Key Insights

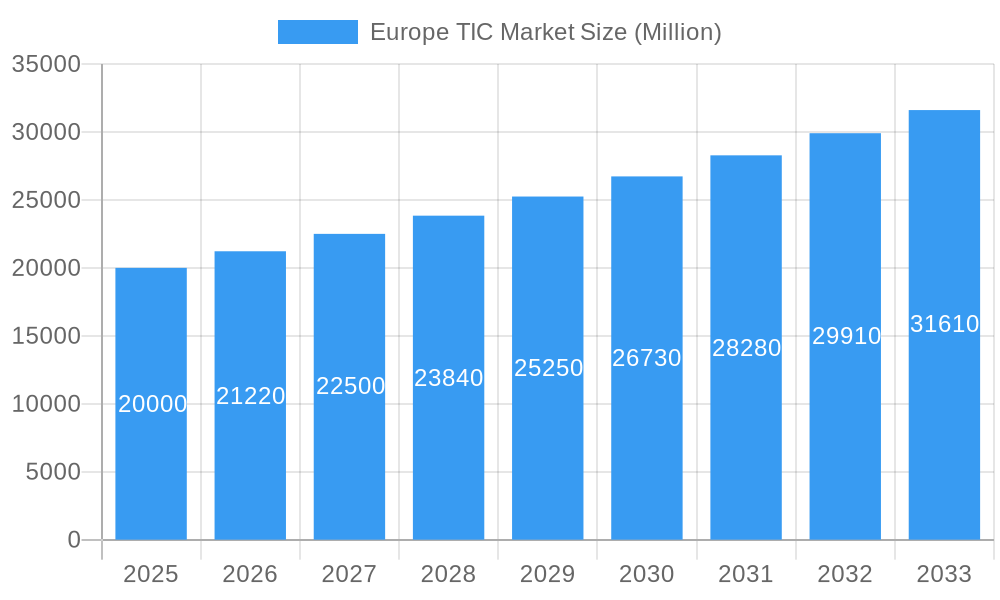

The European Testing, Inspection, and Certification (TIC) market is poised for significant expansion, propelled by escalating demands for regulatory adherence, enhanced product quality and safety imperatives, and the integration of cutting-edge technologies within the TIC landscape. The market, valued at 119057.8 million in the 2025 base year, is projected to achieve a Compound Annual Growth Rate (CAGR) of 3% from 2025 to 2033. This trajectory forecasts substantial market growth driven by rigorous compliance requirements in key sectors including automotive, food and agriculture, and healthcare, necessitating extensive TIC services for product validation and quality assurance. The globalization of supply chains further intensifies the need for comprehensive testing and certification to meet international standards, acting as a key growth catalyst.

Europe TIC Market Market Size (In Billion)

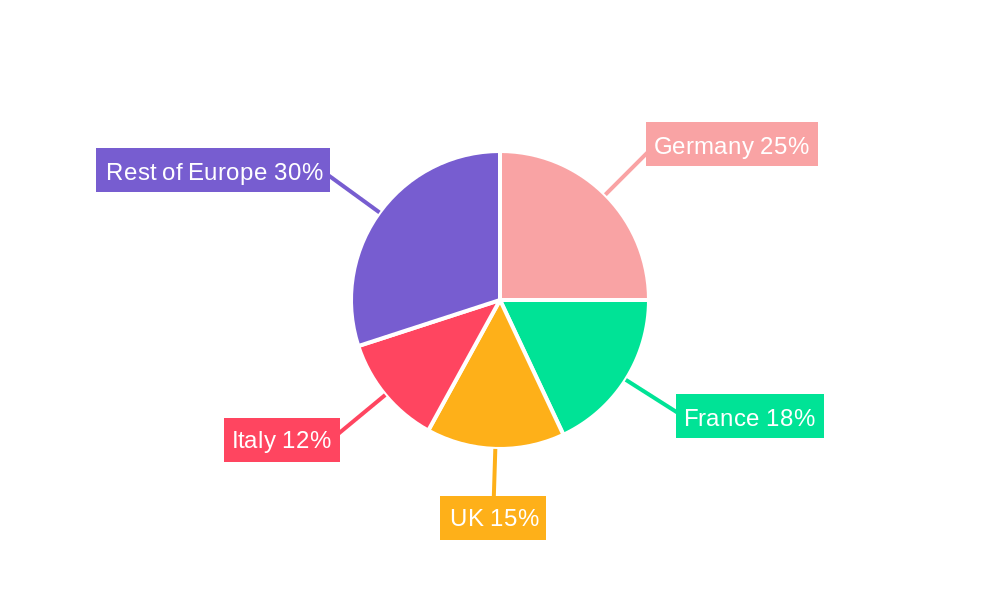

Growth is notably robust within testing and inspection services, reflecting the increasing need for meticulous quality control across diverse industries. The automotive sector, under pressure from stringent safety and performance regulations, is a major market contributor. However, economic volatility and potential regulatory approval delays may present market challenges. The market's fragmented structure offers both consolidation opportunities for niche players and strategic acquisition prospects for larger entities. Geographically, key European economies like Germany, the United Kingdom, and France are leading growth due to their strong industrial foundations and established regulatory environments. Emerging economies within the Rest of Europe also present considerable growth potential as their industries increasingly prioritize quality and compliance.

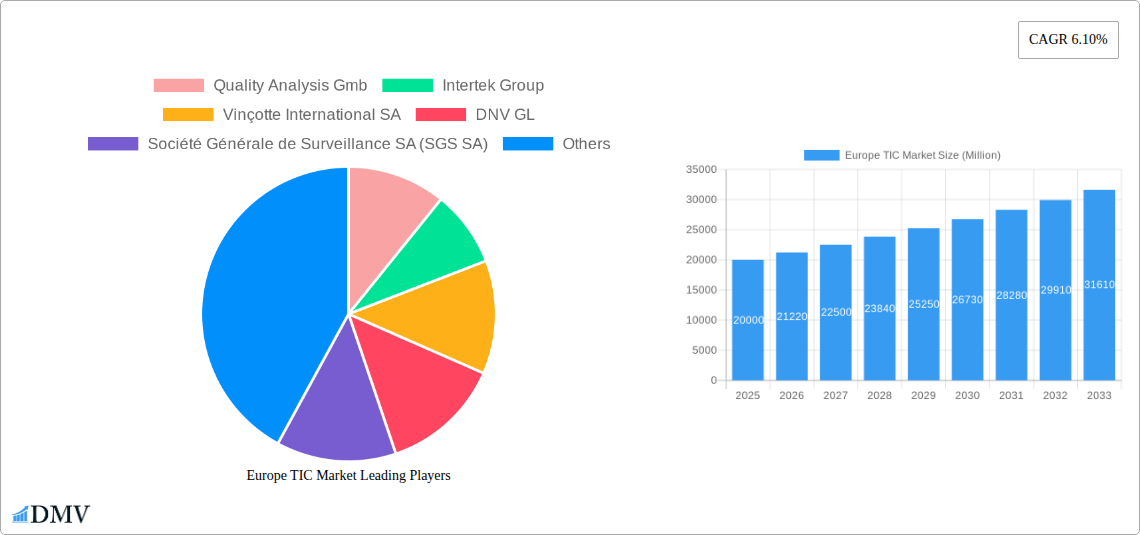

Europe TIC Market Company Market Share

Europe TIC Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe TIC (Testing, Inspection, and Certification) market, offering a comprehensive overview of its current state, future trends, and key players. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. It delves into market segmentation by sourcing type, service type, end-user vertical, and country, providing valuable data for stakeholders across the industry. The market size is projected to reach xx Million by 2033, demonstrating significant growth potential.

Europe TIC Market Composition & Trends

The Europe TIC market is characterized by a moderately concentrated landscape, with several multinational players holding significant market share. While precise market share distribution figures for each company are unavailable at this time and would require further research, the top 10 companies are estimated to collectively hold around 60% of the market share in 2025. Market concentration is influenced by factors such as economies of scale, global reach, and the high capital investment required for testing infrastructure and expertise. Innovation is driven primarily by technological advancements such as AI, automation, and digitalization of services, which are streamlining processes and improving efficiency. Stringent regulatory frameworks in various sectors (e.g., automotive, food safety) significantly influence market demand, demanding compliance from companies and driving growth in specialized TIC services. The market experiences competition from substitute products or in-house capabilities, but the demand for independent third-party validation generally outweighs this. M&A activity has been observed; however, precise deal values for recent transactions are unavailable and require more detailed financial data for accurate calculation, but are anticipated to be in the range of xx-xx Million.

- Key Market Trends: Increased demand for digital solutions, growing focus on sustainability and environmental compliance, and expansion into emerging sectors like renewable energy and life sciences.

- Market Share Distribution (Estimate for 2025): Top 10 companies ~60%, remaining players ~40% (requires further research for specific figures)

- M&A Activity: Ongoing consolidation within the industry, with deal values requiring additional research to calculate accurately.

Europe TIC Market Industry Evolution

The European TIC market has witnessed substantial growth over the past five years, driven by a confluence of factors. Increasing regulatory scrutiny across various sectors, particularly in areas such as product safety and environmental compliance, has fueled demand for robust TIC services. The growth rate from 2019 to 2024 is estimated to be approximately xx%, reflecting the industry’s resilience and expansion, while the projected compound annual growth rate (CAGR) from 2025 to 2033 is predicted to be xx%. Technological advancements, such as the adoption of AI-powered inspection tools and blockchain technology for improved traceability, are enhancing the efficiency and accuracy of testing and certification processes. Consumer demand for higher quality, safer, and more sustainably produced goods is also driving demand for TIC services. This demand underscores the market’s capacity for growth, particularly within sectors experiencing significant advancements, such as the renewable energy sector and the growing life sciences segment, where the adoption rate of advanced TIC methods has increased at an estimated rate of xx% annually over the past five years.

Leading Regions, Countries, or Segments in Europe TIC Market

The Western European markets, namely Germany, France, and the UK, currently dominate the Europe TIC market due to established industrial bases, stringent regulatory landscapes, and higher disposable incomes. However, significant growth opportunities exist within the “Rest of Europe” segment, as emerging economies continue to industrialize and implement stricter quality standards.

- By Sourcing Type: Outsourced services dominate, reflecting the preference for independent third-party verification.

- By Type of Service: Testing and inspection currently hold the largest market share, though certification services are projected to experience rapid growth.

- By End-User Vertical: The automotive, food and agriculture, and manufacturing sectors account for a large share, driven by regulatory mandates and consumer expectations. The Energy and Utilities Sector, due to renewable energy investments and stringent regulations, exhibits an above-average growth rate compared to other sectors.

- By Country: Germany, UK, and France lead due to their robust manufacturing sectors and strict regulatory environment. Eastern European countries are emerging as key growth markets.

Key Drivers:

- Germany: Strong automotive and manufacturing sectors, coupled with rigorous regulatory standards.

- UK: Significant presence of multinational TIC companies, contributing to strong market activity.

- France: Growing focus on food safety and environmental regulations.

- Rest of Europe: Emerging economies with increasing industrialization and growing demand for quality assurance.

Europe TIC Market Product Innovations

Recent innovations include AI-powered image analysis for automated defect detection, blockchain technology for enhanced traceability and transparency, and remote inspection solutions leveraging IoT devices. These innovations offer improved efficiency, accuracy, and cost-effectiveness, ultimately improving the value proposition for clients and driving market growth.

Propelling Factors for Europe TIC Market Growth

Several factors propel growth in the European TIC market. Stringent regulatory compliance requirements across multiple sectors (e.g., REACH, RoHS) drive demand for testing and certification services. Increased consumer awareness of product safety and quality is another catalyst. Moreover, technological advancements, specifically AI and automation, are improving the speed and accuracy of testing processes, increasing efficiency and lowering costs. The rising adoption of sustainable practices across industries is also bolstering the demand for environmental compliance testing.

Obstacles in the Europe TIC Market

Challenges include maintaining the cost-effectiveness of advanced technologies, navigating diverse and evolving regulatory landscapes, and managing potential supply chain disruptions. Intense competition among established players and emerging providers creates pricing pressures and a need for continuous innovation.

Future Opportunities in Europe TIC Market

Future opportunities lie in leveraging the capabilities of emerging technologies such as AI and blockchain to improve the efficiency and transparency of services. Expanding into new, less-penetrated sectors like renewable energy and the life sciences will also present significant growth avenues. Furthermore, providing tailored solutions focusing on specific client needs and niche applications will become increasingly important.

Major Players in the Europe TIC Market Ecosystem

- Quality Analysis Gmb

- Intertek Group

- Vinçotte International SA

- DNV GL

- Société Générale de Surveillance SA (SGS SA)

- Applus Services SA

- TÜV NORD Group

- A/S Baltic Control Ltd Aarhus

- RTM BREDA SRL

- TÜV SÜD Limited

- LabAnalysis SRL

- CIS Commodity Inspection Services BV

- TÜV Rheinland Group

- VIC Inspection Services Holding Ltd

- DEKRA SA

- UL LLC

- Kiwa NV

- ALS Limited

- AQM SRL

- Bureau Veritas SA

- Element Materials Technology

- Eurofins Scientific SE

- ATG Technology Group

Key Developments in Europe TIC Market Industry

- June 2023: NMi and CCIC Europe partner to provide TIC services to PRC manufacturers. This expands the reach of European TIC providers into the significant Chinese market, increasing competition and driving innovation.

- October 2022: TÜV NORD invests in Global Surface Intelligence, combining AI-based image analysis with certification services. This showcases the adoption of innovative technologies within the industry, improving efficiency and broadening service offerings.

- January 2022: SGS collaborates with Microsoft to develop innovative solutions for TIC customers. This partnership demonstrates the increasing role of data analytics and digital transformation within the TIC sector.

Strategic Europe TIC Market Forecast

The European TIC market is poised for continued growth, driven by a combination of factors such as increasing regulatory pressures, technological advancements, and growing consumer demand for quality and safety. The market is expected to experience significant expansion in the coming years, particularly in sectors such as renewable energy, life sciences, and sustainable manufacturing. The forecast suggests a steady increase in demand for innovative and cost-effective solutions, which will stimulate competition and drive further industry evolution.

Europe TIC Market Segmentation

-

1. Sourcing Type

-

1.1. Outsourced

-

1.1.1. Type of Service

- 1.1.1.1. Testing and Inspection

- 1.1.1.2. Certification

-

1.1.1. Type of Service

- 1.2. In-house/Government

-

1.1. Outsourced

-

2. End User Vertical

- 2.1. Consumer Good and Retail

- 2.2. Automotive

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Energy and Utilities

- 2.6. Oil & Gas and Chemicals

- 2.7. Construction

- 2.8. Transport, Aerospace, and Rail

- 2.9. Life Sciences

- 2.10. Marine & Mining

- 2.11. Other End User Verticals

Europe TIC Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe TIC Market Regional Market Share

Geographic Coverage of Europe TIC Market

Europe TIC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trading Across Borders and Stringent Regulations; Technological Evolution; Mass Customization and Shorter Product Life Cycles

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Consumer Goods and Retail Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe TIC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. Outsourced

- 5.1.1.1. Type of Service

- 5.1.1.1.1. Testing and Inspection

- 5.1.1.1.2. Certification

- 5.1.1.1. Type of Service

- 5.1.2. In-house/Government

- 5.1.1. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Consumer Good and Retail

- 5.2.2. Automotive

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Energy and Utilities

- 5.2.6. Oil & Gas and Chemicals

- 5.2.7. Construction

- 5.2.8. Transport, Aerospace, and Rail

- 5.2.9. Life Sciences

- 5.2.10. Marine & Mining

- 5.2.11. Other End User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Quality Analysis Gmb

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intertek Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vinçotte International SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DNV GL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Société Générale de Surveillance SA (SGS SA)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Applus Services SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TÜV NORD Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 A/S Baltic Control Ltd Aarhus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 RTM BREDA SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TÜV SÜD Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LabAnalysis SRL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CIS Commodity Inspection Services BV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TÜV Rheinland Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VIC Inspection Services Holding Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 DEKRA SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 UL LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Kiwa NV

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 ALS Limited

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 AQM SRL

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Bureau Veritas SA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Element Materials Technology

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Eurofins Scientific SE

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 ATG Technology Group

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 Quality Analysis Gmb

List of Figures

- Figure 1: Europe TIC Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe TIC Market Share (%) by Company 2025

List of Tables

- Table 1: Europe TIC Market Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Europe TIC Market Revenue million Forecast, by End User Vertical 2020 & 2033

- Table 3: Europe TIC Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe TIC Market Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Europe TIC Market Revenue million Forecast, by End User Vertical 2020 & 2033

- Table 6: Europe TIC Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe TIC Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Europe TIC Market?

Key companies in the market include Quality Analysis Gmb, Intertek Group, Vinçotte International SA, DNV GL, Société Générale de Surveillance SA (SGS SA), Applus Services SA, TÜV NORD Group, A/S Baltic Control Ltd Aarhus, RTM BREDA SRL, TÜV SÜD Limited, LabAnalysis SRL, CIS Commodity Inspection Services BV, TÜV Rheinland Group, VIC Inspection Services Holding Ltd, DEKRA SA, UL LLC, Kiwa NV, ALS Limited, AQM SRL, Bureau Veritas SA, Element Materials Technology, Eurofins Scientific SE, ATG Technology Group.

3. What are the main segments of the Europe TIC Market?

The market segments include Sourcing Type, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 119057.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trading Across Borders and Stringent Regulations; Technological Evolution; Mass Customization and Shorter Product Life Cycles.

6. What are the notable trends driving market growth?

Consumer Goods and Retail Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023 - NMi, one of the market leaders in the certification of measuring and metering technologies, and CCIC Europe (CCIC EU), the regional company of the China Inspection & Certification Group, have announced a partnership to provide testing, inspection, and certification services to manufacturers in the People’s Republic of China (PRC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe TIC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe TIC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe TIC Market?

To stay informed about further developments, trends, and reports in the Europe TIC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence