Key Insights

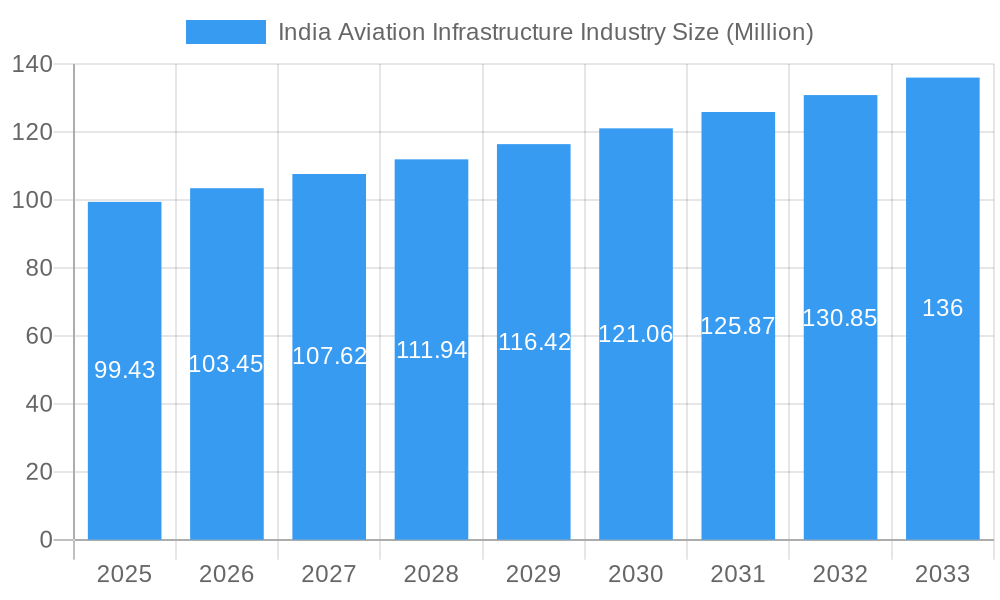

The India aviation infrastructure market, valued at $99.43 million in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 4% from 2025 to 2033. This expansion is driven by several key factors. Firstly, India's burgeoning air passenger traffic, fueled by a growing middle class and increasing affordability of air travel, necessitates significant capacity additions across airports. Secondly, the government's proactive infrastructure development initiatives, including airport modernization and expansion programs, are creating a favorable investment climate. The strategic focus on regional connectivity, aiming to enhance accessibility to remote areas, further contributes to market growth. Finally, the increasing adoption of advanced technologies like AI-powered air traffic management systems and sustainable infrastructure solutions is shaping the sector's future. The market segmentation reveals strong demand across various airport types (commercial, military, general aviation) and infrastructure components (terminals, runways, hangars). While Greenfield airport construction presents significant opportunities, brownfield expansions also contribute substantially to the overall market value. Leading players like Adani Group, L&T Construction, and GMR Infrastructure are actively involved in shaping this growth trajectory.

India Aviation Infrastructure Industry Market Size (In Million)

However, challenges remain. Land acquisition complexities and regulatory hurdles can potentially impede project timelines and increase costs. The impact of fluctuating fuel prices and global economic uncertainties could influence investment decisions. Furthermore, ensuring environmental sustainability and mitigating noise pollution around airports are crucial considerations for long-term market success. Regional variations in market growth are anticipated, with high-growth potential concentrated in regions witnessing rapid economic development and population growth. Competition is expected to intensify as both domestic and international players vie for market share within this dynamic sector. The market's future hinges on effective policy implementation, efficient project management, and a sustained focus on enhancing operational efficiency and passenger experience.

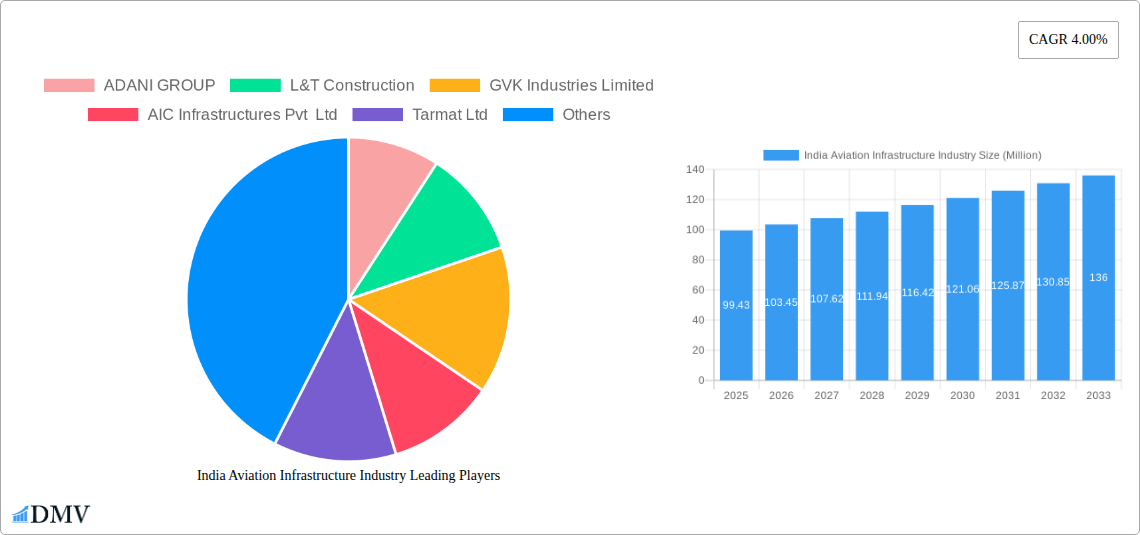

India Aviation Infrastructure Industry Company Market Share

India Aviation Infrastructure Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India aviation infrastructure industry, projecting robust growth from 2025 to 2033. It examines market dynamics, key players, technological advancements, and future opportunities, offering invaluable insights for stakeholders across the aviation ecosystem. The report covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, detailing market size in Millions (INR).

India Aviation Infrastructure Industry Market Composition & Trends

This section delves into the competitive landscape of the Indian aviation infrastructure market, analyzing market concentration, innovation, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We examine market share distribution amongst key players like Adani Group, L&T Construction, and GMR Infrastructure Limited, revealing the degree of market concentration. The report quantifies M&A deal values over the study period (2019-2024) and assesses their impact on market structure. Analysis includes:

- Market Share Distribution: Adani Group holds an estimated xx% market share in 2025, followed by L&T Construction at xx% and GMR Infrastructure Limited at xx%. Smaller players like GVK Industries Limited and AIC Infrastructures Pvt Ltd collectively contribute xx%.

- M&A Activity: Total M&A deal value in the aviation infrastructure sector from 2019-2024 is estimated at INR xx Million, with the largest deal valued at INR xx Million.

- Regulatory Landscape: A detailed analysis of regulatory policies influencing investment, project approvals, and operational efficiency.

- Innovation Catalysts: Exploration of technological advancements driving innovation in airport design, construction, and operations.

- Substitute Products & Services: Examination of potential substitutes and their impact on market growth.

- End-User Profiles: Segmentation of end-users based on airport type (commercial, military, general aviation) and infrastructure type (terminals, runways, etc.).

India Aviation Infrastructure Industry Evolution

This section charts the evolution of India's aviation infrastructure market from 2019 to 2033, analyzing growth trajectories, technological advancements, and shifts in consumer demands. We present detailed data on the growth rate of various segments, highlighting factors driving expansion. The analysis considers factors like rising passenger traffic, government initiatives (e.g., Bharatmala Pariyojana), and the increasing adoption of advanced technologies in airport operations and management. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by significant investments in Greenfield and Brownfield airport projects.

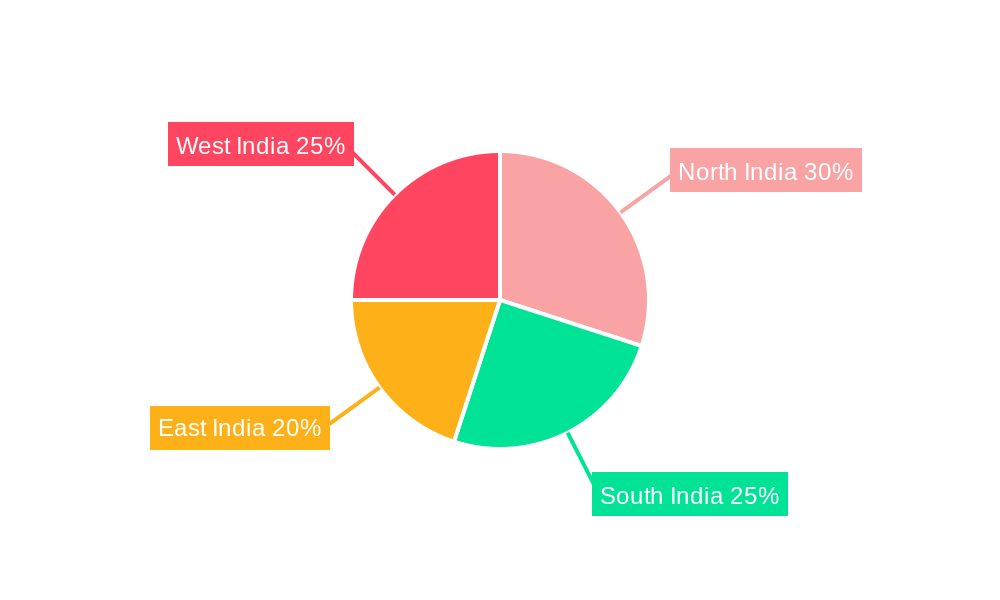

Leading Regions, Countries, or Segments in India Aviation Infrastructure Industry

This section pinpoints the leading segments within the Indian aviation infrastructure market. The analysis identifies the dominant regions based on airport type, infrastructure type, and construction type. Key drivers such as investment trends, government support, and regional economic growth are explored.

Dominant Segment: Commercial airports currently dominate, contributing xx% to the total market value in 2025. This is expected to remain the largest segment throughout the forecast period.

Key Drivers:

- Increased passenger traffic: Driving demand for capacity expansion in existing airports (Brownfield) and the development of new airports (Greenfield).

- Government initiatives: Significant investments under the National Civil Aviation Policy and other government programs stimulate market growth.

- Private sector participation: Increased involvement of private players like Adani Group and GMR Infrastructure Limited accelerates project execution.

Infrastructure Type: Terminal construction accounts for the largest share of infrastructure spending, followed by runway and taxiway upgrades. Hangars and other support infrastructure are also showing significant growth.

Regional Dominance: Major metropolitan areas and key economic hubs like Mumbai, Delhi, Bengaluru, and Hyderabad are expected to maintain their leading positions, due to high passenger volume and economic activity.

India Aviation Infrastructure Industry Product Innovations

This section highlights recent product innovations and technological advancements in airport infrastructure, emphasizing their unique selling propositions (USPs) and performance metrics. This includes innovations in baggage handling systems, passenger processing technologies, security systems, and sustainable infrastructure solutions. The adoption of AI and machine learning for predictive maintenance and improved operational efficiency are key areas of focus.

Propelling Factors for India Aviation Infrastructure Industry Growth

Several key factors are driving the growth of India's aviation infrastructure industry. These include:

- Government Initiatives: The significant investments made by the government under various programs, including the National Civil Aviation Policy, provide substantial impetus to industry growth.

- Economic Growth: India’s strong economic growth fuels demand for air travel, increasing the need for modernized and expanded airport infrastructure.

- Technological Advancements: Adoption of cutting-edge technologies improves efficiency and reduces operational costs.

Obstacles in the India Aviation Infrastructure Industry Market

Despite the significant growth potential, the Indian aviation infrastructure sector faces several challenges:

- Land Acquisition: Delays and complexities in land acquisition for new airport projects create significant hurdles.

- Regulatory Hurdles: Obtaining necessary approvals and permits can often be a lengthy and complex process.

- Funding Constraints: Securing funding for large-scale infrastructure projects can be challenging, especially for smaller developers.

Future Opportunities in India Aviation Infrastructure Industry

The Indian aviation infrastructure sector presents several lucrative opportunities:

- Regional Connectivity: Expanding air connectivity to underserved regions through regional airports and improved infrastructure.

- Cargo Infrastructure: Development of specialized cargo handling facilities to meet the growing demand for air freight.

- Sustainable Infrastructure: Investing in environmentally friendly technologies and sustainable practices to reduce the sector's carbon footprint.

Major Players in the India Aviation Infrastructure Industry Ecosystem

- ADANI GROUP

- L&T Construction

- GVK Industries Limited

- AIC Infrastructures Pvt Ltd

- Tarmat Ltd

- GMR Infrastructure Limited

- Taneja Aerospace & Aviation Ltd

- AIRPORTS AUTHORITY OF INDIA

- Gujarat State Aviation Infrastructure Company Limited

- Tata Sons Private Limited

Key Developments in India Aviation Infrastructure Industry Industry

- 2022-Q4: Adani Group secures the management rights for six major airports.

- 2023-Q1: Government announces a new round of investments in regional airport development.

- 2023-Q2: L&T Construction wins a major contract for the expansion of a key airport terminal. (Further developments will be added based on the study period)

Strategic India Aviation Infrastructure Industry Market Forecast

The Indian aviation infrastructure market is poised for substantial growth, driven by sustained economic expansion, rising passenger traffic, and supportive government policies. Future opportunities exist in regional connectivity, cargo infrastructure, and the adoption of sustainable technologies. The market is expected to witness significant investment in both Greenfield and Brownfield projects, leading to the modernization and expansion of existing infrastructure and the creation of new airports across the country. The projected CAGR offers significant potential for both domestic and international investors.

India Aviation Infrastructure Industry Segmentation

-

1. Airport Construction Type

- 1.1. Greenfield Airport

- 1.2. Brownfield Airport

-

2. Airport Type

- 2.1. Commercial Airport

- 2.2. Military Airport

- 2.3. General Aviation Airport

-

3. Infrastructure Type

- 3.1. Terminal

- 3.2. Control Tower

- 3.3. Taxiway and Runway

- 3.4. Apron

- 3.5. Hangar

- 3.6. Other Infrastructure Type

India Aviation Infrastructure Industry Segmentation By Geography

- 1. India

India Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of India Aviation Infrastructure Industry

India Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Construction Type

- 5.1.1. Greenfield Airport

- 5.1.2. Brownfield Airport

- 5.2. Market Analysis, Insights and Forecast - by Airport Type

- 5.2.1. Commercial Airport

- 5.2.2. Military Airport

- 5.2.3. General Aviation Airport

- 5.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.3.1. Terminal

- 5.3.2. Control Tower

- 5.3.3. Taxiway and Runway

- 5.3.4. Apron

- 5.3.5. Hangar

- 5.3.6. Other Infrastructure Type

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Airport Construction Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADANI GROUP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 L&T Construction

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GVK Industries Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AIC Infrastructures Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tarmat Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GMR Infrastructure Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taneja Aerospace & Aviation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIRPORTS AUTHORITY OF INDIA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gujarat State Aviation Infrastructure Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tata Sons Private Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADANI GROUP

List of Figures

- Figure 1: India Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Aviation Infrastructure Industry Share (%) by Company 2025

List of Tables

- Table 1: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Construction Type 2020 & 2033

- Table 2: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 3: India Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 4: India Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Construction Type 2020 & 2033

- Table 6: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 7: India Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 8: India Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Aviation Infrastructure Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the India Aviation Infrastructure Industry?

Key companies in the market include ADANI GROUP, L&T Construction, GVK Industries Limited, AIC Infrastructures Pvt Ltd, Tarmat Ltd, GMR Infrastructure Limited, Taneja Aerospace & Aviation Ltd, AIRPORTS AUTHORITY OF INDIA, Gujarat State Aviation Infrastructure Company Limited, Tata Sons Private Limite.

3. What are the main segments of the India Aviation Infrastructure Industry?

The market segments include Airport Construction Type, Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.43 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the India Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence