Key Insights

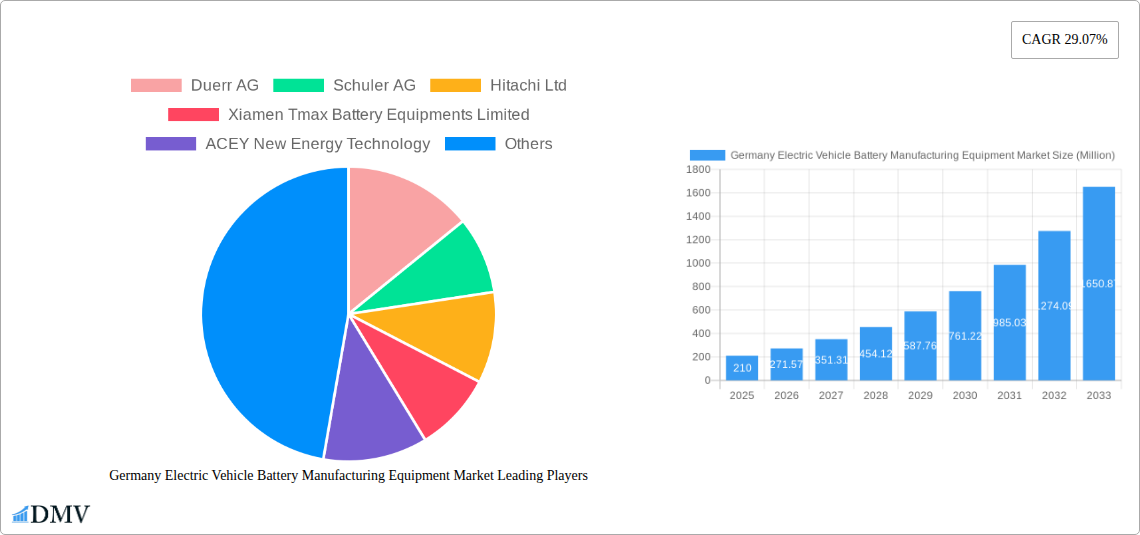

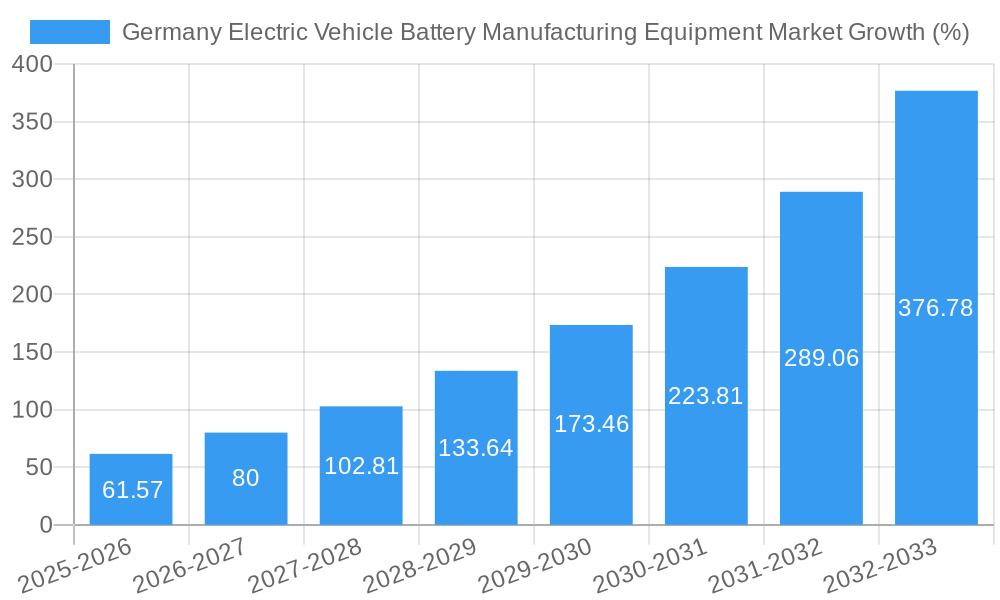

The Germany Electric Vehicle Battery Manufacturing Equipment market is experiencing robust growth, projected to reach €0.21 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 29.07% from 2025 to 2033. This significant expansion is fueled by the accelerating adoption of electric vehicles (EVs) in Germany, driven by government incentives, environmental concerns, and advancements in battery technology. Key drivers include increasing investments in domestic battery production to reduce reliance on foreign suppliers, coupled with the rising demand for high-capacity and energy-dense batteries. Technological advancements, such as the development of more efficient and automated manufacturing processes, further contribute to market growth. While data on specific market segments is unavailable, it's reasonable to assume strong growth in segments related to cell assembly, module production, and battery pack integration equipment. Leading players like Dürr AG, Schuler AG, and Hitachi Ltd are leveraging their expertise in automation and precision engineering to capture significant market share, while emerging companies like Xiamen Tmax and ACEY are challenging the established players with innovative solutions. Despite the positive outlook, potential restraints could include supply chain disruptions, the volatility of raw material prices, and the intense competition among manufacturers.

The forecast period (2025-2033) anticipates continued market expansion, driven by ongoing technological innovation and government support for the EV industry. Germany's commitment to achieving its climate goals will likely intensify the demand for EV batteries, creating a ripple effect in the manufacturing equipment sector. While challenges remain, the long-term outlook for the German EV battery manufacturing equipment market is exceptionally positive. The market's growth trajectory suggests significant opportunities for both established and emerging players, with a focus on efficiency, automation, and sustainable manufacturing practices likely to define future success.

Germany Electric Vehicle Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Germany Electric Vehicle (EV) Battery Manufacturing Equipment Market, offering a comprehensive overview of market dynamics, trends, and future prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans from 2025 to 2033, and the historical period encompasses 2019-2024. This report is essential for stakeholders including manufacturers, investors, and policymakers seeking to understand and capitalize on the burgeoning EV battery manufacturing landscape in Germany. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Germany Electric Vehicle Battery Manufacturing Equipment Market Market Composition & Trends

This section delves into the intricate composition of the German EV battery manufacturing equipment market, examining key aspects that shape its current trajectory and future potential. The market displays a moderately concentrated structure, with key players holding significant market share. However, the emergence of innovative startups and the entry of international players are increasing competition.

- Market Concentration: The market concentration ratio (CR4) for 2025 is estimated at xx%, indicating a moderately consolidated market. The top 5 players account for approximately xx% of the total market share.

- Innovation Catalysts: Stringent emission regulations, government incentives for EV adoption, and the continuous advancements in battery technologies are driving innovation in manufacturing equipment.

- Regulatory Landscape: German regulations regarding environmental standards and worker safety significantly influence the manufacturing processes and equipment choices.

- Substitute Products: While specialized equipment dominates, some adaptable general-purpose machinery exists, offering a degree of substitution but often at the cost of efficiency.

- End-User Profiles: Key end-users comprise major EV battery manufacturers, Tier-1 automotive suppliers, and specialized equipment integrators.

- M&A Activities: The past five years have witnessed xx M&A deals in the sector, with a total deal value exceeding xx Million. These mergers and acquisitions significantly reshape the market landscape.

Germany Electric Vehicle Battery Manufacturing Equipment Market Industry Evolution

The German EV battery manufacturing equipment market has witnessed robust growth in recent years, fueled by the increasing demand for electric vehicles and government support for the transition to electric mobility. Technological advancements are at the heart of this evolution, with automation, robotics, and AI playing an increasingly prominent role in enhancing efficiency and precision. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This trajectory is anticipated to continue, with a projected CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing investments in domestic battery production and the continued expansion of the EV market. Adoption of advanced manufacturing techniques, including digitalization and Industry 4.0 principles, is rapidly increasing, leading to improved productivity and reduced manufacturing costs. Consumer demand shifts towards more sustainable and efficient vehicles directly fuel demand for high-performance, environmentally conscious manufacturing equipment.

Leading Regions, Countries, or Segments in Germany Electric Vehicle Battery Manufacturing Equipment Market

Within Germany, the dominant region for EV battery manufacturing equipment is currently Bavaria, due to the concentration of automotive manufacturers and related suppliers. This dominance is reinforced by substantial government investments and supportive regulatory policies. Other regions are rapidly catching up.

- Key Drivers for Bavaria's Dominance:

- Significant investments in research and development: Bavaria attracts substantial funding for battery technology innovation, creating a fertile ground for equipment development.

- Strong automotive industry presence: The region's well-established automotive industry necessitates a robust and advanced supply chain, including specialized battery manufacturing equipment.

- Supportive government policies: The Bavarian government offers substantial incentives for companies investing in the EV battery sector, fostering growth in the manufacturing equipment market.

The dominance of Bavaria is expected to persist, although other German states may gain more share in the coming years, particularly those that attract new battery gigafactories.

Germany Electric Vehicle Battery Manufacturing Equipment Market Product Innovations

Recent innovations encompass advanced automation systems, improved precision in battery cell assembly, and the integration of AI for predictive maintenance and quality control. These innovations are leading to greater efficiency, reduced production costs, and higher quality battery cells. Unique selling propositions include faster production cycles, enhanced safety features, and lower energy consumption during manufacturing.

Propelling Factors for Germany Electric Vehicle Battery Manufacturing Equipment Market Growth

The German EV battery manufacturing equipment market's growth is propelled by several factors:

- Government incentives and policies promoting EV adoption: Government subsidies and tax breaks for electric vehicles significantly boost market demand.

- Technological advancements in battery technology: Improvements in battery energy density and lifespan fuel the need for more sophisticated manufacturing equipment.

- Stringent emission regulations: Stricter emission standards push automakers to produce more electric vehicles, driving demand for battery manufacturing equipment.

Obstacles in the Germany Electric Vehicle Battery Manufacturing Equipment Market Market

Challenges include potential supply chain disruptions, particularly concerning rare earth minerals essential for battery production, high initial investment costs for advanced equipment, and intense competition among established and emerging players. These factors can hinder the market's growth trajectory.

Future Opportunities in Germany Electric Vehicle Battery Manufacturing Equipment Market

Future opportunities lie in the development of next-generation battery technologies (solid-state batteries), advancements in recycling and reuse technologies, and the growing demand for customized manufacturing solutions tailored to specific battery chemistries. Expansion into new European markets, capitalizing on the growing regional EV market, also presents a significant opportunity.

Major Players in the Germany Electric Vehicle Battery Manufacturing Equipment Ecosystem

- Duerr AG

- Schuler AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- ACEY New Energy Technology

- IPG Photonics Corporation

- Wuxi Lead Intelligent Equipment Co Ltd

- Targray Technology International Inc

- Xiamen Lith Machine Limited

- Robert Bosch Manufacturing Solutions GmbH

- *List Not Exhaustive

Key Developments in Germany Electric Vehicle Battery Manufacturing Equipment Market Industry

- July 2023 & February 2024: Epsilon Advanced Materials (EAM)'s acquisition of a lithium-ion phosphate (LFP) cathode active material technology center in Moosburg, Germany, signals a significant shift in the European battery materials landscape and indirectly impacts the demand for related manufacturing equipment. While the plant is located in India, it signifies a growing interest in LFP technology, potentially influencing equipment choices in German facilities. The projected 100,000-ton capacity by 2030 represents a substantial increase in future demand.

Strategic Germany Electric Vehicle Battery Manufacturing Equipment Market Market Forecast

The German EV battery manufacturing equipment market is poised for sustained growth driven by the expanding domestic EV market, government initiatives promoting electric mobility, and technological advancements in battery production. The market's long-term potential is substantial, with continued opportunities in automation, specialized equipment for next-generation battery chemistries, and the integration of Industry 4.0 technologies. The continued investment in domestic battery production capacity strengthens the overall outlook for the market.

Germany Electric Vehicle Battery Manufacturing Equipment Market Segmentation

-

1. Process

- 1.1. Mixing

- 1.2. Coating

- 1.3. Calendaring

- 1.4. Slitting and Electrode Making

- 1.5. Other Processes

-

2. Battery

- 2.1. Lithium-ion

- 2.2. Lead-acid

- 2.3. Nickel Metal Hydride Battery

- 2.4. Other Batteries

Germany Electric Vehicle Battery Manufacturing Equipment Market Segmentation By Geography

- 1. Germany

Germany Electric Vehicle Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 29.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electric Vehicle Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Mixing

- 5.1.2. Coating

- 5.1.3. Calendaring

- 5.1.4. Slitting and Electrode Making

- 5.1.5. Other Processes

- 5.2. Market Analysis, Insights and Forecast - by Battery

- 5.2.1. Lithium-ion

- 5.2.2. Lead-acid

- 5.2.3. Nickel Metal Hydride Battery

- 5.2.4. Other Batteries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Duerr AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schuler AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xiamen Tmax Battery Equipments Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ACEY New Energy Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IPG Photonics Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Targray Technology International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Xiamen Lith Machine Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch Manufacturing Solutions GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysis6 5 List of Other Prominent Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Duerr AG

List of Figures

- Figure 1: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Electric Vehicle Battery Manufacturing Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Process 2019 & 2032

- Table 4: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Process 2019 & 2032

- Table 5: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Battery 2019 & 2032

- Table 6: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Battery 2019 & 2032

- Table 7: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Process 2019 & 2032

- Table 10: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Process 2019 & 2032

- Table 11: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Battery 2019 & 2032

- Table 12: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Battery 2019 & 2032

- Table 13: Germany Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Electric Vehicle Battery Manufacturing Equipment Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electric Vehicle Battery Manufacturing Equipment Market?

The projected CAGR is approximately 29.07%.

2. Which companies are prominent players in the Germany Electric Vehicle Battery Manufacturing Equipment Market?

Key companies in the market include Duerr AG, Schuler AG, Hitachi Ltd, Xiamen Tmax Battery Equipments Limited, ACEY New Energy Technology, IPG Photonics Corporation, Wuxi Lead Intelligent Equipment Co Ltd, Targray Technology International Inc, Xiamen Lith Machine Limited, Robert Bosch Manufacturing Solutions GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysis6 5 List of Other Prominent Companie.

3. What are the main segments of the Germany Electric Vehicle Battery Manufacturing Equipment Market?

The market segments include Process, Battery.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.21 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies.

6. What are the notable trends driving market growth?

Increasing Adoption of Electric Vehicles.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Electric Vehicles4.; Supportive Government Regulations and Policies.

8. Can you provide examples of recent developments in the market?

February 2024: Epsilon Advanced Materials (EAM) completed the acquisition of a lithium-ion phosphate (LFP) cathode active material technology center in Moosburg, Germany. This acquisition positions India as the first Asian country outside China to produce LFP cathode materials. EAM plans to begin constructing its facility in India in 2024, with a large-scale customer qualification plant set to be operational by 2025 and expected to reach a capacity of 100,000 tons by 2030.July 2023: Epsilon Advanced Materials (EAM) completed the acquisition of a lithium-ion phosphate (LFP) cathode active material technology center in Moosburg, Germany. This acquisition positions India as the first Asian country outside of China to produce LFP cathode materials. EAM plans to begin construction of its facility in India in 2024, with a large-scale customer qualification plant set to be operational by 2025 and expected to reach a capacity of 100,000 tons by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electric Vehicle Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electric Vehicle Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electric Vehicle Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the Germany Electric Vehicle Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence