Key Insights

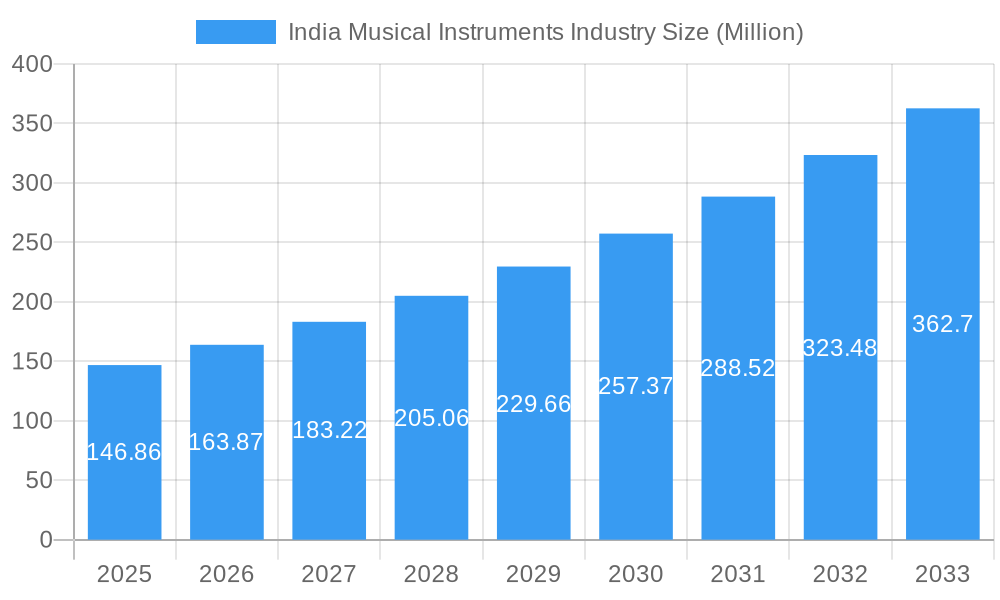

The Indian musical instruments market, valued at $146.86 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033. This surge is driven by several factors. Rising disposable incomes, particularly among the young population, are fueling increased spending on leisure activities, including music education and instrument purchases. The burgeoning popularity of Indian classical and contemporary music genres, coupled with the growing influence of Western music styles, is further stimulating demand. A rise in the number of music schools, workshops, and online music learning platforms is creating a conducive environment for market expansion. Furthermore, the increasing penetration of e-commerce platforms is expanding market access and providing convenient purchasing options for a wider customer base. While the market is currently dominated by offline channels, the online segment is poised for significant growth in the forecast period. The market is segmented by instrument type (electronic, stringed, wind, acoustic pianos/keyboards, percussion, and accessories) and distribution channel (online and offline). Leading brands like Yamaha, Fender, and Roland compete alongside domestic manufacturers, catering to diverse preferences and price points across various regions (North, South, East, and West India).

India Musical Instruments Industry Market Size (In Million)

The market's growth, however, faces some challenges. Price sensitivity among a significant portion of the consumer base might restrain high-end instrument sales. Competition from counterfeit and low-quality instruments also poses a threat. Furthermore, the market's growth is geographically uneven, with certain regions demonstrating faster adoption than others. To capitalize on the growth opportunities, manufacturers are focusing on product innovation, offering a diverse product portfolio to cater to various customer needs and price points, and leveraging digital marketing to enhance brand visibility and reach a broader audience. This includes targeted advertising campaigns on social media and collaborations with music influencers. The increasing availability of financing options could also further stimulate market expansion in the years ahead.

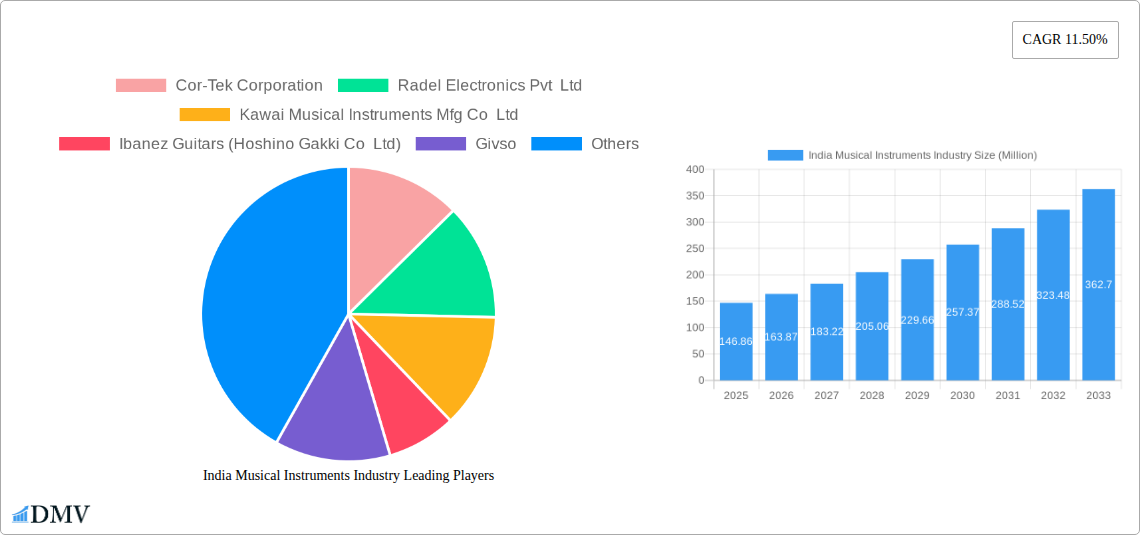

India Musical Instruments Industry Company Market Share

India Musical Instruments Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India musical instruments market, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market trends, key players, and future growth opportunities. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

India Musical Instruments Industry Market Composition & Trends

The Indian musical instruments market exhibits a dynamic interplay of established players and emerging brands, shaping a complex competitive landscape. Market concentration is moderate, with a few dominant players alongside numerous smaller regional manufacturers. Innovation is driven by technological advancements in digital instruments, increasing demand for personalized instruments, and the rising popularity of various musical genres. The regulatory landscape is relatively straightforward, focusing primarily on product safety and import/export regulations. Substitute products include digital audio workstations (DAWs) and music creation software, impacting the market share of traditional instruments. End-users range from individual musicians and students to professional orchestras and educational institutions. The market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million, largely driven by consolidation efforts and expansion strategies.

- Market Share Distribution (2025 Estimate): Yamaha Corporation (xx%), Roland Corporation (xx%), Fender Musical Instruments Corporation (xx%), Others (xx%).

- M&A Activity (2019-2024): Three major acquisitions, totaling an estimated xx Million.

India Musical Instruments Industry Industry Evolution

The Indian musical instruments market has experienced substantial growth over the historical period (2019-2024), driven by rising disposable incomes, increasing awareness of music education, and the expanding popularity of live music events. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024. Technological advancements, particularly in digital instruments, have significantly impacted market dynamics, leading to the emergence of hybrid instruments combining acoustic and electronic features. This has catered to the evolving consumer demands for versatile, technologically advanced instruments. The shift towards online distribution channels has also influenced the market, offering greater accessibility to a wider customer base. Furthermore, a growing preference for customized and personalized instruments is also a notable trend driving innovation.

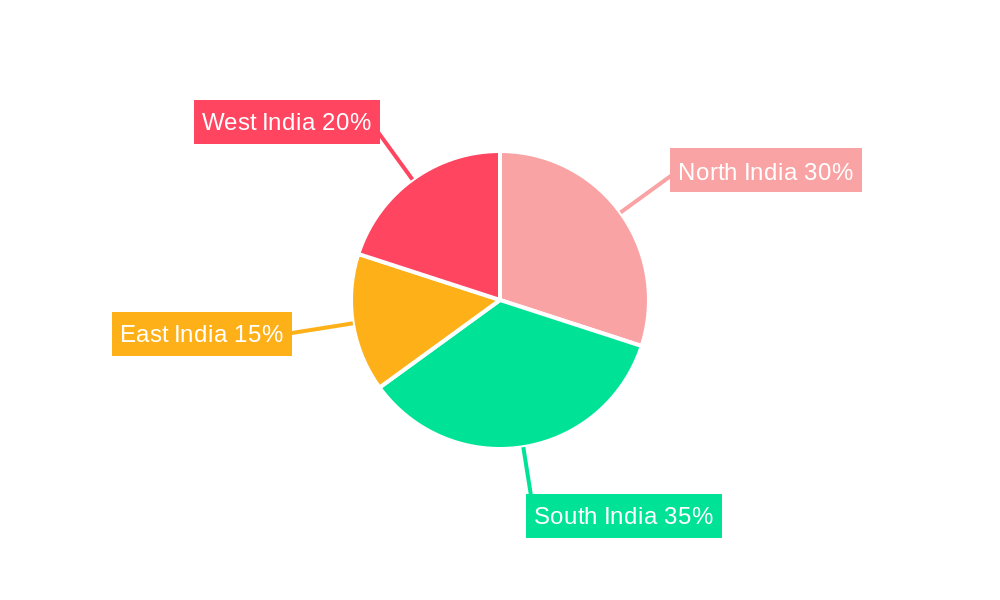

Leading Regions, Countries, or Segments in India Musical Instruments Industry

The Indian musical instruments market demonstrates regional variations in growth and segment dominance. Metropolitan areas like Mumbai, Delhi, Bengaluru, and Chennai exhibit higher demand due to a larger concentration of musical institutions and a thriving music scene.

By Type: Stringed instruments (including guitars, violins, and sitar) represent the largest segment, driven by strong cultural affinity and diverse musical traditions. Electronic musical instruments are experiencing rapid growth due to technological advancements and affordability.

By Distribution Channel: Offline channels (music stores, retail outlets) still dominate, but online sales are rapidly gaining traction, facilitated by increased internet penetration and e-commerce growth. Key drivers for online growth include wider selection, competitive pricing, and convenience. Offline channels maintain their dominance due to the experiential nature of instrument selection and the requirement for physical interaction.

Key Drivers: Rising disposable incomes, increasing music education initiatives, government support for cultural events, and growing online sales contribute to the overall market growth.

India Musical Instruments Industry Product Innovations

Recent innovations include hybrid instruments blending acoustic and digital technologies, offering expanded tonal possibilities and enhanced playability. Smart instruments with integrated connectivity and learning apps are also gaining popularity. These innovations are aimed at enhancing the user experience and catering to evolving musician preferences. The focus on lightweight, portable, and aesthetically pleasing designs also contributes to increased sales.

Propelling Factors for India Musical Instruments Industry Growth

Several factors are driving the growth of the Indian musical instruments market. Technological advancements resulting in more affordable and versatile instruments are a key catalyst. The growing popularity of music education, fuelled by increasing awareness of its cognitive and emotional benefits, is another crucial driver. Economic growth and rising disposable incomes further contribute to the market’s expansion, with more consumers willing to invest in quality musical instruments.

Obstacles in the India Musical Instruments Industry Market

The market faces challenges, including the availability of counterfeit products and the inconsistent quality of some domestically produced instruments. Supply chain disruptions due to global events can impact the availability and pricing of imported instruments. The competitive landscape, with both established international players and smaller domestic manufacturers, creates pressure on pricing and market share.

Future Opportunities in India Musical Instruments Industry

The Indian musical instruments market presents significant opportunities. The expansion of online sales channels provides avenues for reaching a wider audience. Technological advancements, such as AI-powered music creation tools, will further fuel innovation. The increasing participation in music festivals and events creates further demand for high-quality instruments.

Major Players in the India Musical Instruments Industry Ecosystem

- Cor-Tek Corporation

- Radel Electronics Pvt Ltd

- Kawai Musical Instruments Mfg Co Ltd

- Ibanez Guitars (Hoshino Gakki Co Ltd)

- Givso

- Kadence

- Steinway & Sons

- Yamaha Corporation

- Roland Corporation

- Fender Musical Instruments Corporation

Key Developments in India Musical Instruments Industry Industry

- February 2024: Kawai's CA901 digital piano received the "Editor's Choice" award at the 2024 NAMM Show. This recognition boosted brand reputation and sales.

- March 2024: Roland launched the RD-08 stage piano, featuring 100 scenes and over 3,000 tones. This new product launch expands Roland's market share and caters to professional musicians.

Strategic India Musical Instruments Industry Market Forecast

The Indian musical instruments market is poised for sustained growth over the forecast period (2025-2033), driven by ongoing technological innovation, the expansion of music education initiatives, and the rise of online sales. The increasing disposable incomes and evolving consumer preferences for high-quality and diverse musical instruments will further fuel market expansion. The market presents considerable opportunities for both established players and new entrants, promising a dynamic and exciting future for the industry.

India Musical Instruments Industry Segmentation

-

1. Type

- 1.1. Electronic Musical Instruments

- 1.2. Stringed Musical Instruments

- 1.3. Wind Instruments

- 1.4. Acoustic Pianos and Stringed Keyboard Instruments

- 1.5. Percussion Instruments

- 1.6. Other Musical Instruments (Parts and Accessories)

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

India Musical Instruments Industry Segmentation By Geography

- 1. India

India Musical Instruments Industry Regional Market Share

Geographic Coverage of India Musical Instruments Industry

India Musical Instruments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Live Concerts and Performances; Increasing Technological Advancements in Musical Instruments

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Live Concerts and Performances to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Musical Instruments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electronic Musical Instruments

- 5.1.2. Stringed Musical Instruments

- 5.1.3. Wind Instruments

- 5.1.4. Acoustic Pianos and Stringed Keyboard Instruments

- 5.1.5. Percussion Instruments

- 5.1.6. Other Musical Instruments (Parts and Accessories)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cor-Tek Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Radel Electronics Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kawai Musical Instruments Mfg Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ibanez Guitars (Hoshino Gakki Co Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Givso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kadence

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Steinway & Sons

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yamaha Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Roland Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fender Musical Instruments Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cor-Tek Corporation

List of Figures

- Figure 1: India Musical Instruments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Musical Instruments Industry Share (%) by Company 2025

List of Tables

- Table 1: India Musical Instruments Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Musical Instruments Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Musical Instruments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Musical Instruments Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: India Musical Instruments Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Musical Instruments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Musical Instruments Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the India Musical Instruments Industry?

Key companies in the market include Cor-Tek Corporation, Radel Electronics Pvt Ltd, Kawai Musical Instruments Mfg Co Ltd, Ibanez Guitars (Hoshino Gakki Co Ltd), Givso, Kadence, Steinway & Sons, Yamaha Corporation, Roland Corporation, Fender Musical Instruments Corporation.

3. What are the main segments of the India Musical Instruments Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Live Concerts and Performances; Increasing Technological Advancements in Musical Instruments.

6. What are the notable trends driving market growth?

Growing Popularity of Live Concerts and Performances to Witness the Growth.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

March 2024 - Roland recently unveiled its newest addition to the RD stage piano lineup, the RD-08. Boasting an impressive array of features, the RD-08 stands out with its 100 scenes, over 3,000 tones, and an extensive selection of effects. The piano offers hands-on control through assignable pitch bend and modulation wheels, along with four control knobs. Additionally, it provides inputs for a damper pedal and two other assignable pedals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Musical Instruments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Musical Instruments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Musical Instruments Industry?

To stay informed about further developments, trends, and reports in the India Musical Instruments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence