Key Insights

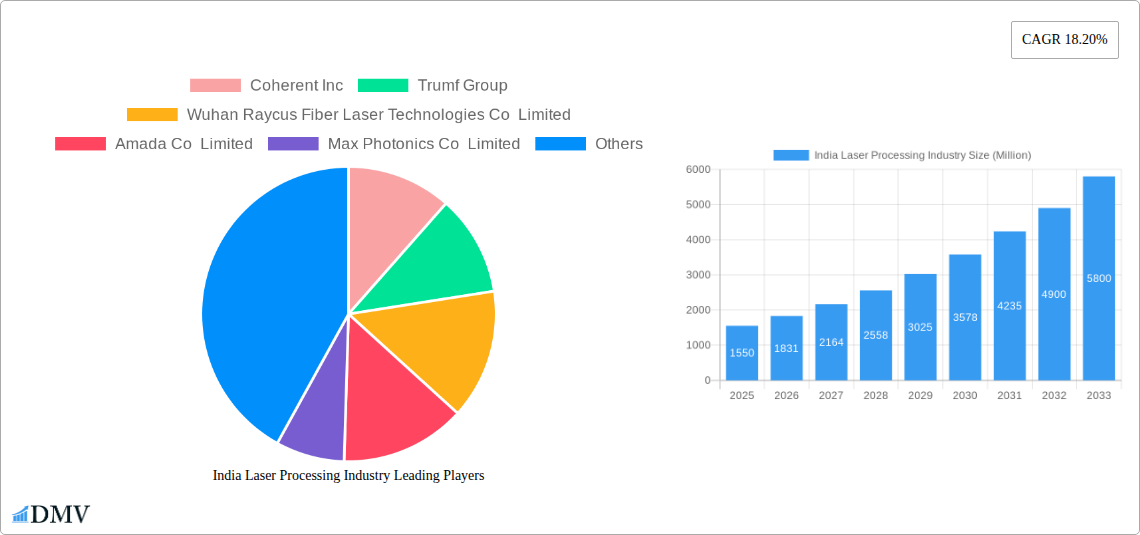

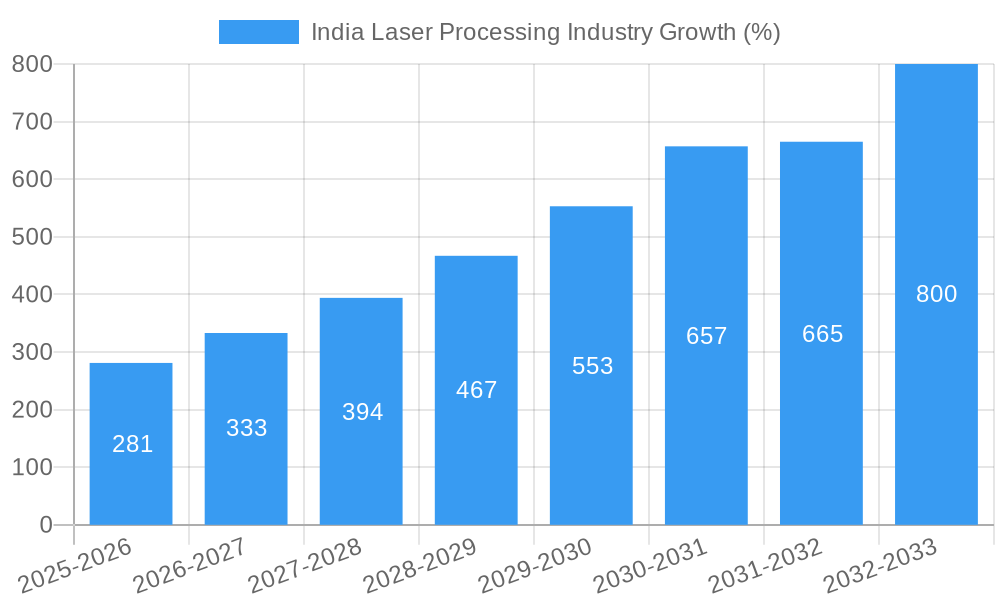

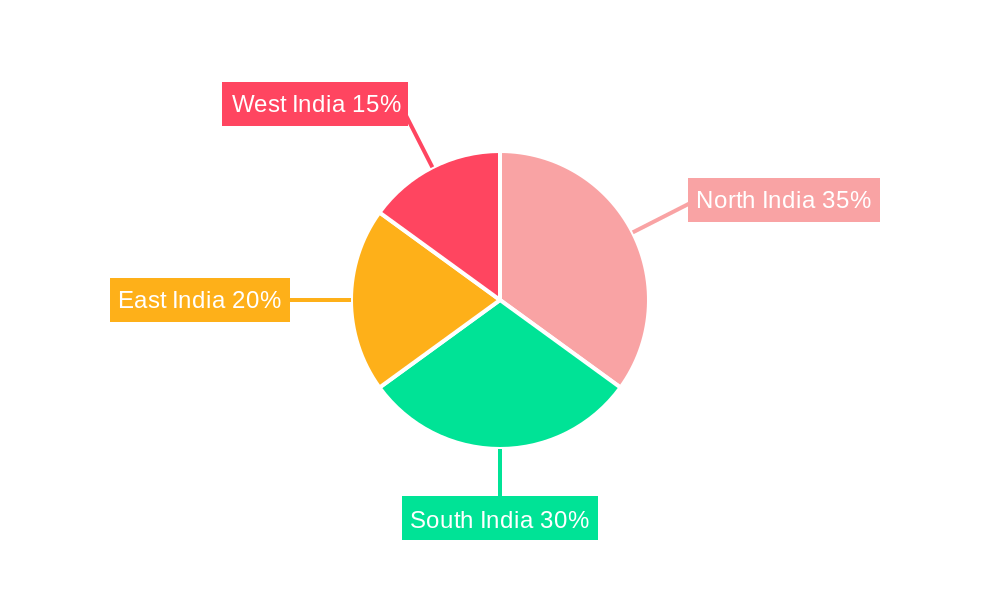

The India laser processing market, valued at $1.55 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 18.20% from 2025 to 2033. This surge is driven by several key factors. The automotive industry's increasing adoption of laser cutting and welding for enhanced precision and efficiency is a major contributor. Similarly, the construction sector is leveraging laser technology for improved material processing and automation, further fueling market expansion. The burgeoning solar energy industry in India, requiring precise laser processing for cell manufacturing, also presents significant growth opportunities. Technological advancements, such as the development of more efficient and cost-effective laser systems, are further accelerating market penetration. While challenges such as the initial high investment cost of laser equipment and a need for skilled labor exist, the long-term benefits in terms of productivity and precision outweigh these limitations, supporting continued market growth. Segmentation reveals strong demand across various laser types, with fiber lasers likely dominating due to their efficiency and versatility. Regional analysis suggests strong growth across all regions of India, potentially with North and South India showing comparatively faster growth due to existing industrial infrastructure and government initiatives.

The forecast period from 2025 to 2033 anticipates continued expansion, with the market likely exceeding $6 billion by 2033. Specific growth within segments will depend on factors such as government policies promoting industrial automation, the pace of technological innovations, and the overall economic growth of the country. Competition within the market is intense, with both domestic and international players vying for market share. Companies such as Coherent Inc., TRUMPF Group, and IPG Photonics are major players, while domestic manufacturers like Wuhan Raycus are gaining traction. The market's future hinges on continued technological advancements, strategic partnerships, and the sustained growth of key end-user industries. Successfully navigating these factors will be crucial for businesses seeking a strong foothold in this rapidly evolving market.

India Laser Processing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India laser processing industry, offering valuable insights for stakeholders seeking to understand market dynamics, growth potential, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market is segmented by type (CO2 laser, fiber laser, Nd:YAG laser, other types) and end-user (automotive, railways, construction, agriculture, communications, solar industry, other end-users). Key players include Coherent Inc, Trumpf Group, Wuhan Raycus Fiber Laser Technologies Co Limited, Amada Co Limited, Max Photonics Co Limited, Laserline, nLight Inc, Alpha Laser, and IPG Photonics (list not exhaustive). The report projects a market value of xx Million USD by 2033.

India Laser Processing Industry Market Composition & Trends

The Indian laser processing industry exhibits a moderately concentrated market structure, with a few dominant players capturing a significant market share. However, the presence of numerous smaller players fosters competition and innovation. The market is driven by increasing adoption across diverse sectors, fuelled by technological advancements and government initiatives promoting industrial automation. Regulatory frameworks, though largely supportive, present some challenges related to safety standards and import regulations. Substitute technologies, such as traditional machining methods, pose a limited threat due to the superior precision and efficiency offered by laser processing. The automotive, construction, and solar energy sectors are key end-users, driving substantial demand. Recent M&A activities in the industry have been limited in value and number, suggesting a focus on organic growth. The overall market share distribution is estimated as follows: Top 3 players hold approximately 40% of the market, while the remaining share is distributed among numerous smaller participants. Recent M&A deal values are estimated at xx Million USD.

- Market Concentration: Moderately concentrated, with a few major players.

- Innovation Catalysts: Technological advancements, government initiatives, and increasing demand from diverse sectors.

- Regulatory Landscape: Mostly supportive, with some challenges related to safety and imports.

- Substitute Products: Traditional machining methods, posing a limited threat.

- End-User Profiles: Automotive, construction, solar energy sectors are key drivers.

- M&A Activities: Limited activity with estimated values of xx Million USD.

India Laser Processing Industry Industry Evolution

The Indian laser processing industry has witnessed significant growth over the past few years, driven by increasing industrialization and technological advancements. The adoption of fiber lasers has been particularly prominent, owing to their superior efficiency and cost-effectiveness. The market has shifted from primarily CO2 lasers to a more balanced distribution across fiber lasers, Nd:YAG lasers, and other emerging technologies. Consumer demand is primarily driven by the need for high-precision cutting, welding, and marking in diverse sectors. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of approximately xx%, fueled by investments in manufacturing and infrastructure projects. Technological advancements like the integration of AI and automation are further accelerating market growth, leading to higher productivity and lower operational costs. The forecast period (2025-2033) is expected to witness a CAGR of xx%, driven by increasing adoption across sectors like automotive and solar energy.

Leading Regions, Countries, or Segments in India Laser Processing Industry

The fiber laser segment dominates the Indian laser processing market, driven by its high efficiency, precision, and versatility across diverse applications. The automotive and solar energy sectors are leading end-users, largely due to high-volume production needs and increasing demand for renewable energy solutions.

- Key Drivers for Fiber Laser Dominance: High efficiency, cost-effectiveness, and suitability for various applications.

- Key Drivers for Automotive Sector Dominance: High production volumes, demand for precise cutting and welding.

- Key Drivers for Solar Energy Sector Dominance: Growing demand for solar panels, need for efficient and precise laser processing.

- Regional Dominance: Major industrial hubs such as Gujarat, Maharashtra, and Tamil Nadu are leading regions due to the concentration of manufacturing and automotive industries.

India Laser Processing Industry Product Innovations

Recent innovations include the development of compact, high-power fiber lasers that offer enhanced performance and reduced operational costs. These advancements have expanded the range of applications to include more intricate processes, improved surface finish, and higher production speeds. The integration of AI-powered control systems has further improved process optimization and reduced waste. Unique selling propositions often center on improved precision, efficiency, ease of use, and reduced downtime.

Propelling Factors for India Laser Processing Industry Growth

The industry's growth is primarily fueled by factors such as increasing industrialization, supportive government policies, the rising demand for automation in manufacturing, and technological advancements leading to greater efficiency and precision in laser processing. The focus on "Make in India" and increasing investments in renewable energy further support market expansion.

Obstacles in the India Laser Processing Industry Market

Key challenges include the high initial investment costs associated with laser processing equipment, potential supply chain disruptions impacting component availability, and intense competition from both domestic and international players. These factors combined with occasional skill gaps among operators may slightly hinder rapid adoption in certain sectors.

Future Opportunities in India Laser Processing Industry

Significant opportunities exist in expanding laser processing applications in emerging sectors like medical devices, electronics, and aerospace. Further technological advancements, particularly in areas such as additive manufacturing and laser-based micromachining, are expected to open up new market segments. Growing demand for automation across industries will drive further growth in the coming years.

Major Players in the India Laser Processing Industry Ecosystem

- Coherent Inc

- Trumpf Group

- Wuhan Raycus Fiber Laser Technologies Co Limited

- Amada Co Limited

- Max Photonics Co Limited

- Laserline

- nLight Inc

- Alpha Laser

- IPG Photonics

Key Developments in India Laser Processing Industry Industry

- June 2022: LUMIBIRD established Lumibird Medical India in Mumbai, expanding its medical laser product offerings in the Indian market.

- January 2022: An Indian scientist developed a fully automated laser-based technique for repairing expensive industrial parts, improving efficiency and reducing repair costs.

Strategic India Laser Processing Industry Market Forecast

The Indian laser processing industry is poised for substantial growth over the next decade, driven by technological advancements, increasing industrialization, and supportive government policies. The market's future potential is substantial, particularly in emerging sectors like renewable energy and advanced manufacturing, promising considerable returns for stakeholders.

India Laser Processing Industry Segmentation

-

1. Type

- 1.1. Co2 Laser

- 1.2. Fiber Laser

- 1.3. Nd YaG Laser

- 1.4. Other Types

-

2. End User

- 2.1. Automotive

- 2.2. Railways

- 2.3. Construction

- 2.4. Agriculture

- 2.5. Communications

- 2.6. Solar Industry

- 2.7. Other End Users

India Laser Processing Industry Segmentation By Geography

- 1. India

India Laser Processing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Market Concentration Coupled with Increased Availability of Products has Played a Role in Cost Decline; High Demand for Laser Cutting Related Applications; Replacement of Existing Installations and the Emergence of India as One of the Major Manufacturing Destinations (Driven by Favorable Policy Changes)

- 3.3. Market Restrains

- 3.3.1. Integration issues with traditional systems; Data quality and accuracy issues

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Laser Processing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Co2 Laser

- 5.1.2. Fiber Laser

- 5.1.3. Nd YaG Laser

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Railways

- 5.2.3. Construction

- 5.2.4. Agriculture

- 5.2.5. Communications

- 5.2.6. Solar Industry

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Laser Processing Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Laser Processing Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Laser Processing Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Laser Processing Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Coherent Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trumf Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Wuhan Raycus Fiber Laser Technologies Co Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Amada Co Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Max Photonics Co Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Laserline

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 nLight Inc *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Alpha Laser

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 IPG Photonics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Coherent Inc

List of Figures

- Figure 1: India Laser Processing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Laser Processing Industry Share (%) by Company 2024

List of Tables

- Table 1: India Laser Processing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Laser Processing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Laser Processing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Laser Processing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Laser Processing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Laser Processing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Laser Processing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Laser Processing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Laser Processing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Laser Processing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Laser Processing Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 12: India Laser Processing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Laser Processing Industry?

The projected CAGR is approximately 18.20%.

2. Which companies are prominent players in the India Laser Processing Industry?

Key companies in the market include Coherent Inc, Trumf Group, Wuhan Raycus Fiber Laser Technologies Co Limited, Amada Co Limited, Max Photonics Co Limited, Laserline, nLight Inc *List Not Exhaustive, Alpha Laser, IPG Photonics.

3. What are the main segments of the India Laser Processing Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Market Concentration Coupled with Increased Availability of Products has Played a Role in Cost Decline; High Demand for Laser Cutting Related Applications; Replacement of Existing Installations and the Emergence of India as One of the Major Manufacturing Destinations (Driven by Favorable Policy Changes).

6. What are the notable trends driving market growth?

Automotive Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Integration issues with traditional systems; Data quality and accuracy issues.

8. Can you provide examples of recent developments in the market?

June 2022: LUMIBIRD, the European laser technology pioneer, launched the establishment of Lumibird Medical India in Mumbai. With a standard selection of ultrasonography platforms, ophthalmic lasers, and tools for the detection and therapy of dry eye, the firm hopes to increase the revenues of Quantel Medical and Ellex goods in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Laser Processing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Laser Processing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Laser Processing Industry?

To stay informed about further developments, trends, and reports in the India Laser Processing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence