Key Insights

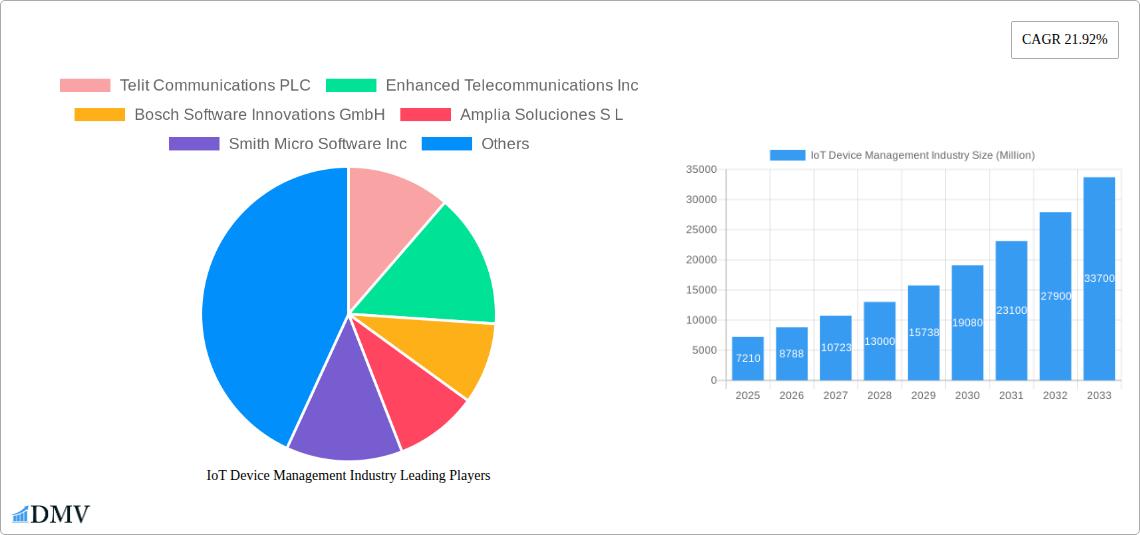

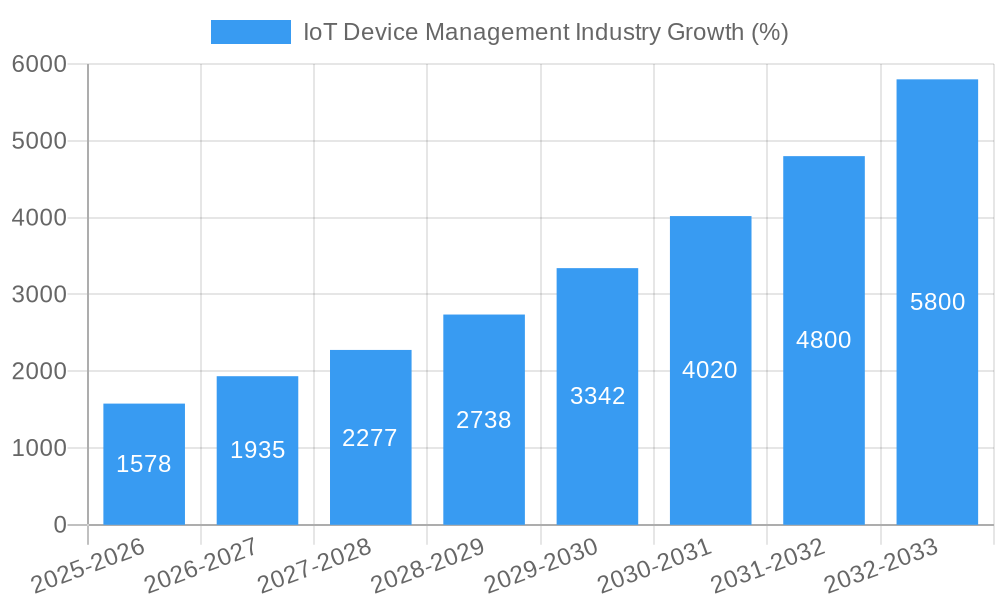

The IoT Device Management market is experiencing robust growth, projected to reach a market size of $7.21 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 21.92% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of Internet of Things (IoT) devices across various sectors, including retail, healthcare, transportation and logistics, and manufacturing, necessitates efficient management solutions. Businesses are recognizing the critical need for centralized platforms to monitor, control, and secure their expanding IoT deployments, minimizing downtime and optimizing performance. Furthermore, advancements in cloud computing and artificial intelligence are fueling the development of sophisticated device management tools offering enhanced capabilities in areas like predictive maintenance, remote diagnostics, and automated software updates. The market is segmented by component (solutions and services), organization size (SMEs and large enterprises), and end-user vertical. Large enterprises are currently driving a significant portion of the market due to their extensive IoT infrastructure and higher budgets for advanced management solutions. However, the adoption of IoT among SMEs is expected to increase substantially in the coming years, contributing significantly to market growth. Competitive forces within the market are characterized by a mix of established technology players like IBM and Microsoft, alongside specialized IoT device management providers like Telit Communications and Aeris Communications.

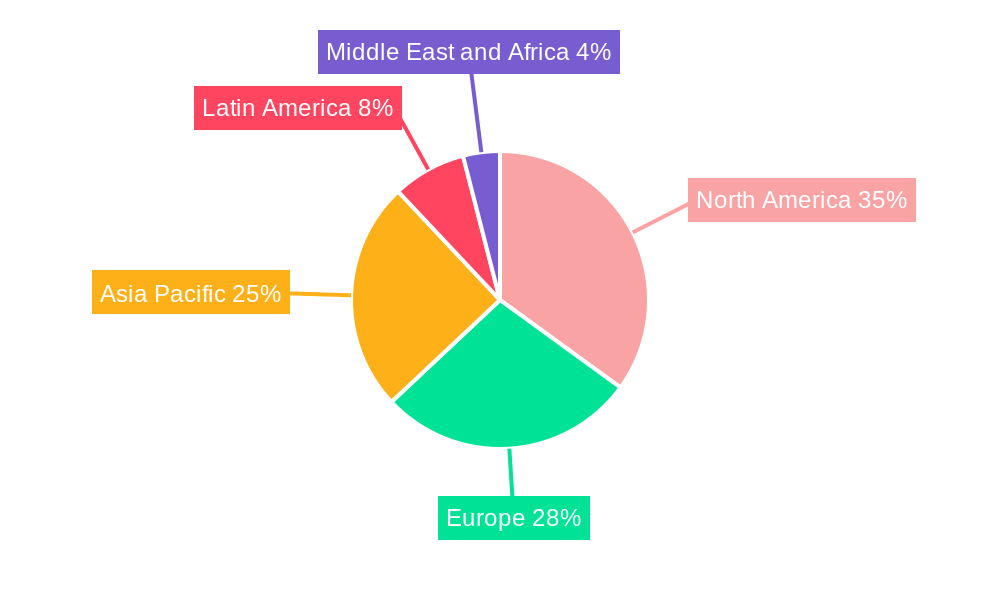

The market's growth trajectory is also shaped by several trends. The increasing demand for security and compliance solutions is becoming a major factor driving investments in IoT device management. Furthermore, the rising complexity of IoT networks and the need for streamlined operations are spurring the adoption of advanced analytics and automation features within these management platforms. Despite the positive outlook, the market faces some restraints, primarily the high initial investment costs associated with implementing IoT device management solutions, especially for smaller businesses. Integration challenges with existing IT infrastructure and a potential skills gap in managing and maintaining these complex systems also pose hurdles to market growth. However, these challenges are expected to be gradually overcome with the development of more user-friendly solutions and increased availability of skilled professionals. The North American market currently holds a substantial share, driven by early adoption and technological advancements. However, the Asia-Pacific region is expected to witness significant growth in the coming years, fuelled by increasing industrialization and digital transformation initiatives.

IoT Device Management Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the IoT Device Management industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages data from the historical period of 2019-2024 to project the future trajectory of this rapidly evolving market, expected to reach xx Million by 2033.

IoT Device Management Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory factors, and market dynamics within the IoT Device Management industry. We analyze market concentration, revealing the share held by key players like Telit Communications PLC, Bosch Software Innovations GmbH, and Microsoft Corporation. We also delve into the impact of mergers and acquisitions (M&A) activities, estimating the total value of deals at xx Million over the past five years. The report further examines the influence of substitute products and evolving end-user profiles across various sectors.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players commanding approximately xx% of the market share in 2024.

- Innovation Catalysts: Advancements in cloud computing, AI, and 5G technology are driving innovation within the sector.

- Regulatory Landscape: Government regulations concerning data privacy and security are shaping industry practices.

- M&A Activity: The past five years have witnessed xx M&A deals, totaling approximately xx Million, indicating a consolidating market.

- End-User Profiles: The report segments end-users by organization size (SMEs and large enterprises) and industry vertical (Retail, Healthcare, Transportation & Logistics, Manufacturing, and Others).

IoT Device Management Industry Evolution

This section traces the evolution of the IoT Device Management market, analyzing growth trajectories, technological shifts, and changing consumer demands from 2019 to 2024. The report highlights a Compound Annual Growth Rate (CAGR) of xx% during the historical period, driven by the increasing adoption of IoT devices across various sectors. We explore the impact of technological advancements, such as the emergence of AI-powered device management platforms and the expansion of 5G networks, on market growth. Furthermore, we examine how evolving consumer expectations, particularly regarding security and data privacy, are influencing the development of new solutions. The anticipated CAGR for the forecast period (2025-2033) is estimated to be xx%. The increasing demand for efficient and secure management of connected devices is expected to fuel market growth.

Leading Regions, Countries, or Segments in IoT Device Management Industry

This section identifies the dominant regions, countries, and segments within the IoT Device Management market. The analysis considers segments by component (Solutions and Services, including Real-Time Streaming Analytics and Network Bandwidth Management), organization size (SMEs and Large Enterprises), and end-user vertical. We reveal the key factors driving dominance in each segment.

- By Component: The Solutions segment currently dominates, representing xx% of the market in 2025. The growth of Services, particularly real-time streaming analytics, is expected to increase significantly in the forecast period.

- By Organization Size: Large Enterprises are the major consumers of IoT Device Management solutions, owing to their higher adoption rates and greater resources.

- By End-user Vertical: The Manufacturing and Transportation & Logistics sectors are leading adopters due to the significant potential for process optimization and efficiency gains.

Key Drivers:

- High Investment in IoT infrastructure: Significant capital expenditure in developing and deploying IoT networks and devices fuels the demand for robust management solutions.

- Stringent Data Security Regulations: Growing concerns about data breaches and privacy violations are driving the need for advanced security features in IoT device management platforms.

IoT Device Management Industry Product Innovations

Recent product innovations in the IoT device management space include AI-powered predictive maintenance tools, advanced security features like end-to-end encryption, and cloud-based management platforms offering scalability and flexibility. These innovations offer unique selling propositions (USPs) such as improved operational efficiency, reduced downtime, and enhanced security posture. The integration of blockchain technology for secure data management is gaining traction.

Propelling Factors for IoT Device Management Industry Growth

Several factors are driving the growth of the IoT Device Management industry. These include the escalating adoption of IoT devices across various sectors, advancements in technologies such as AI and machine learning, and the increasing demand for efficient and secure management of connected devices. Furthermore, supportive government regulations promoting IoT deployment and investment are fueling market expansion.

Obstacles in the IoT Device Management Industry Market

The industry faces challenges including the complexity of integrating diverse IoT devices, ensuring data security across numerous platforms, and managing the costs associated with deployment and maintenance. Supply chain disruptions and the high initial investment costs can also hinder market growth. The competitive landscape, with numerous vendors offering similar solutions, adds to the pressure.

Future Opportunities in IoT Device Management Industry

The IoT Device Management industry is poised for significant growth due to opportunities in emerging technologies like edge computing and the expansion of IoT in new verticals like smart agriculture and smart cities. Increased adoption in developing economies and the integration of advanced analytics for predictive maintenance will create new revenue streams.

Major Players in the IoT Device Management Industry Ecosystem

- Telit Communications PLC

- Enhanced Telecommunications Inc

- Bosch Software Innovations GmbH

- Amplia Soluciones S L

- Smith Micro Software Inc

- Microsoft Corporation

- Aeris Communication Inc

- International Business Management (IBM) Corporation

- PTC Incorporation

- Zentri Inc

- Oracle Corporation

- Advantech Co Ltd

- Cumulocity GmbH

Key Developments in IoT Device Management Industry

- May 2023: Laird Connectivity launches Canvas Device Manager, enhancing its IoT device management capabilities.

- February 2023: KORE unveils MODGo, a unified IoT asset management software solution.

Strategic IoT Device Management Industry Market Forecast

The IoT Device Management market is projected to experience robust growth over the forecast period, driven by increasing IoT adoption, technological advancements, and supportive government policies. New market opportunities in emerging sectors and the development of innovative solutions will further fuel market expansion, creating substantial potential for growth and investment.

IoT Device Management Industry Segmentation

-

1. Component

-

1.1. Solutions

- 1.1.1. Security Solution

- 1.1.2. Data Management

- 1.1.3. Remote Monitoring

- 1.1.4. Other So

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solutions

-

2. Organization Size

- 2.1. Small and Medium-Sized Enterprises

- 2.2. Large Enterprises

-

3. End-user Vertical

- 3.1. Retail

- 3.2. Healthcare

- 3.3. Transportation & Logistics

- 3.4. Manufacturing

- 3.5. Other End-user Vertical

IoT Device Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

IoT Device Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Smart Connected Devices; Accelerating Need for Converged Device Management

- 3.3. Market Restrains

- 3.3.1. Unavailability of Uniform IoT Standards for Interoperability

- 3.4. Market Trends

- 3.4.1. Retail to Have a Major Share in the IoT Device Management Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.1.1. Security Solution

- 5.1.1.2. Data Management

- 5.1.1.3. Remote Monitoring

- 5.1.1.4. Other So

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium-Sized Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Retail

- 5.3.2. Healthcare

- 5.3.3. Transportation & Logistics

- 5.3.4. Manufacturing

- 5.3.5. Other End-user Vertical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.1.1. Security Solution

- 6.1.1.2. Data Management

- 6.1.1.3. Remote Monitoring

- 6.1.1.4. Other So

- 6.1.2. Services

- 6.1.2.1. Professional Services

- 6.1.2.2. Managed Services

- 6.1.1. Solutions

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium-Sized Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Retail

- 6.3.2. Healthcare

- 6.3.3. Transportation & Logistics

- 6.3.4. Manufacturing

- 6.3.5. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.1.1. Security Solution

- 7.1.1.2. Data Management

- 7.1.1.3. Remote Monitoring

- 7.1.1.4. Other So

- 7.1.2. Services

- 7.1.2.1. Professional Services

- 7.1.2.2. Managed Services

- 7.1.1. Solutions

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium-Sized Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Retail

- 7.3.2. Healthcare

- 7.3.3. Transportation & Logistics

- 7.3.4. Manufacturing

- 7.3.5. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.1.1. Security Solution

- 8.1.1.2. Data Management

- 8.1.1.3. Remote Monitoring

- 8.1.1.4. Other So

- 8.1.2. Services

- 8.1.2.1. Professional Services

- 8.1.2.2. Managed Services

- 8.1.1. Solutions

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium-Sized Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Retail

- 8.3.2. Healthcare

- 8.3.3. Transportation & Logistics

- 8.3.4. Manufacturing

- 8.3.5. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.1.1. Security Solution

- 9.1.1.2. Data Management

- 9.1.1.3. Remote Monitoring

- 9.1.1.4. Other So

- 9.1.2. Services

- 9.1.2.1. Professional Services

- 9.1.2.2. Managed Services

- 9.1.1. Solutions

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium-Sized Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Retail

- 9.3.2. Healthcare

- 9.3.3. Transportation & Logistics

- 9.3.4. Manufacturing

- 9.3.5. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.1.1. Security Solution

- 10.1.1.2. Data Management

- 10.1.1.3. Remote Monitoring

- 10.1.1.4. Other So

- 10.1.2. Services

- 10.1.2.1. Professional Services

- 10.1.2.2. Managed Services

- 10.1.1. Solutions

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Small and Medium-Sized Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Retail

- 10.3.2. Healthcare

- 10.3.3. Transportation & Logistics

- 10.3.4. Manufacturing

- 10.3.5. Other End-user Vertical

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa IoT Device Management Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Telit Communications PLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Enhanced Telecommunications Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bosch Software Innovations GmbH

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Amplia Soluciones S L

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Smith Micro Software Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Microsoft Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Aeris Communication Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 International Business Management (IBM) Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 PTC Incorporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Zentri Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Oracle Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Advantech Co Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Cumulocity GmbH

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Telit Communications PLC

List of Figures

- Figure 1: Global IoT Device Management Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America IoT Device Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America IoT Device Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America IoT Device Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 15: North America IoT Device Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 16: North America IoT Device Management Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 17: North America IoT Device Management Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 18: North America IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe IoT Device Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe IoT Device Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe IoT Device Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 23: Europe IoT Device Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 24: Europe IoT Device Management Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 25: Europe IoT Device Management Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 26: Europe IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific IoT Device Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 29: Asia Pacific IoT Device Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 30: Asia Pacific IoT Device Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 31: Asia Pacific IoT Device Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 32: Asia Pacific IoT Device Management Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Asia Pacific IoT Device Management Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Asia Pacific IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America IoT Device Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 37: Latin America IoT Device Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 38: Latin America IoT Device Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 39: Latin America IoT Device Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 40: Latin America IoT Device Management Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 41: Latin America IoT Device Management Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 42: Latin America IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa IoT Device Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa IoT Device Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa IoT Device Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 47: Middle East and Africa IoT Device Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 48: Middle East and Africa IoT Device Management Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 49: Middle East and Africa IoT Device Management Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 50: Middle East and Africa IoT Device Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa IoT Device Management Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global IoT Device Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global IoT Device Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global IoT Device Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Global IoT Device Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Global IoT Device Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: IoT Device Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: IoT Device Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: IoT Device Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: IoT Device Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: IoT Device Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global IoT Device Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 17: Global IoT Device Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 18: Global IoT Device Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 19: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global IoT Device Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Global IoT Device Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 22: Global IoT Device Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global IoT Device Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 25: Global IoT Device Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 26: Global IoT Device Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 27: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global IoT Device Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global IoT Device Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 30: Global IoT Device Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 31: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global IoT Device Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global IoT Device Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 34: Global IoT Device Management Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 35: Global IoT Device Management Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IoT Device Management Industry?

The projected CAGR is approximately 21.92%.

2. Which companies are prominent players in the IoT Device Management Industry?

Key companies in the market include Telit Communications PLC, Enhanced Telecommunications Inc, Bosch Software Innovations GmbH, Amplia Soluciones S L, Smith Micro Software Inc, Microsoft Corporation, Aeris Communication Inc, International Business Management (IBM) Corporation, PTC Incorporation, Zentri Inc, Oracle Corporation, Advantech Co Ltd, Cumulocity GmbH.

3. What are the main segments of the IoT Device Management Industry?

The market segments include Component, Organization Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Smart Connected Devices; Accelerating Need for Converged Device Management.

6. What are the notable trends driving market growth?

Retail to Have a Major Share in the IoT Device Management Market.

7. Are there any restraints impacting market growth?

Unavailability of Uniform IoT Standards for Interoperability.

8. Can you provide examples of recent developments in the market?

May 2023: Laird Connectivity, a global leader in wireless technology, brings device management capabilities to its portfolio of IoT devices with Canvas Device Manager. Canvas Device Manager simplifies configuring and managing IoT products in the field throughout the full product lifecycle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IoT Device Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IoT Device Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IoT Device Management Industry?

To stay informed about further developments, trends, and reports in the IoT Device Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence