Key Insights

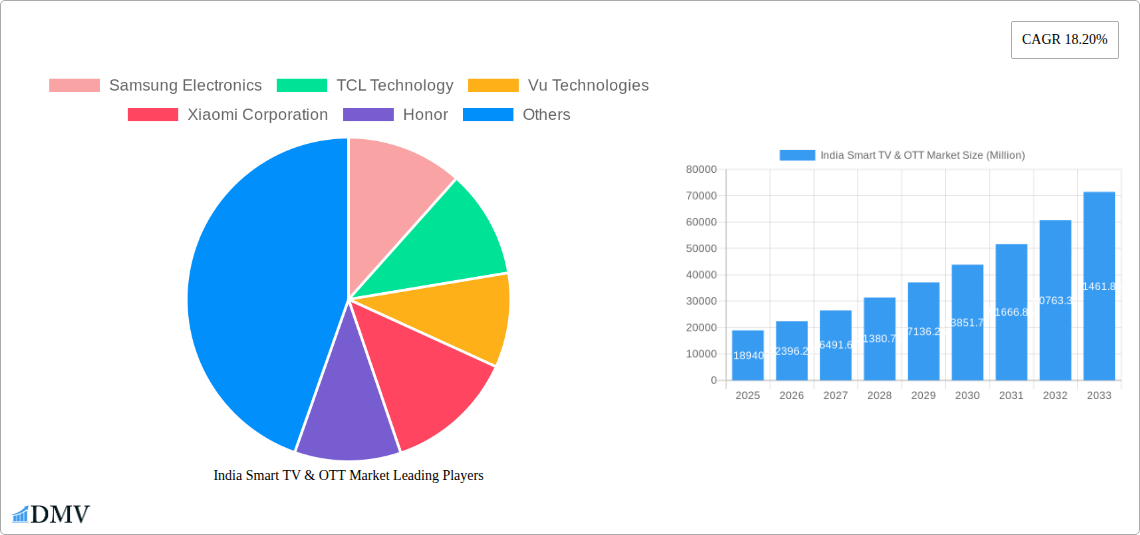

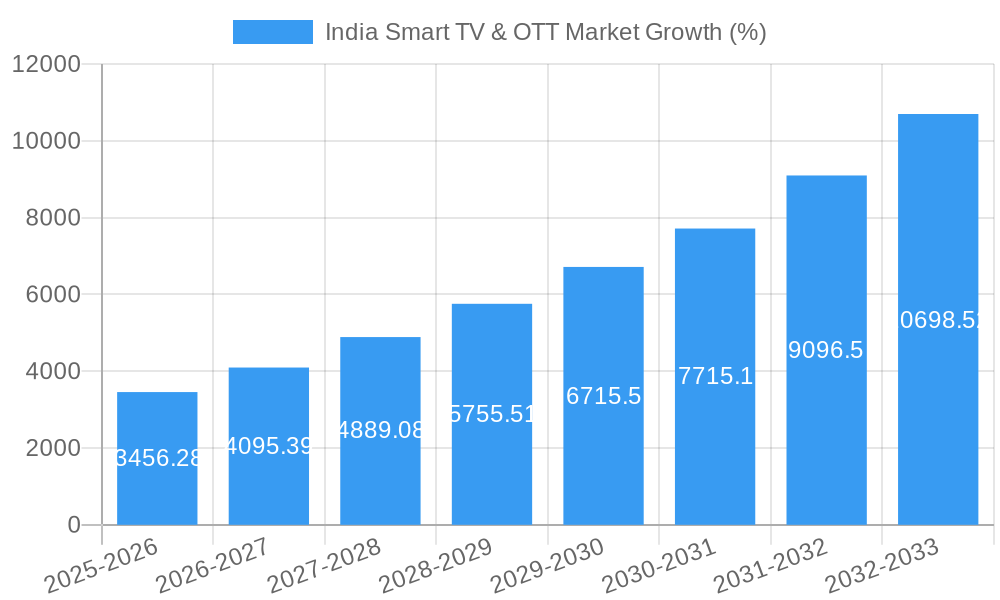

The India Smart TV and OTT market is experiencing robust growth, projected to reach a market size of $18.94 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 18.20% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing internet and smartphone penetration, particularly in rural areas, is significantly boosting demand for affordable smart TVs and convenient OTT streaming services. The rising disposable income of the Indian middle class and a preference for convenient entertainment options contribute significantly to market expansion. Furthermore, aggressive pricing strategies by major players like Samsung, Xiaomi, and TCL, coupled with the availability of diverse content tailored to local preferences on platforms like Netflix, Disney+ Hotstar, and Amazon Prime Video, are driving consumption. The market is segmented by screen size, display type (OLED, QLED, etc.), operating system, and additional features for Smart TVs, while OTT platforms are segmented by content type (movies, shows, sports), subscription model (SVOD, AVOD), and target audience (family, youth). The Asia-Pacific region, specifically India, holds a dominant market share due to its vast population and increasing adoption rate of smart technologies.

However, certain restraints exist. Challenges include the digital divide in remote areas with limited internet access and infrastructure limitations, particularly in rural regions. Competition amongst established and emerging players can lead to price wars impacting profitability. Furthermore, content licensing costs and piracy remain considerable challenges for the OTT sector. To overcome these, companies are focusing on improving affordability, expanding rural internet accessibility, and investing in anti-piracy measures. The market's future trajectory hinges on continued technological advancements, innovative content creation, strategic partnerships, and addressing infrastructure gaps to unlock the substantial growth potential across India's diverse regions. This robust growth outlook makes the India Smart TV and OTT market an attractive investment opportunity for both domestic and international players.

India Smart TV & OTT Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic India Smart TV & OTT market, covering the period from 2019 to 2033. It delves into market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, future opportunities, and key players. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the burgeoning Indian Smart TV and OTT landscape. The report leverages extensive data analysis and expert insights to offer actionable intelligence, including market size projections in Millions.

India Smart TV & OTT Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the Indian Smart TV and OTT market. We examine market concentration, revealing the market share distribution among key players like Samsung Electronics, TCL Technology, Vu Technologies, Xiaomi Corporation, Honor, Haier, OnePlus, Sansui, Panasonic Corporation, Sony Corporation, and LG Corporation (list not exhaustive). The report also explores the impact of M&A activities, quantifying deal values where possible (xx Million) and their influence on market consolidation. We further investigate the influence of substitute products, evolving end-user profiles (e.g., age, income, location), and the regulatory landscape's role in shaping market growth.

- Market Share Distribution (2024): Samsung (xx%), Xiaomi (xx%), TCL (xx%), Others (xx%). (Specific percentages unavailable, report will provide detailed analysis)

- M&A Activity (2019-2024): Total deal value estimated at xx Million. (Specific deal values to be included in the final report)

- Innovation Catalysts: Focus on technological advancements like 8K resolution, AI-powered features, and improved user interfaces.

- Regulatory Landscape: Analysis of government policies impacting the sector, including digital content regulations and taxation.

India Smart TV & OTT Market Industry Evolution

This section meticulously charts the evolution of the Indian Smart TV and OTT market from 2019 to 2024 and projects its trajectory until 2033. We analyze the historical growth rate (xx% CAGR 2019-2024) and project future growth (xx% CAGR 2025-2033) based on various factors. The report examines technological advancements, such as the rise of 4K, 8K, and OLED displays, the integration of smart features, and the proliferation of voice assistants. We also study shifting consumer demands, including preferences for larger screen sizes, higher resolutions, and diverse content options. The impact of increasing internet penetration and smartphone adoption on Smart TV and OTT market growth will be critically assessed, providing detailed data points and adoption metrics for each segment.

Leading Regions, Countries, or Segments in India Smart TV & OTT Market

This section identifies the dominant regions, countries, and segments within the Indian Smart TV and OTT market. For Smart TVs, we analyze market leadership by screen size (e.g., dominance of 55-inch and above), display type (e.g., LED vs. OLED vs. QLED), operating system (Android TV, WebOS, etc.), and additional features (e.g., smart home integration). For OTT platforms, we examine content type (movies, series, sports, etc.), subscription models (SVOD, AVOD, TVOD), and target audience segmentation (age, demographics, interests).

Key Drivers:

- Investment Trends: Significant investments in infrastructure and content development.

- Regulatory Support: Government initiatives promoting digitalization and content creation.

Dominance Factors:

(Detailed analysis of factors driving the dominance of specific regions, segments, or players will be provided in the full report)

India Smart TV & OTT Market Product Innovations

This section highlights the key product innovations driving market growth, including advancements in display technology, improved user interfaces, and the integration of smart home features. We analyze the unique selling propositions of various Smart TV models and OTT platforms, focusing on their performance metrics and consumer appeal. The emphasis will be on technological advancements that enhance viewing experience and user engagement.

Propelling Factors for India Smart TV & OTT Market Growth

Several factors are propelling the growth of the India Smart TV & OTT market. Rising disposable incomes, increasing internet penetration, affordability of Smart TVs, and the burgeoning demand for diverse and high-quality digital content are key drivers. Government initiatives promoting digitalization and infrastructure development further contribute to the market's expansion.

Obstacles in the India Smart TV & OTT Market

Despite the positive outlook, challenges remain. These include regulatory hurdles related to content licensing and streaming rights, supply chain disruptions impacting manufacturing and distribution, and intense competition among manufacturers and OTT platforms. The report will quantify the impact of these barriers, providing specific data where possible (e.g., supply chain disruption leading to xx Million in losses).

Future Opportunities in India Smart TV & OTT Market

The Indian Smart TV and OTT market presents significant future opportunities. The expansion into rural markets, the adoption of new technologies like 8K resolution and advanced AI features, and the increasing demand for personalized content experiences will create new avenues for growth. The rise of hyperlocal content and the integration of Smart TVs with other smart home devices also present lucrative opportunities.

Major Players in the India Smart TV & OTT Market Ecosystem

- Samsung Electronics

- TCL Technology

- Vu Technologies

- Xiaomi Corporation

- Honor

- Haier

- OnePlus

- Sansui

- Panasonic Corporation

- Sony Corporation

- LG Corporation

Key Developments in India Smart TV & OTT Market Industry

- February 2022: T-Series enters web series production for video streaming devices, expanding content offerings.

- May 2022: Kerala Government launches CSpace, a state-owned OTT platform, increasing competition and content diversity.

Strategic India Smart TV & OTT Market Forecast

The Indian Smart TV and OTT market is poised for sustained growth, driven by increasing affordability, expanding internet access, and a rising demand for diverse and high-quality content. The market's future trajectory will be influenced by technological innovations, evolving consumer preferences, and the competitive landscape. The report provides detailed forecasts outlining the market's potential and future growth opportunities.

India Smart TV & OTT Market Segmentation

- 1. OS Type (Tizen, WebOS, Android TV, etc.)

- 2. Price Range

India Smart TV & OTT Market Segmentation By Geography

- 1. India

India Smart TV & OTT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Volume of the Indian Households and Relative Less Levels of Penetration; Growing Spending Power and Growth in Smartphone Adoption to boost OTT Demand; Declining Unit Prices Coupled with Entry of Several Regional Players to Drive Bargaining Leverage of Buyers

- 3.3. Market Restrains

- 3.3.1. Manufacturers Faced with Taxation Challenges and Relatively Higher Replacement Rate

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Smart Devices Across IoT Ecosystem to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by OS Type (Tizen, WebOS, Android TV, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Price Range

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by OS Type (Tizen, WebOS, Android TV, etc.)

- 6. China India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 8. India India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Samsung Electronics

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TCL Technology

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Vu Technologies

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Xiaomi Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Honor

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Haier

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 OnePlus

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sansui*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Panasonic Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sony Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LG Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Samsung Electronics

List of Figures

- Figure 1: India Smart TV & OTT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Smart TV & OTT Market Share (%) by Company 2024

List of Tables

- Table 1: India Smart TV & OTT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Smart TV & OTT Market Revenue Million Forecast, by OS Type (Tizen, WebOS, Android TV, etc.) 2019 & 2032

- Table 3: India Smart TV & OTT Market Revenue Million Forecast, by Price Range 2019 & 2032

- Table 4: India Smart TV & OTT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Smart TV & OTT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Smart TV & OTT Market Revenue Million Forecast, by OS Type (Tizen, WebOS, Android TV, etc.) 2019 & 2032

- Table 14: India Smart TV & OTT Market Revenue Million Forecast, by Price Range 2019 & 2032

- Table 15: India Smart TV & OTT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Smart TV & OTT Market?

The projected CAGR is approximately 18.20%.

2. Which companies are prominent players in the India Smart TV & OTT Market?

Key companies in the market include Samsung Electronics, TCL Technology, Vu Technologies, Xiaomi Corporation, Honor, Haier, OnePlus, Sansui*List Not Exhaustive, Panasonic Corporation, Sony Corporation, LG Corporation.

3. What are the main segments of the India Smart TV & OTT Market?

The market segments include OS Type (Tizen, WebOS, Android TV, etc.), Price Range.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Volume of the Indian Households and Relative Less Levels of Penetration; Growing Spending Power and Growth in Smartphone Adoption to boost OTT Demand; Declining Unit Prices Coupled with Entry of Several Regional Players to Drive Bargaining Leverage of Buyers.

6. What are the notable trends driving market growth?

Increasing Adoption of Smart Devices Across IoT Ecosystem to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Manufacturers Faced with Taxation Challenges and Relatively Higher Replacement Rate.

8. Can you provide examples of recent developments in the market?

May 2022: Kerala Government announced to launch of a state-owned over-the-top platform offering an array of movies, short films, and documentaries. The OTT platform's name is CSpace, an initiative of the Kerala State Film Development Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Smart TV & OTT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Smart TV & OTT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Smart TV & OTT Market?

To stay informed about further developments, trends, and reports in the India Smart TV & OTT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence