Key Insights

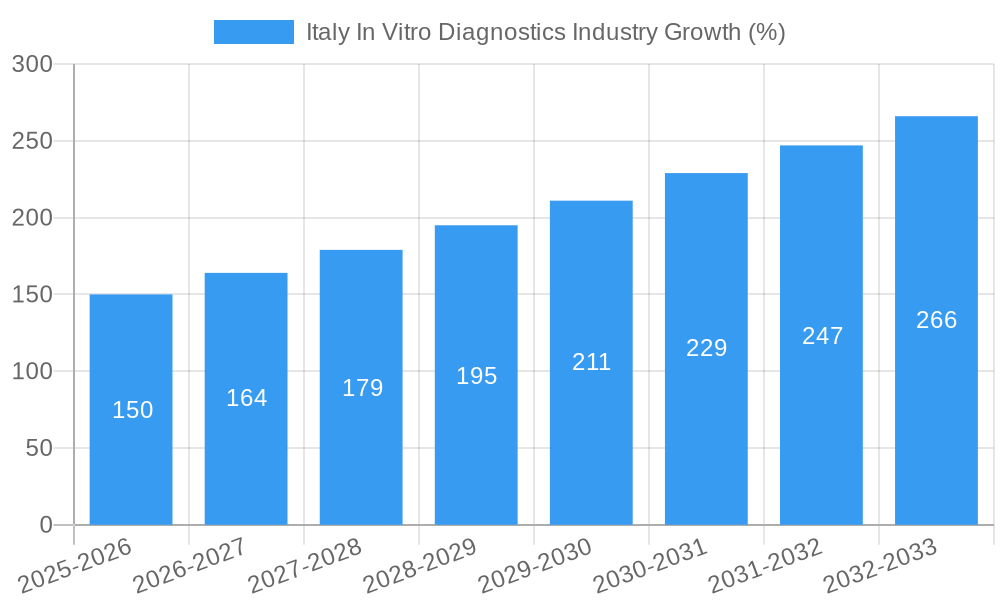

The Italian In Vitro Diagnostics (IVD) market, valued at approximately €X million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.50% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the rising prevalence of chronic diseases like diabetes and cancer, coupled with an aging population, necessitates increased diagnostic testing. Secondly, advancements in molecular diagnostics and immunodiagnostics are enabling earlier and more accurate disease detection, further stimulating market demand. Technological innovations, such as the development of more sophisticated and user-friendly disposable IVD devices, are streamlining testing processes and enhancing efficiency within diagnostic laboratories and hospitals. Government initiatives promoting preventative healthcare and improved healthcare infrastructure also contribute positively to market growth. However, the market faces certain challenges, including stringent regulatory approvals for new IVD products and potential price pressures from increasing competition. The market is segmented across various test types (clinical chemistry, molecular diagnostics, immunodiagnostics), product categories (instruments, reagents), usability (disposable vs. reusable devices), applications (infectious diseases, cancer, cardiology), and end-users (diagnostic laboratories, hospitals). The competitive landscape is characterized by both global giants such as Abbott Laboratories, Roche, and Siemens Healthineers, and regional players, indicating a dynamic market with opportunities for both established and emerging companies. The dominance of specific segments (e.g., clinical chemistry or a particular application) will likely influence future market trajectory, demanding ongoing analysis of technological advancements and evolving healthcare policies.

The forecast period (2025-2033) for the Italian IVD market indicates continued expansion driven by these aforementioned factors. However, careful monitoring of economic conditions and healthcare spending within Italy will be crucial for accurate forecasting. Specifically, potential fluctuations in healthcare budgets could impact the adoption rate of advanced IVD technologies. The competitive intensity is also anticipated to increase, with companies focusing on innovation, strategic partnerships, and mergers and acquisitions to maintain their market position. The segmentation analysis will highlight areas of greatest growth potential, providing valuable insights for investors and industry players seeking strategic investment and growth opportunities. Overall, the outlook for the Italian IVD market remains positive, promising continued expansion fueled by technological advancement, disease prevalence, and evolving healthcare needs.

Italy In Vitro Diagnostics (IVD) Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Italy In Vitro Diagnostics market, offering invaluable insights for stakeholders seeking to understand the current landscape and future trajectory of this vital sector. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. We examine key market segments, leading players, and emerging trends to provide a 360-degree view of the Italian IVD market, projected to reach xx Million by 2033.

Italy In Vitro Diagnostics Industry Market Composition & Trends

The Italian IVD market exhibits a moderately concentrated structure, with key players like Abbott Laboratories, Becton Dickinson and Company, and Siemens Healthineers AG holding significant market share. However, a number of smaller, specialized companies also contribute substantially to the overall market value. Innovation is driven by advancements in molecular diagnostics and point-of-care testing, catering to the increasing demand for rapid and accurate diagnostic solutions. The regulatory landscape is significantly shaped by the implementation of the EU In Vitro Diagnostic Regulation (EU) 2017/746 (IVDR), which came into effect in May 2022, impacting the market through stricter device approvals and labeling requirements. Substitute products, such as traditional diagnostic methods, pose some competitive pressure, but the advantages of IVDs in terms of speed, accuracy, and automation continue to fuel market expansion.

- Market Share Distribution (2024): Abbott Laboratories (15%), Becton Dickinson and Company (12%), Siemens Healthineers AG (10%), Others (63%).

- M&A Activity (2019-2024): xx Million in total deal value, with a noticeable increase in activity post-IVDR implementation. Most transactions were focused on acquiring smaller specialized companies with innovative technologies.

- End-User Profile: Hospitals and clinics are currently the major consumers of IVD products. However, a growing trend is the increasing adoption of point-of-care testing in smaller clinics and physician offices.

Italy In Vitro Diagnostics Industry Industry Evolution

The Italian IVD market has experienced consistent growth over the historical period (2019-2024), fueled by factors such as an aging population, rising prevalence of chronic diseases (diabetes, cancer, cardiovascular diseases), and increasing government healthcare spending. Technological advancements, particularly in molecular diagnostics and automation, have further accelerated market expansion. The adoption of high-throughput screening technologies and sophisticated diagnostic platforms has dramatically improved diagnostic accuracy and efficiency. The introduction of the IVDR has led to a period of adjustment, but this is expected to positively impact the industry in the long-run through greater standardization and improved patient safety. Consumer demand has shifted towards more personalized and rapid diagnostic solutions, emphasizing the need for innovative IVD products. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately 4.5%. We predict a CAGR of 5.2% from 2025 to 2033.

Leading Regions, Countries, or Segments in Italy In Vitro Diagnostics Industry

The northern regions of Italy (Lombardy, Veneto, Emilia-Romagna) dominate the IVD market, driven by a higher concentration of hospitals and diagnostic laboratories, as well as greater investment in healthcare infrastructure. Within the market segments, Clinical Chemistry, Immuno Diagnostics, and Molecular Diagnostics are the major contributors.

Key Drivers:

- Significant investments in healthcare infrastructure, particularly in the northern regions.

- Government initiatives and funding for the adoption of advanced IVD technologies.

- Strong research and development activities by industry players.

- Increased prevalence of chronic diseases driving demand for diagnostic testing.

Dominance Factors:

- High concentration of specialized hospitals and laboratories.

- Strong private sector investment in healthcare.

- High per capita healthcare spending compared to other regions in Italy. The prevalence of chronic diseases, especially within the aging population, creates high demand for diagnostics. The concentration of sophisticated medical facilities and research centers in the north drives innovation and adoption of advanced technologies.

Italy In Vitro Diagnostics Industry Product Innovations

Recent innovations in the Italian IVD market include the development of portable and point-of-care testing devices, enabling rapid diagnostics outside traditional laboratory settings. Advancements in molecular diagnostics, including next-generation sequencing (NGS) technologies, offer enhanced diagnostic capabilities for complex diseases like cancer. Many companies are focusing on developing integrated diagnostic platforms that offer a comprehensive suite of testing capabilities. These innovations are characterized by improved accuracy, speed, and ease of use, resulting in better patient outcomes and reduced healthcare costs.

Propelling Factors for Italy In Vitro Diagnostics Industry Growth

The growth of the Italian IVD market is propelled by several factors. Technological advancements, particularly in automation and molecular diagnostics, are increasing the efficiency and accuracy of testing. Rising healthcare expenditure by both public and private sectors fuels demand for advanced diagnostic tools. The increasing prevalence of chronic diseases, alongside an aging population, necessitates increased diagnostic testing. Government regulations like the IVDR, while initially disruptive, are ultimately expected to standardize quality and foster market growth.

Obstacles in the Italy In Vitro Diagnostics Industry Market

Despite significant growth potential, the Italian IVD market faces certain challenges. The implementation of the IVDR led to initial complexities and increased regulatory costs for manufacturers. Supply chain disruptions, especially during the COVID-19 pandemic, impacted product availability and pricing. Intense competition among established players and emerging companies creates pressures on pricing and profitability.

Future Opportunities in Italy In Vitro Diagnostics Industry

The Italian IVD market presents several promising future opportunities. Increased adoption of personalized medicine will drive demand for customized diagnostic solutions. The growing use of telemedicine and remote patient monitoring could integrate IVD testing into home healthcare. Further development and adoption of point-of-care testing will expand accessibility and convenience. Focus on innovative diagnostic tools tailored to emerging infectious diseases also presents a large market opportunity.

Major Players in the Italy In Vitro Diagnostics Industry Ecosystem

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- DIESSE Diagnostica Senese Societa Benefit SpA

- BioMerieux

- Abbott Laboratories

- Siemens Healthineers AG

- F Hoffmann-La Roche AG

- Thermo Fischer Scientific Inc

- MTD Diagnostics S R L

- Sysmex Corporation

- Danaher

- QIAGEN

- SCLAVO Diagnostics International

Key Developments in Italy In Vitro Diagnostics Industry Industry

- April 2023: Biovica International partnered with IT Health Fusion to commercialize the DiviTum TKa assay in Italy.

- May 2022: The EU In Vitro Diagnostic Regulation (IVDR) became fully effective in Italy.

Strategic Italy In Vitro Diagnostics Industry Market Forecast

The Italian IVD market is poised for sustained growth, driven by technological innovation, increasing healthcare expenditure, and the rising prevalence of chronic diseases. The forecast period (2025-2033) suggests a significant expansion, with considerable opportunities for both established players and emerging companies. The market will likely witness increased consolidation through mergers and acquisitions, as companies strive to expand their product portfolios and market reach. The adoption of advanced technologies, such as AI and machine learning, will further enhance the accuracy and efficiency of IVD testing, leading to improved patient outcomes and cost-effectiveness.

Italy In Vitro Diagnostics Industry Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Other Techniques

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer

- 4.4. Cardiology

- 4.5. Other Applications

-

5. End-users

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End-users

Italy In Vitro Diagnostics Industry Segmentation By Geography

- 1. Italy

Italy In Vitro Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Molecular Diagnostics Segment is Expected to Hold a Major Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Other Techniques

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer

- 5.4.4. Cardiology

- 5.4.5. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End-users

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End-users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bio-Rad Laboratories Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DIESSE Diagnostica Senese Societa Benefit SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BioMerieux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthineers AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 F Hoffmann-La Roche AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fischer Scientific Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MTD Diagnostics S R L

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sysmex Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Danaher

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 QIAGEN

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SCLAVO Diagnostics International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Italy In Vitro Diagnostics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy In Vitro Diagnostics Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 4: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 5: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 7: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2019 & 2032

- Table 8: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2019 & 2032

- Table 9: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 12: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by End-users 2019 & 2032

- Table 13: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 18: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 19: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 20: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 21: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2019 & 2032

- Table 22: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2019 & 2032

- Table 23: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 26: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by End-users 2019 & 2032

- Table 27: Italy In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Italy In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy In Vitro Diagnostics Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Italy In Vitro Diagnostics Industry?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, DIESSE Diagnostica Senese Societa Benefit SpA, BioMerieux, Abbott Laboratories, Siemens Healthineers AG, F Hoffmann-La Roche AG, Thermo Fischer Scientific Inc, MTD Diagnostics S R L , Sysmex Corporation, Danaher, QIAGEN, SCLAVO Diagnostics International.

3. What are the main segments of the Italy In Vitro Diagnostics Industry?

The market segments include Test Type, Product, Usability, Application, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics.

6. What are the notable trends driving market growth?

Molecular Diagnostics Segment is Expected to Hold a Major Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In April 2023, Biovica International signed a commercial partnership with IT Health Fusion with an aim to commercialize the DiviTum TKa assay in Italy. This is an in-vitro-diagnostic device that is used for semi-quantitative measurement of thymidine kinase activity (TKa) in human serum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy In Vitro Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy In Vitro Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy In Vitro Diagnostics Industry?

To stay informed about further developments, trends, and reports in the Italy In Vitro Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence