Key Insights

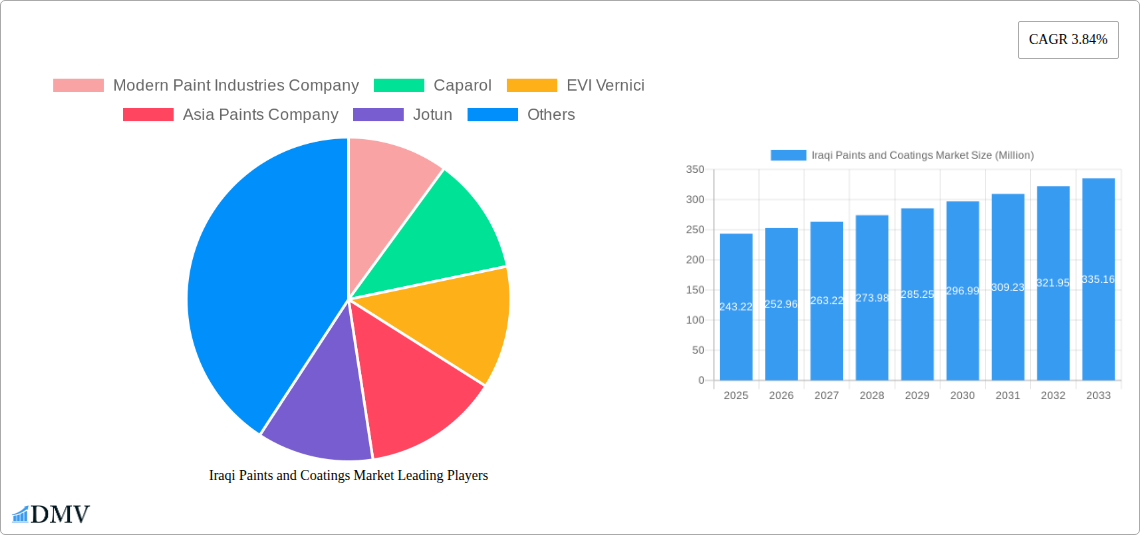

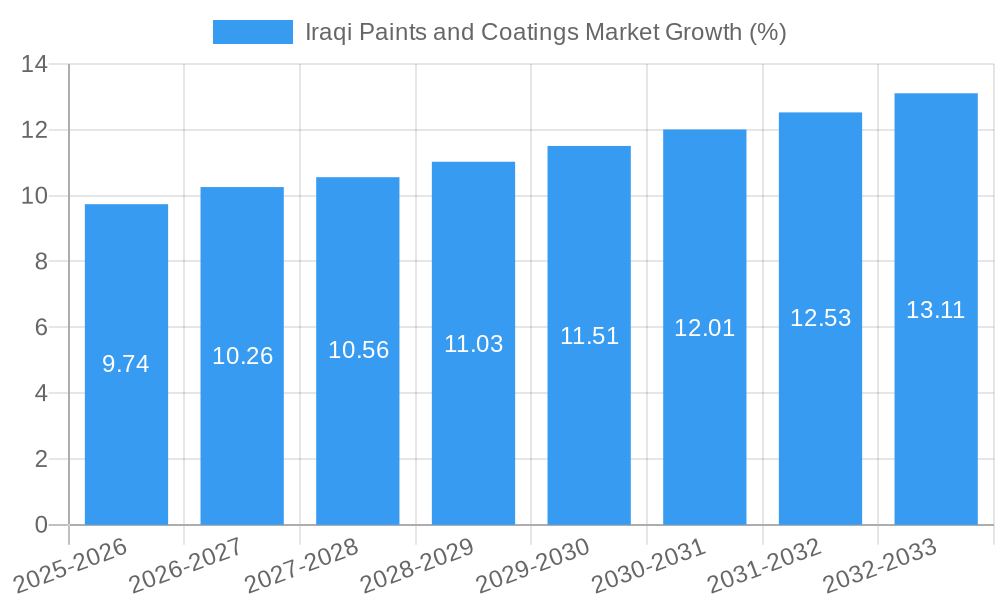

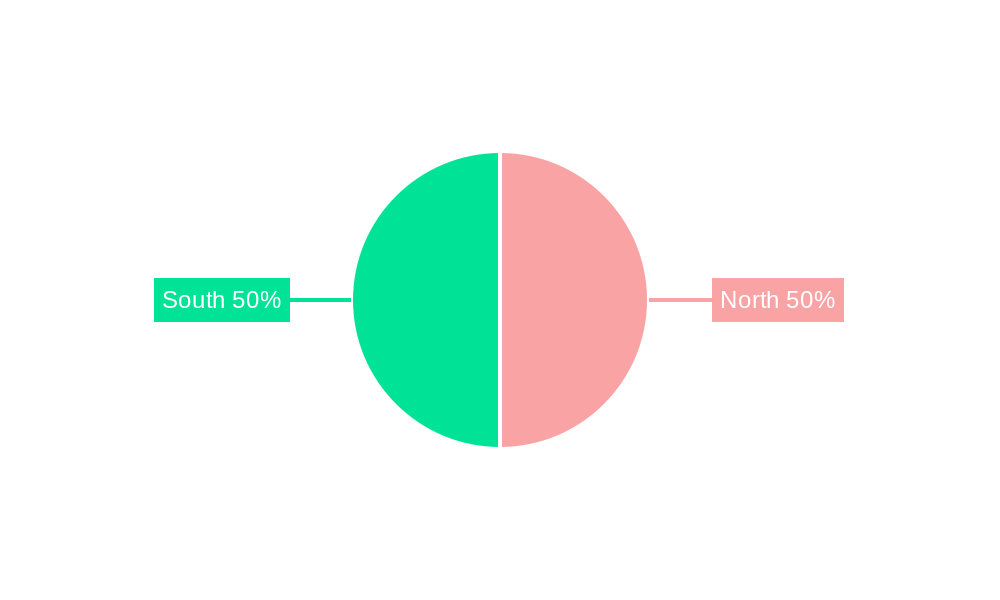

The Iraqi paints and coatings market, valued at $243.22 million in 2025, is projected to experience steady growth, driven by a robust construction sector and increasing government investments in infrastructure development. A compound annual growth rate (CAGR) of 3.84% from 2025 to 2033 indicates a promising outlook. Key growth drivers include rising urbanization, the expanding automotive industry, and a growing demand for aesthetically pleasing and durable coatings in residential and commercial buildings. The market is segmented by resin type (acrylic, alkyd, polyurethane, epoxy, polyester, and others), technology (water-borne, solvent-borne, and others), and end-user industry (architectural, automotive, wood, industrial, and others). While specific data on regional distribution (North and South) is limited, it's reasonable to assume a relatively even distribution initially, with potential shifts based on infrastructure projects and economic activity across the country. The competitive landscape includes both international players like Akzo Nobel, Jotun, and Asian Paints, and established local manufacturers such as Modern Paint Industries and Jazeera Paints. Challenges could include economic volatility, fluctuations in raw material prices, and potential supply chain disruptions; however, the overall market trend indicates sustained growth, driven by the aforementioned factors. Further market segmentation by specific paint types (e.g., interior wall paints, exterior paints, etc.) would provide a more granular understanding of the market's dynamics.

The dominance of acrylic and water-borne paints is expected to continue, reflecting both environmental considerations and affordability. The architectural segment is likely to contribute the largest share of the market, driven by construction activities and renovation projects. However, growth in the automotive and industrial sectors will also contribute significantly to the overall market expansion. Competitive pressures will likely remain high, with both multinational corporations and local manufacturers vying for market share. Strategic partnerships, technological advancements, and a focus on sustainability will be crucial for success in this dynamic market. Future growth will depend on sustained economic development, improved infrastructure, and a stable political climate in Iraq. A deeper analysis of specific regional market trends, coupled with consumer preference data, would allow for a more refined forecast.

Iraqi Paints and Coatings Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Iraqi paints and coatings market, offering a comprehensive overview of market trends, competitive landscape, and future growth prospects. Covering the period from 2019 to 2033, with 2025 as the base year, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033.

Iraqi Paints and Coatings Market Market Composition & Trends

The Iraqi paints and coatings market is characterized by a moderately concentrated landscape, with key players vying for market share. The market's growth is driven by factors such as increasing construction activities, rising disposable incomes, and government initiatives to improve infrastructure. However, the market also faces challenges, including volatile political and economic conditions, import restrictions, and competition from cheaper, lower-quality substitutes. Innovation in the sector centers on water-borne technologies to meet environmental regulations and enhance consumer appeal. The regulatory landscape is evolving, with a growing focus on environmental protection and product safety standards.

Key Market Dynamics:

- Market Concentration: The top five players hold approximately xx% of the market share in 2025.

- M&A Activity: Significant M&A activity, including Nippon Paint's acquisition of Betek Boya in 2019, illustrates the strategic importance of the Iraqi market. The total value of M&A deals between 2019 and 2024 is estimated at xx Million.

- Substitute Products: Lower-priced alternatives pose a threat to premium paint brands.

- End-User Profile: The architectural segment accounts for the largest share (approximately xx%), followed by the industrial segment (approximately xx%).

Iraqi Paints and Coatings Market Industry Evolution

The Iraqi paints and coatings market has witnessed significant evolution since 2019. The period between 2019 and 2024 saw a Compound Annual Growth Rate (CAGR) of approximately xx%, driven by reconstruction efforts and infrastructure development. Technological advancements, particularly the increased adoption of water-borne paints, have improved product quality and reduced environmental impact. Shifting consumer preferences towards higher-quality, eco-friendly coatings are also influencing market dynamics. The demand for specialized coatings, such as those used in automotive and industrial applications, is steadily increasing. The market is expected to maintain a robust growth trajectory through 2033, with a projected CAGR of xx% from 2025-2033, primarily fueled by continuous infrastructure projects and a growing middle class.

Leading Regions, Countries, or Segments in Iraqi Paints and Coatings Market

The Southern region of Iraq currently holds the largest market share due to high construction activity and population density. The architectural segment represents the most significant end-use industry, driven by both residential and commercial construction booms. Among resin types, acrylic paints maintain a dominant position due to their versatility, durability, and affordability. Water-borne technology also holds a significant share, reflecting the growing emphasis on environmentally friendly products.

Key Drivers:

- South Region Dominance: High population density, extensive construction projects, and government investments fuel growth.

- Architectural Segment Leadership: Robust residential and commercial construction fuels demand for paints and coatings.

- Acrylic Resin Type Prevalence: Its versatility and cost-effectiveness makes it the preferred choice across various applications.

- Water-borne Technology Adoption: Growing environmental awareness and stricter regulations drive the shift towards sustainable options.

Iraqi Paints and Coatings Market Product Innovations

Recent innovations in the Iraqi paints and coatings market focus on enhancing product performance, improving durability, and minimizing environmental impact. Manufacturers are introducing high-performance coatings with enhanced resistance to UV radiation, weathering, and corrosion. Self-cleaning and antimicrobial coatings are also gaining traction, catering to the increasing demand for hygiene and ease of maintenance. These innovations are often accompanied by marketing strategies highlighting unique selling propositions like superior longevity, ease of application, and eco-friendliness.

Propelling Factors for Iraqi Paints and Coatings Market Growth

Several factors contribute to the anticipated growth of the Iraqi paints and coatings market. Reconstruction efforts following years of conflict are driving demand for construction materials, including paints and coatings. Furthermore, the growing middle class with increasing disposable incomes is fueling demand for improved housing and aesthetics. Government investments in infrastructure projects and a focus on improving the nation's urban landscape also bolster market growth. The adoption of innovative technologies and environmentally friendly products further adds to market expansion.

Obstacles in the Iraqi Paints and Coatings Market Market

The Iraqi paints and coatings market faces certain challenges. Political instability and security concerns can disrupt supply chains and hinder investment. Economic volatility and fluctuating currency exchange rates pose risks to both manufacturers and consumers. Furthermore, intense competition from both domestic and international players creates pressure on pricing and profit margins. Import restrictions and customs duties can inflate prices and limit the availability of certain products.

Future Opportunities in Iraqi Paints and Coatings Market

The Iraqi paints and coatings market presents numerous opportunities. The growing construction sector, particularly infrastructure projects, creates sustained demand. The increasing adoption of advanced technologies like UV-resistant and self-cleaning paints opens new market niches. Moreover, the increasing awareness of environmental sustainability creates demand for eco-friendly coatings. Government initiatives to stimulate economic growth will further propel market expansion.

Major Players in the Iraqi Paints and Coatings Market Ecosystem

- Jotun

- Akzo Nobel NV

- Asia Paints Company

- Asian Paints Berger

- Modern Paint Industries Company

- Caparol

- EVI Vernici

- Betek Boya ve Kimya Sanayi AS (Nippon paint Holdings Co Ltd)

- Silkcoat

- Jazeera Paints

- National Paints Factories Limited

- MAS PAINTS & CHEMICAL INDUSTRIES

- Nasr Paint

- Hempel AS

- Al-Tabieaa Company

Key Developments in Iraqi Paints and Coatings Market Industry

- April 2019: Nippon Paint Holdings Co. Ltd acquired Turkish Paint Manufacturer Betek Boya ve Kimya Sanayi Anonim Şirketi, expanding its presence in the Middle East.

- December 2018: Jazeera Paints opened its second showroom in Sulaymaniyah, Kurdistan region, strengthening its market reach.

- August 2018: CaparolPaints signed partnerships with Iraqi contractors, improving market penetration.

Strategic Iraqi Paints and Coatings Market Market Forecast

The Iraqi paints and coatings market is poised for sustained growth, driven by ongoing infrastructure development, rising consumer spending, and the adoption of innovative products. The market's potential is significant, with opportunities in both established and emerging segments. Continued political and economic stability would further enhance market growth trajectory, making it an attractive investment destination for both domestic and international players.

Iraqi Paints and Coatings Market Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Polyester

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Other Technologies

-

3. End-user Industry

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Industrial

- 3.5. Other End-user Industries

-

4. Province

- 4.1. North

- 4.2. South

Iraqi Paints and Coatings Market Segmentation By Geography

- 1. Iraq

Iraqi Paints and Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activities in Iraq; Increasing Investment in the Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. Impact of COVID-; Other Restraints

- 3.4. Market Trends

- 3.4.1. Industrial Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iraqi Paints and Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Industrial

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Province

- 5.4.1. North

- 5.4.2. South

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Iraq

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Modern Paint Industries Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caparol

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EVI Vernici

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asia Paints Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jotun

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Betek Boya ve Kimya Sanayi AS (Nippon paint Holdings Co Ltd)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silkcoat*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akzo Nobel NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jazeera Paints

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asian Paints Berger

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 National Paints Factories Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MAS PAINTS & CHEMICAL INDUSTRIES

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Nasr Paint

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hempel AS

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Al-Tabieaa Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Modern Paint Industries Company

List of Figures

- Figure 1: Iraqi Paints and Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iraqi Paints and Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Iraqi Paints and Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iraqi Paints and Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: Iraqi Paints and Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Iraqi Paints and Coatings Market Volume liter Forecast, by Resin Type 2019 & 2032

- Table 5: Iraqi Paints and Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Iraqi Paints and Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 7: Iraqi Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Iraqi Paints and Coatings Market Volume liter Forecast, by End-user Industry 2019 & 2032

- Table 9: Iraqi Paints and Coatings Market Revenue Million Forecast, by Province 2019 & 2032

- Table 10: Iraqi Paints and Coatings Market Volume liter Forecast, by Province 2019 & 2032

- Table 11: Iraqi Paints and Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Iraqi Paints and Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 13: Iraqi Paints and Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Iraqi Paints and Coatings Market Volume liter Forecast, by Country 2019 & 2032

- Table 15: Iraqi Paints and Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 16: Iraqi Paints and Coatings Market Volume liter Forecast, by Resin Type 2019 & 2032

- Table 17: Iraqi Paints and Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 18: Iraqi Paints and Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 19: Iraqi Paints and Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Iraqi Paints and Coatings Market Volume liter Forecast, by End-user Industry 2019 & 2032

- Table 21: Iraqi Paints and Coatings Market Revenue Million Forecast, by Province 2019 & 2032

- Table 22: Iraqi Paints and Coatings Market Volume liter Forecast, by Province 2019 & 2032

- Table 23: Iraqi Paints and Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Iraqi Paints and Coatings Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iraqi Paints and Coatings Market?

The projected CAGR is approximately 3.84%.

2. Which companies are prominent players in the Iraqi Paints and Coatings Market?

Key companies in the market include Modern Paint Industries Company, Caparol, EVI Vernici, Asia Paints Company, Jotun, Betek Boya ve Kimya Sanayi AS (Nippon paint Holdings Co Ltd), Silkcoat*List Not Exhaustive, Akzo Nobel NV, Jazeera Paints, Asian Paints Berger, National Paints Factories Limited, MAS PAINTS & CHEMICAL INDUSTRIES, Nasr Paint, Hempel AS, Al-Tabieaa Company.

3. What are the main segments of the Iraqi Paints and Coatings Market?

The market segments include Resin Type, Technology, End-user Industry, Province.

4. Can you provide details about the market size?

The market size is estimated to be USD 243.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activities in Iraq; Increasing Investment in the Oil and Gas Industry.

6. What are the notable trends driving market growth?

Industrial Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Impact of COVID-; Other Restraints.

8. Can you provide examples of recent developments in the market?

In April 2019, Nippon Paint Holdings Co. Ltd acquired Turkish Paint Manufacturer Betek Boya ve Kimya Sanayi Anonim Şirketi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iraqi Paints and Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iraqi Paints and Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iraqi Paints and Coatings Market?

To stay informed about further developments, trends, and reports in the Iraqi Paints and Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence