Key Insights

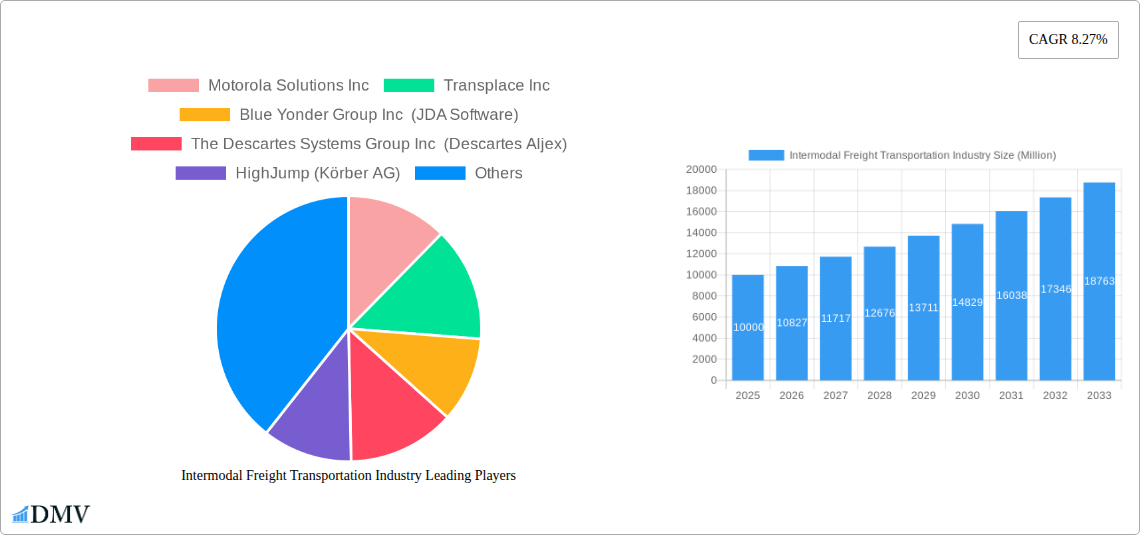

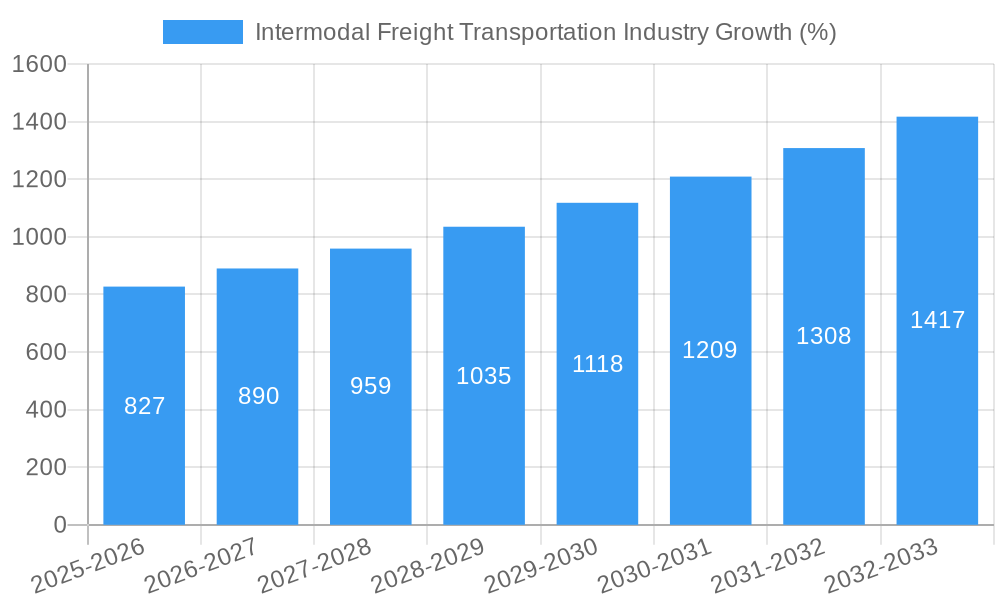

The intermodal freight transportation market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 8.27% from 2025 to 2033. This expansion is driven by several key factors. The increasing globalization of trade necessitates efficient and cost-effective logistics solutions, making intermodal transport, which combines different modes like rail, road, and maritime, a compelling choice. E-commerce's continued boom fuels demand for faster and more reliable delivery networks, further bolstering the industry's growth. Technological advancements, such as advanced tracking systems, improved route optimization software, and the integration of blockchain technology for enhanced security and transparency, are streamlining operations and boosting efficiency. Furthermore, a growing focus on sustainability and reducing carbon emissions is driving the adoption of more environmentally friendly intermodal transportation options. The industry's segmentation reflects its diverse applications across various sectors, including industrial and manufacturing, oil and gas, consumer and retail, food and beverage, and construction. Each sector contributes uniquely to overall market growth, presenting opportunities for specialized service providers.

However, the market faces certain restraints. Fluctuating fuel prices and geopolitical instability can significantly impact transportation costs and operational efficiency. Infrastructure limitations, particularly in certain regions, can constrain the seamless flow of goods and limit the full potential of intermodal transport. Moreover, regulatory complexities and the need for effective coordination between different transportation modes present operational challenges. Despite these limitations, the long-term outlook for the intermodal freight transportation market remains positive, driven by persistent demand for efficient logistics and the ongoing technological advancements within the sector. The market's diverse segments and the presence of established players like Motorola Solutions Inc, Transplace Inc, and Blue Yonder Group Inc, alongside emerging technology providers, indicate a dynamic and competitive landscape.

Intermodal Freight Transportation Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Intermodal Freight Transportation Industry, projecting a market valuation of $XX Million by 2033. It covers market composition, evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, and key players. The study period spans 2019-2033, with 2025 serving as both the base and estimated year. This report is essential for stakeholders seeking to understand and capitalize on the dynamic landscape of intermodal freight transportation.

Intermodal Freight Transportation Industry Market Composition & Trends

This section delves into the intricate structure of the intermodal freight transportation market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market exhibits a moderately concentrated structure with a few major players controlling a significant share, estimated at approximately 40% in 2025. The remaining 60% is distributed across numerous smaller companies.

- Market Share Distribution (2025): Top 5 players: 40%; Remaining players: 60%

- M&A Activity (2019-2024): A total of xx M&A deals valued at approximately $xx Million were recorded, primarily driven by the need for expansion into new markets and technological integration. The average deal size was approximately $xx Million.

- Innovation Catalysts: Technological advancements like IoT, AI, and blockchain are transforming logistics optimization, increasing efficiency and reducing costs. Government initiatives promoting sustainable transportation are also fueling innovation.

- Regulatory Landscape: Stringent regulations concerning emissions, safety, and security impact market dynamics. Varied regulatory frameworks across different geographies pose both challenges and opportunities for market players.

- Substitute Products: While other modes of transport exist, the inherent cost-effectiveness and efficiency advantages of intermodal solutions limit the impact of direct substitutes.

- End-User Profiles: The report profiles various end-user industries, including industrial and manufacturing, oil and gas, consumer and retail, food and beverage, construction, and others, analyzing their specific transportation needs and market contribution.

Intermodal Freight Transportation Industry Industry Evolution

This section analyzes the transformative journey of the intermodal freight transportation industry, tracing its growth trajectory, highlighting technological advancements, and exploring the evolution of consumer demand from 2019 to 2024. The industry witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), primarily driven by the increasing demand for efficient and cost-effective logistics solutions. Growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033).

The adoption of advanced technologies such as AI-powered route optimization software, real-time tracking systems, and autonomous vehicles is reshaping industry operations. Increasing e-commerce activity and the growing need for supply chain resilience have further fuelled industry growth. The changing consumer preferences towards faster delivery times and greater transparency are impacting the demand for efficient and reliable intermodal transportation services. The shift towards sustainability and the growing adoption of green transportation solutions are also becoming increasingly influential.

Leading Regions, Countries, or Segments in Intermodal Freight Transportation Industry

This section identifies the dominant regions, countries, and segments within the intermodal freight transportation industry. While specific data points for regional or country dominance require further analysis, certain segments are already exhibiting significant growth and influence.

By Component:

- Software: High growth due to the increasing demand for efficient logistics management and optimization tools. Key drivers include rising investments in software development and increasing adoption of cloud-based solutions.

- Service: Significant growth driven by the need for specialized services such as warehousing, last-mile delivery, and freight forwarding. The development of robust logistics networks is key to expansion.

By Transportation Mode:

- Maritime and Road Transport: This segment is currently the dominant mode due to its ability to handle large volumes of cargo over long distances. Continued investment in port infrastructure and improved road networks will sustain this dominance.

By End-User Industry:

- Industrial and Manufacturing: This segment is a major contributor due to the high volume of goods transported. Growth is driven by ongoing industrial expansion and increasing global trade.

Key Drivers:

- Rising investments in infrastructure development, particularly port modernization and improved road networks.

- Supportive government policies and regulations that encourage intermodal transportation.

- Growing demand for efficient and sustainable logistics solutions.

Intermodal Freight Transportation Industry Product Innovations

Recent innovations have focused on enhancing efficiency, visibility, and sustainability. Software solutions integrate diverse data sources for real-time tracking and predictive analytics. New sensor technologies and AI algorithms are improving route optimization, reducing fuel consumption and emissions. These innovations provide unique selling propositions including cost savings, improved delivery times, and enhanced supply chain transparency.

Propelling Factors for Intermodal Freight Transportation Industry Growth

Several factors contribute to the industry's growth. Technological advancements like AI-powered route optimization and real-time tracking significantly enhance efficiency. Economic factors such as increasing globalization and e-commerce drive demand for efficient logistics. Supportive government regulations promoting sustainable transportation and infrastructure development further stimulate growth. For example, the recent investment in intermodal terminals highlights the growing focus on improving supply chain infrastructure.

Obstacles in the Intermodal Freight Transportation Industry Market

Challenges include regulatory hurdles impacting cross-border transport, supply chain disruptions causing delays and increased costs, and intense competition among service providers. These factors contribute to increased operational complexity and fluctuating costs, impacting profitability. For instance, the recent supply chain stalemate illustrates the vulnerability to disruptions.

Future Opportunities in Intermodal Freight Transportation Industry

Emerging opportunities exist in expanding into underserved markets, integrating emerging technologies such as autonomous vehicles and drones, and leveraging data analytics for predictive maintenance and risk management. The focus on sustainability also presents opportunities for companies developing and deploying eco-friendly transportation solutions.

Major Players in the Intermodal Freight Transportation Industry Ecosystem

- Motorola Solutions Inc

- Transplace Inc

- Blue Yonder Group Inc (JDA Software)

- The Descartes Systems Group Inc (Descartes Aljex)

- HighJump (Körber AG)

- Cognizant Technology Solutions Corp

- Oracle Corporation

- Elemica Inc (Eyefreight BV)

- Envase Technologie

- GE Transportation (Wabtec Corporation)

Key Developments in Intermodal Freight Transportation Industry Industry

- June 2022: Launch of the first sea-rail intermodal freight train from Ningxia, China, to Iran, establishing a new international logistics channel. This significantly expands market reach and trade opportunities.

- December 2022: Aware Super's introduction of an intermodal terminals investment platform aims to alleviate supply chain bottlenecks. This reflects a growing recognition of the need for improved infrastructure investment.

Strategic Intermodal Freight Transportation Industry Market Forecast

The intermodal freight transportation industry is poised for continued growth, driven by technological advancements, rising e-commerce, and increasing focus on supply chain resilience. Emerging markets, particularly in developing economies, present significant opportunities for expansion. The industry's future hinges on adapting to evolving consumer demands, embracing sustainable practices, and effectively managing regulatory complexities to unlock substantial market potential. The market is expected to reach $XX Million by 2033.

Intermodal Freight Transportation Industry Segmentation

-

1. Component

- 1.1. Software

- 1.2. Service

-

2. Transportation Mode

- 2.1. Rail and Road Transport

- 2.2. Air and Road Transport

- 2.3. Maritime and Road Transport

- 2.4. Other Transportation Modes

-

3. End-User Industry

- 3.1. Industrial and Manufacturing

- 3.2. Oil and Gas

- 3.3. Consumer and Retail

- 3.4. Food & Beverage

- 3.5. Construction

- 3.6. Other End-User Industries

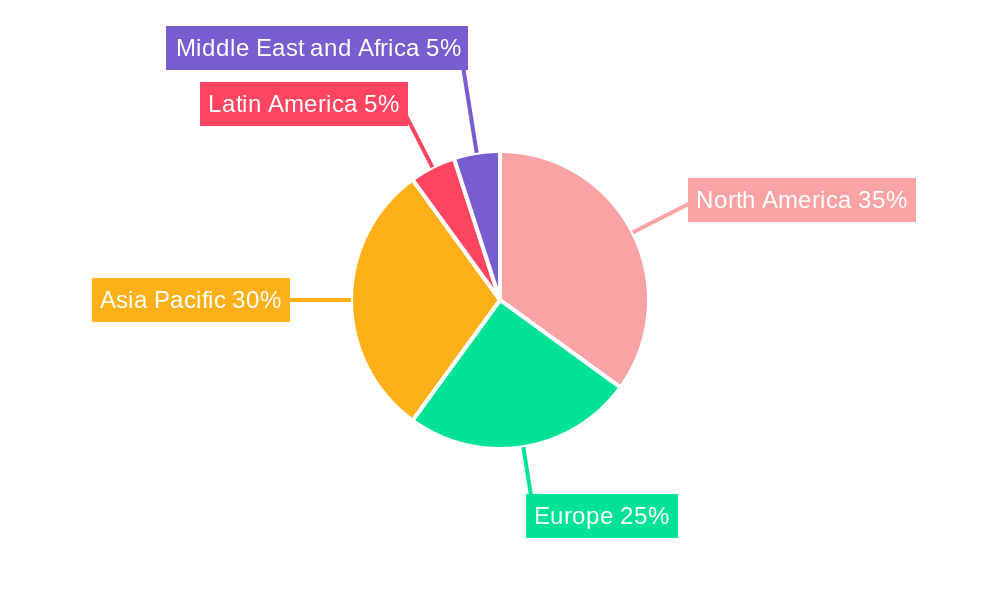

Intermodal Freight Transportation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Intermodal Freight Transportation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for effective and cost-efficient means of transportation by global supply chains; Rising awareness regarding the reduction of carbon footprint

- 3.3. Market Restrains

- 3.3.1. Slightly High Cost of Implementation of the Software

- 3.4. Market Trends

- 3.4.1. Rail and Road Transport is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Transportation Mode

- 5.2.1. Rail and Road Transport

- 5.2.2. Air and Road Transport

- 5.2.3. Maritime and Road Transport

- 5.2.4. Other Transportation Modes

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Industrial and Manufacturing

- 5.3.2. Oil and Gas

- 5.3.3. Consumer and Retail

- 5.3.4. Food & Beverage

- 5.3.5. Construction

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Software

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Transportation Mode

- 6.2.1. Rail and Road Transport

- 6.2.2. Air and Road Transport

- 6.2.3. Maritime and Road Transport

- 6.2.4. Other Transportation Modes

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Industrial and Manufacturing

- 6.3.2. Oil and Gas

- 6.3.3. Consumer and Retail

- 6.3.4. Food & Beverage

- 6.3.5. Construction

- 6.3.6. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Software

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Transportation Mode

- 7.2.1. Rail and Road Transport

- 7.2.2. Air and Road Transport

- 7.2.3. Maritime and Road Transport

- 7.2.4. Other Transportation Modes

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Industrial and Manufacturing

- 7.3.2. Oil and Gas

- 7.3.3. Consumer and Retail

- 7.3.4. Food & Beverage

- 7.3.5. Construction

- 7.3.6. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Software

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Transportation Mode

- 8.2.1. Rail and Road Transport

- 8.2.2. Air and Road Transport

- 8.2.3. Maritime and Road Transport

- 8.2.4. Other Transportation Modes

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Industrial and Manufacturing

- 8.3.2. Oil and Gas

- 8.3.3. Consumer and Retail

- 8.3.4. Food & Beverage

- 8.3.5. Construction

- 8.3.6. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Software

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Transportation Mode

- 9.2.1. Rail and Road Transport

- 9.2.2. Air and Road Transport

- 9.2.3. Maritime and Road Transport

- 9.2.4. Other Transportation Modes

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Industrial and Manufacturing

- 9.3.2. Oil and Gas

- 9.3.3. Consumer and Retail

- 9.3.4. Food & Beverage

- 9.3.5. Construction

- 9.3.6. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Software

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Transportation Mode

- 10.2.1. Rail and Road Transport

- 10.2.2. Air and Road Transport

- 10.2.3. Maritime and Road Transport

- 10.2.4. Other Transportation Modes

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Industrial and Manufacturing

- 10.3.2. Oil and Gas

- 10.3.3. Consumer and Retail

- 10.3.4. Food & Beverage

- 10.3.5. Construction

- 10.3.6. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Intermodal Freight Transportation Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Motorola Solutions Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Transplace Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Blue Yonder Group Inc (JDA Software)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 The Descartes Systems Group Inc (Descartes Aljex)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 HighJump (Körber AG)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cognizant Technology Solutions Corp

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Oracle Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Elemica Inc (Eyefreight BV)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Envase Technologie

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 GE Transportation (Wabtec Corporation)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Global Intermodal Freight Transportation Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Intermodal Freight Transportation Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America Intermodal Freight Transportation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America Intermodal Freight Transportation Industry Revenue (Million), by Transportation Mode 2024 & 2032

- Figure 15: North America Intermodal Freight Transportation Industry Revenue Share (%), by Transportation Mode 2024 & 2032

- Figure 16: North America Intermodal Freight Transportation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 17: North America Intermodal Freight Transportation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 18: North America Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Intermodal Freight Transportation Industry Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Intermodal Freight Transportation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Intermodal Freight Transportation Industry Revenue (Million), by Transportation Mode 2024 & 2032

- Figure 23: Europe Intermodal Freight Transportation Industry Revenue Share (%), by Transportation Mode 2024 & 2032

- Figure 24: Europe Intermodal Freight Transportation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 25: Europe Intermodal Freight Transportation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 26: Europe Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Intermodal Freight Transportation Industry Revenue (Million), by Component 2024 & 2032

- Figure 29: Asia Pacific Intermodal Freight Transportation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 30: Asia Pacific Intermodal Freight Transportation Industry Revenue (Million), by Transportation Mode 2024 & 2032

- Figure 31: Asia Pacific Intermodal Freight Transportation Industry Revenue Share (%), by Transportation Mode 2024 & 2032

- Figure 32: Asia Pacific Intermodal Freight Transportation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 33: Asia Pacific Intermodal Freight Transportation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 34: Asia Pacific Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Intermodal Freight Transportation Industry Revenue (Million), by Component 2024 & 2032

- Figure 37: Latin America Intermodal Freight Transportation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 38: Latin America Intermodal Freight Transportation Industry Revenue (Million), by Transportation Mode 2024 & 2032

- Figure 39: Latin America Intermodal Freight Transportation Industry Revenue Share (%), by Transportation Mode 2024 & 2032

- Figure 40: Latin America Intermodal Freight Transportation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 41: Latin America Intermodal Freight Transportation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 42: Latin America Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Intermodal Freight Transportation Industry Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa Intermodal Freight Transportation Industry Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa Intermodal Freight Transportation Industry Revenue (Million), by Transportation Mode 2024 & 2032

- Figure 47: Middle East and Africa Intermodal Freight Transportation Industry Revenue Share (%), by Transportation Mode 2024 & 2032

- Figure 48: Middle East and Africa Intermodal Freight Transportation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 49: Middle East and Africa Intermodal Freight Transportation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 50: Middle East and Africa Intermodal Freight Transportation Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Intermodal Freight Transportation Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Transportation Mode 2019 & 2032

- Table 4: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Intermodal Freight Transportation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Intermodal Freight Transportation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Intermodal Freight Transportation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Intermodal Freight Transportation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Intermodal Freight Transportation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 17: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Transportation Mode 2019 & 2032

- Table 18: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 19: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Transportation Mode 2019 & 2032

- Table 22: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 23: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 25: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Transportation Mode 2019 & 2032

- Table 26: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 27: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Transportation Mode 2019 & 2032

- Table 30: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 31: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Transportation Mode 2019 & 2032

- Table 34: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 35: Global Intermodal Freight Transportation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intermodal Freight Transportation Industry?

The projected CAGR is approximately 8.27%.

2. Which companies are prominent players in the Intermodal Freight Transportation Industry?

Key companies in the market include Motorola Solutions Inc, Transplace Inc, Blue Yonder Group Inc (JDA Software), The Descartes Systems Group Inc (Descartes Aljex), HighJump (Körber AG), Cognizant Technology Solutions Corp, Oracle Corporation, Elemica Inc (Eyefreight BV), Envase Technologie, GE Transportation (Wabtec Corporation).

3. What are the main segments of the Intermodal Freight Transportation Industry?

The market segments include Component, Transportation Mode, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for effective and cost-efficient means of transportation by global supply chains; Rising awareness regarding the reduction of carbon footprint.

6. What are the notable trends driving market growth?

Rail and Road Transport is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Slightly High Cost of Implementation of the Software.

8. Can you provide examples of recent developments in the market?

December 2022: Aware Super introduced the intermodal terminals investment platform and targeted the national supply chain stalemate. Aware Super launched a new investment platform aimed at acquiring, constructing, operating, and managing an independent network of intermodal ports as the fund's latest plan to pursue and explore new sources of long-term returns for its infrastructure portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intermodal Freight Transportation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intermodal Freight Transportation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intermodal Freight Transportation Industry?

To stay informed about further developments, trends, and reports in the Intermodal Freight Transportation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence