transformation Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the adoption of big data analytics and other technologies in the country; The rapid proliferation of mobile devices and apps.

6. What are the notable trends driving market growth?

Cloud Edge Computing to Register Significant Growth.

7. Are there any restraints impacting market growth?

Increase in the adoption of big data analytics and other technologies in the country; The rapid proliferation of mobile devices and apps.

8. Can you provide examples of recent developments in the market?

March 2024: Google collaborated with the Government of Malaysia, has launched two strategic initiatives to enhance Malaysia’s digital competitiveness. The first initiative focuses on equipping Malaysian youth with AI skills, while the second aims to improve public service delivery using cloud-native, AI-driven tools, in line with Malaysia’s MADANI Economy Framework. The second initiative will equip 445,000 public officers with Google Workspace tools to boost productivity across the public sector. This effort is in partnership with Jabatan Digital Negara (JDN), the government agency responsible for coordinating and implementing national and public sector digitalization projects under the Ministry of Digital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Malaysia Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence