Key Insights

The India Battery Energy Storage Systems (BESS) market is projected to reach $385 million by 2033, driven by a Compound Annual Growth Rate (CAGR) of 14% from the 2025 base year. This significant expansion is primarily attributed to the escalating integration of renewable energy sources like solar and wind, which necessitates efficient energy storage. Government policies supporting clean energy and infrastructure development further accelerate demand. Growing concerns over grid stability and the need for reliable backup power, especially in remote regions, are also key growth drivers. Lithium-ion batteries lead the market due to their superior energy density and lifespan, though lead-acid batteries remain relevant for cost-sensitive applications. The market is segmented by battery type (Lithium-ion, Lead-acid, Flow, Other) and connection type (On-grid, Off-grid). The on-grid segment is anticipated to grow faster, driven by its integration with large-scale renewable projects. Southern and Western India exhibit stronger market penetration due to higher renewable energy adoption and developed infrastructure. Leading players such as Delta Electronics, Toshiba, Panasonic, Exide Industries, and AES Corporation are actively innovating and forming strategic alliances. Continuous technological advancements, decreasing battery costs, and favorable government policies are expected to sustain this positive market trajectory.

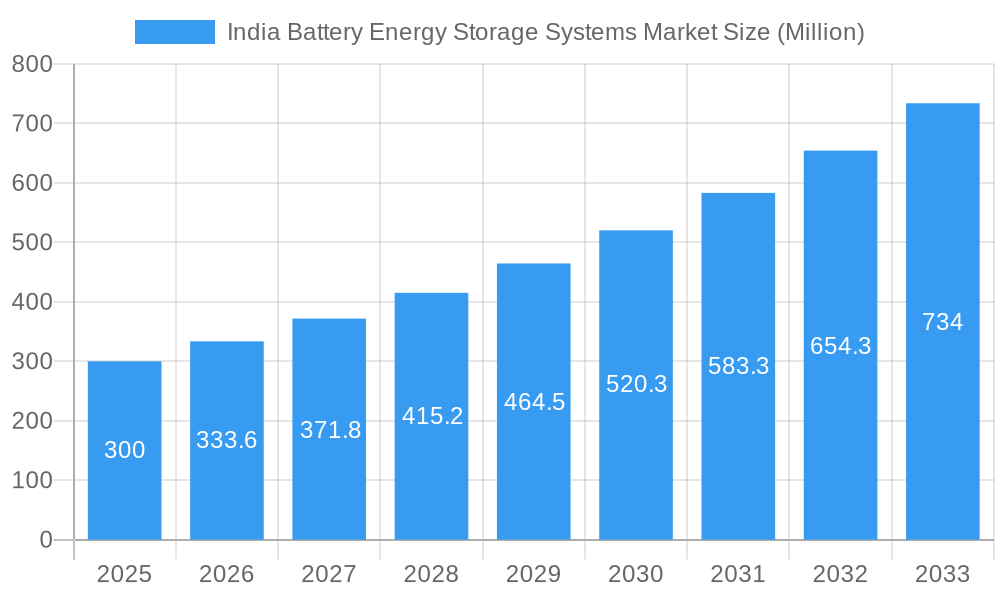

India Battery Energy Storage Systems Market Market Size (In Million)

India Battery Energy Storage Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning India Battery Energy Storage Systems (BESS) market, encompassing market size, growth drivers, challenges, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for stakeholders across the energy sector. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

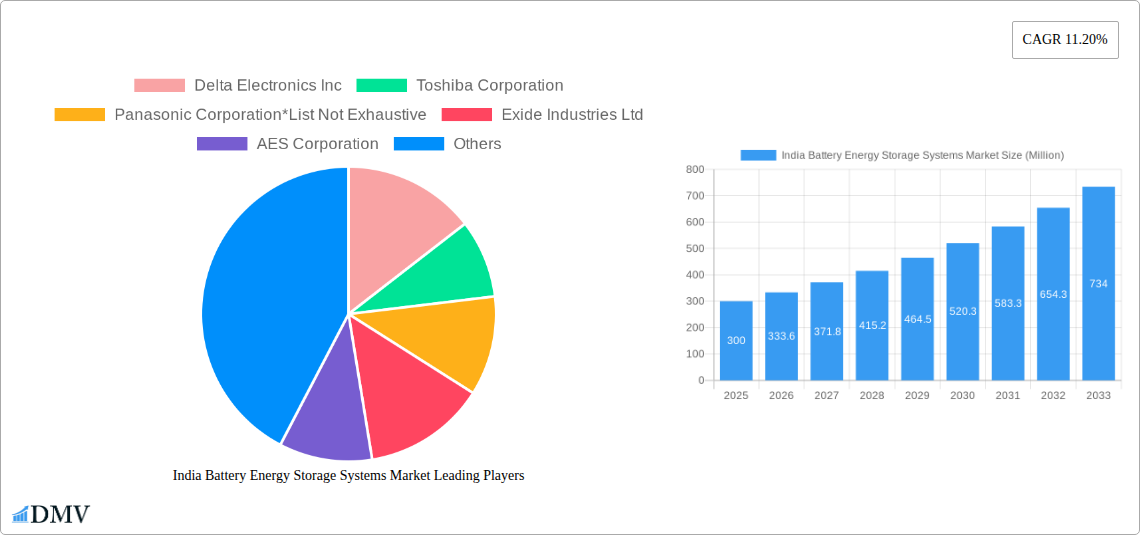

India Battery Energy Storage Systems Market Company Market Share

India Battery Energy Storage Systems Market Composition & Trends

The Indian BESS market is experiencing dynamic growth fueled by the increasing adoption of renewable energy sources and government initiatives. Market concentration is currently moderate, with a few major players and several emerging companies competing. Innovation is primarily driven by advancements in battery technologies (Lithium-ion, Lead-acid, Flow, and others) and improved energy management systems. The regulatory landscape, while evolving, is generally supportive, with incentives driving deployment. Substitute products, such as pumped hydro storage, are also present but face limitations in terms of geography and scalability. End-users predominantly include utilities, industrial facilities, and commercial establishments. M&A activities are increasing, with deal values expected to rise significantly in the coming years.

- Market Share Distribution (2025): Lithium-ion: 45%; Lead-acid: 30%; Flow: 15%; Other: 10% (These are estimated values).

- M&A Deal Value (2019-2024): Approximately xx Million USD. A significant increase is anticipated in the forecast period.

India Battery Energy Storage Systems Market Industry Evolution

The Indian BESS market has witnessed remarkable growth in recent years, driven by factors such as increasing electricity demand, the growing penetration of renewable energy sources (solar and wind), and government support for energy storage. Technological advancements, particularly in Lithium-ion battery technology, have significantly reduced costs and improved performance, making BESS solutions more commercially viable. Consumer demand is shifting towards more reliable and efficient energy solutions, which is fueling the adoption of BESS systems. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to be xx% during the forecast period (2025-2033). Adoption of BESS is particularly strong in regions with high solar and wind energy penetration, further boosted by government incentives and supportive policies to enhance grid stability and reliability. The rising concerns around climate change and the need for sustainable energy solutions further propel this growth.

Leading Regions, Countries, or Segments in India Battery Energy Storage Systems Market

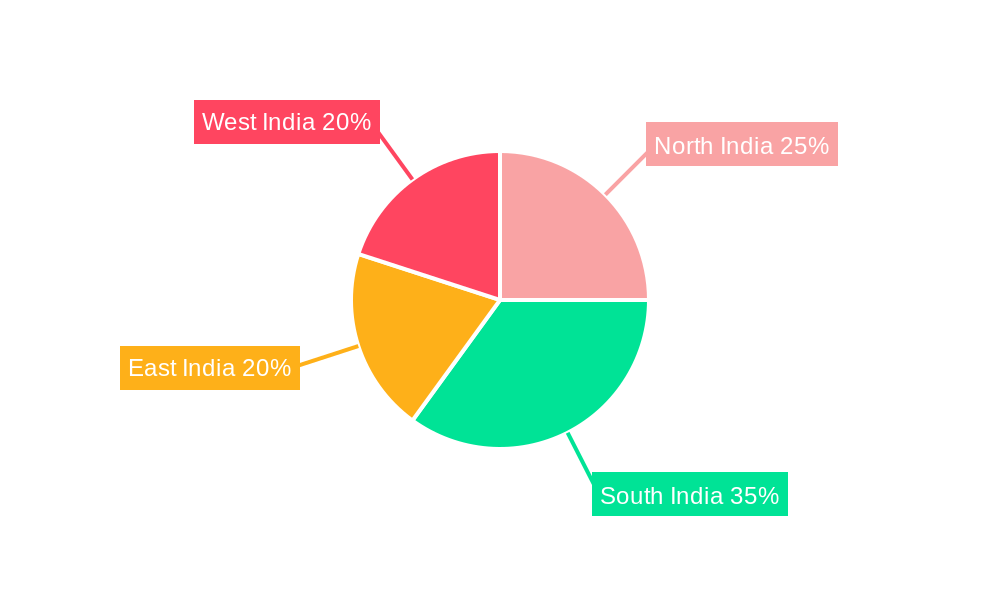

While the market is expanding across India, certain regions and segments show stronger growth.

Dominant Battery Type: Lithium-ion batteries are leading due to their high energy density and longer lifespan, despite higher initial costs. Lead-acid batteries maintain a significant share due to their lower cost and established infrastructure.

Dominant Connection Type: On-grid systems are currently more prevalent due to better integration with existing grid infrastructure and regulatory support, although off-grid applications are showing rapid growth in remote areas.

Key Drivers:

- Government Incentives: The recent USD 455.2 Million incentive scheme exemplifies the government’s commitment to BESS deployment.

- Renewable Energy Integration: The need to manage intermittent renewable energy sources like solar and wind is a major driver for BESS adoption.

- Grid Stability: BESS improves grid stability and reliability, reducing the frequency and impact of power outages.

The states of Maharashtra, Gujarat, Tamil Nadu, and Karnataka are currently leading in BESS adoption due to higher renewable energy penetration and supportive government policies.

India Battery Energy Storage Systems Market Product Innovations

Recent innovations focus on improving battery lifespan, energy density, and safety. Advancements in battery chemistry, thermal management systems, and sophisticated power electronics are enhancing the performance and reliability of BESS. The integration of AI and machine learning for predictive maintenance and optimized energy management is also gaining traction. Unique selling propositions include improved cycle life, reduced degradation rates, and enhanced safety features. These improvements translate to lower lifecycle costs and increased customer satisfaction.

Propelling Factors for India Battery Energy Storage Systems Market Growth

The Indian BESS market is propelled by several factors:

- Government Policies: Significant financial incentives and supportive regulations are accelerating adoption.

- Technological Advancements: Improved battery technologies, reduced costs, and higher efficiency are making BESS more attractive.

- Renewable Energy Expansion: The rapid growth of solar and wind power necessitates efficient energy storage solutions.

- Grid Modernization: BESS plays a critical role in modernizing the electricity grid and improving its resilience.

Obstacles in the India Battery Energy Storage Systems Market

Challenges hindering market growth include:

- High Initial Investment Costs: The upfront cost of BESS remains a significant barrier for many potential adopters.

- Supply Chain Bottlenecks: The reliance on imported components creates vulnerabilities in the supply chain.

- Lack of Skilled Workforce: A shortage of skilled professionals for installation and maintenance hinders widespread adoption.

Future Opportunities in India Battery Energy Storage Systems Market

Significant opportunities exist in:

- Microgrid Applications: BESS solutions are ideal for powering remote areas and improving energy access.

- Electric Vehicle (EV) Charging Infrastructure: BESS can support the rapid expansion of EV charging stations.

- Grid-Scale Energy Storage: Large-scale BESS projects are essential for integrating renewable energy sources into the national grid.

Major Players in the India Battery Energy Storage Systems Market Ecosystem

- Delta Electronics Inc

- Toshiba Corporation

- Panasonic Corporation

- Exide Industries Ltd

- AES Corporation

- Amara Raja Group

Key Developments in India Battery Energy Storage Systems Market Industry

- June 2023: The Indian government announced USD 455.2 Million in incentives for 400 MWh of battery energy storage projects, aiming for 500 MW of renewable capacity by 2030. This significantly boosts market growth.

- April 2023: India Grid Trust completed its first BESS project at the Dhule substation in Maharashtra, demonstrating the growing interest in BESS integration with renewable energy sources.

Strategic India Battery Energy Storage Systems Market Forecast

The Indian BESS market is poised for exponential growth, driven by strong government support, technological advancements, and the increasing demand for reliable and sustainable energy solutions. The forecast period anticipates a significant increase in market size, with a robust CAGR driven by large-scale projects, the expanding renewable energy sector, and the growing adoption of BESS across various applications. The market's potential is vast, and proactive participation from both public and private sectors is expected to accelerate growth further.

India Battery Energy Storage Systems Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion

- 1.2. Lead-acid

- 1.3. Flow

- 1.4. Other Battery Types

-

2. Connection Type

- 2.1. On-grid

- 2.2. Off-grid

India Battery Energy Storage Systems Market Segmentation By Geography

- 1. India

India Battery Energy Storage Systems Market Regional Market Share

Geographic Coverage of India Battery Energy Storage Systems Market

India Battery Energy Storage Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Energy Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion

- 5.1.2. Lead-acid

- 5.1.3. Flow

- 5.1.4. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Connection Type

- 5.2.1. On-grid

- 5.2.2. Off-grid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exide Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AES Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amara Raja Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Delta Electronics Inc

List of Figures

- Figure 1: India Battery Energy Storage Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Battery Energy Storage Systems Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 3: India Battery Energy Storage Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 5: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 6: India Battery Energy Storage Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Energy Storage Systems Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the India Battery Energy Storage Systems Market?

Key companies in the market include Delta Electronics Inc, Toshiba Corporation, Panasonic Corporation*List Not Exhaustive, Exide Industries Ltd, AES Corporation, Amara Raja Group.

3. What are the main segments of the India Battery Energy Storage Systems Market?

The market segments include Battery Type, Connection Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 385 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

June 2023: The Indian government shall offer USD 455.2 million as incentives to the companies for installing battery energy storage projects of 400 MWh. The government intends to reach its 2030 goal of 500 MW of renewable capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Energy Storage Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Energy Storage Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Energy Storage Systems Market?

To stay informed about further developments, trends, and reports in the India Battery Energy Storage Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence