Key Insights

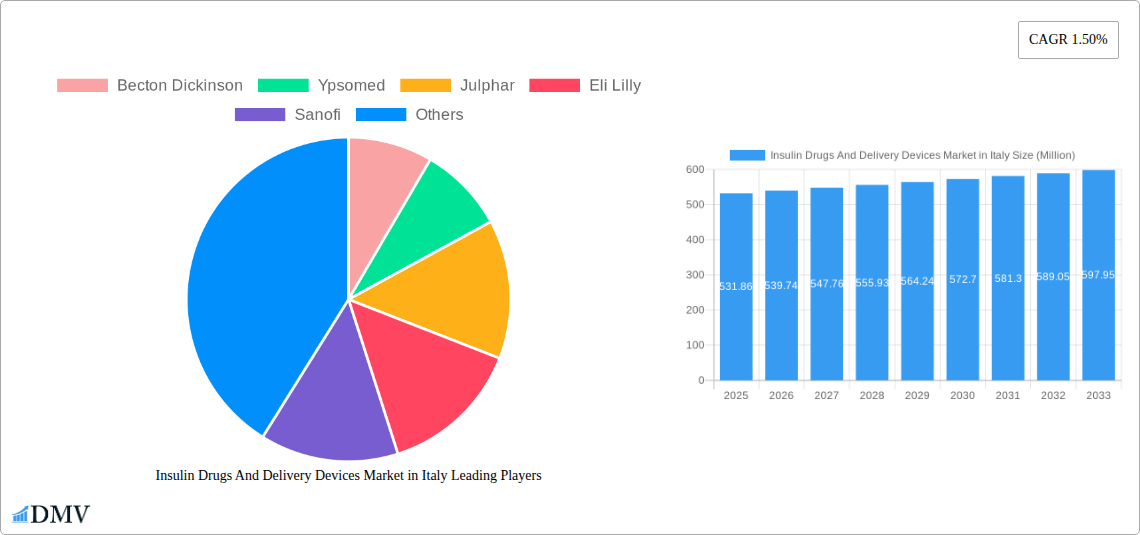

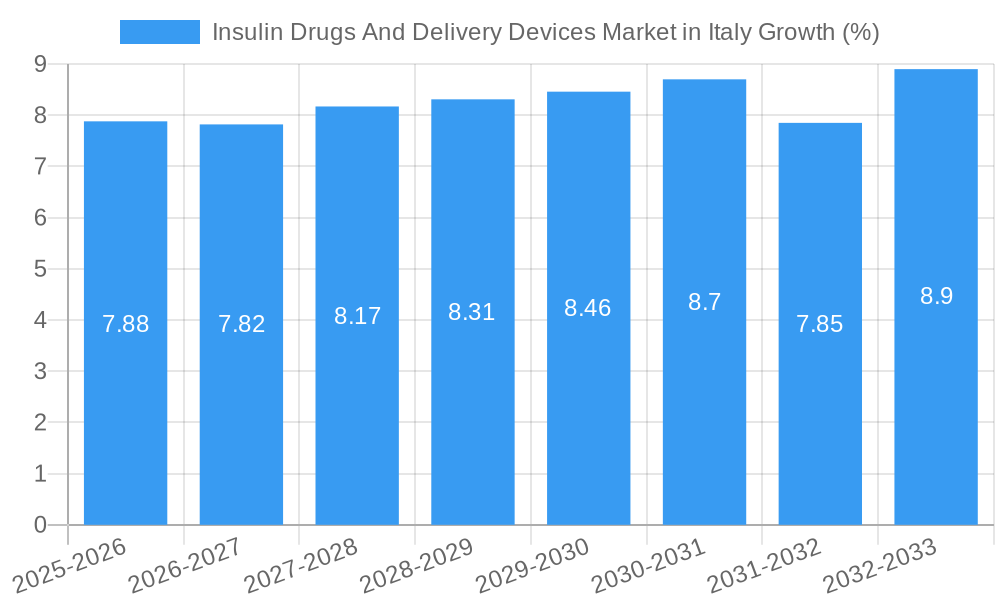

The Italian insulin drugs and delivery devices market, valued at €531.86 million in 2025, exhibits a steady growth trajectory, projected at a CAGR of 1.50% from 2025 to 2033. This growth is fueled by several key factors. The rising prevalence of diabetes, particularly type 1 and type 2, within the Italian population is a primary driver. An aging population and increasing sedentary lifestyles contribute to this rise in diabetes cases, creating consistent demand for insulin therapies. Furthermore, advancements in insulin delivery technologies, such as the increasing adoption of insulin pens and pumps offering improved convenience and efficacy, contribute to market expansion. The market also benefits from ongoing research and development leading to the introduction of novel insulin analogs and biosimilars, offering patients more treatment options and potentially lowering costs. However, the market faces certain restraints including the high cost of insulin therapies, particularly novel insulins and advanced delivery systems, which can limit accessibility for some patients. Additionally, stringent regulatory approvals for new products can impact market entry and growth timelines. The market is segmented across various insulin types (basal/long-acting, bolus/fast-acting, combination insulins, biosimilars) and delivery devices (pens, syringes, pumps, jet injectors). Major players like Sanofi, Novo Nordisk, Eli Lilly, and Medtronic, along with device manufacturers such as Becton Dickinson and Ypsomed, actively compete in this dynamic market.

The competitive landscape is characterized by both established pharmaceutical companies and emerging players, driving innovation and competition. The presence of biosimilars is gradually increasing, offering cost-effective alternatives to branded insulins. This competition creates opportunities for price optimization and expands patient access. The Italian market will likely see continued focus on improving patient education and adherence to therapy regimens to optimize treatment outcomes and reduce long-term complications associated with diabetes. This includes promoting the usage of advanced delivery systems and improving access to affordable insulin options, which remain critical areas for future market development. The continued growth is contingent upon successful management of healthcare costs, innovative product launches, and focused patient education programs.

Insulin Drugs And Delivery Devices Market in Italy: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Insulin Drugs and Delivery Devices market in Italy, covering the period 2019-2033. It offers a comprehensive overview of market trends, competitive landscape, technological advancements, and future growth prospects, empowering stakeholders with critical data for strategic decision-making. The report meticulously examines market segments including insulin types (Basal/Long-acting, Bolus/Fast-acting, Traditional Human, Combination, Biosimilars) and delivery devices (Insulin Pens, Syringes, Jet Injectors, Pumps, Infusion Sets), incorporating key players like Novo Nordisk, Sanofi, Eli Lilly, and Medtronic. With a base year of 2025 and forecast period extending to 2033, this report is an indispensable resource for understanding the dynamics of this vital healthcare market.

Insulin Drugs And Delivery Devices Market in Italy Market Composition & Trends

The Italian insulin drugs and delivery devices market is characterized by a moderate level of concentration, with key players holding significant market share. Novo Nordisk and Sanofi are estimated to control approximately xx% and xx% of the market, respectively, in 2025, followed by Eli Lilly and other significant players. Market growth is primarily driven by the rising prevalence of diabetes, an aging population, and increased awareness of advanced therapies. Innovation in insulin delivery systems, such as automated insulin delivery (AID) systems and smart pens, fuels market expansion.

Regulatory landscapes play a crucial role, with stringent approvals impacting market entry and pricing. Substitute products, like oral antidiabetic drugs, exert competitive pressure, though insulin remains the cornerstone of diabetes management for many. The end-user profile encompasses a wide range, including hospitals, clinics, pharmacies, and individual patients. M&A activity has been relatively modest in recent years, with deal values averaging around xx Million Euros annually, reflecting a stable but consolidating market.

- Market Share Distribution (2025): Novo Nordisk (xx%), Sanofi (xx%), Eli Lilly (xx%), Others (xx%)

- Average M&A Deal Value (2019-2024): xx Million Euros

- Key Innovation Catalysts: Automated Insulin Delivery (AID), Smart Pens, Biosimilars

- Regulatory Landscape: Stringent approval processes, price controls

Insulin Drugs And Delivery Devices Market in Italy Industry Evolution

The Italian insulin drugs and delivery devices market has witnessed consistent growth over the past five years (2019-2024), expanding at a CAGR of approximately xx%. This growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with a projected CAGR of xx%. This moderation reflects a mature market, though sustained demand from a growing diabetic population and technological advancements will offset this.

Technological advancements, including the rise of continuous glucose monitoring (CGM) systems and connected insulin delivery devices, are transforming the market. The integration of CGM with insulin pumps and smart pens is significantly improving diabetes management, leading to improved patient outcomes and a greater adoption of advanced therapies. The increasing preference for convenience and ease of use has driven demand for pre-filled insulin pens and disposable insulin syringes. Patient preference shifts toward less invasive and more user-friendly delivery systems, such as insulin pens over traditional syringes, further drives market expansion. The increasing availability of biosimilar insulins also presents an opportunity for cost-effective therapy. The market is seeing greater emphasis on personalized medicine and tailored treatment plans, contributing to its evolving nature.

Leading Regions, Countries, or Segments in Insulin Drugs And Delivery Devices Market in Italy

The Italian insulin drugs and delivery devices market demonstrates a relatively even distribution across regions, with no single area significantly dominating. However, densely populated urban centers show higher demand reflecting higher diabetes prevalence. Among segments, disposable insulin pens (including syringes and jet injectors) constitute the largest market share, driven by convenience and ease of use. Basal or long-acting insulins hold a greater market share than bolus or fast-acting insulins due to their role in maintaining stable blood glucose levels.

Key Drivers for Disposable Insulin Pens: High patient preference, convenience, ease of use

Key Drivers for Basal/Long-acting Insulins: Essential for blood glucose control, high demand among Type 1 and Type 2 diabetes patients

Dominance Factors: High prevalence of diabetes, growing elderly population, increasing awareness of disease management, government healthcare initiatives

Key Drivers for Insulin Pumps: Increased technological advancements, improved glycemic control, and high patient demand for advanced therapy. This segment is projected to witness significant growth in the forecast period.

Key Drivers for Biosimilar Insulins: Cost-effectiveness and similar efficacy compared to originator products, driving market adoption

Insulin Drugs And Delivery Devices Market in Italy Product Innovations

Recent innovations have focused on enhancing the convenience and efficacy of insulin delivery. Automated insulin delivery (AID) systems, combining CGM and insulin pumps, are gaining traction, offering real-time glucose monitoring and automated insulin adjustments. Smart insulin pens integrate technology for improved dose tracking and medication adherence. The development of more biosimilar insulins also offers cost-effective alternatives without compromising efficacy. These advancements address user needs for simpler, more effective, and affordable diabetes management solutions.

Propelling Factors for Insulin Drugs And Delivery Devices Market in Italy Growth

Technological advancements in insulin delivery systems (e.g., AID systems), coupled with rising diabetes prevalence and an aging population, are major growth drivers. Government initiatives promoting diabetes awareness and improved healthcare access further stimulate market expansion. The increasing availability of cost-effective biosimilars expands market accessibility, particularly in the public healthcare sector.

Obstacles in the Insulin Drugs And Delivery Devices Market in Italy Market

Regulatory hurdles and stringent approval processes can slow down product launches and market entry. Supply chain disruptions and cost fluctuations for raw materials, particularly during periods of global uncertainty, can affect production and pricing. Intense competition amongst established players and emerging companies creates pricing pressures.

Future Opportunities in Insulin Drugs And Delivery Devices Market in Italy

The market presents opportunities in expanding the reach of innovative technologies like AID systems and smart pens, particularly in rural areas. Development of personalized medicine approaches, tailoring insulin therapy to individual needs, offers significant potential. The rising focus on digital health and telehealth creates opportunities for remote patient monitoring and virtual care solutions linked to insulin delivery.

Major Players in the Insulin Drugs And Delivery Devices Market in Italy Ecosystem

- Becton Dickinson

- Ypsomed

- Julphar

- Eli Lilly

- Sanofi

- Medtronic

- Biocon

- Novo Nordisk

Key Developments in Insulin Drugs And Delivery Devices Market in Italy Industry

- April 2022: CamDiab and Ypsomed partnered to develop and commercialize an integrated automated insulin delivery (AID) system, significantly enhancing diabetes management. This partnership exemplifies the growing trend towards connected care and improved treatment options.

- January 2022: A clinical research study commenced comparing semaglutide combined with insulin glargine to higher-dose insulin glargine alone in type 2 diabetes patients. This study highlights ongoing efforts to improve treatment efficacy and explore new therapeutic combinations.

Strategic Insulin Drugs And Delivery Devices Market in Italy Market Forecast

The Italian insulin drugs and delivery devices market is poised for sustained growth, driven by increasing diabetes prevalence, technological innovation, and supportive government policies. The adoption of advanced technologies like AID systems and the expansion of biosimilar offerings will further fuel market expansion. The market's future trajectory reflects a strong demand for convenient, effective, and cost-effective diabetes management solutions.

Insulin Drugs And Delivery Devices Market in Italy Segmentation

-

1. Drug

- 1.1. Basal Or Long-Acting Insulins

- 1.2. Bolus Or Fast-Acting Insulins

- 1.3. Traditional Human Insulins

-

2. Device

- 2.1. Insulin Pumps

- 2.2. Insulin Pens

- 2.3. Insulin Syringes

Insulin Drugs And Delivery Devices Market in Italy Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Insulin Drugs And Delivery Devices Market in Italy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Growing Diabetes and Obesity Population in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Insulin Drugs And Delivery Devices Market in Italy Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Basal Or Long-Acting Insulins

- 5.1.2. Bolus Or Fast-Acting Insulins

- 5.1.3. Traditional Human Insulins

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Insulin Pumps

- 5.2.2. Insulin Pens

- 5.2.3. Insulin Syringes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. North America Insulin Drugs And Delivery Devices Market in Italy Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Basal Or Long-Acting Insulins

- 6.1.2. Bolus Or Fast-Acting Insulins

- 6.1.3. Traditional Human Insulins

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Insulin Pumps

- 6.2.2. Insulin Pens

- 6.2.3. Insulin Syringes

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. South America Insulin Drugs And Delivery Devices Market in Italy Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Basal Or Long-Acting Insulins

- 7.1.2. Bolus Or Fast-Acting Insulins

- 7.1.3. Traditional Human Insulins

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Insulin Pumps

- 7.2.2. Insulin Pens

- 7.2.3. Insulin Syringes

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Europe Insulin Drugs And Delivery Devices Market in Italy Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Basal Or Long-Acting Insulins

- 8.1.2. Bolus Or Fast-Acting Insulins

- 8.1.3. Traditional Human Insulins

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Insulin Pumps

- 8.2.2. Insulin Pens

- 8.2.3. Insulin Syringes

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Drug

- 9.1.1. Basal Or Long-Acting Insulins

- 9.1.2. Bolus Or Fast-Acting Insulins

- 9.1.3. Traditional Human Insulins

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Insulin Pumps

- 9.2.2. Insulin Pens

- 9.2.3. Insulin Syringes

- 9.1. Market Analysis, Insights and Forecast - by Drug

- 10. Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Drug

- 10.1.1. Basal Or Long-Acting Insulins

- 10.1.2. Bolus Or Fast-Acting Insulins

- 10.1.3. Traditional Human Insulins

- 10.2. Market Analysis, Insights and Forecast - by Device

- 10.2.1. Insulin Pumps

- 10.2.2. Insulin Pens

- 10.2.3. Insulin Syringes

- 10.1. Market Analysis, Insights and Forecast - by Drug

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ypsomed

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Julphar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eli Lilly

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sanofi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medtronic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Biocon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novo Nordisk

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson

List of Figures

- Figure 1: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Insulin Drugs And Delivery Devices Market in Italy Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: Italy Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Country 2024 & 2032

- Figure 4: Italy Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Country 2024 & 2032

- Figure 5: Italy Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Country 2024 & 2032

- Figure 6: Italy Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Drug 2024 & 2032

- Figure 8: North America Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Drug 2024 & 2032

- Figure 9: North America Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Drug 2024 & 2032

- Figure 10: North America Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Drug 2024 & 2032

- Figure 11: North America Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Device 2024 & 2032

- Figure 12: North America Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Device 2024 & 2032

- Figure 13: North America Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Device 2024 & 2032

- Figure 14: North America Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Device 2024 & 2032

- Figure 15: North America Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Country 2024 & 2032

- Figure 17: North America Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Drug 2024 & 2032

- Figure 20: South America Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Drug 2024 & 2032

- Figure 21: South America Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Drug 2024 & 2032

- Figure 22: South America Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Drug 2024 & 2032

- Figure 23: South America Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Device 2024 & 2032

- Figure 24: South America Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Device 2024 & 2032

- Figure 25: South America Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Device 2024 & 2032

- Figure 26: South America Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Device 2024 & 2032

- Figure 27: South America Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Country 2024 & 2032

- Figure 28: South America Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Country 2024 & 2032

- Figure 29: South America Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Country 2024 & 2032

- Figure 31: Europe Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Drug 2024 & 2032

- Figure 32: Europe Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Drug 2024 & 2032

- Figure 33: Europe Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Drug 2024 & 2032

- Figure 34: Europe Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Drug 2024 & 2032

- Figure 35: Europe Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Device 2024 & 2032

- Figure 36: Europe Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Device 2024 & 2032

- Figure 37: Europe Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Device 2024 & 2032

- Figure 38: Europe Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Device 2024 & 2032

- Figure 39: Europe Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Country 2024 & 2032

- Figure 41: Europe Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Country 2024 & 2032

- Figure 43: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Drug 2024 & 2032

- Figure 44: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Drug 2024 & 2032

- Figure 45: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Drug 2024 & 2032

- Figure 46: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Drug 2024 & 2032

- Figure 47: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Device 2024 & 2032

- Figure 48: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Device 2024 & 2032

- Figure 49: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Device 2024 & 2032

- Figure 50: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Device 2024 & 2032

- Figure 51: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Country 2024 & 2032

- Figure 52: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Country 2024 & 2032

- Figure 53: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Drug 2024 & 2032

- Figure 56: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Drug 2024 & 2032

- Figure 57: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Drug 2024 & 2032

- Figure 58: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Drug 2024 & 2032

- Figure 59: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Device 2024 & 2032

- Figure 60: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Device 2024 & 2032

- Figure 61: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Device 2024 & 2032

- Figure 62: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Device 2024 & 2032

- Figure 63: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Revenue (Million), by Country 2024 & 2032

- Figure 64: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit), by Country 2024 & 2032

- Figure 65: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Revenue Share (%), by Country 2024 & 2032

- Figure 66: Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Drug 2019 & 2032

- Table 4: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Drug 2019 & 2032

- Table 5: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Device 2019 & 2032

- Table 6: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Device 2019 & 2032

- Table 7: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Drug 2019 & 2032

- Table 12: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Drug 2019 & 2032

- Table 13: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Device 2019 & 2032

- Table 14: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Device 2019 & 2032

- Table 15: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United States Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Canada Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Mexico Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Drug 2019 & 2032

- Table 24: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Drug 2019 & 2032

- Table 25: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Device 2019 & 2032

- Table 26: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Device 2019 & 2032

- Table 27: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Brazil Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Brazil Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Argentina Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Argentina Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Rest of South America Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of South America Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Drug 2019 & 2032

- Table 36: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Drug 2019 & 2032

- Table 37: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Device 2019 & 2032

- Table 38: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Device 2019 & 2032

- Table 39: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: United Kingdom Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Germany Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: France Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Italy Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Spain Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Russia Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Russia Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Benelux Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Benelux Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Nordics Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Nordics Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Rest of Europe Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Drug 2019 & 2032

- Table 60: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Drug 2019 & 2032

- Table 61: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Device 2019 & 2032

- Table 62: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Device 2019 & 2032

- Table 63: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Country 2019 & 2032

- Table 65: Turkey Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Turkey Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Israel Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Israel Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: GCC Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: GCC Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: North Africa Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: North Africa Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: South Africa Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Africa Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Rest of Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Middle East & Africa Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Drug 2019 & 2032

- Table 78: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Drug 2019 & 2032

- Table 79: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Device 2019 & 2032

- Table 80: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Device 2019 & 2032

- Table 81: Global Insulin Drugs And Delivery Devices Market in Italy Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Insulin Drugs And Delivery Devices Market in Italy Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: China Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: China Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: India Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: India Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Japan Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Japan Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: South Korea Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: South Korea Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: ASEAN Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: ASEAN Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Oceania Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Oceania Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: Rest of Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Asia Pacific Insulin Drugs And Delivery Devices Market in Italy Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insulin Drugs And Delivery Devices Market in Italy?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the Insulin Drugs And Delivery Devices Market in Italy?

Key companies in the market include Becton Dickinson, Ypsomed, Julphar, Eli Lilly, Sanofi, Medtronic, Biocon, Novo Nordisk.

3. What are the main segments of the Insulin Drugs And Delivery Devices Market in Italy?

The market segments include Drug, Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 531.86 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Growing Diabetes and Obesity Population in Italy.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

April 2022: CamDiab and Ypsomed announced the partnership to develop and commercialize an integrated automated insulin delivery (AID) system to help lessen the burden of diabetes management for people with diabetes. The new integrated AID system is designed to connect Abbott's FreeStyle Libre 3 sensor, the world's smallest and most accurate continuous glucose monitoring sensor, to CamDiab's CamAPS FX mobile app, which connects with Ypsomed's mylife YpsoPump creating a smart, automated process to deliver insulin based on real-time glucose data. The connected, smart wearable solution is designed to continuously monitor a person's glucose levels and automatically adjust and deliver the right amount of insulin at the right time, removing the guesswork of insulin dosing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insulin Drugs And Delivery Devices Market in Italy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insulin Drugs And Delivery Devices Market in Italy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insulin Drugs And Delivery Devices Market in Italy?

To stay informed about further developments, trends, and reports in the Insulin Drugs And Delivery Devices Market in Italy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence