Key Insights

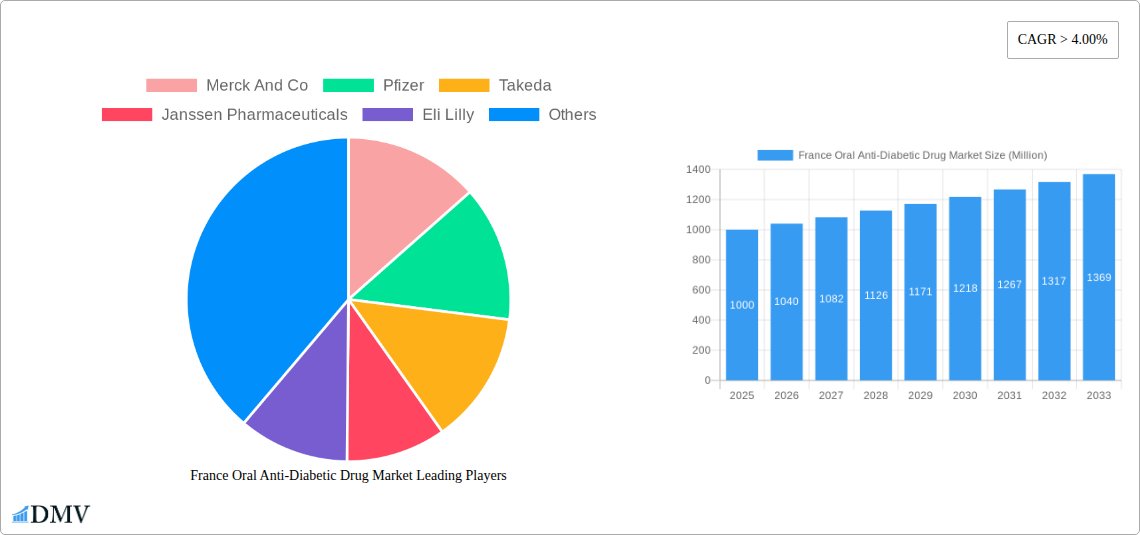

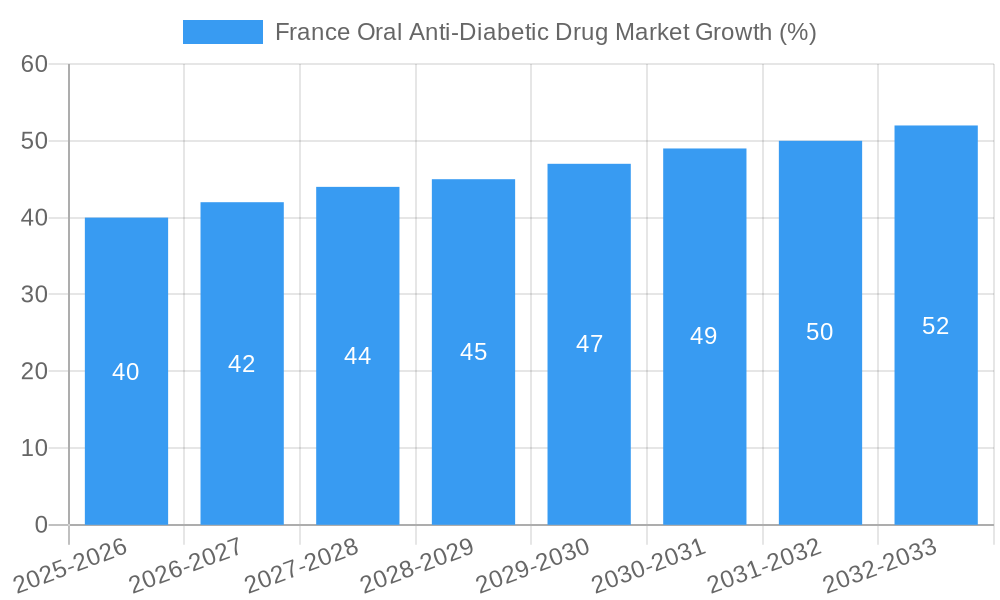

The France oral anti-diabetic drug market, valued at approximately €[Estimate based on market size XX and currency conversion; assume €1000 million in 2025 for example] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is fueled by several key drivers. The rising prevalence of type 2 diabetes in France, coupled with an aging population and increasing awareness of the disease, is significantly boosting demand for effective oral anti-diabetic medications. Furthermore, advancements in drug development, leading to the introduction of newer, more effective drugs with improved safety profiles like SGLT-2 inhibitors and DPP-4 inhibitors, contribute to market growth. The market is segmented by drug class, including Sulfonylureas, Biguanides (like Metformin), Meglitinides, Alpha-Glucosidase Inhibitors, DPP-4 inhibitors (like Ipragliflozin), and SGLT-2 inhibitors. The competitive landscape is dominated by major pharmaceutical players such as Merck & Co, Pfizer, Takeda, and others, who are actively engaged in research and development, and strategic marketing initiatives to maintain their market share.

However, market growth may face certain restraints. The high cost of these medications, particularly newer-generation drugs, can limit accessibility for a segment of the population. Furthermore, the potential for adverse side effects associated with some oral anti-diabetic drugs can impact market demand. The market is also influenced by ongoing research into alternative treatment methods for diabetes, such as lifestyle interventions and newer classes of drugs. Nonetheless, the overall outlook for the France oral anti-diabetic drug market remains positive, underpinned by the growing diabetic population and continuous innovation within the pharmaceutical industry. The market is expected to see substantial expansion throughout the forecast period, with specific drug classes potentially experiencing varied growth trajectories based on their efficacy, safety profiles and market penetration.

France Oral Anti-Diabetic Drug Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the France Oral Anti-Diabetic Drug Market, offering a comprehensive overview of market trends, competitive landscape, and future growth projections from 2019 to 2033. With a focus on key segments including Suglat (Ipragliflozin), Galvus (Vildagliptin), Sulfonylureas, Biguanides, Metformin, Alpha-Glucosidase Inhibitors, and SGLT-2 inhibitors, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report leverages extensive market research, incorporating data from 2019-2024 (Historical Period), with the base year set at 2025 and the forecast period spanning 2025-2033. The estimated market value in 2025 is xx Million.

France Oral Anti-Diabetic Drug Market Composition & Trends

This section delves into the intricate composition of the French oral anti-diabetic drug market, analyzing market concentration, innovation drivers, regulatory dynamics, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a moderately concentrated landscape with key players holding significant shares. Innovation is driven by the need for improved efficacy, safety, and convenience, while the regulatory environment plays a critical role in shaping market access and product development. Substitute therapies include lifestyle modifications and injectable medications, impacting market penetration.

- Market Share Distribution: Merck And Co holds approximately xx% market share, followed by Pfizer at xx%, Takeda at xx%, and other players sharing the remaining xx%. (Exact figures are subject to data availability)

- M&A Activity: The report includes details on significant M&A transactions within the period, indicating a total deal value of approximately xx Million. Specific deals and their impact on market dynamics are detailed within the full report.

- Innovation Catalysts: Research and development efforts are focused on novel drug mechanisms, such as the growing interest in SGLT-2 inhibitors.

- Regulatory Landscape: The French regulatory framework influences market access, pricing, and reimbursement policies for oral anti-diabetic drugs. Recent examples include the increased monitoring of Ozempic, impacting market dynamics.

France Oral Anti-Diabetic Drug Market Industry Evolution

The French oral anti-diabetic drug market has witnessed significant evolution throughout the historical period (2019-2024). Growth has been primarily driven by increasing prevalence of type 2 diabetes, an aging population, and rising healthcare expenditure. Technological advancements, such as the development of newer drug classes with improved efficacy and safety profiles, have significantly influenced market growth. Furthermore, a shift in consumer preferences towards more convenient and effective therapies, like once-daily formulations, has also influenced adoption rates. The market is expected to experience steady growth throughout the forecast period, driven by continued innovation and an increased focus on diabetes management. Specific growth rates for each segment and sub-segment are detailed in the full report. The adoption of newer drug classes, such as SGLT-2 inhibitors, showcases a significant upward trend, surpassing xx% market penetration in 2024.

Leading Regions, Countries, or Segments in France Oral Anti-Diabetic Drug Market

The French oral anti-diabetic drug market exhibits variations in performance across different segments. While data on regional variations is limited, specific segments demonstrate significant influence:

Suglat (Ipragliflozin): DPP-4 inhibitors: Growth is primarily driven by its efficacy and once-daily dosage convenience.

Galvus (Vildagliptin): Sulfonylureas: This combination therapy displays moderate growth, driven by its established position in the market.

Sulfonylureas: Meglitinides: This segment shows relatively stable market share but is projected to decrease due to emergence of newer agents.

Oral Anti-diabetic drugs: Biguanides: Metformin, a cornerstone of diabetes treatment, holds a robust market share.

Metformin: Alpha-Glucosidase Inhibitors: This combination provides stable growth, attributed to its synergistic effects.

Alpha-Glucosidase Inhibitors: Dopamine D2 receptor agonist: This niche segment demonstrates limited growth due to specific patient population.

Bromocriptin: SGLT-2 inhibitors: This emerging segment is rapidly gaining traction, driven by its efficacy in weight management and cardiovascular benefits, resulting in high demand and significant market share expansion.

Key Drivers: Increased prevalence of type 2 diabetes, Government initiatives promoting diabetes awareness and management, R&D efforts focusing on improved efficacy and safety, Favorable reimbursement policies.

France Oral Anti-Diabetic Drug Market Product Innovations

Recent years have witnessed significant product innovations in the French oral anti-diabetic drug market. Novel formulations, such as fixed-dose combinations and once-daily regimens, have improved patient adherence and convenience. Furthermore, the development of drugs targeting multiple pathways, like SGLT-2 inhibitors, has improved overall treatment outcomes by addressing multiple aspects of diabetes management. The emphasis on cardiovascular benefits associated with certain classes of drugs further drives market innovation.

Propelling Factors for France Oral Anti-Diabetic Drug Market Growth

The growth of the French oral anti-diabetic drug market is propelled by several key factors: the rising prevalence of type 2 diabetes, an aging population susceptible to the condition, increasing healthcare expenditure, continuous advancements in drug development leading to improved efficacy and safety, government initiatives promoting diabetes management and awareness programs, and favorable reimbursement policies enhancing market access.

Obstacles in the France Oral Anti-Diabetic Drug Market

Challenges hindering market growth include the high cost of innovative therapies, potential side effects associated with some drugs, intense competition among existing and emerging players, stringent regulatory requirements impacting drug approval and launch timelines, and potential supply chain disruptions. Furthermore, concerns surrounding the off-label use of certain drugs, as evidenced by the heightened monitoring of Ozempic, pose an obstacle to market stability and equitable access.

Future Opportunities in France Oral Anti-Diabetic Drug Market

Future opportunities lie in the development and commercialization of novel drugs targeting unmet medical needs, the expansion of personalized medicine approaches tailoring treatment to individual patient characteristics, the increasing adoption of digital health technologies improving disease management, and the exploration of new drug delivery systems. Further opportunities are presented by the growing understanding of the links between diabetes and other comorbidities, leading to combination therapies.

Major Players in the France Oral Anti-Diabetic Drug Market Ecosystem

- Merck And Co (Merck And Co)

- Pfizer (Pfizer)

- Takeda (Takeda)

- Janssen Pharmaceuticals (Janssen Pharmaceuticals)

- Eli Lilly (Eli Lilly)

- Novartis (Novartis)

- AstraZeneca (AstraZeneca)

- Bristol Myers Squibb (Bristol Myers Squibb)

- Novo Nordisk (Novo Nordisk)

- Boehringer Ingelheim (Boehringer Ingelheim)

- Sanofi (Sanofi)

- Astellas (Astellas)

Key Developments in France Oral Anti-Diabetic Drug Market Industry

- May 2023: The French drug safety agency announced increased monitoring of Ozempic due to influencer-driven demand and associated health concerns, potentially jeopardizing access for diabetic patients.

- May 2022: Pfizer's diabetes drug demonstrated weight loss comparable to Ozempic in a mid-stage trial, potentially impacting market competition and future product development.

Strategic France Oral Anti-Diabetic Drug Market Forecast

The French oral anti-diabetic drug market is poised for continued growth throughout the forecast period (2025-2033). Driven by factors like the increasing prevalence of diabetes, innovative drug development, and supportive regulatory policies, the market is expected to witness a steady expansion. Emerging therapeutic areas, such as personalized medicine and digital health integration, are likely to further shape market evolution and create new opportunities for growth and innovation. The market is predicted to reach xx Million by 2033.

France Oral Anti-Diabetic Drug Market Segmentation

-

1. Oral Anti-diabetic drugs

- 1.1. Biguanides

- 1.2. Alpha-Glucosidase Inhibitors

- 1.3. Dopamine D2 receptor agonist

- 1.4. SGLT-2 inhibitors

- 1.5. DPP-4 inhibitors

- 1.6. Sulfonylureas

- 1.7. Meglitinides

France Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. France

France Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Dipeptidyl peptidase - 4 (DPP-4) inhibitors Segment Occupied the Highest Market Share in France’s Oral Anti-Diabetic Drugs Market in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Oral Anti-diabetic drugs

- 5.1.1. Biguanides

- 5.1.2. Alpha-Glucosidase Inhibitors

- 5.1.3. Dopamine D2 receptor agonist

- 5.1.4. SGLT-2 inhibitors

- 5.1.5. DPP-4 inhibitors

- 5.1.6. Sulfonylureas

- 5.1.7. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Oral Anti-diabetic drugs

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bristol Myers Squibb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novo Nordisk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Boehringer Ingelheim

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sanofi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: France Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Oral Anti-Diabetic Drug Market Share (%) by Company 2024

List of Tables

- Table 1: France Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: France Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Oral Anti-diabetic drugs 2019 & 2032

- Table 4: France Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Oral Anti-diabetic drugs 2019 & 2032

- Table 5: France Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: France Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: France Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: France Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: France Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Oral Anti-diabetic drugs 2019 & 2032

- Table 10: France Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Oral Anti-diabetic drugs 2019 & 2032

- Table 11: France Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: France Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the France Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Sanofi, Astellas.

3. What are the main segments of the France Oral Anti-Diabetic Drug Market?

The market segments include Oral Anti-diabetic drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Dipeptidyl peptidase - 4 (DPP-4) inhibitors Segment Occupied the Highest Market Share in France’s Oral Anti-Diabetic Drugs Market in the current year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

May 2023: The French drug safety agency announced it was stepping up monitoring of Ozempic, a diabetes drug promoted by influencers on social networks who flaunt its weight-loss properties. As well as health concerns, the authorities say the increased demand could jeopardize access for legitimate diabetic patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the France Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence