Key Insights

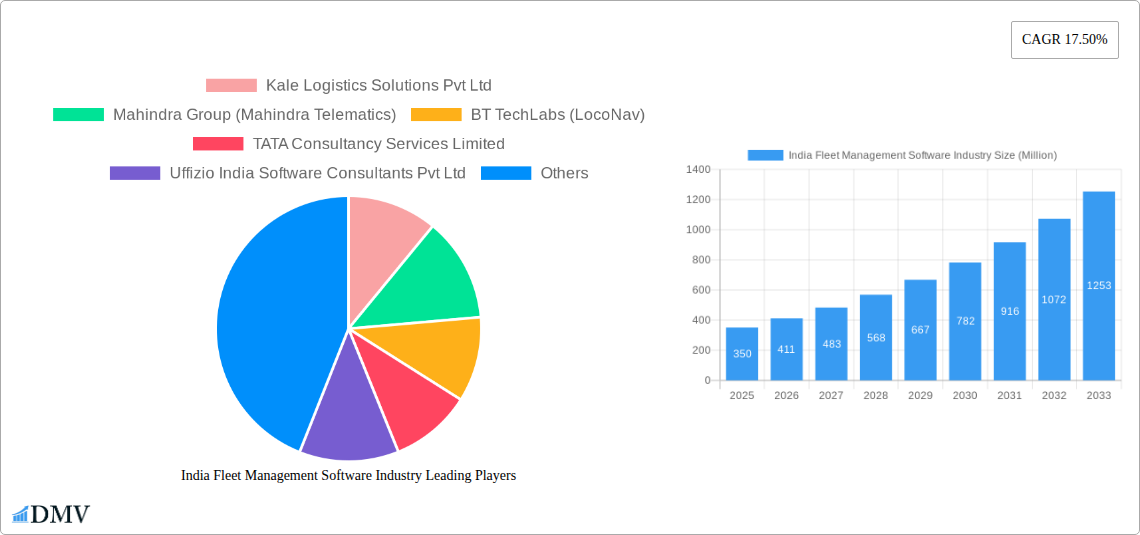

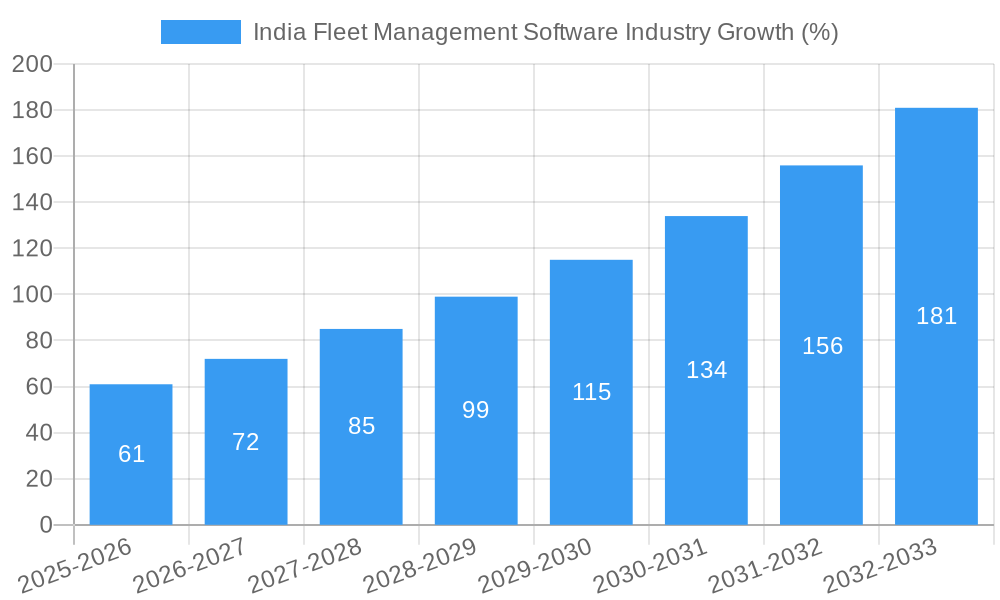

The Indian fleet management software market is experiencing robust growth, driven by increasing adoption of technology across logistics, manufacturing, and other sectors. The market's Compound Annual Growth Rate (CAGR) of 17.50% from 2019 to 2024 indicates significant expansion. This growth is fueled by several factors, including the rising need for enhanced operational efficiency, improved fuel management, reduced maintenance costs, and increased driver safety. The shift towards cloud-based solutions offers scalability and cost-effectiveness, further accelerating market penetration. While the precise market size in 2025 is unavailable, extrapolating from the given CAGR and a projected market size by 2033, we can reasonably estimate the 2025 market value to be in the range of $300-400 million (USD). Further growth will be supported by government initiatives promoting digitalization in transportation and logistics and a burgeoning e-commerce sector demanding optimized delivery networks.

However, challenges remain. High initial investment costs for software implementation and integration can be a barrier for smaller companies. Concerns regarding data security and privacy might also influence adoption rates. Nevertheless, the long-term prospects for the Indian fleet management software market remain positive, with a projected continued rise in market value through 2033 fueled by increasing technological advancements and evolving business needs. The segmentation by deployment (on-premise vs. cloud) and end-user (logistics, manufacturing, etc.) highlights diverse application areas and presents lucrative opportunities for tailored software solutions. The presence of both domestic and international players indicates a competitive yet dynamic market.

India Fleet Management Software Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the India fleet management software market, offering invaluable insights for stakeholders seeking to understand its current state, future trajectory, and key players. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. The market size is projected to reach xx Million by 2033, driven by technological advancements, increasing adoption across various sectors, and government initiatives promoting digitalization.

India Fleet Management Software Industry Market Composition & Trends

The Indian fleet management software market is characterized by a moderately fragmented landscape, with several major players and numerous smaller companies competing for market share. While precise market share distribution data is proprietary, we estimate that the top 5 players collectively hold approximately xx% of the market in 2025. The market's growth is fueled by several factors, including:

- Innovation Catalysts: The emergence of AI-powered solutions, IoT integration, and cloud-based platforms are driving significant innovation. Companies are constantly enhancing features like predictive maintenance, real-time tracking, and fuel efficiency optimization.

- Regulatory Landscape: Government regulations promoting efficient transportation and logistics are creating a favorable environment for fleet management software adoption. Compliance needs are driving demand.

- Substitute Products: While alternative solutions exist (e.g., manual tracking methods), the efficiency and data-driven insights provided by fleet management software offer a compelling advantage.

- End-User Profiles: The market caters to a diverse clientele, spanning logistics, manufacturing, and other sectors (corporate, education). Logistics remains the dominant segment, contributing xx% of total revenue in 2025.

- M&A Activities: The sector has witnessed a moderate level of mergers and acquisitions, with deal values ranging from xx Million to xx Million in recent years. Consolidation is expected to continue as larger players seek to expand their market reach and capabilities. For example, the partnership between Goldstone Technologies and Quantron AG demonstrates the strategic moves being made within the industry to leverage the growing electric vehicle fleet market.

India Fleet Management Software Industry Industry Evolution

The Indian fleet management software market has experienced significant growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue during the forecast period (2025-2033), albeit at a potentially slightly moderated rate (xx% CAGR), as the market matures and reaches a higher base. Technological advancements, particularly in AI and IoT, are transforming the industry. The shift towards cloud-based solutions is gaining momentum, offering improved scalability and cost-effectiveness. Changing consumer demands are driving the adoption of advanced features, including route optimization, driver behavior monitoring, and predictive maintenance capabilities, thereby optimizing operational efficiency. This evolution is creating a move towards integrated platforms that provide holistic fleet management solutions, exceeding simple GPS tracking. The adoption rate of fleet management software is increasing across various industries, with particularly significant growth observed in the logistics and manufacturing sectors. This adoption is facilitated by the growing awareness among businesses regarding the benefits of improved fleet efficiency, cost savings, and enhanced operational visibility. Specific adoption metrics show xx% growth in the logistics sector during 2021-2025.

Leading Regions, Countries, or Segments in India Fleet Management Software Industry

The Indian fleet management software market demonstrates robust growth across various segments, with the Cloud deployment model emerging as the dominant segment, fueled by its scalability and cost-effectiveness.

Key Drivers for Cloud Deployment:

- Increased investment in cloud infrastructure by businesses.

- Reduced upfront costs and improved accessibility.

- Enhanced data security and disaster recovery capabilities.

Key Drivers for Logistics Segment Dominance:

- High volume of freight movement and growing e-commerce sector.

- Need for real-time tracking and efficient delivery management.

- Stringent delivery timelines demanding optimized route planning.

Other End-User Segments: While the logistics sector is the largest, manufacturing and other end-users (corporate, education) are showing increasing adoption rates due to their own efficiency needs.

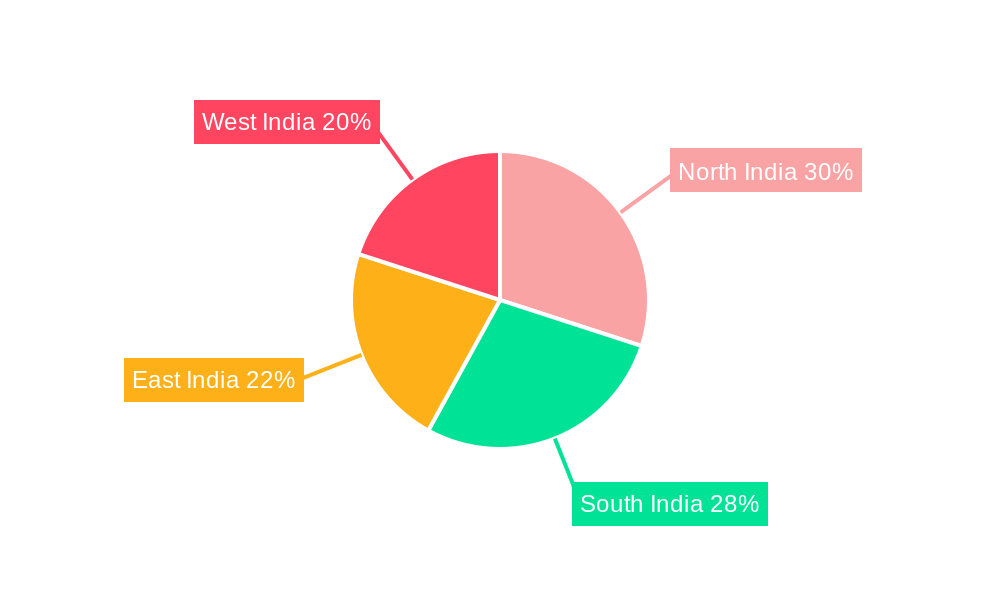

The dominance of Cloud deployment and the Logistics sector is attributed to the factors mentioned above and further fueled by government support and private investment. Metropolitan areas with high logistic activity, such as Mumbai, Delhi, and Bangalore, contribute significantly to market growth.

India Fleet Management Software Industry Product Innovations

Recent innovations include the integration of AI and machine learning to provide predictive maintenance alerts, optimize routes, and improve driver safety. Cloud-based platforms offer real-time data visibility and improved collaboration capabilities. The unique selling propositions focus on user-friendly interfaces, enhanced security features, and cost optimization through reduced fuel consumption and operational efficiencies. These advancements result in improved fleet utilization, reduced operational costs, and enhanced compliance with industry regulations.

Propelling Factors for India Fleet Management Software Industry Growth

The growth of the Indian fleet management software market is propelled by several factors. Technological advancements such as the integration of AI, IoT, and cloud computing are improving the efficiency and functionality of the software. Economic growth and the expansion of the logistics and manufacturing sectors are driving demand. Government initiatives to promote digitalization in the transportation sector create a positive regulatory environment. The increasing adoption of electric vehicles (as seen in the Vedanta Aluminium and GEAR contract) further fuels the need for sophisticated fleet management solutions.

Obstacles in the India Fleet Management Software Industry Market

Despite significant growth potential, the market faces several challenges. Regulatory complexities and evolving data privacy regulations can hinder market expansion. Supply chain disruptions, particularly concerning hardware components and skilled personnel, can impact the deployment of new solutions. Intense competition amongst both large established players and new entrants poses a pressure on pricing and profitability. The overall impact of these barriers is estimated to cause a xx% reduction in market growth in 2026 compared to predicted growth without these constraints.

Future Opportunities in India Fleet Management Software Industry

The future holds immense growth potential for the Indian fleet management software market. Expansion into new sectors, such as agriculture and construction, offers significant opportunities. The adoption of advanced technologies such as blockchain for secure data management and 5G for enhanced connectivity is poised to transform the industry. Furthermore, evolving consumer preferences for sustainable and environmentally-friendly transportation solutions are driving demand for integrated fleet management software that supports the transition to electric fleets.

Major Players in the India Fleet Management Software Industry Ecosystem

- Kale Logistics Solutions Pvt Ltd

- Mahindra Group (Mahindra Telematics)

- BT TechLabs (LocoNav)

- TATA Consultancy Services Limited

- Uffizio India Software Consultants Pvt Ltd

- iTriangle Infotech Pvt Ltd

- Zoho Corporation (WebNMS)

- Orange GPS Solutions Pvt Ltd (iTrack)

- Trimble Inc (Trimble Mobility Solutions India)

- Efkon India Private Limited

- fleetx Technologies Private Limited

Key Developments in India Fleet Management Software Industry Industry

- April 2023: Goldstone Technologies Ltd.'s partnership with Quantron AG highlights the growing focus on AI-enabled fleet management solutions for electric vehicles, particularly in international markets. This indicates a growing potential for expansion into the electric vehicle fleet management market, expected to accelerate growth in coming years.

- January 2022: Vedanta Aluminium's adoption of electric forklifts powered by lithium-ion batteries showcases the increasing adoption of sustainable practices within the industry, highlighting the growing demand for solutions that support environmental sustainability within fleet operations. This shift contributes to the demand for features monitoring energy consumption and operational efficiency.

- October 2022: Shipsy's launch of a self-serve, plug-and-play international logistics solution underscores the increasing demand for user-friendly and scalable solutions that cater to the needs of multinational companies operating in India. This development simplifies implementation and adoption processes.

Strategic India Fleet Management Software Industry Market Forecast

The Indian fleet management software market is poised for sustained growth, driven by ongoing technological advancements, increasing adoption across diverse sectors, and favorable regulatory support. The market's future is bright, with opportunities arising from the expanding electric vehicle market, the growth of e-commerce, and the continued focus on improving operational efficiency and sustainability within logistics and other sectors. The focus on cloud-based solutions and the integration of AI and IoT are key aspects determining the overall market potential.

India Fleet Management Software Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. End User

- 2.1. Logistics

- 2.2. Manufacturing

- 2.3. Other End Users (Corporate, Education, etc.)

India Fleet Management Software Industry Segmentation By Geography

- 1. India

India Fleet Management Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Lowering Total Cost of Ownership Among Fleet Operators; Growing Demand for Mobility and Digital Transformation Trends

- 3.3. Market Restrains

- 3.3.1. Integration issues with traditional systems; Data quality and accuracy issues

- 3.4. Market Trends

- 3.4.1. IoT Deployment is expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Logistics

- 5.2.2. Manufacturing

- 5.2.3. Other End Users (Corporate, Education, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Kale Logistics Solutions Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mahindra Group (Mahindra Telematics)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BT TechLabs (LocoNav)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TATA Consultancy Services Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Uffizio India Software Consultants Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 iTriangle Infotech Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Zoho Corporation (WebNMS)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Orange GPS Solutions Pvt Ltd (iTrack)*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Trimble Inc (Trimble Mobility Solutions India)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Efkon India Private Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 fleetx Technologies Private Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Kale Logistics Solutions Pvt Ltd

List of Figures

- Figure 1: India Fleet Management Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Fleet Management Software Industry Share (%) by Company 2024

List of Tables

- Table 1: India Fleet Management Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Fleet Management Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: India Fleet Management Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Fleet Management Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Fleet Management Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Fleet Management Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 11: India Fleet Management Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 12: India Fleet Management Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Fleet Management Software Industry?

The projected CAGR is approximately 17.50%.

2. Which companies are prominent players in the India Fleet Management Software Industry?

Key companies in the market include Kale Logistics Solutions Pvt Ltd, Mahindra Group (Mahindra Telematics), BT TechLabs (LocoNav), TATA Consultancy Services Limited, Uffizio India Software Consultants Pvt Ltd, iTriangle Infotech Pvt Ltd, Zoho Corporation (WebNMS), Orange GPS Solutions Pvt Ltd (iTrack)*List Not Exhaustive, Trimble Inc (Trimble Mobility Solutions India), Efkon India Private Limited, fleetx Technologies Private Limited.

3. What are the main segments of the India Fleet Management Software Industry?

The market segments include Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Lowering Total Cost of Ownership Among Fleet Operators; Growing Demand for Mobility and Digital Transformation Trends.

6. What are the notable trends driving market growth?

IoT Deployment is expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Integration issues with traditional systems; Data quality and accuracy issues.

8. Can you provide examples of recent developments in the market?

April 2023: In order to take advantage of the fleet management market, Goldstone Technologies Ltd., which is based in Hyderabad, announced a partnership with Quantron AG, one of Germany's largest e-mobility companies. Fleet management with AI-enabled solutions is a focus of the GTL and Quantron Joint Undertaking. In particular, it will be suited to demand in Europe, the United States, India, and the Middle East. In order to address efficiency and digitalization challenges, the Joint Undertaking aims to offer mobility-as-a-service (MaaS) solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Fleet Management Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Fleet Management Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Fleet Management Software Industry?

To stay informed about further developments, trends, and reports in the India Fleet Management Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence