Key Insights

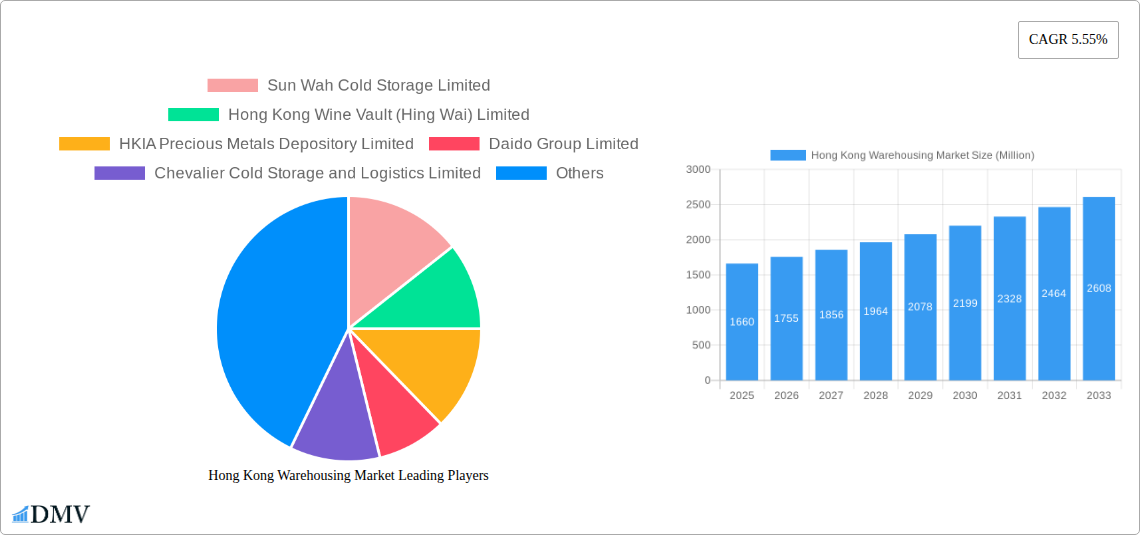

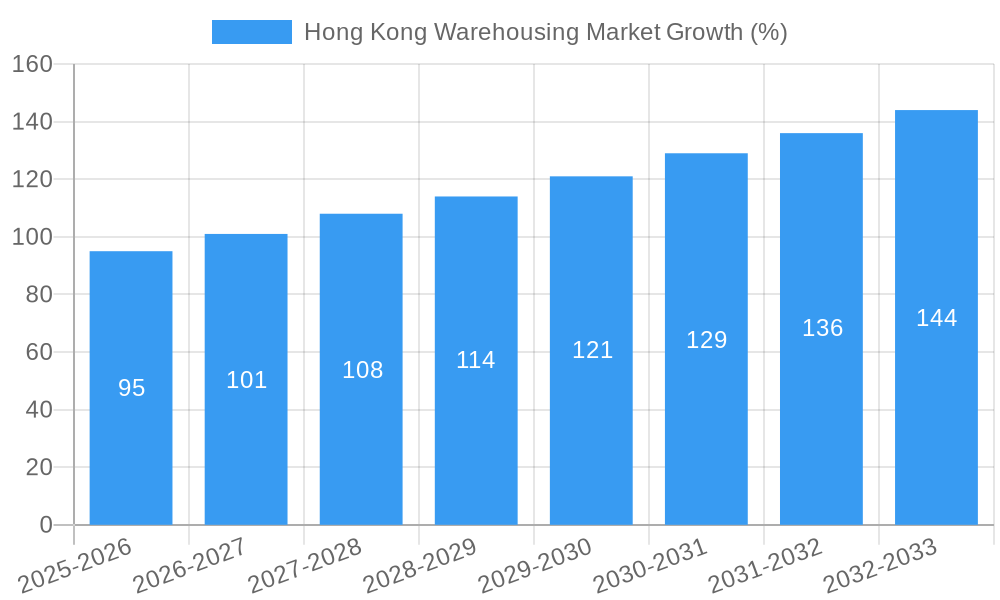

The Hong Kong warehousing market, valued at $1.66 billion in 2025, is projected to experience robust growth, driven by a burgeoning e-commerce sector, increasing logistics activity, and the city's strategic position as a regional trade hub. The market's Compound Annual Growth Rate (CAGR) of 5.55% from 2025 to 2033 indicates a steady expansion, fueled by demand from diverse end-user industries including manufacturing, consumer goods, food and beverage, retail, and healthcare. Growth will be particularly strong in refrigerated warehousing, catering to the increasing demand for temperature-sensitive goods. The market segmentation reveals a mix of private and public warehousing options, with bonded warehouses playing a crucial role in facilitating international trade. While land scarcity and high operational costs in Hong Kong pose challenges, the ongoing infrastructure development and government initiatives aimed at improving logistics efficiency are expected to mitigate these restraints. Competition among established players like Sun Wah Cold Storage Limited and Kerry Logistics, alongside emerging players, will further shape market dynamics.

The forecast period of 2025-2033 shows significant potential for expansion, particularly within the specialized warehousing segments. The rising adoption of advanced technologies, including automation and warehouse management systems (WMS), will enhance efficiency and optimize operations. Furthermore, the increasing focus on sustainable practices within the logistics sector presents opportunities for warehousing providers to adopt eco-friendly solutions and attract environmentally conscious clients. Analyzing the market segments reveals that general warehousing will maintain a significant share, but refrigerated and farm product warehousing are poised for accelerated growth due to changing consumption patterns and supply chain requirements. Overall, the Hong Kong warehousing market presents attractive investment opportunities for businesses seeking to capitalize on the region's thriving economy and strategic trade connections.

Hong Kong Warehousing Market Market Composition & Trends

This comprehensive report provides an in-depth analysis of the Hong Kong warehousing market, covering the period 2019-2033. The study meticulously examines market concentration, revealing a moderately consolidated landscape with key players like Sun Wah Cold Storage Limited and China Resources Logistics holding significant market share. Innovation within the sector is driven by the increasing adoption of automation technologies, like AMRs (Autonomous Mobile Robots), as seen in Rhenus Warehousing Solutions' recent implementation of Geek+ solutions. The regulatory environment, while generally supportive of logistics growth, presents challenges related to land scarcity and operational permits. Substitute products, such as cloud-based inventory management systems, are impacting traditional warehousing, while the significant M&A activity, highlighted by the USD 667 Million acquisition of Kerry Warehouses by China Resources Logistics in May 2023, indicates industry consolidation and expansion.

- Market Concentration: Moderately consolidated, with top players controlling approximately xx% of the market.

- Innovation Catalysts: Automation (AMRs), IoT, data analytics, and cloud-based inventory management systems.

- Regulatory Landscape: Supportive but challenging due to land scarcity and permit processes.

- M&A Activity: Significant consolidation, with notable deals totaling approximately USD xx Million in the last five years.

- End-User Profiles: Dominated by Manufacturing, Consumer Goods, Food & Beverage, and Retail sectors.

Hong Kong Warehousing Market Industry Evolution

The Hong Kong warehousing market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is primarily fueled by Hong Kong's strategic location as a global trade hub, burgeoning e-commerce, and increasing demand for efficient supply chain solutions. Technological advancements, including the integration of automation technologies and sophisticated warehouse management systems (WMS), have significantly enhanced operational efficiency and reduced costs. The growing emphasis on cold chain logistics for temperature-sensitive products such as pharmaceuticals and food, coupled with stringent quality and safety regulations, has further accelerated market growth. The predicted CAGR for the forecast period (2025-2033) is xx%, driven by continued e-commerce expansion and increasing demand for specialized warehousing solutions like refrigerated storage. Consumer demands for faster delivery and greater transparency in the supply chain continue to drive innovation and investment in the sector. The shift towards sustainable warehousing practices, including energy-efficient facilities and eco-friendly transportation methods, is also gaining traction.

Leading Regions, Countries, or Segments in Hong Kong Warehousing Market

The Hong Kong warehousing market is geographically concentrated within major urban and industrial areas with strong transportation links. Specific segments exhibit pronounced leadership:

- By Type: General warehousing remains the largest segment, driven by diverse industry needs. Refrigerated warehousing and storage shows strong growth, mirroring the increasing demand for temperature-sensitive goods.

- By Ownership: Public warehouses dominate the market, offering scalable solutions to a broad range of clients. Private warehouses cater to larger corporations with specific logistics needs. Bonded warehouses play a crucial role in international trade.

- By End-User Industry: The Food & Beverage and Consumer Goods sectors are the largest consumers of warehousing services, driven by high import and export volumes. Manufacturing and Retail sectors also contribute substantially.

Key Drivers:

- Investment Trends: Significant investments in modernizing facilities and implementing advanced technologies.

- Regulatory Support: Government initiatives promoting efficient logistics and supply chain management.

- Geographical Advantages: Hong Kong's strategic location and well-developed infrastructure.

The dominance of these segments stems from a combination of factors, including established infrastructure, access to key transportation routes, and strong regulatory support.

Hong Kong Warehousing Market Product Innovations

Recent innovations focus on enhancing efficiency and optimizing space utilization. Autonomous mobile robots (AMRs), like those implemented by Rhenus, are transforming warehouse operations, enabling faster order fulfillment and improved accuracy. The integration of cloud-based Warehouse Management Systems (WMS) allows for real-time inventory tracking and optimized space management. These innovations improve efficiency, reduce labor costs, and provide greater transparency in the supply chain. Furthermore, the development of specialized warehousing solutions tailored to specific industry needs, such as climate-controlled facilities for pharmaceuticals and food products, is driving market growth.

Propelling Factors for Hong Kong Warehousing Market Growth

The Hong Kong warehousing market's growth is propelled by several factors: The burgeoning e-commerce sector fuels demand for efficient last-mile delivery solutions and increased storage capacity. Government initiatives promoting logistics infrastructure development create a favorable environment for investment. Technological advancements, such as automation and IoT integration, enhance efficiency and reduce operational costs. Moreover, Hong Kong's strategic geographical location and well-established transportation network continue to attract businesses, further driving demand for warehousing services. The growth of specialized warehousing, especially refrigerated and climate-controlled facilities, caters to the increasing demand for temperature-sensitive products.

Obstacles in the Hong Kong Warehousing Market Market

The Hong Kong warehousing market faces challenges, including high land costs leading to limited expansion opportunities and increasing operational expenses. Supply chain disruptions, stemming from global events and geopolitical factors, can impact warehouse operations and lead to inefficiencies. Intense competition among warehousing providers necessitates continuous innovation and cost optimization to maintain market share. Regulatory compliance and obtaining necessary permits can also be time-consuming and costly, posing a barrier to new entrants.

Future Opportunities in Hong Kong Warehousing Market

Significant opportunities exist in specialized warehousing, particularly for temperature-sensitive goods and high-value products. The integration of advanced technologies such as AI, big data analytics, and blockchain can further enhance efficiency and transparency. Expansion into niche markets, such as the growing demand for cold chain logistics for pharmaceutical products and e-commerce fulfillment services, presents further potential. Sustainable and environmentally friendly warehousing practices will become increasingly important in attracting clients and meeting regulatory standards.

Major Players in the Hong Kong Warehousing Market Ecosystem

- Sun Wah Cold Storage Limited

- Hong Kong Wine Vault (Hing Wai) Limited

- HKIA Precious Metals Depository Limited

- Daido Group Limited

- Chevalier Cold Storage and Logistics Limited

- Kerry Warehouse (Chai Wan) Limited

- China Resources Logistics (Shatin Cold Storage) Limited

- Dragon Crown Group Holdings Limited

- Kerry D G Warehouse (Kowloon Bay) Limited

- Pinjun Express Co Limited

Key Developments in Hong Kong Warehousing Market Industry

- July 2023: Rhenus Warehousing Solutions implements Geek+ AMR technology, becoming the first in Hong Kong to use both TTP & GTP solutions. This signifies a significant leap in automation adoption, enhancing efficiency and potentially disrupting the market.

- May 2023: China Resources Logistics acquires Kerry Warehouse (Chai Wan) and Kerry Warehouse (Shatin) for a combined USD 667 Million, demonstrating significant consolidation within the market and potential for increased pricing power.

Strategic Hong Kong Warehousing Market Market Forecast

The Hong Kong warehousing market is poised for continued growth, driven by e-commerce expansion, technological advancements, and favorable government policies. The increasing adoption of automation and specialized warehousing solutions will shape the market landscape. The focus on sustainability and efficient supply chain management will create new opportunities for innovative providers. The forecast period (2025-2033) promises significant expansion, with the market size expected to reach USD xx Million by 2033, driven by continued growth in e-commerce, technological advancements, and the rising demand for specialized warehousing services.

Hong Kong Warehousing Market Segmentation

-

1. Type

- 1.1. General Warehousing and Storage

- 1.2. Refrigerated Warehousing and Storage

- 1.3. Farm Product Warehousing and Storage

-

2. Ownership

- 2.1. Private Warehouses

- 2.2. Public Warehouses

- 2.3. Bonded Warehouses

-

3. End-User Industry

- 3.1. Manufacturing

- 3.2. Consumer Goods

- 3.3. Food and Beverage

- 3.4. Retail

- 3.5. Healthcare

Hong Kong Warehousing Market Segmentation By Geography

- 1. Hong Kong

Hong Kong Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E- commerce; Pharmaceutical Industry is driving the market

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor

- 3.4. Market Trends

- 3.4.1. E-Commerce driving the demand for warehousing market in Hong Kong

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hong Kong Warehousing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General Warehousing and Storage

- 5.1.2. Refrigerated Warehousing and Storage

- 5.1.3. Farm Product Warehousing and Storage

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Private Warehouses

- 5.2.2. Public Warehouses

- 5.2.3. Bonded Warehouses

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Manufacturing

- 5.3.2. Consumer Goods

- 5.3.3. Food and Beverage

- 5.3.4. Retail

- 5.3.5. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Hong Kong

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sun Wah Cold Storage Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hong Kong Wine Vault (Hing Wai) Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HKIA Precious Metals Depository Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daido Group Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevalier Cold Storage and Logistics Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Warehouse (Chai Wan) Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Resources Logistics (Shatin Cold Storage) Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dragon Crown Group Holdings Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry D G Warehouse (Kowloon Bay) Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pinjun Express Co Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sun Wah Cold Storage Limited

List of Figures

- Figure 1: Hong Kong Warehousing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Hong Kong Warehousing Market Share (%) by Company 2024

List of Tables

- Table 1: Hong Kong Warehousing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Hong Kong Warehousing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Hong Kong Warehousing Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 4: Hong Kong Warehousing Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Hong Kong Warehousing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Hong Kong Warehousing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Hong Kong Warehousing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Hong Kong Warehousing Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 9: Hong Kong Warehousing Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 10: Hong Kong Warehousing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Warehousing Market?

The projected CAGR is approximately 5.55%.

2. Which companies are prominent players in the Hong Kong Warehousing Market?

Key companies in the market include Sun Wah Cold Storage Limited, Hong Kong Wine Vault (Hing Wai) Limited, HKIA Precious Metals Depository Limited, Daido Group Limited, Chevalier Cold Storage and Logistics Limited, Kerry Warehouse (Chai Wan) Limited, China Resources Logistics (Shatin Cold Storage) Limited, Dragon Crown Group Holdings Limited, Kerry D G Warehouse (Kowloon Bay) Limited, Pinjun Express Co Limited.

3. What are the main segments of the Hong Kong Warehousing Market?

The market segments include Type, Ownership, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E- commerce; Pharmaceutical Industry is driving the market.

6. What are the notable trends driving market growth?

E-Commerce driving the demand for warehousing market in Hong Kong.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor.

8. Can you provide examples of recent developments in the market?

July 2023: Rhenus Warehousing Solutions launched a new project with global AMR manufacturer Geek+ at the Rhenus Innovation Hub. The project deploys autonomous mobile robots (AMRs) to transport small and flat packaged goods as a ‘tote-to-person’ solution (TTP). The official go-ahead for the project makes Rhenus the first company in Hong Kong to use both TTP & GTP solutions from Geek+ in its real-time operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Warehousing Market?

To stay informed about further developments, trends, and reports in the Hong Kong Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence