Key Insights

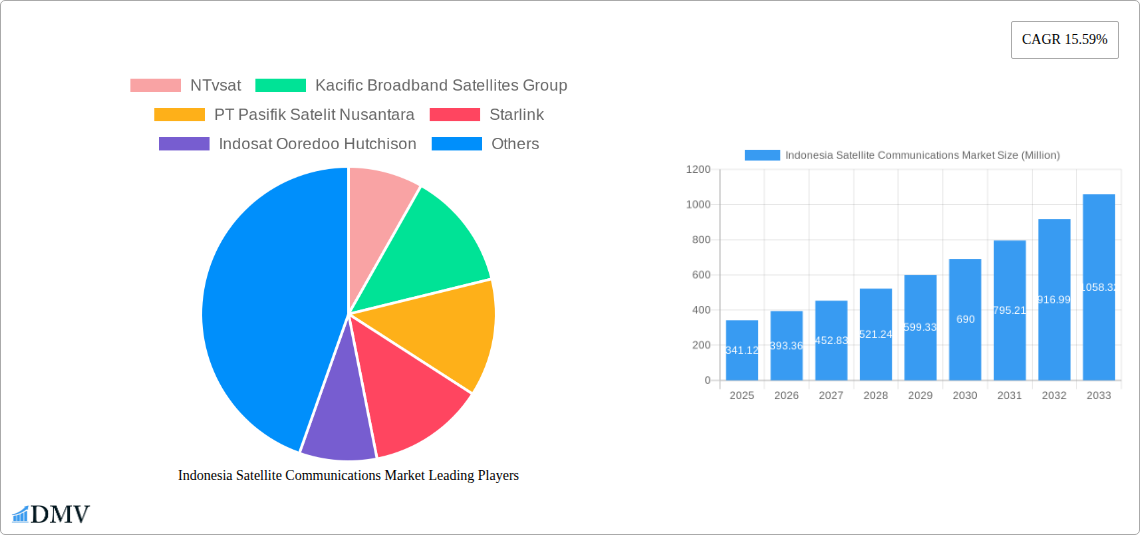

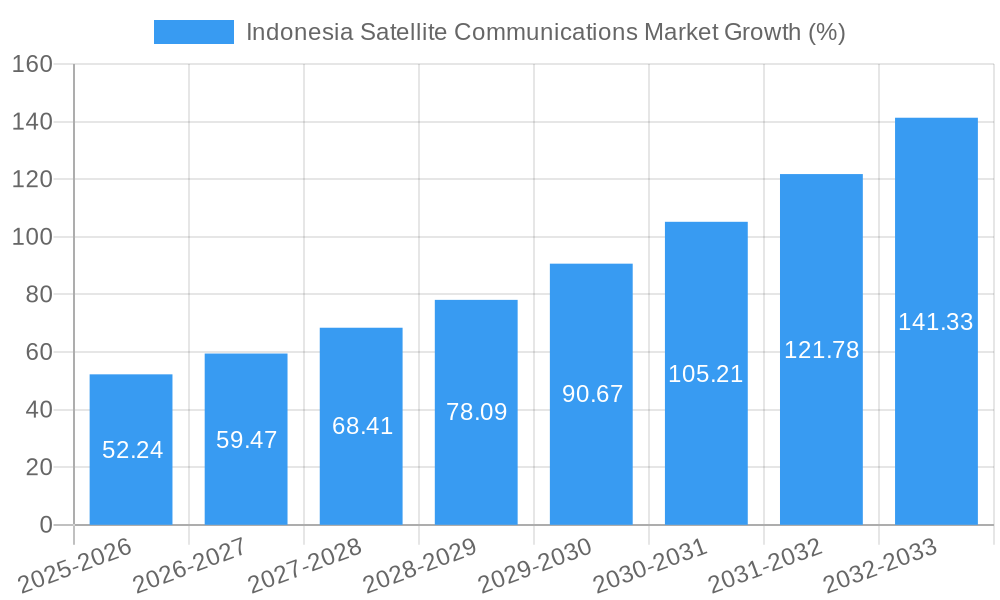

The Indonesia Satellite Communications Market is experiencing robust growth, projected to reach \$341.12 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.59% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing demand for high-speed internet access in remote and underserved areas, coupled with the Indonesian government's initiatives to bridge the digital divide, are significantly boosting market adoption. Furthermore, the rising popularity of satellite-based broadband services for both residential and enterprise customers is fueling market expansion. The proliferation of smart devices and the growth of data-intensive applications, such as video streaming and online gaming, are also contributing to the increased demand for reliable satellite communication infrastructure. The market is witnessing technological advancements, including the launch of high-throughput satellites offering greater bandwidth and improved performance, contributing to the overall market growth. Competitive landscape includes both established players like PT Telkom Satelit Indonesia and newcomers like Starlink, further stimulating innovation and market penetration.

However, certain challenges remain. High initial investment costs associated with satellite infrastructure deployment can hinder market expansion, especially for smaller operators. Regulatory complexities and licensing requirements can also pose obstacles. Furthermore, competition from terrestrial communication technologies like fiber optics, especially in urban areas, presents a significant challenge to satellite providers. Nevertheless, the ongoing expansion of the Indonesian economy and the increasing reliance on digital technologies point toward a positive outlook for the Indonesian Satellite Communications Market, ensuring its sustained growth in the foreseeable future. The market segmentation will likely see strong growth in both government and enterprise sectors due to their higher budgets and the need for secure, reliable communication networks.

Indonesia Satellite Communications Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Indonesia Satellite Communications Market, covering the period from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, this comprehensive study offers a meticulous forecast for 2025-2033, building upon historical data from 2019-2024. The report delves into market trends, key players, technological advancements, and future growth opportunities, offering invaluable insights for stakeholders in this dynamic sector. The Indonesian satellite communications market is projected to reach xx Million by 2033, presenting significant investment and expansion possibilities.

Indonesia Satellite Communications Market Composition & Trends

This section analyzes the competitive landscape, innovative drivers, regulatory framework, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities within the Indonesian satellite communications market. The market is characterized by a mix of established players and emerging entrants, leading to a moderately consolidated structure.

- Market Concentration: The market share is distributed among key players like PT Telkom Satelit Indonesia, PT Pasifik Satelit Nusantara, and Indosat Ooredoo Hutchison, with a combined market share of approximately xx%. However, the entry of Starlink and other new players is expected to increase competition in the coming years.

- Innovation Catalysts: Technological advancements such as the adoption of High-Throughput Satellites (HTS) and Low Earth Orbit (LEO) constellations are driving innovation and expanding market capabilities. The development and launch of the Merah-Putih-2 satellite demonstrates a significant step forward in Indonesia’s satellite communication infrastructure.

- Regulatory Landscape: The Indonesian government's focus on expanding broadband access and digital infrastructure presents both opportunities and challenges. Regulatory approvals and licensing processes significantly influence market entry and expansion strategies.

- Substitute Products: Terrestrial fiber optic networks and 5G cellular networks present some level of substitution, but satellite communication remains crucial for reaching remote and underserved areas.

- End-User Profiles: Key end-users include government agencies, telecommunication providers, broadcasting companies, and enterprises across various sectors, notably those in remote areas.

- M&A Activities: The report analyzes significant M&A activities in the historical period (2019-2024), providing details on deal values (xx Million) and their impact on market consolidation. Specific deals will be detailed within the report itself.

Indonesia Satellite Communications Market Industry Evolution

This section examines the growth trajectories, technological progress, and evolving consumer demands shaping the Indonesian satellite communications market. The market has experienced significant growth during the historical period (2019-2024), driven by increasing demand for broadband internet access and the expansion of digital services. This growth is projected to continue throughout the forecast period (2025-2033), albeit at a potentially moderated pace due to increased competition. Technological advancements, particularly in satellite technology and HTS, will continue to be key drivers. The shift in consumer demand towards higher bandwidth and more reliable connectivity is also influencing market evolution. Specific growth rates and adoption metrics for various technologies will be provided within the full report. The market's evolution is further influenced by government initiatives to bridge the digital divide and improve connectivity across the archipelago.

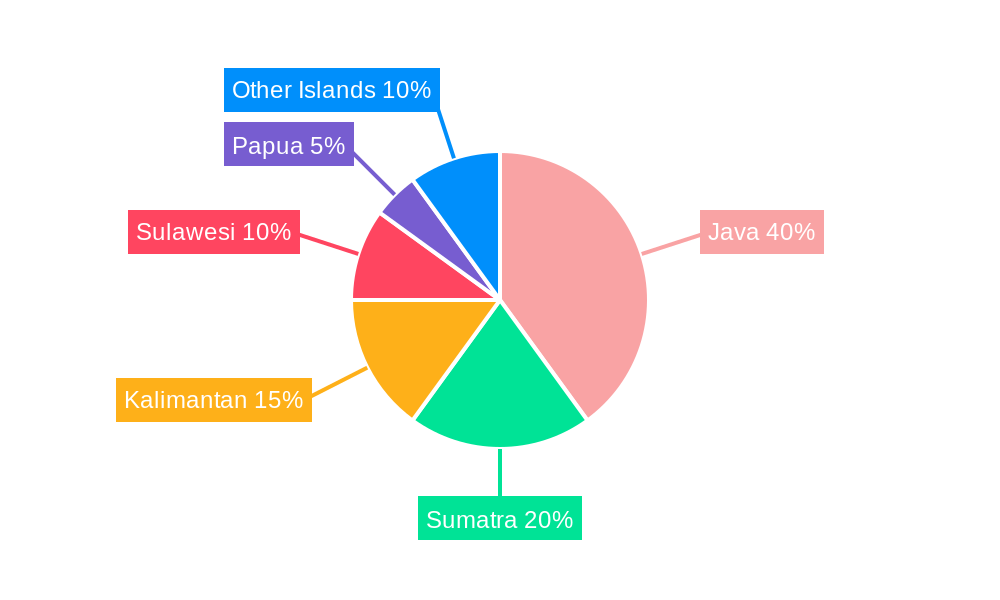

Leading Regions, Countries, or Segments in Indonesia Satellite Communications Market

This section identifies the dominant regions, countries, or segments within the Indonesian satellite communications market. While precise market share breakdowns will be provided in the full report, the analysis will likely reveal that the most densely populated and economically active regions of Indonesia benefit most from satellite services, driving significant demand.

- Key Drivers:

- Government Investments: Significant government investment in infrastructure development is a major driver.

- Regulatory Support: Favorable regulatory frameworks are promoting the expansion of satellite communications.

- Private Sector Participation: Increased private sector investment is fostering innovation and competition.

- Geographical Challenges: The archipelago's geography makes satellite communication a vital solution for connectivity.

The dominance of specific regions and segments is closely tied to factors such as population density, economic activity, and the availability of alternative communication infrastructure. Areas with limited terrestrial infrastructure experience greater reliance on satellite services, significantly contributing to segment-specific growth.

Indonesia Satellite Communications Market Product Innovations

This section details the latest product innovations, applications, and performance metrics within the Indonesian satellite communications market. Recent advancements include the increased use of HTS and LEO technologies, offering higher bandwidth and improved latency. These innovations address the growing demand for high-speed internet access across Indonesia's diverse geographical landscape. The unique selling propositions (USPs) of these new technologies lie in their ability to provide reliable and affordable connectivity to even the most remote areas.

Propelling Factors for Indonesia Satellite Communications Market Growth

Several factors are driving the growth of the Indonesian satellite communications market: These include the increasing demand for broadband internet access, particularly in remote and underserved areas, coupled with government initiatives to promote digital inclusion. Furthermore, technological advancements in satellite technology, such as HTS and LEO constellations, are offering higher bandwidth capacity and improved performance. These innovations are attracting new investments and fostering competition in the market, resulting in more affordable and accessible satellite services.

Obstacles in the Indonesia Satellite Communications Market

The Indonesian satellite communications market faces several challenges. These include regulatory hurdles related to licensing and spectrum allocation, which can create delays and increase costs for market entry. Furthermore, supply chain disruptions, particularly concerning satellite hardware and components, can impact the availability and affordability of services. The highly competitive market environment also presents a challenge, with the entry of new players intensifying competition. These challenges necessitate strategic planning and adaptive approaches for businesses in this sector.

Future Opportunities in Indonesia Satellite Communications Market

The Indonesian satellite communications market presents significant future opportunities. The expansion of internet access in underserved regions presents a vast potential market. The adoption of new technologies like LEO constellations and the integration of satellite communications with other technologies like 5G creates opportunities for innovative service offerings. Emerging applications in sectors such as IoT and remote sensing further enhance the market's growth potential.

Major Players in the Indonesia Satellite Communications Market Ecosystem

- NTvsat

- Kacific Broadband Satellites Group

- PT Pasifik Satelit Nusantara

- Starlink

- Indosat Ooredoo Hutchison

- PT PRIMACOM INTERBUANA

- PT Telkom Satelit Indonesia

- Thaicom Public Company Limited

- SES S A

- PT Wahana Telekomunikasi Dirgantara

- PT SATELIT NUSANTARA TIG

Key Developments in Indonesia Satellite Communications Market Industry

- February 2024: Successful launch of the Merah-Putih-2 telecommunications satellite, significantly enhancing Indonesia's connectivity capabilities.

- April 2024: Memorandum of Understanding (MoU) signed between APJII and SpaceX's Starlink, aiming to improve internet accessibility.

Strategic Indonesia Satellite Communications Market Forecast

The Indonesian satellite communications market is poised for sustained growth, driven by increasing demand for connectivity, government initiatives, and technological advancements. The entry of new players and the adoption of innovative technologies will further shape the market dynamics. The market's long-term potential is significant, fueled by the nation's commitment to digital transformation and expanding broadband reach across its vast and diverse archipelago.

Indonesia Satellite Communications Market Segmentation

-

1. Offering

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Indonesia Satellite Communications Market Segmentation By Geography

- 1. Indonesia

Indonesia Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.3. Market Restrains

- 3.3.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.4. Market Trends

- 3.4.1. Expansion of 5G Satellite Communication is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Satellite Communications Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 NTvsat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kacific Broadband Satellites Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Pasifik Satelit Nusantara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Starlink

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indosat Ooredoo Hutchison

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT PRIMACOM INTERBUANA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Telkom Satelit Indonesia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thaicom Public Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SES S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Telkom Satelit Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Wahana Telekomunikasi Dirgantara

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Pasifik Satelit Nusantara

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PT SATELIT NUSANTARA TIG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 NTvsat

List of Figures

- Figure 1: Indonesia Satellite Communications Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Satellite Communications Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Satellite Communications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Satellite Communications Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2019 & 2032

- Table 5: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 6: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2019 & 2032

- Table 7: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 8: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2019 & 2032

- Table 9: Indonesia Satellite Communications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Indonesia Satellite Communications Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 12: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2019 & 2032

- Table 13: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 14: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2019 & 2032

- Table 15: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 16: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Indonesia Satellite Communications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Indonesia Satellite Communications Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Satellite Communications Market?

The projected CAGR is approximately 15.59%.

2. Which companies are prominent players in the Indonesia Satellite Communications Market?

Key companies in the market include NTvsat, Kacific Broadband Satellites Group, PT Pasifik Satelit Nusantara, Starlink, Indosat Ooredoo Hutchison, PT PRIMACOM INTERBUANA, PT Telkom Satelit Indonesia, Thaicom Public Company Limited, SES S A, PT Telkom Satelit Indonesia, PT Wahana Telekomunikasi Dirgantara, PT Pasifik Satelit Nusantara, PT SATELIT NUSANTARA TIG.

3. What are the main segments of the Indonesia Satellite Communications Market?

The market segments include Offering, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 341.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

6. What are the notable trends driving market growth?

Expansion of 5G Satellite Communication is Driving the Market.

7. Are there any restraints impacting market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

8. Can you provide examples of recent developments in the market?

April 2024 - The Indonesian Internet Service Providers Association (APJII) inked a memorandum of understanding (MoU) with SpaceX's Starlink. This collaboration seeks to bolster internet accessibility in Indonesia as Starlink, the LEO satellite operator, awaits the green light from regulators to kick off its operations in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Indonesia Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence