Key Insights

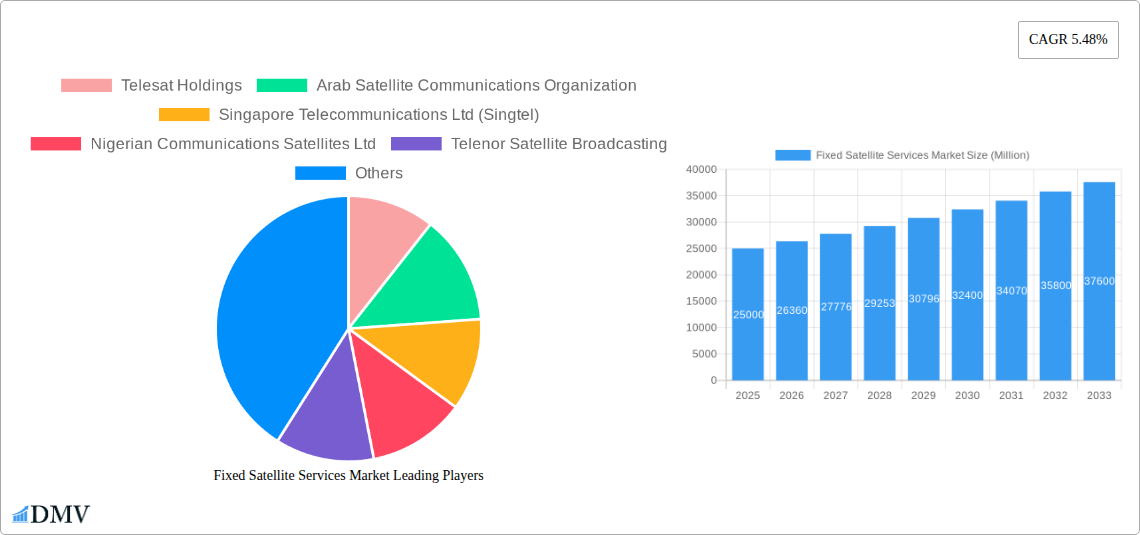

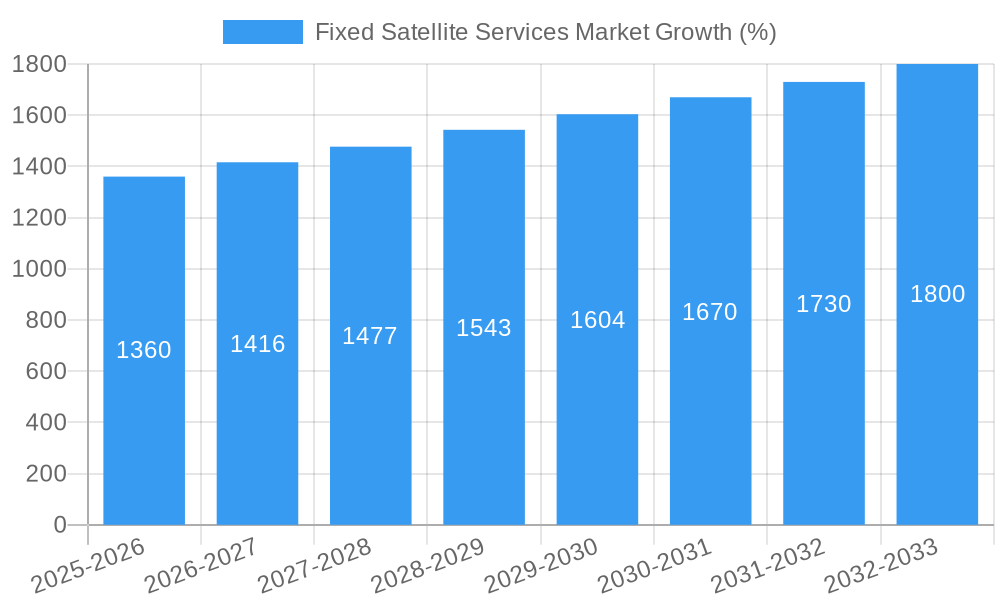

The Fixed Satellite Services (FSS) market is experiencing robust growth, driven by increasing demand for high-bandwidth connectivity, particularly in remote and underserved areas. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and a starting point in 2019), is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.48% from 2025 to 2033. This growth is fueled by several key factors. The burgeoning adoption of satellite-based internet services, especially in regions with limited terrestrial infrastructure, is a significant driver. Furthermore, the increasing reliance on satellite communication for government operations, defense applications, and the broadcasting industry contributes significantly to market expansion. The transition to higher throughput satellites, offering enhanced capacity and improved service quality, further stimulates market growth. The segment of Managed Services is experiencing particularly strong growth due to the increasing preference for outsourcing satellite operations management to specialized providers. Competition among major players, including Telesat Holdings, SES SA, and Intelsat SA, continues to be intense, driving innovation and pricing pressures.

However, certain factors restrain market expansion. High upfront investment costs associated with satellite deployment and maintenance remain a significant barrier to entry for smaller players. Regulatory hurdles and spectrum allocation complexities in different regions also pose challenges. Furthermore, technological advancements in terrestrial network infrastructure, such as the expansion of fiber optic networks, present competitive pressures for satellite-based services. Despite these challenges, the continued demand for reliable and high-capacity connectivity in various sectors, particularly government, defense, and media, is expected to maintain the upward trajectory of the FSS market over the forecast period. The market segmentation by end-user vertical and service type reflects the diverse applications of FSS technologies and the varied customer needs they address. Regional variations in market growth will likely be influenced by factors such as existing infrastructure, government policies, and economic development.

Fixed Satellite Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Fixed Satellite Services market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period spanning 2025-2033. This report is essential for stakeholders seeking to understand the current market landscape and make informed strategic decisions. The market is projected to reach xx Million by 2033.

Fixed Satellite Services Market Composition & Trends

This section delves into the competitive intensity of the Fixed Satellite Services market, examining market share distribution among key players like Telesat Holdings, SES SA, Intelsat SA, and Eutelsat Communications. We analyze innovation drivers, including advancements in satellite technology and the rise of high-throughput satellites (HTS). The regulatory landscape, encompassing licensing and spectrum allocation policies across different geographies, is also scrutinized. The report further explores substitute products and services, such as terrestrial fiber optics and 5G networks, and their impact on market growth. We also profile end-users across diverse sectors like government, commercial, aerospace & defense, and media, providing insights into their unique needs and adoption rates. Finally, the report assesses M&A activity within the sector, quantifying deal values and analyzing their implications for market consolidation.

- Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players commanding significant market share. xx% of the market is controlled by the top 5 players in 2025.

- Innovation Catalysts: Advancements in HTS technology and the development of new frequency bands are key innovation drivers.

- Regulatory Landscape: Varying regulatory frameworks across regions impact market access and growth potential.

- Substitute Products: Terrestrial fiber optics and 5G present competitive challenges, particularly in densely populated areas.

- M&A Activity: Significant M&A activity was observed during the historical period (2019-2024), with deal values exceeding xx Million.

Fixed Satellite Services Market Industry Evolution

This section charts the evolution of the Fixed Satellite Services market, detailing growth trajectories from 2019 to 2024 and projecting growth rates for 2025-2033. The analysis incorporates technological advancements, like the shift towards HTS and the integration of Software Defined Networking (SDN), and their impact on market dynamics. We examine shifting consumer demands, focusing on the increasing need for higher bandwidth, lower latency, and greater reliability. Specific data points on adoption rates for various satellite services and market penetration across different regions are included. The analysis also explores the impact of government policies and investments on market growth. The market experienced a CAGR of xx% during the historical period and is projected to grow at a CAGR of xx% during the forecast period.

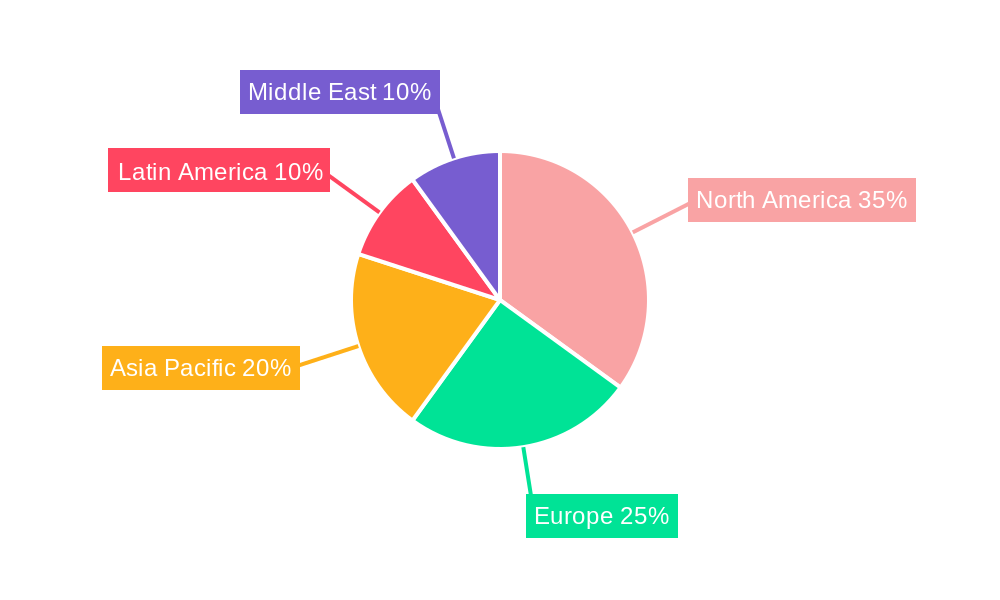

Leading Regions, Countries, or Segments in Fixed Satellite Services Market

This section pinpoints the dominant regions, countries, and segments within the Fixed Satellite Services market. We analyze market leadership based on both end-user verticals (Government, Commercial, Aerospace and Defense, Media, Other End-users Verticals) and service types (Transponder Agreements, Managed Services).

By End-user Vertical:

- Government: Government applications dominate in several regions due to significant investments in national security and communication infrastructure.

- Commercial: The commercial sector displays robust growth, driven by increasing demand for broadband services and enterprise connectivity.

- Aerospace & Defense: This sector showcases steady growth, fueled by the need for secure and reliable communication solutions.

By Type of Services:

- Transponder Agreements: This remains the dominant service type, but managed services are witnessing accelerated growth.

- Managed Services: Increasing demand for managed services reflects a shift towards outsourcing network management and operation.

Key Drivers:

- Significant government investments in satellite infrastructure.

- Favorable regulatory policies promoting private sector participation.

- Increasing demand for high-bandwidth applications in various sectors.

Fixed Satellite Services Market Product Innovations

Recent innovations in Fixed Satellite Services have focused on enhancing bandwidth, reducing latency, and improving service reliability. The introduction of HTS and advanced modulation techniques has significantly expanded capacity and enabled the delivery of high-speed data services. New applications, such as satellite-based broadband internet access in remote areas and enhanced connectivity for IoT devices, are emerging. The unique selling propositions of these innovative services include their ability to provide widespread coverage, even in geographically challenging areas, and their high reliability.

Propelling Factors for Fixed Satellite Services Market Growth

Several factors are driving the growth of the Fixed Satellite Services market. Technological advancements, such as the development of HTS and improved ground segment technology, are significantly enhancing the capacity and efficiency of satellite networks. The increasing demand for broadband internet access and improved connectivity in remote and underserved areas is another key driver. Favorable regulatory policies, including spectrum allocations and supportive government initiatives, further stimulate market growth. Economic factors like increasing disposable incomes and rising demand for communication services in developing economies contribute to expansion.

Obstacles in the Fixed Satellite Services Market

Despite its growth potential, the Fixed Satellite Services market faces challenges. Regulatory hurdles, such as obtaining necessary licenses and navigating complex spectrum allocation processes, can hinder market expansion. Supply chain disruptions, including delays in satellite manufacturing and launch schedules, can impact service availability and increase costs. Intense competition from terrestrial providers, offering alternative connectivity solutions like fiber optics and 5G, puts pressure on pricing and margins.

Future Opportunities in Fixed Satellite Services Market

Future opportunities abound within the Fixed Satellite Services market. Expanding into new and underserved markets, particularly in developing countries, offers significant growth potential. The integration of new technologies like Software Defined Radio (SDR) and the development of low Earth orbit (LEO) constellations promise enhanced performance and capacity. Emerging consumer trends, such as the increasing demand for high-bandwidth applications and the proliferation of IoT devices, create additional market opportunities.

Major Players in the Fixed Satellite Services Market Ecosystem

- Telesat Holdings

- Arab Satellite Communications Organization

- Singapore Telecommunications Ltd (Singtel)

- Nigerian Communications Satellites Ltd

- Telenor Satellite Broadcasting

- Hispasat SA

- SES SA

- Intelsat SA

- Embratel Star One

- Thaicom Public Company Ltd

- Eutelsat Communications

Key Developments in Fixed Satellite Services Market Industry

- 2022 Q4: SES SA launched a new generation of high-throughput satellites, expanding its capacity.

- 2023 Q1: Intelsat SA announced a significant investment in ground infrastructure, enhancing its service reliability.

- 2023 Q2: Telesat Holdings completed a merger with another satellite operator, expanding its market reach. (Further developments can be added here)

Strategic Fixed Satellite Services Market Forecast

The Fixed Satellite Services market is poised for robust growth in the coming years, driven by ongoing technological advancements and increasing demand for connectivity. The expansion into new markets, coupled with the adoption of innovative service offerings, will contribute to market expansion. The continued investment in HTS technology and the development of new satellite constellations will further strengthen market dynamics. The forecast period indicates significant growth potential, with substantial revenue generation expected in the coming years.

Fixed Satellite Services Market Segmentation

-

1. Type of Services

- 1.1. Transponder Agreements

- 1.2. Managed Services

-

2. End-user Vertical

- 2.1. Government

- 2.2. Commercial

- 2.3. Aerospace and Defense

- 2.4. Media

- 2.5. Other End-users Verticals

Fixed Satellite Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Fixed Satellite Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing DTH Subscriptions; Increasing Demand from Corporate Enterprise and Growing use of Transponders in the Media and Entertainment Industry

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Increasing Use of Fiber Optic Transmission Cables; Regulatory Constraints and Limited Orbital Locations

- 3.4. Market Trends

- 3.4.1. Increasing 5G Penetration to Stimulate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Services

- 5.1.1. Transponder Agreements

- 5.1.2. Managed Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Government

- 5.2.2. Commercial

- 5.2.3. Aerospace and Defense

- 5.2.4. Media

- 5.2.5. Other End-users Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Services

- 6. North America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Services

- 6.1.1. Transponder Agreements

- 6.1.2. Managed Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Government

- 6.2.2. Commercial

- 6.2.3. Aerospace and Defense

- 6.2.4. Media

- 6.2.5. Other End-users Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type of Services

- 7. Europe Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Services

- 7.1.1. Transponder Agreements

- 7.1.2. Managed Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Government

- 7.2.2. Commercial

- 7.2.3. Aerospace and Defense

- 7.2.4. Media

- 7.2.5. Other End-users Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type of Services

- 8. Asia Pacific Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Services

- 8.1.1. Transponder Agreements

- 8.1.2. Managed Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Government

- 8.2.2. Commercial

- 8.2.3. Aerospace and Defense

- 8.2.4. Media

- 8.2.5. Other End-users Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type of Services

- 9. Latin America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Services

- 9.1.1. Transponder Agreements

- 9.1.2. Managed Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Government

- 9.2.2. Commercial

- 9.2.3. Aerospace and Defense

- 9.2.4. Media

- 9.2.5. Other End-users Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type of Services

- 10. Middle East Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Services

- 10.1.1. Transponder Agreements

- 10.1.2. Managed Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Government

- 10.2.2. Commercial

- 10.2.3. Aerospace and Defense

- 10.2.4. Media

- 10.2.5. Other End-users Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type of Services

- 11. North America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Fixed Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Telesat Holdings

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Arab Satellite Communications Organization

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Singapore Telecommunications Ltd (Singtel)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nigerian Communications Satellites Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Telenor Satellite Broadcasting

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Hispasat SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SES SA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Intelsat SA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Embratel Star One

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Thaicom Public Company Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Eutelsat Communications

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Telesat Holdings

List of Figures

- Figure 1: Global Fixed Satellite Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 13: North America Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 14: North America Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: North America Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: North America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 19: Europe Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 20: Europe Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 21: Europe Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 22: Europe Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 25: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 26: Asia Pacific Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Asia Pacific Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 31: Latin America Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 32: Latin America Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Latin America Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Latin America Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Fixed Satellite Services Market Revenue (Million), by Type of Services 2024 & 2032

- Figure 37: Middle East Fixed Satellite Services Market Revenue Share (%), by Type of Services 2024 & 2032

- Figure 38: Middle East Fixed Satellite Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 39: Middle East Fixed Satellite Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 40: Middle East Fixed Satellite Services Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Fixed Satellite Services Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fixed Satellite Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 3: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global Fixed Satellite Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Fixed Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 16: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 19: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 22: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 25: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Fixed Satellite Services Market Revenue Million Forecast, by Type of Services 2019 & 2032

- Table 28: Global Fixed Satellite Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Fixed Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed Satellite Services Market?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the Fixed Satellite Services Market?

Key companies in the market include Telesat Holdings, Arab Satellite Communications Organization, Singapore Telecommunications Ltd (Singtel), Nigerian Communications Satellites Ltd, Telenor Satellite Broadcasting, Hispasat SA, SES SA, Intelsat SA, Embratel Star One, Thaicom Public Company Ltd, Eutelsat Communications.

3. What are the main segments of the Fixed Satellite Services Market?

The market segments include Type of Services, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing DTH Subscriptions; Increasing Demand from Corporate Enterprise and Growing use of Transponders in the Media and Entertainment Industry.

6. What are the notable trends driving market growth?

Increasing 5G Penetration to Stimulate the Market Growth.

7. Are there any restraints impacting market growth?

; High Capital Investment and Increasing Use of Fiber Optic Transmission Cables; Regulatory Constraints and Limited Orbital Locations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed Satellite Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed Satellite Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed Satellite Services Market?

To stay informed about further developments, trends, and reports in the Fixed Satellite Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence