Key Insights

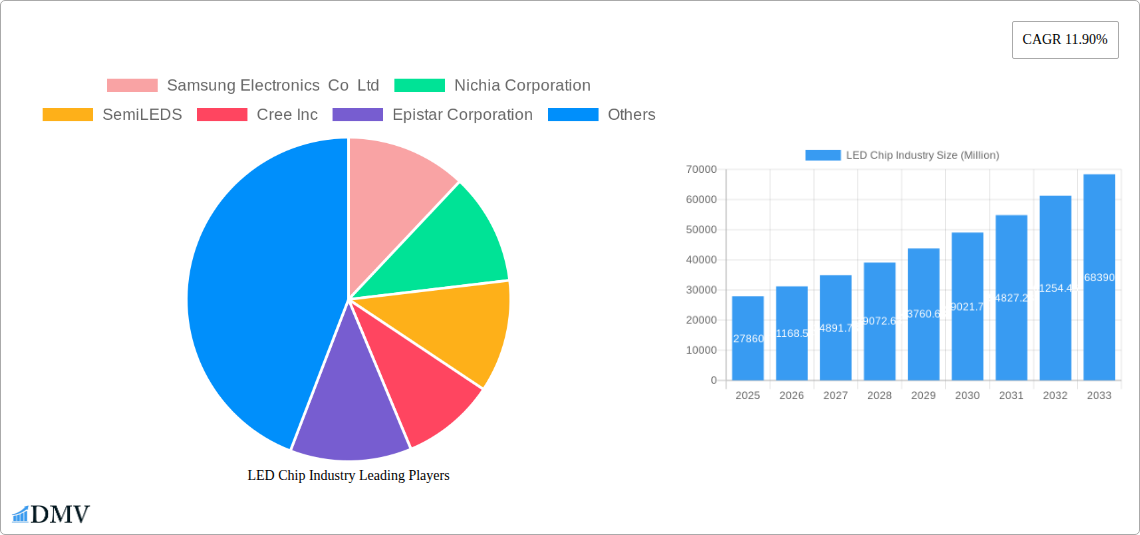

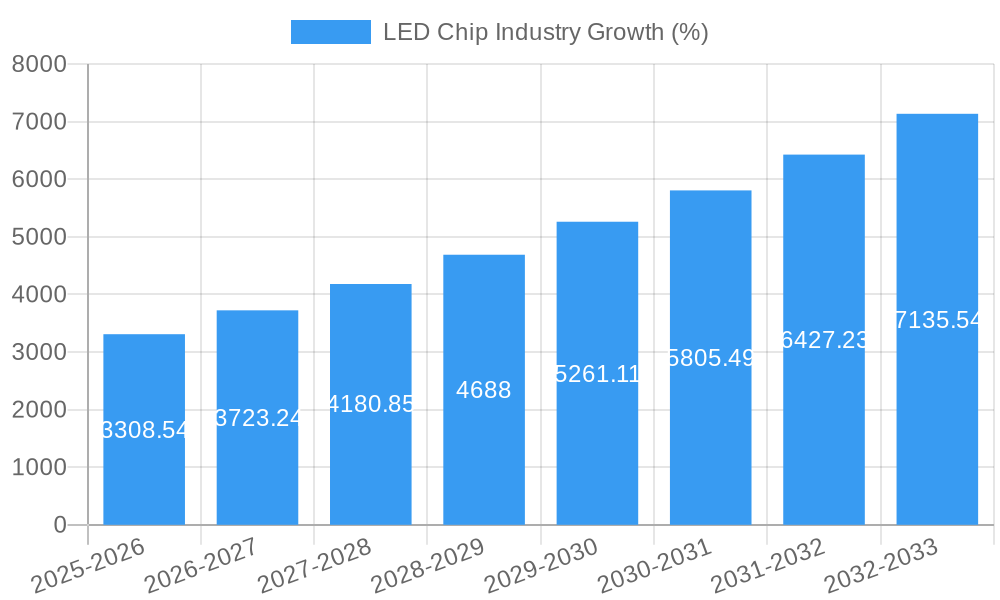

The LED chip market, valued at $27.86 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.90% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of LEDs in backlighting applications for consumer electronics (smartphones, TVs, laptops) fuels significant demand. Furthermore, the automotive industry's shift towards energy-efficient lighting systems, encompassing headlights, taillights, and interior lighting, is a major growth catalyst. The expanding smart city initiatives globally are also driving demand for advanced LED lighting solutions in streetlights and signage. Technological advancements leading to higher efficacy, improved color rendering, and smaller chip sizes are further contributing to market expansion. While the market faces restraints such as the price competition from cheaper LED manufacturers and the potential for supply chain disruptions, the overall outlook remains positive, particularly in regions like Asia, which is expected to dominate market share due to strong manufacturing presence and increasing consumer demand.

The market segmentation reveals a significant contribution from backlighting and automotive applications. The "other applications" segment, encompassing diverse applications like general illumination, horticulture lighting and medical devices, is also experiencing substantial growth due to technological advancements and rising adoption. Major players like Samsung, Nichia, Cree, and Osram are leading the market, competing through innovation, strategic partnerships, and vertical integration. However, emerging players from Asia are also posing a challenge, driving competitiveness and potentially influencing future pricing dynamics. The forecast period (2025-2033) presents substantial opportunities for companies to capitalize on increasing demand and technological advancements. Successful players will be those who can effectively manage supply chains, adapt to technological shifts, and cater to the evolving needs of diverse end-use sectors.

LED Chip Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the LED chip industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future trends and opportunities within the LED chip market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

LED Chip Industry Market Composition & Trends

This section analyzes the competitive landscape, technological advancements, regulatory factors, and market dynamics influencing the LED chip industry. The market exhibits a moderately concentrated structure, with key players like Samsung Electronics Co Ltd, Nichia Corporation, SemiLEDS, Cree Inc, Epistar Corporation, OSRAM Opto Semiconductors GmbH, Bridgelux Inc, Formosa Epitaxy, TOYODA GOSEI Co, Seoul Viosys Co Ltd, and Lumileds Holding B V holding significant market share. The distribution of market share among these players fluctuates based on innovation, pricing strategies, and market demand for specific applications. Innovation in materials science, chip design, and packaging techniques is a key driver, continually pushing efficiency and cost reduction. Stringent environmental regulations concerning energy efficiency are impacting product development and adoption rates positively. Substitute products like OLEDs present a challenge, while strategic mergers and acquisitions (M&A) like the xx Million deal between [Insert example M&A if available, otherwise replace with “Company A” and “Company B”] are reshaping the competitive landscape. End-user demand varies across applications, with high growth seen in automotive lighting and horticulture.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% of market share in 2025.

- Innovation Catalysts: Advancements in materials science, chip design, and packaging technologies.

- Regulatory Landscape: Stringent energy efficiency regulations driving innovation and adoption.

- Substitute Products: OLEDs and other emerging lighting technologies pose competition.

- M&A Activity: Significant M&A activity reshaping the market landscape; average deal value xx Million in 2024 (estimated).

- End-User Profiles: Diverse, including consumer electronics, automotive, general lighting, and horticulture.

LED Chip Industry Industry Evolution

The LED chip industry has witnessed exponential growth, driven by technological advancements and increasing demand for energy-efficient lighting solutions. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, largely fueled by the transition from traditional lighting sources to LEDs in various sectors. Technological innovations such as micro-LEDs and advanced packaging techniques are contributing to increased efficiency, improved performance, and new application possibilities. Consumer demand continues to shift towards higher lumen output, longer lifespans, and more compact form factors, creating opportunities for manufacturers to offer premium features. Future growth is projected to be driven by adoption in emerging markets and growth of smart lighting systems, with a CAGR of xx% expected from 2025 to 2033. The adoption rate of LED chips in backlighting and automotive applications is particularly high, driven by increasing integration into consumer electronics and stringent automotive lighting standards. The market’s growth trajectory suggests a continuing shift towards LED technology across various applications.

Leading Regions, Countries, or Segments in LED Chip Industry

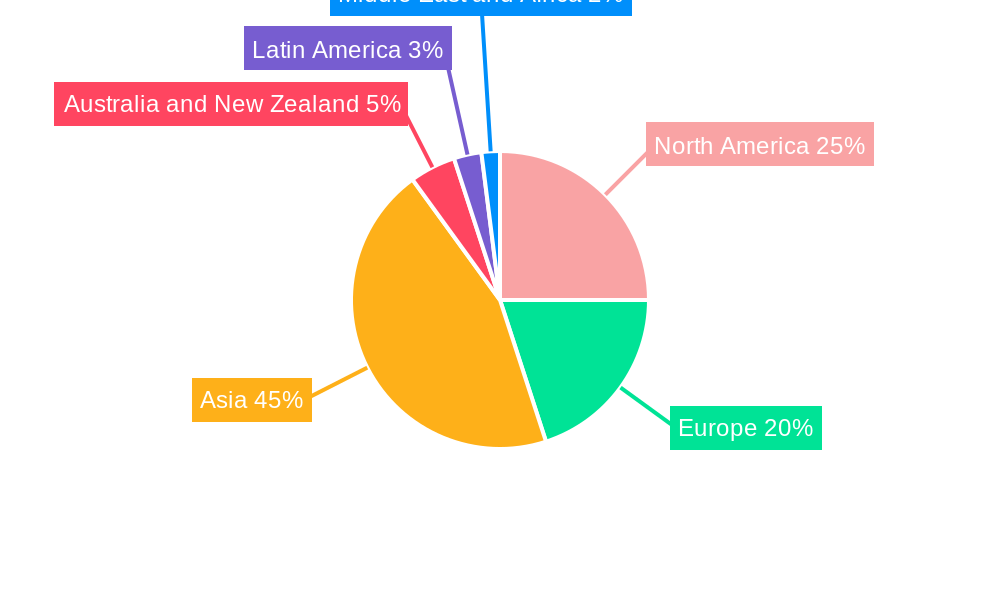

The Asia-Pacific region dominates the LED chip market, driven by a high concentration of manufacturing facilities and strong demand from consumer electronics and lighting sectors. China, in particular, has emerged as a leading player owing to substantial government investment in semiconductor technology and massive domestic demand.

Key Drivers for Asia-Pacific Dominance:

- High concentration of manufacturing facilities and a robust supply chain.

- Substantial government investment in the semiconductor industry.

- Strong demand from the consumer electronics and general lighting sectors.

- Favorable cost structure for large-scale manufacturing.

Segment Analysis:

- Automotive: Rapid adoption of LED headlights and tail lights due to improved safety and energy efficiency.

- Backlighting: Remains a significant segment, fueled by the continued growth of the display industry.

- Illumination: Expanding rapidly with growing awareness of energy efficiency and cost savings.

- Signs and Signals: Steady growth driven by adoption in outdoor advertising and traffic management systems.

- Other Applications: Increasingly diverse applications in horticulture, medical devices, and other specialized areas.

The dominance of the Asia-Pacific region is reinforced by its relatively lower production costs and strong manufacturing capabilities. The growth of specific applications, such as automotive lighting, is also accelerating in this region due to government support and a significant increase in vehicle production and sales. Europe and North America follow, exhibiting a mature market with high adoption rates but a slower growth rate due to market saturation and greater reliance on imports.

LED Chip Industry Product Innovations

Recent innovations focus on enhancing efficiency, color rendering, and lifespan. Micro-LED technology is revolutionizing display backlighting with superior brightness, contrast, and energy efficiency. Chip-on-Board (COB) technology simplifies assembly and reduces costs for general lighting. Improvements in materials science and packaging are leading to higher lumen output and improved thermal management. Miniaturization trends continue, driving innovation in smaller, more power-efficient chips for various applications.

Propelling Factors for LED Chip Industry Growth

The LED chip industry is propelled by several key factors: the increasing demand for energy-efficient lighting solutions, driven by stringent government regulations; ongoing technological advancements that improve product performance, cost reduction in production, and growing adoption in various sectors, such as automotive and general illumination; and the development of smart lighting systems and internet of things (IoT) technologies creating new opportunities for growth.

Obstacles in the LED Chip Industry Market

The industry faces challenges such as intense price competition from low-cost manufacturers, fluctuations in raw material prices, potential supply chain disruptions, and environmental concerns about end-of-life management. These factors can influence the profitability of manufacturers and can affect the industry's ability to meet the growing global demand.

Future Opportunities in LED Chip Industry

Future opportunities include expansion into emerging markets, continued miniaturization for specialized applications, and integration with smart lighting systems. The development of new materials and manufacturing techniques can further enhance product performance and reduce costs. The growing demand for advanced lighting solutions in the automotive industry, as well as the increasing use of LEDs in horticulture, will create new revenue streams.

Major Players in the LED Chip Industry Ecosystem

- Samsung Electronics Co Ltd

- Nichia Corporation

- SemiLEDS

- Cree Inc

- Epistar Corporation

- OSRAM Opto Semiconductors GmbH

- Bridgelux Inc

- Formosa Epitaxy

- TOYODA GOSEI Co

- Seoul Viosys Co Ltd

- Lumileds Holding B V

Key Developments in LED Chip Industry Industry

- May 2022: AMS OSRAM launched the OSLON Optimal family of LEDs for horticulture lighting, based on the latest AMS ORAM 1mm2 chip.

- January 2023: Nichia Corporation and Infineon Technologies AG launched the industry's first fully integrated micro-LED light engine.

- April 2023: Sharp NEC Display Solutions Europe launched the NEC LED FC Series with COB technology.

Strategic LED Chip Industry Market Forecast

The LED chip market is poised for sustained growth, driven by technological advancements, increasing demand for energy-efficient lighting, and expansion into new applications. The continued development of micro-LEDs and other innovative technologies will further enhance product performance and drive market expansion. Emerging markets and the growing adoption of smart lighting systems present significant opportunities for growth in the coming years. The market is expected to experience a robust CAGR throughout the forecast period, leading to substantial market expansion.

LED Chip Industry Segmentation

-

1. Application

- 1.1. Backlighting

- 1.2. Illumination

- 1.3. Automotive

- 1.4. Signs and Signals

- 1.5. Other Applications

LED Chip Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

LED Chip Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Backlighting Application of Devices Boosting the LED Chips Market; R&D Investments and Government Initiatives; Power Efficiency of LED Chips

- 3.3. Market Restrains

- 3.3.1. Installation Complexities

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Backlighting

- 5.1.2. Illumination

- 5.1.3. Automotive

- 5.1.4. Signs and Signals

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Backlighting

- 6.1.2. Illumination

- 6.1.3. Automotive

- 6.1.4. Signs and Signals

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Backlighting

- 7.1.2. Illumination

- 7.1.3. Automotive

- 7.1.4. Signs and Signals

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Backlighting

- 8.1.2. Illumination

- 8.1.3. Automotive

- 8.1.4. Signs and Signals

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Backlighting

- 9.1.2. Illumination

- 9.1.3. Automotive

- 9.1.4. Signs and Signals

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Backlighting

- 10.1.2. Illumination

- 10.1.3. Automotive

- 10.1.4. Signs and Signals

- 10.1.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Backlighting

- 11.1.2. Illumination

- 11.1.3. Automotive

- 11.1.4. Signs and Signals

- 11.1.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa LED Chip Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Samsung Electronics Co Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Nichia Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 SemiLEDS

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Cree Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Epistar Corporation

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 OSRAM Opto Semiconductors GmbH

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Bridgelux Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Formosa Epitaxy*List Not Exhaustive

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 TOYODA GOSEI Co

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Seoul Viosys Co Ltd

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Lumileds Holding B V

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Samsung Electronics Co Ltd

List of Figures

- Figure 1: Global LED Chip Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America LED Chip Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America LED Chip Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe LED Chip Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe LED Chip Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia LED Chip Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia LED Chip Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Australia and New Zealand LED Chip Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Australia and New Zealand LED Chip Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Australia and New Zealand LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Australia and New Zealand LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America LED Chip Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America LED Chip Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America LED Chip Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa LED Chip Industry Revenue (Million), by Application 2024 & 2032

- Figure 35: Middle East and Africa LED Chip Industry Revenue Share (%), by Application 2024 & 2032

- Figure 36: Middle East and Africa LED Chip Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East and Africa LED Chip Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LED Chip Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global LED Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global LED Chip Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: LED Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: LED Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: LED Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: LED Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: LED Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: LED Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global LED Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global LED Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global LED Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global LED Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global LED Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global LED Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Global LED Chip Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Chip Industry?

The projected CAGR is approximately 11.90%.

2. Which companies are prominent players in the LED Chip Industry?

Key companies in the market include Samsung Electronics Co Ltd, Nichia Corporation, SemiLEDS, Cree Inc, Epistar Corporation, OSRAM Opto Semiconductors GmbH, Bridgelux Inc, Formosa Epitaxy*List Not Exhaustive, TOYODA GOSEI Co, Seoul Viosys Co Ltd, Lumileds Holding B V.

3. What are the main segments of the LED Chip Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Backlighting Application of Devices Boosting the LED Chips Market; R&D Investments and Government Initiatives; Power Efficiency of LED Chips.

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Installation Complexities.

8. Can you provide examples of recent developments in the market?

April 2023: Sharp NEC Display Solutions Europe launched the NEC LED FC Series with Chip on Board (COB) technology that impresses with high contrast, excellent durability in public spaces, and superb energy efficiency. Utilizing the already established F-style cabinets for comfortable setup and flexible usage, the latest FC Series benefits from front serviceability for all components, allowing easy access for maintenance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Chip Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Chip Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Chip Industry?

To stay informed about further developments, trends, and reports in the LED Chip Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence