Key Insights

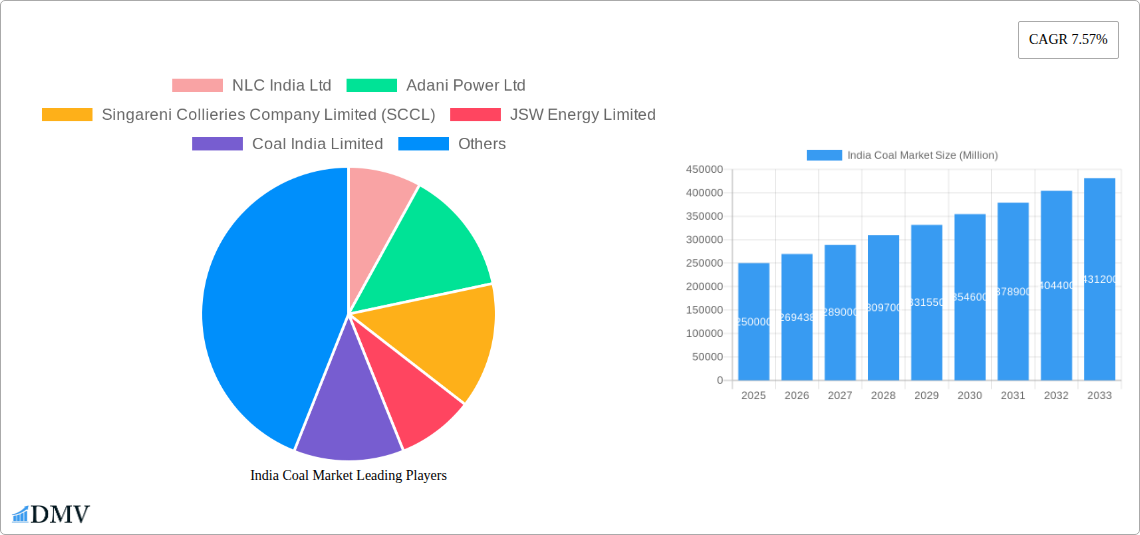

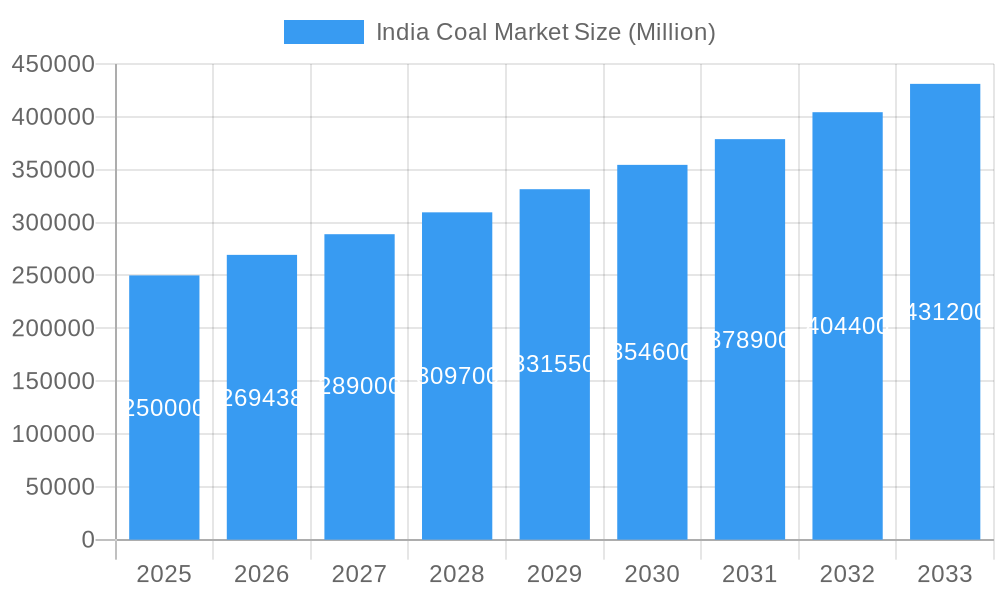

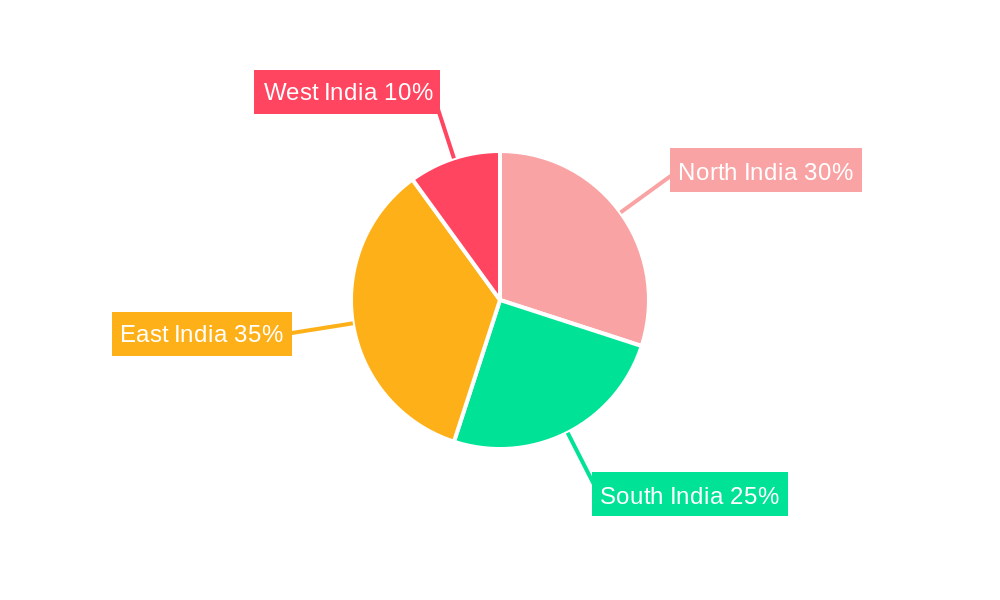

The Indian coal market, projected to reach 1.04 billion by 2025, is set for significant expansion. Driven by escalating energy requirements and industrial development, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.57% from 2025 to 2033, reaching substantial future valuations. Thermal coal's continued importance in power generation, particularly in addressing electricity deficits in North and East India, is a key growth driver. Coking coal demand is also robust, supported by India's infrastructure expansion. While environmental concerns persist, government focus on cleaner coal technologies and energy diversification may mitigate challenges. Leading entities such as Coal India Limited, Adani Power Ltd, and NTPC Ltd are strategically investing in production and innovation to leverage this growth. Application-based segmentation highlights power generation and steel manufacturing as dominant sectors, offering opportunities for targeted strategies. Regional analysis across North, South, East, and West India underscores the need for localized distribution and partnerships.

India Coal Market Market Size (In Billion)

The "Others" application segment includes industrial uses like cement production and brick kilns, along with potential domestic consumption. Geographical segmentation (North, South, East, West India) reveals critical regional supply-demand dynamics. This analysis is vital for stakeholders aiming to invest, operate, or compete in the Indian coal market. Despite long-term competition from renewables, coal will remain integral to India's energy mix in the near future, potentially benefiting from increased global energy security demands. Navigating the regulatory and environmental landscape is crucial for success in this dynamic sector.

India Coal Market Company Market Share

India Coal Market Analysis: Size, Growth, and Forecast (2019-2033)

This comprehensive report analyzes the India coal market, covering historical data (2019-2024), the base year (2025), and forecasts through 2033. It provides critical insights into market dynamics, key players, and future growth prospects for stakeholders across the coal value chain.

India Coal Market Composition & Trends

The Indian coal market, valued at xx Million in 2024, exhibits a complex interplay of factors influencing its composition and future trajectories. Market concentration is heavily skewed towards Coal India Limited, which holds a dominant market share of approximately xx%, followed by other significant players such as Singareni Collieries Company Limited (SCCL), NLC India Ltd, and Adani Power Ltd. The remaining market share is fragmented amongst numerous smaller players. Innovation within the sector is primarily driven by efficiency improvements in mining and transportation, alongside efforts to mitigate environmental impact. Stringent regulatory frameworks, including environmental regulations and mining licenses, heavily influence market operations. Substitute products, such as renewable energy sources (solar, wind), pose a growing competitive threat, although coal remains crucial for India's energy mix. End-user profiles consist mainly of power generation companies (thermal coal) and steel producers (coking coal), alongside smaller industrial users. M&A activity has been moderate, with total deal values averaging xx Million annually during the historical period, reflecting consolidation trends within the sector.

- Market Share Distribution (2024): Coal India Ltd (xx%), SCCL (xx%), NLC India Ltd (xx%), Adani Power Ltd (xx%), Others (xx%)

- Average Annual M&A Deal Value (2019-2024): xx Million

- Key Regulatory Influences: Environmental regulations, mining lease allocation policies

India Coal Market Industry Evolution

The Indian coal market has witnessed fluctuating growth during the historical period (2019-2024), influenced by economic cycles and government policies. The average annual growth rate (AAGR) stood at approximately xx% during this period. Technological advancements have primarily focused on enhancing mining efficiency through the adoption of heavy machinery and improved logistics. However, the adoption rate of advanced technologies such as automation and data analytics remains relatively low compared to global benchmarks. Shifting consumer demands, particularly the increasing emphasis on cleaner energy sources, are putting pressure on the coal industry, forcing companies to adapt and diversify. The government's push towards renewable energy is a significant factor impacting future growth projections. However, coal continues to be a pivotal energy source, underpinning industrial development and power generation.

Leading Regions, Countries, or Segments in India Coal Market

The power generation segment (thermal coal) overwhelmingly dominates the Indian coal market, accounting for approximately xx% of total consumption in 2024. This dominance is driven by India's substantial reliance on coal-fired power plants for electricity generation. The demand for coking coal, used in steel production, constitutes a smaller yet significant portion (xx%), influenced by the nation's robust steel industry. Other applications, such as industrial heating and cement manufacturing, represent the remaining market share.

- Power Generation (Thermal Coal):

- Key Drivers: High electricity demand, existing infrastructure of coal-fired power plants, relatively low cost compared to other energy sources.

- Coking Coal:

- Key Drivers: Growth of the Indian steel sector, relatively high steel production targets.

The dominant region for coal consumption and production remains concentrated in eastern and central India, where most of the coal reserves and power plants are located.

India Coal Market Product Innovations

Recent innovations in the Indian coal market have primarily focused on enhancing mining efficiency and reducing environmental impacts. These include the introduction of advanced mining equipment, improved transportation methods, and research into cleaner coal technologies like carbon capture and storage, albeit with limited large-scale deployment. The focus is predominantly on optimizing existing technologies rather than revolutionary breakthroughs. Unique selling propositions for coal companies often center on efficient supply chains, competitive pricing, and adherence to environmental regulations.

Propelling Factors for India Coal Market Growth

The primary growth drivers for the Indian coal market include the country's sustained economic growth, increasing energy demands fueled by industrialization, and the relatively low cost of coal compared to other energy sources. Government support for infrastructure development, including power plants and transportation networks, further bolsters market growth. However, environmental concerns and the government's commitment to transitioning to renewable energy sources pose a countervailing force.

Obstacles in the India Coal Market

Significant obstacles in the Indian coal market include environmental regulations that impose constraints on mining operations, potential supply chain disruptions due to infrastructure limitations and transportation challenges, and the increasing competitive pressure from renewable energy sources. Furthermore, fluctuating global coal prices and geopolitical factors can significantly impact market stability. These constraints affect profitability and investment decisions within the sector.

Future Opportunities in India Coal Market

Future opportunities lie in optimizing existing coal mining operations through technological advancements, exploring coal-bed methane extraction, and focusing on enhancing the efficiency of coal-fired power plants. Growth in downstream applications, such as coal gasification and coal-to-chemicals, also holds significant potential. Furthermore, exploring sustainable coal mining practices and minimizing environmental impact can unlock new avenues for growth.

Major Players in the India Coal Market Ecosystem

- Coal India Limited

- NLC India Ltd

- Adani Power Ltd

- Singareni Collieries Company Limited (SCCL)

- JSW Energy Limited

- Jindal Steel & Power Ltd

- NTPC Ltd

Key Developments in India Coal Market Industry

- November 2022: NTPC Ltd secured contracts for four additional coal-fired power projects, adding 4.8 GW of capacity.

- February 2023: Inauguration of the 2600 MW Singareni Thermal Power Plant (STPP), marking a significant milestone in South India's power generation capacity.

Strategic India Coal Market Forecast

The Indian coal market is projected to experience moderate growth during the forecast period (2025-2033), driven by persistent energy demands and ongoing industrial expansion. However, the growth trajectory will likely be moderated by the increasing adoption of renewable energy sources and stringent environmental regulations. The market will witness increased focus on efficiency improvements, technological advancements, and sustainability initiatives to ensure long-term viability and competitiveness.

India Coal Market Segmentation

-

1. Application

- 1.1. Power Generation (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Others

India Coal Market Segmentation By Geography

- 1. India

India Coal Market Regional Market Share

Geographic Coverage of India Coal Market

India Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Increasing Thermal Power Generation is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NLC India Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Power Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Singareni Collieries Company Limited (SCCL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JSW Energy Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coal India Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jindal Steel & Power Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NTPC Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NLC India Ltd

List of Figures

- Figure 1: India Coal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Coal Market Share (%) by Company 2025

List of Tables

- Table 1: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: India Coal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Coal Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: India Coal Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Coal Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Coal Market?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the India Coal Market?

Key companies in the market include NLC India Ltd, Adani Power Ltd, Singareni Collieries Company Limited (SCCL), JSW Energy Limited, Coal India Limited, Jindal Steel & Power Ltd, NTPC Ltd.

3. What are the main segments of the India Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Increasing Thermal Power Generation is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

February 2023, the 2600 megawatt Singareni Thermal Power Plant (STPP) at Pegadapalli in Mancherial district is all set to become South India's first public sector coal-based power generating station and the country's first among State Public Sector Undertakings (PSU).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Coal Market?

To stay informed about further developments, trends, and reports in the India Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence