Key Insights

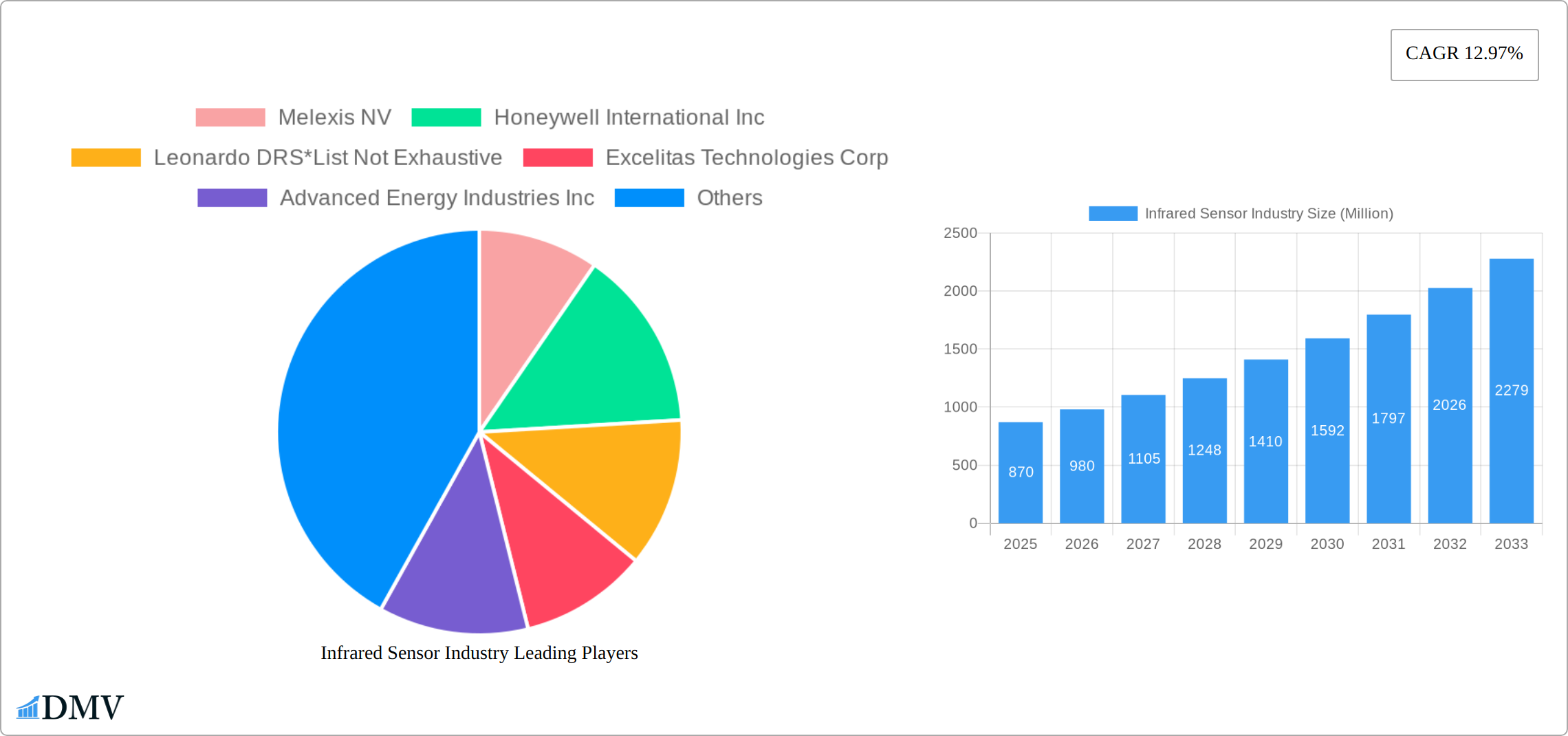

The infrared sensor market, valued at $0.87 billion in 2025, is projected to experience robust growth, driven by increasing demand across diverse sectors. A compound annual growth rate (CAGR) of 12.97% from 2025 to 2033 indicates a significant expansion potential, reaching an estimated market size of approximately $3.1 billion by 2033. This growth is fueled by several key factors. The automotive industry's adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies is a primary driver, requiring sophisticated infrared sensors for object detection and night vision. Furthermore, the healthcare sector's increasing use of infrared sensors in thermal imaging for diagnostics and non-invasive temperature monitoring contributes significantly to market expansion. The expanding aerospace and defense sector, leveraging infrared sensors for target acquisition and surveillance, further boosts market demand. Technological advancements leading to smaller, more energy-efficient, and cost-effective infrared sensors are also contributing to wider adoption. While challenges such as stringent regulatory compliance and high initial investment costs exist, the overall market outlook remains positive, with substantial growth opportunities anticipated across various regions and applications.

Market segmentation reveals significant opportunities within specific areas. The Near Infrared (NIR) segment, due to its applications in spectroscopy and medical imaging, is expected to maintain strong growth. Similarly, the healthcare and automotive end-user industries are projected to dominate market share due to the high volume of sensor integration in vehicles and medical devices. Geographically, North America and Europe are currently leading the market due to strong technological advancements and high adoption rates. However, the Asia-Pacific region is anticipated to experience the fastest growth, driven by expanding industrialization and rising consumer demand. Competition in the market is intense, with numerous established players and emerging companies vying for market share. Strategic partnerships, technological innovations, and expansion into new geographical markets will play critical roles in shaping future market dynamics.

Infrared Sensor Industry Market Composition & Trends

The Infrared Sensor Industry is marked by a dynamic interplay of market concentration, innovation, and regulatory influences. The industry exhibits a moderate level of market concentration with leading players like Melexis NV, Honeywell International Inc, and Leonardo DRS commanding significant market shares. For instance, in 2025, these top companies collectively hold approximately 45% of the market. Innovation is driven by the need for advanced sensor technology in various end-user industries such as healthcare, aerospace, and automotive. Key catalysts include the development of high-resolution sensors and the integration of AI for data processing.

Regulatory landscapes are evolving, with stringent standards for sensor accuracy and reliability, particularly in healthcare and aerospace sectors. The presence of substitute products, such as thermal cameras, influences market dynamics, though infrared sensors are favored for their precision and cost-effectiveness. End-user profiles are diverse, with healthcare applications growing at a CAGR of 8% from 2019 to 2024, driven by demand for non-invasive diagnostics.

Mergers and acquisitions (M&A) have been pivotal in shaping the industry. Notable deals include the acquisition of AMS AG by Osram Licht AG for $5.5 Billion in 2020, enhancing market presence in automotive applications. The M&A activities are expected to continue, with a projected deal value of $10 Billion by 2033, focusing on technological synergy and market expansion.

- Market Share Distribution: Top three companies hold 45% in 2025.

- Healthcare Sector Growth: CAGR of 8% from 2019 to 2024.

- M&A Deal Value: Projected to reach $10 Billion by 2033.

Infrared Sensor Industry Industry Evolution

The Infrared Sensor Industry has undergone significant evolution from 2019 to 2033, characterized by robust market growth trajectories, technological advancements, and shifting consumer demands. The market is poised to grow at a CAGR of 7.5% during the forecast period from 2025 to 2033, driven by the integration of infrared sensors in smart devices and IoT applications. Technological advancements have been pivotal, with the development of far infrared (FIR) sensors that offer enhanced sensitivity and range. For example, the adoption of FIR sensors in automotive applications increased by 12% in 2024 due to their ability to detect objects in adverse weather conditions.

Consumer demands are shifting towards more reliable and versatile sensor technologies. In the healthcare sector, the demand for non-invasive monitoring devices has surged, with infrared sensors being integral to devices like pulse oximeters and thermometers. The automotive industry has also seen a rise in the use of near infrared (NIR) sensors for driver monitoring systems, which grew by 10% in 2023. These trends reflect a broader consumer preference for safety and convenience, driving innovation in sensor technology.

The industry's evolution is further supported by investments in R&D, with companies like Teledyne FLIR Systems Inc and Murata Manufacturing Co Ltd leading the charge. The focus on miniaturization and energy efficiency has resulted in sensors that are more compact and consume less power, making them suitable for a wider range of applications. As the industry continues to evolve, the integration of AI and machine learning for real-time data analysis is expected to further enhance sensor capabilities, positioning the Infrared Sensor Industry for continued growth and innovation.

Leading Regions, Countries, or Segments in Infrared Sensor Industry

The Infrared Sensor Industry showcases distinct regional and segment dominance, with North America leading the market due to its robust aerospace and defense sectors. The United States, in particular, has a high adoption rate of infrared sensors in military applications, driven by government investments and technological advancements. Key drivers include:

- Investment Trends: Significant funding in defense technology, with the US government allocating over $100 Million annually for sensor development.

- Regulatory Support: Favorable policies encouraging the integration of advanced sensor technologies in commercial and defense applications.

The automotive segment is another dominant area, with Europe leading due to stringent safety regulations and the push for autonomous vehicles. The European Union's commitment to reducing road accidents has led to increased use of infrared sensors in vehicles, with a projected growth rate of 9% from 2025 to 2033.

In terms of sensor types, Near Infrared (NIR) sensors are gaining traction across various industries due to their versatility and cost-effectiveness. The healthcare sector, for instance, relies heavily on NIR sensors for applications like glucose monitoring and pulse oximetry. The growth of NIR sensors is propelled by:

- Technological Advancements: Continuous improvements in sensor accuracy and miniaturization.

- Consumer Demand: Increasing preference for non-invasive diagnostic tools.

The dominance of these regions and segments can be attributed to a combination of factors including technological innovation, regulatory support, and consumer demand. North America's lead in aerospace and defense is reinforced by the presence of key industry players and substantial R&D investments. Europe's focus on automotive safety aligns with global trends towards autonomous driving, while the healthcare sector's reliance on NIR sensors reflects a broader shift towards non-invasive diagnostics. As these trends continue, the Infrared Sensor Industry is poised for sustained growth and further market penetration.

Infrared Sensor Industry Product Innovations

The Infrared Sensor Industry is witnessing continuous product innovations aimed at enhancing performance and expanding applications. Recent advancements include the development of thermal-diode sensors capable of measuring high temperatures up to 200°C, catering to industrial and kitchen safety needs. These sensors, like Mitsubishi Electric's MelDIR 'MIR8060B3', utilize advanced signal processing and optimized lenses to deliver accurate temperature readings. Additionally, the integration of AI and machine learning into sensor systems is enabling real-time data analysis and improved decision-making, offering unique selling propositions such as predictive maintenance and enhanced situational awareness.

Propelling Factors for Infrared Sensor Industry Growth

The growth of the Infrared Sensor Industry is propelled by several key factors. Technological advancements, such as the development of high-resolution and miniaturized sensors, are driving demand across various sectors. Economic factors include increased investments in R&D, particularly in regions like North America and Europe, where funding for defense and automotive technologies is substantial. Regulatory influences are also significant, with stringent safety standards in the automotive and healthcare sectors pushing the adoption of advanced sensor technologies. For instance, the US government's annual allocation of over $100 Million for sensor development in defense applications is a testament to the industry's growth potential.

Obstacles in the Infrared Sensor Industry Market

The Infrared Sensor Industry faces several obstacles that could impede growth. Regulatory challenges, such as compliance with varying international standards, can increase costs and delay product launches. Supply chain disruptions, exacerbated by global events like pandemics, have led to material shortages and production delays, impacting market growth by up to 5% in 2022. Competitive pressures are intense, with numerous players vying for market share, resulting in price wars and reduced profit margins. These factors collectively pose significant barriers to the industry's expansion and profitability.

Future Opportunities in Infrared Sensor Industry

The Infrared Sensor Industry presents numerous future opportunities. The rise of IoT and smart devices offers new markets for sensor integration, particularly in home automation and industrial monitoring. Emerging technologies like AI and machine learning are set to revolutionize sensor applications, enabling predictive analytics and real-time decision-making. Consumer trends towards health and safety are driving demand for non-invasive diagnostics and safety systems in vehicles, presenting growth avenues for infrared sensors. These opportunities underscore the industry's potential for innovation and market expansion.

Major Players in the Infrared Sensor Industry Ecosystem

- Melexis NV

- Honeywell International Inc

- Leonardo DRS

- Excelitas Technologies Corp

- Advanced Energy Industries Inc

- Mitsubisihi Electric Corporation

- Sick AG

- Austria Micro Systems (AMS) AG

- Teledyne Imaging

- Yokogawa Electric Corporation

- Teledyne FLIR Systems Inc

- Murata Manufacturing Co Ltd

- Amphenol Advanced Sensors

Key Developments in Infrared Sensor Industry Industry

- December 2022: Leonardo DRS to provide third-generation FLIR sensors for the US Army. The company will start low-rate initial production of the FLIR Dewar Cooler Bench (DCB) long-range sensor, aimed at replacing the existing second-generation sensors. This development enhances situational awareness under contested battlefield environments and rough weather conditions, impacting the defense sector's demand for advanced infrared technology.

- December 2022: Mitsubishi Electric to ship samples of an 80x60-pixel thermal-diode infrared sensor capable of measuring temperatures up to 200°C. The new MelDIR 'MIR8060B3' sensor addresses the demand for higher temperature measurements in kitchens and factories, improving safety and convenience. This innovation is expected to shorten lead times in product planning and production, influencing market dynamics in industrial applications.

Strategic Infrared Sensor Industry Market Forecast

The Infrared Sensor Industry is poised for significant growth over the forecast period from 2025 to 2033, driven by technological advancements, regulatory support, and increasing demand across various sectors. The integration of AI and IoT technologies offers new opportunities for sensor applications, particularly in smart homes and industrial automation. The healthcare and automotive sectors will continue to be key growth areas, fueled by the need for non-invasive diagnostics and enhanced vehicle safety systems. As the industry evolves, the focus on energy efficiency and miniaturization will further expand market potential, positioning infrared sensors for widespread adoption and market expansion.

Infrared Sensor Industry Segmentation

-

1. Type

- 1.1. Near Infrared (NIR)

- 1.2. Far Infrared (FIR)

-

2. End-user Industry

- 2.1. Healthcare

- 2.2. Aerospace and Defense

- 2.3. Automotive

- 2.4. Commercial Applications

- 2.5. Manufacturing

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Infrared Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Infrared Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Wireless Communications; Growing Demand for Home Automation Products and Smart Devices

- 3.3. Market Restrains

- 3.3.1. Requirement of Advanced Micro level Technical Competence for Developing Ceramic Capacitors

- 3.4. Market Trends

- 3.4.1. Near Infrared (NIR) To Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Near Infrared (NIR)

- 5.1.2. Far Infrared (FIR)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare

- 5.2.2. Aerospace and Defense

- 5.2.3. Automotive

- 5.2.4. Commercial Applications

- 5.2.5. Manufacturing

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Near Infrared (NIR)

- 6.1.2. Far Infrared (FIR)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Healthcare

- 6.2.2. Aerospace and Defense

- 6.2.3. Automotive

- 6.2.4. Commercial Applications

- 6.2.5. Manufacturing

- 6.2.6. Oil and Gas

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Near Infrared (NIR)

- 7.1.2. Far Infrared (FIR)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Healthcare

- 7.2.2. Aerospace and Defense

- 7.2.3. Automotive

- 7.2.4. Commercial Applications

- 7.2.5. Manufacturing

- 7.2.6. Oil and Gas

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Near Infrared (NIR)

- 8.1.2. Far Infrared (FIR)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Healthcare

- 8.2.2. Aerospace and Defense

- 8.2.3. Automotive

- 8.2.4. Commercial Applications

- 8.2.5. Manufacturing

- 8.2.6. Oil and Gas

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Near Infrared (NIR)

- 9.1.2. Far Infrared (FIR)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Healthcare

- 9.2.2. Aerospace and Defense

- 9.2.3. Automotive

- 9.2.4. Commercial Applications

- 9.2.5. Manufacturing

- 9.2.6. Oil and Gas

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Near Infrared (NIR)

- 10.1.2. Far Infrared (FIR)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Healthcare

- 10.2.2. Aerospace and Defense

- 10.2.3. Automotive

- 10.2.4. Commercial Applications

- 10.2.5. Manufacturing

- 10.2.6. Oil and Gas

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Near Infrared (NIR)

- 11.1.2. Far Infrared (FIR)

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Healthcare

- 11.2.2. Aerospace and Defense

- 11.2.3. Automotive

- 11.2.4. Commercial Applications

- 11.2.5. Manufacturing

- 11.2.6. Oil and Gas

- 11.2.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Melexis NV

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Honeywell International Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Leonardo DRS*List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Excelitas Technologies Corp

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Advanced Energy Industries Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Mitsubisihi Electric Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sick AG

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Austria Micro Systems (AMS) AG

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Teledyne Imaging

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Yokogawa Electric Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Teledyne FLIR Systems Inc

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Murata Manufacturing Co Ltd

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Amphenol Advanced Sensors

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.1 Melexis NV

List of Figures

- Figure 1: Global Infrared Sensor Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Australia and New Zealand Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Australia and New Zealand Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Australia and New Zealand Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Australia and New Zealand Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Australia and New Zealand Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Australia and New Zealand Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Latin America Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Latin America Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Latin America Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Latin America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 43: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 44: Middle East and Africa Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 45: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 46: Middle East and Africa Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 47: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Infrared Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Infrared Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrared Sensor Industry?

The projected CAGR is approximately 12.97%.

2. Which companies are prominent players in the Infrared Sensor Industry?

Key companies in the market include Melexis NV, Honeywell International Inc, Leonardo DRS*List Not Exhaustive, Excelitas Technologies Corp, Advanced Energy Industries Inc, Mitsubisihi Electric Corporation, Sick AG, Austria Micro Systems (AMS) AG, Teledyne Imaging, Yokogawa Electric Corporation, Teledyne FLIR Systems Inc, Murata Manufacturing Co Ltd, Amphenol Advanced Sensors.

3. What are the main segments of the Infrared Sensor Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Wireless Communications; Growing Demand for Home Automation Products and Smart Devices.

6. What are the notable trends driving market growth?

Near Infrared (NIR) To Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Requirement of Advanced Micro level Technical Competence for Developing Ceramic Capacitors.

8. Can you provide examples of recent developments in the market?

December 2022 - Leonardo DRS to provide third-generation FLIR sensors for US Army. As part of this contract, the company will start low-rate initial production of the FLIR Dewar Cooler Bench (DCB) long-range sensor. The new infrared sensors are being procured to replace the US Army's existing second-generation sensors, called Horizontal Technology Integration (HTI). The DCB sensor will support the conversion of infrared radiation into video images and provide next-generation FLIR sights. It will offer several range and resolution enhancements to improve situational awareness, especially under contested battlefield environments or rough weather conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infrared Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infrared Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infrared Sensor Industry?

To stay informed about further developments, trends, and reports in the Infrared Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence