Key Insights

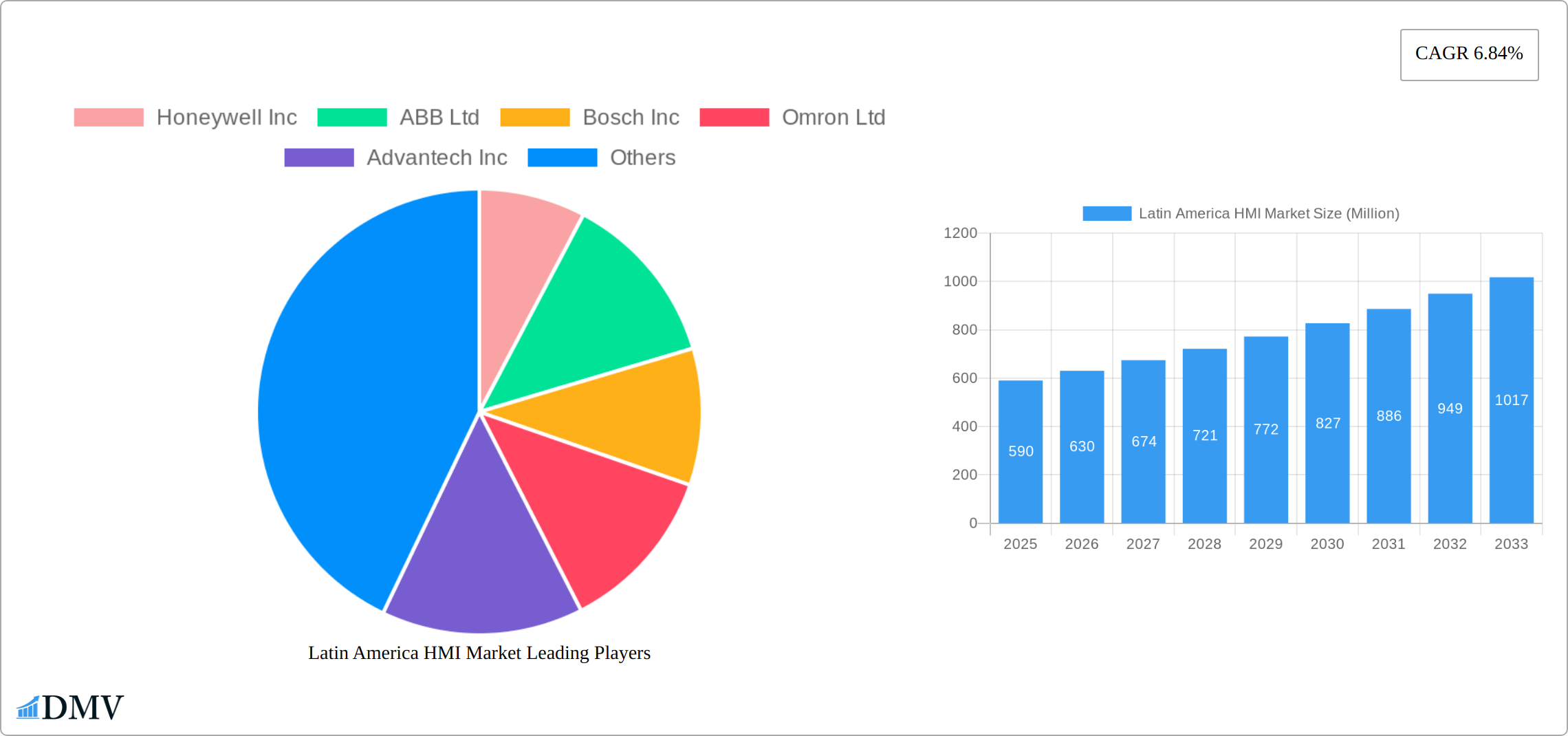

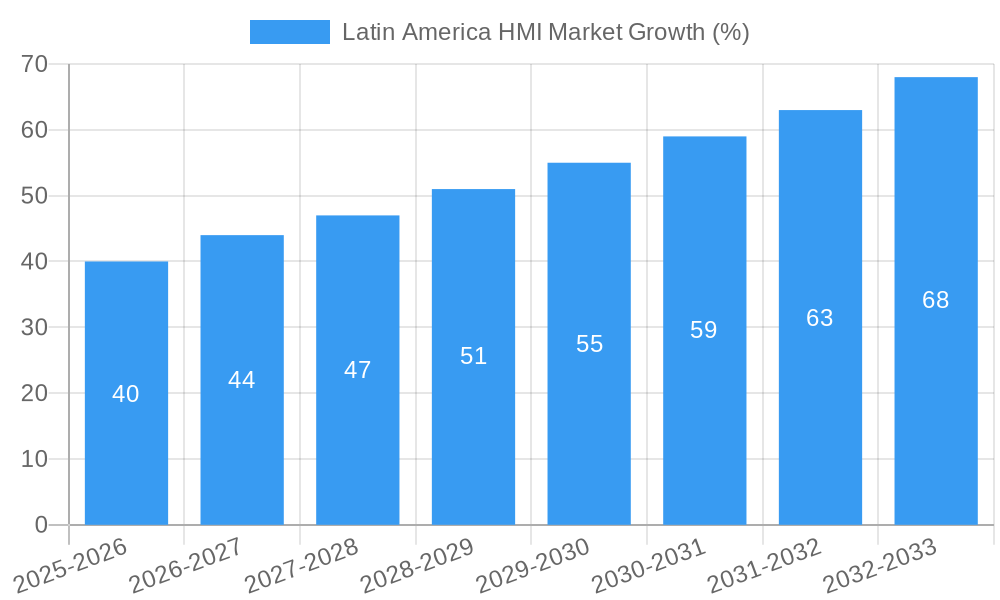

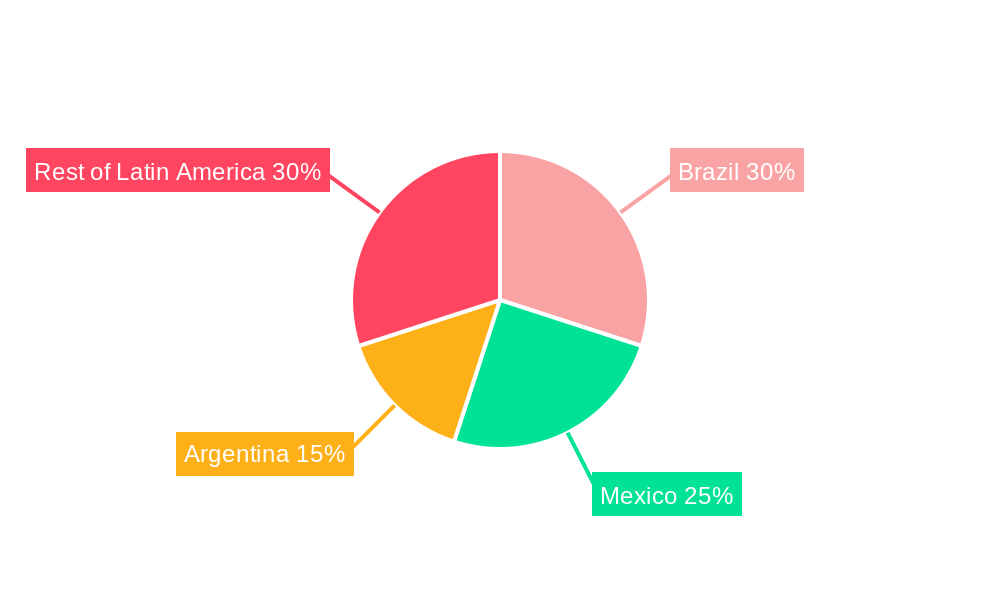

The Latin American Human Machine Interface (HMI) market is projected to reach a value of $0.59 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.84% from 2025 to 2033. This growth is fueled by several key factors. Increased automation across diverse end-user industries such as automotive, food and beverage, and pharmaceuticals is a primary driver. Latin America's burgeoning manufacturing sector, coupled with a rising demand for improved operational efficiency and enhanced worker safety, significantly contributes to the HMI market's expansion. Furthermore, the increasing adoption of Industry 4.0 technologies and smart manufacturing initiatives across the region is pushing the demand for advanced HMI solutions with features like predictive maintenance and real-time data analytics. The prevalence of sophisticated software functionalities integrated into HMI systems, enabling remote monitoring and control, further fuels market growth. While initial investment costs may present a restraint for some smaller companies, the long-term return on investment from improved productivity and reduced downtime outweighs this initial hurdle. Growth is expected to be particularly strong in countries like Brazil, Mexico, and Argentina, which are leading adopters of advanced manufacturing technologies within the region.

The market segmentation reveals a significant demand for hardware components, driven by the need for robust and reliable physical interfaces in industrial settings. However, software and services segments are witnessing rapid growth due to the increasing demand for customized HMI solutions and remote support. Within end-user industries, automotive and pharmaceutical sectors are showing strong growth, reflecting their emphasis on advanced manufacturing and process control. Leading players like Honeywell, ABB, and Siemens are strategically expanding their product portfolios and strengthening their market presence through partnerships and acquisitions to capitalize on this expanding market. The competitive landscape is characterized by both established global players and regional vendors, leading to innovation and price competition. The long-term forecast indicates continued growth across all segments, with software and service offerings potentially outpacing hardware growth as digital transformation gains momentum.

Latin America HMI Market Market Composition & Trends

The Latin America HMI Market, valued at approximately xx Million in 2025, showcases a dynamic landscape driven by various factors. Market concentration is moderate, with key players like Honeywell Inc, ABB Ltd, and Siemens AG holding significant shares. The market share distribution is as follows: Honeywell Inc at 15%, ABB Ltd at 12%, and Siemens AG at 10%. Innovation catalysts include technological advancements and R&D investments, with companies increasingly focusing on developing user-friendly and advanced HMI solutions.

- Regulatory Landscape: The region's regulatory framework is evolving, with standards like IEC 60068 improving product safety and reliability. Governments are also offering incentives for the adoption of advanced automation technologies.

- Substitute Products: Alternatives like traditional control panels and manual operations still exist but are rapidly being replaced by HMIs due to their efficiency and cost-effectiveness.

- End-user Profiles: The primary end-users are the automotive and food and beverage industries, which together account for 40% of the market demand. These sectors value the real-time data and control provided by HMIs.

- M&A Activities: The market has seen M&A activities worth xx Million in the past year, with strategic acquisitions aimed at expanding product portfolios and geographical reach.

The market's growth is also influenced by the increasing adoption of Industry 4.0 practices, which demand more sophisticated HMI solutions. This trend is expected to continue, driven by the need for enhanced operational efficiency and productivity.

Latin America HMI Market Industry Evolution

The Latin America HMI Market has experienced significant evolution over the study period of 2019–2033, with a projected compound annual growth rate (CAGR) of 8.5% from the base year of 2025 to the forecast period of 2025–2033. During the historical period of 2019–2024, the market saw a growth rate of 6.2%, driven by the increasing demand for automation across various industries.

Technological advancements have played a crucial role in this evolution, with the introduction of wireless HMIs and touch-based interfaces revolutionizing user interaction. The adoption of these technologies has been particularly notable in the automotive sector, where the integration of HMIs into vehicles has increased from 25% in 2019 to 35% in 2025. Similarly, the food and beverage industry has seen a 30% increase in HMI adoption over the same period, driven by the need for improved process control and monitoring.

Shifting consumer demands have also shaped the market, with a growing preference for user-friendly and customizable interfaces. This trend is expected to continue, with end-users increasingly seeking solutions that can be easily integrated into their existing systems. The market's growth trajectory is further supported by the rise of smart factories and the Internet of Things (IoT), which necessitate advanced HMI solutions for seamless data management and operational control.

Leading Regions, Countries, or Segments in Latin America HMI Market

Brazil and Mexico emerge as the leading countries in the Latin America HMI Market, driven by their robust industrial sectors and increasing investments in automation. Within the component type segment, hardware holds the largest share at 50%, followed by software at 30% and services at 20%. The automotive industry leads the end-user segment with a 25% market share, followed closely by the food and beverage sector at 15%.

Key Drivers for Brazil:

Investment in smart manufacturing initiatives, with government support for Industry 4.0.

Strong presence of automotive and food and beverage industries, driving demand for HMIs.

Key Drivers for Mexico:

Proximity to the US market, facilitating technology transfer and investment.

Growing emphasis on operational efficiency and automation in manufacturing.

Dominance Factors for Hardware: The hardware segment's dominance can be attributed to its essential role in HMI systems, providing the physical interface for user interaction. The demand for durable and advanced hardware solutions continues to grow, supported by technological advancements and the need for reliable performance in harsh industrial environments.

Dominance Factors for the Automotive Industry: The automotive sector's lead in HMI adoption is driven by the integration of advanced driver assistance systems (ADAS) and the need for enhanced in-vehicle user experiences. The industry's focus on safety and efficiency has propelled the demand for sophisticated HMI solutions that can handle complex data and control systems.

Latin America HMI Market Product Innovations

Recent product innovations in the Latin America HMI Market include the introduction of wireless and touch-based interfaces, enhancing user interaction and operational efficiency. The Exor X5 Wireless HMI, launched in August 2023, exemplifies this trend, offering a revolutionary way for industrial operators to interact with their machines. These innovations are characterized by their user-friendly design and advanced functionalities, such as real-time data monitoring and remote control capabilities, setting new standards in the industry.

Propelling Factors for Latin America HMI Market Growth

The growth of the Latin America HMI Market is propelled by several key factors:

- Technological Advancements: The integration of IoT and Industry 4.0 technologies necessitates advanced HMI solutions for seamless data management and operational control.

- Economic Influences: Rising industrialization and investments in automation across sectors like automotive and food and beverage drive market expansion.

- Regulatory Support: Government initiatives promoting smart manufacturing and automation further boost the adoption of HMIs.

These factors collectively contribute to the market's robust growth trajectory, with continuous innovation and strategic investments playing pivotal roles.

Obstacles in the Latin America HMI Market Market

Despite its growth, the Latin America HMI Market faces several obstacles:

- Regulatory Challenges: Stringent regulations and compliance requirements can slow down market entry and product development.

- Supply Chain Disruptions: Global supply chain issues impact the availability of critical components, affecting production timelines and costs.

- Competitive Pressures: Intense competition among key players can lead to price wars and reduced profit margins, impacting overall market growth.

These barriers pose significant challenges, requiring strategic solutions to maintain market momentum and profitability.

Future Opportunities in Latin America HMI Market

The Latin America HMI Market presents several future opportunities:

- Emerging Markets: Untapped potential in smaller countries within the region offers new growth avenues.

- Technological Advancements: The development of AI and machine learning-integrated HMIs can revolutionize user interaction and operational efficiency.

- Consumer Trends: Increasing demand for personalized and user-friendly interfaces creates opportunities for customized HMI solutions.

These opportunities highlight the market's potential for expansion and innovation, driven by evolving technologies and consumer preferences.

Major Players in the Latin America HMI Market Ecosystem

- Honeywell Inc

- ABB Ltd

- Bosch Inc

- Omron Ltd

- Advantech Inc

- Rockwell Automation Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Beijer Electronics Inc

- Yokogawa Electric Corporation

- GE Ltd

- Panasonic Corporation

- Eaton Corporation

Key Developments in Latin America HMI Market Industry

- March 2024: Spyrosoft announced a partnership with Candera, a leading provider of human-machine interface and embedded software tools. This collaboration allows Spyrosoft to leverage Candera’s toolkit and expertise, fostering the creation of innovative and user-friendly interfaces across various industries, including automotive, healthcare, and home automation. This development is expected to drive market growth by enhancing product offerings and expanding market reach.

- August 2023: Exor released the Exor X5 Wireless HMI product, designed to revolutionize industrial operator interactions with machines and equipment. This advanced device enhances operational efficiency and user experience, significantly impacting market dynamics by setting new standards for HMI technology.

Strategic Latin America HMI Market Market Forecast

The Latin America HMI Market is poised for significant growth over the forecast period of 2025–2033, driven by technological advancements, increasing industrialization, and supportive government policies. The market's potential is further enhanced by emerging opportunities in new markets and the development of AI-integrated HMIs. As industries continue to prioritize automation and operational efficiency, the demand for sophisticated HMI solutions is expected to surge, positioning the market for sustained growth and innovation.

Latin America HMI Market Segmentation

-

1. Component Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Food and Beverage

- 2.3. Packaging

- 2.4. Pharmaceutical

- 2.5. Oil and Gas

- 2.6. Metal and Mining

- 2.7. Other End-user Industries

Latin America HMI Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America HMI Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage in Industrial Automation; Shift toward Industry 4.0 and Adoption of IoT; Increasing Focus on Developing Manufacturing Processes

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America HMI Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Food and Beverage

- 5.2.3. Packaging

- 5.2.4. Pharmaceutical

- 5.2.5. Oil and Gas

- 5.2.6. Metal and Mining

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. Brazil Latin America HMI Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America HMI Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America HMI Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America HMI Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America HMI Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America HMI Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Honeywell Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ABB Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bosch Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Omron Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Advantech Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Rockwell Automation Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mitsubishi Electric Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Siemens AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Schneider Electric SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Beijer Electronics Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Yokogawa Electric Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 GE Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Panasonic Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Eaton Corporation

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Honeywell Inc

List of Figures

- Figure 1: Latin America HMI Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America HMI Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America HMI Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America HMI Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 3: Latin America HMI Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Latin America HMI Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America HMI Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America HMI Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 13: Latin America HMI Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Latin America HMI Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America HMI Market?

The projected CAGR is approximately 6.84%.

2. Which companies are prominent players in the Latin America HMI Market?

Key companies in the market include Honeywell Inc, ABB Ltd, Bosch Inc, Omron Ltd, Advantech Inc, Rockwell Automation Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Beijer Electronics Inc, Yokogawa Electric Corporation, GE Ltd, Panasonic Corporation, Eaton Corporation.

3. What are the main segments of the Latin America HMI Market?

The market segments include Component Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage in Industrial Automation; Shift toward Industry 4.0 and Adoption of IoT; Increasing Focus on Developing Manufacturing Processes.

6. What are the notable trends driving market growth?

Automotive is Expected to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

March 2024: Spyrosoft announced a partnership with Candera, one of the leading providers of human-machine interface and embedded software tools for industries such as automotive, healthcare, or home automation. Through this collaboration, Spyrosoft has access to Candera’s toolkit and expertise, allowing the creation of innovative and user-friendly interfaces across various industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America HMI Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America HMI Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America HMI Market?

To stay informed about further developments, trends, and reports in the Latin America HMI Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence