Key Insights

The German telecom towers market, projected for substantial growth, is poised to reach an estimated market size of €86.03 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.53% from the base year 2025. This expansion is primarily driven by escalating demand for high-speed mobile broadband, widespread 5G network deployment, and the rapid proliferation of Internet of Things (IoT) applications. Key industry leaders, including Deutsche Telekom, Vodafone Germany, and Telefónica Germany, are significantly contributing to market growth through substantial infrastructure investments.

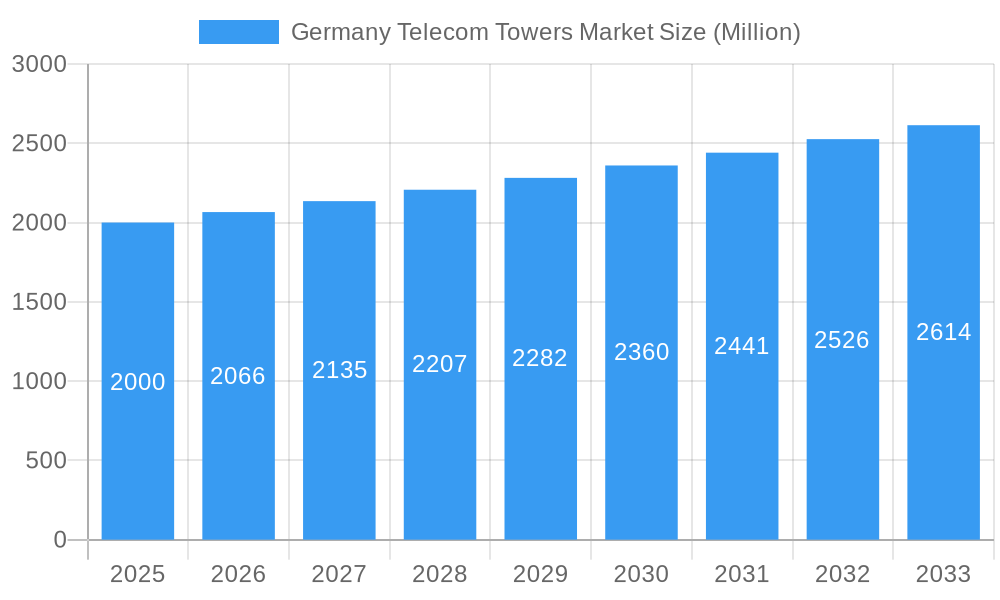

Germany Telecom Towers Market Market Size (In Billion)

The market is strategically segmented by tower type (macro, micro, small cells), ownership (private, public), and geographic region, reflecting diverse deployment strategies. While regulatory complexities and infrastructure deployment costs present challenges, the long-term outlook remains robust, supported by continuous growth in mobile data consumption and the imperative for enhanced network coverage and capacity, particularly in both urban and rural environments. The competitive arena features established giants and agile independent tower companies, fostering dynamic market conditions ripe for strategic mergers and acquisitions.

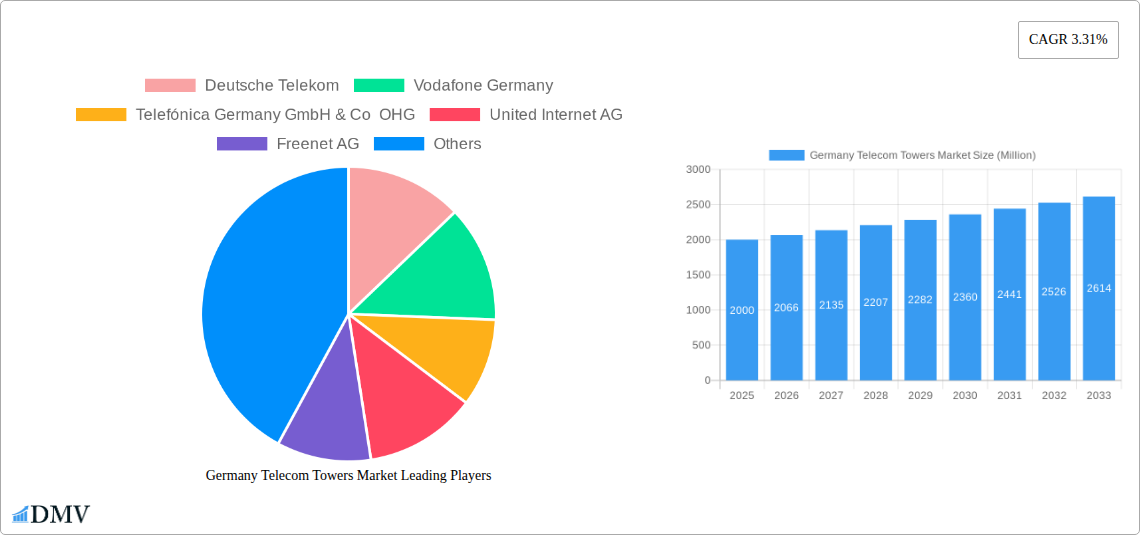

Germany Telecom Towers Market Company Market Share

The forecast period (2025-2033) indicates a significant uplift in market valuation, propelled by ongoing 5G rollouts and the increasing adoption of private 5G networks for industrial use cases. Government-led digitalization initiatives and infrastructure enhancement programs will further accelerate this trajectory. Key restraints may include site acquisition complexities and permitting delays, alongside the perpetual need for infrastructure maintenance and upgrades. This competitive landscape will likely witness persistent innovation in tower technology and operational optimization, necessitating strategic alliances and the exploration of shared infrastructure models to maximize return on investment.

Germany Telecom Towers Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic German telecom towers market, offering a comprehensive analysis of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this report is essential for stakeholders seeking to understand the market's complexities and capitalize on emerging opportunities. The report meticulously examines market size, segmentation, leading companies, technological advancements, and regulatory influences, providing actionable insights for strategic decision-making. The total market value is projected to reach xx Million by 2033.

Germany Telecom Towers Market Composition & Trends

This section offers a detailed overview of the German telecom towers market's composition, exploring market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and mergers and acquisitions (M&A) activities. The market is characterized by a relatively concentrated landscape, with key players like Deutsche Telekom, Vodafone Germany, and Telefónica Germany holding significant market share. However, the emergence of smaller, specialized players and increasing M&A activity are reshaping the competitive dynamics.

- Market Share Distribution (2024): Deutsche Telekom (35%), Vodafone Germany (28%), Telefónica Germany (15%), Others (22%). These figures are estimates based on available data and market analysis.

- M&A Activity (2019-2024): Total deal value estimated at xx Million, reflecting a growing trend of consolidation and investment in tower infrastructure. Specific details of individual deals and their financial impacts are presented within the full report.

- Innovation Catalysts: The push for 5G deployment, the increasing demand for reliable network infrastructure, and government initiatives supporting digitalization are driving innovation in tower technology.

- Regulatory Landscape: Stringent regulations concerning spectrum allocation, tower construction permits, and environmental impact assessments significantly shape market dynamics.

- Substitute Products: While traditional macro towers remain dominant, alternative solutions like small cells and distributed antenna systems (DAS) are gaining traction, particularly in dense urban areas.

- End-User Profiles: The market's primary end-users are mobile network operators (MNOs), followed by infrastructure providers and private network operators.

Germany Telecom Towers Market Industry Evolution

This in-depth analysis examines the evolution of the German telecom towers market, focusing on growth trajectories, technological advancements, and evolving consumer demands from 2019 to 2033. The market has witnessed significant growth fueled by the expanding mobile broadband user base, increasing data consumption, and the rollout of 5G networks. Technological advancements, such as the adoption of innovative antenna technologies and the integration of smart features in towers, have enhanced network efficiency and performance. Shifting consumer demands towards high-speed, reliable connectivity drive further growth.

- Compound Annual Growth Rate (CAGR) (2019-2024): xx%

- Projected CAGR (2025-2033): xx%

- 5G Adoption Rate (2024): xx% of mobile subscriptions, projected to rise significantly by 2033. These figures are estimates based on available data and market analysis. The report features a comprehensive breakdown of these trends and their implications. The continued growth is further driven by the increasing reliance on mobile devices and the rising demand for diverse connected services.

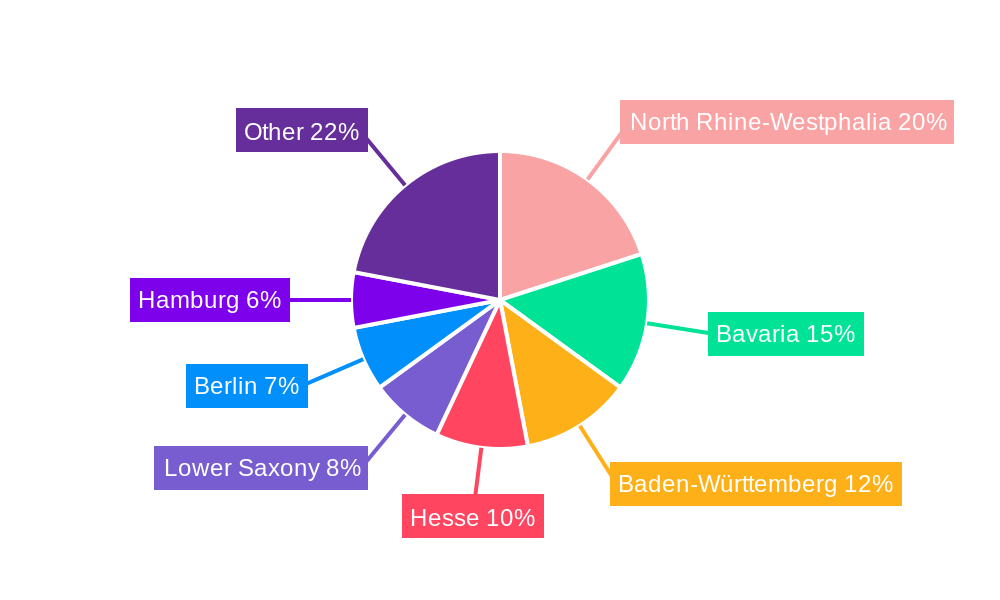

Leading Regions, Countries, or Segments in Germany Telecom Towers Market

This section identifies the dominant regions, countries, or segments within the German telecom towers market. While Germany is a unified market, regional variations in population density, infrastructure development, and regulatory environments impact tower deployment and market dynamics. Urban areas generally exhibit higher tower density and market activity compared to rural regions.

- Key Drivers for Dominant Regions:

- High Population Density: Major cities like Berlin, Munich, and Hamburg witness significant demand for reliable telecom infrastructure due to their large populations.

- Government Initiatives: Government incentives and policies supporting 5G rollout and digital infrastructure development play a substantial role in driving market growth in specific regions.

- Investment Trends: Significant private investments and partnerships are concentrated in areas with high growth potential.

The full report provides a granular analysis of regional variations and their underlying drivers.

Germany Telecom Towers Market Product Innovations

Recent innovations in the German telecom towers market include the integration of smart sensors for predictive maintenance, the adoption of energy-efficient technologies to reduce operational costs, and the deployment of advanced antenna systems to enhance network capacity and coverage. These innovations aim to improve network efficiency, lower operational expenses, and support the increasing demand for high-speed data services. The integration of AI-driven analytics enhances network optimization.

Propelling Factors for Germany Telecom Towers Market Growth

The German telecom towers market is propelled by several factors. The widespread adoption of 5G technology is a primary driver, requiring significant investment in new tower infrastructure. Furthermore, the increasing demand for high-speed mobile data, fueled by the growing number of connected devices and evolving consumer preferences, further enhances market growth. Government initiatives supporting digital infrastructure and favorable regulatory policies also contribute to market expansion.

Obstacles in the Germany Telecom Towers Market

The German telecom towers market faces certain challenges. Stringent environmental regulations and lengthy permitting processes can delay project timelines and increase costs. Competition among existing players and the entry of new entrants can lead to price pressure. Supply chain disruptions related to essential components, particularly during periods of global uncertainty, can also impact the market.

Future Opportunities in Germany Telecom Towers Market

Future opportunities in the German telecom towers market include expansion into underserved rural areas, the increasing deployment of small cells and other alternative tower technologies, and the growth of private 5G networks for industrial applications. The integration of Internet of Things (IoT) devices and smart city initiatives will drive the further demand for advanced tower infrastructure.

Major Players in the Germany Telecom Towers Market Ecosystem

- Deutsche Telekom

- Vodafone Germany

- Telefónica Germany GmbH & Co OHG

- United Internet AG

- Freenet AG

- ATC Germany GmbH

- Sky Germany

- Tele Columbus AG

- BT (Germany) GmbH & Co OHG

- M-net Telekommunikations GmbH

Key Developments in Germany Telecom Towers Market Industry

- July 2024: Vodafone divested an additional 10% stake in its tower business, Vantage Towers, for EUR 1.3 billion (USD 1.42 billion), furthering the consolidation trend in the market.

- December 2023: Nokia and Deutsche Telekom launched a multi-vendor OpenRAN network, showcasing advancements in network technology and potentially impacting future tower infrastructure requirements.

Strategic Germany Telecom Towers Market Forecast

The German telecom towers market is poised for continued growth, driven by 5G deployment, increasing data consumption, and government support for digital infrastructure. Opportunities lie in expanding network coverage, particularly in rural areas, and adopting innovative technologies to enhance network efficiency and performance. The market is expected to witness further consolidation through M&A activities, shaping the competitive landscape in the coming years.

Germany Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive Sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Germany Telecom Towers Market Segmentation By Geography

- 1. Germany

Germany Telecom Towers Market Regional Market Share

Geographic Coverage of Germany Telecom Towers Market

Germany Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 3.4. Market Trends

- 3.4.1. 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive Sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deutsche Telekom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vodafone Germany

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Telefónica Germany GmbH & Co OHG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Internet AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Freenet AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATC Germany GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sky Germany

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tele Columbus AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BT (Germany) GmbH & Co OHG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 M-net Telekommunikations Gmb

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Deutsche Telekom

List of Figures

- Figure 1: Germany Telecom Towers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 2: Germany Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 3: Germany Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: Germany Telecom Towers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 6: Germany Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 7: Germany Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Germany Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Telecom Towers Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Germany Telecom Towers Market?

Key companies in the market include Deutsche Telekom, Vodafone Germany, Telefónica Germany GmbH & Co OHG, United Internet AG, Freenet AG, ATC Germany GmbH, Sky Germany, Tele Columbus AG, BT (Germany) GmbH & Co OHG, M-net Telekommunikations Gmb.

3. What are the main segments of the Germany Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 86.03 billion as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

6. What are the notable trends driving market growth?

5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

8. Can you provide examples of recent developments in the market?

July 2024: Vodafone divested an additional 10% stake in its tower business, Vantage Towers, garnering EUR 1.3 billion (USD 1.42 billion). The sale was mainly a part of the deal announced in 2022 when the carrier finalized a deal to sell a stake in its German-based tower unit to KKR and Global Infrastructure Partners (GIP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Germany Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence