Key Insights

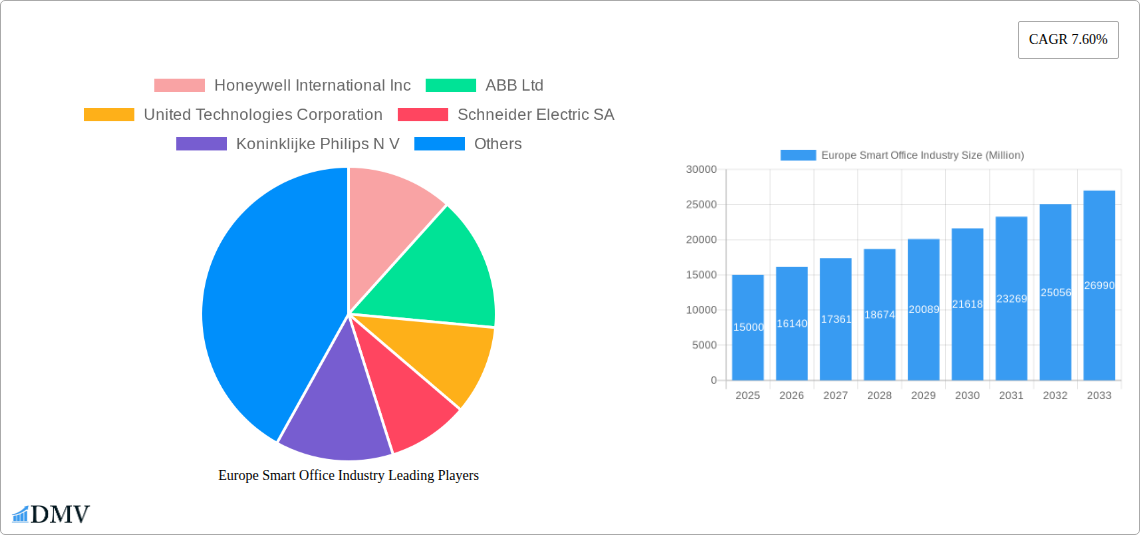

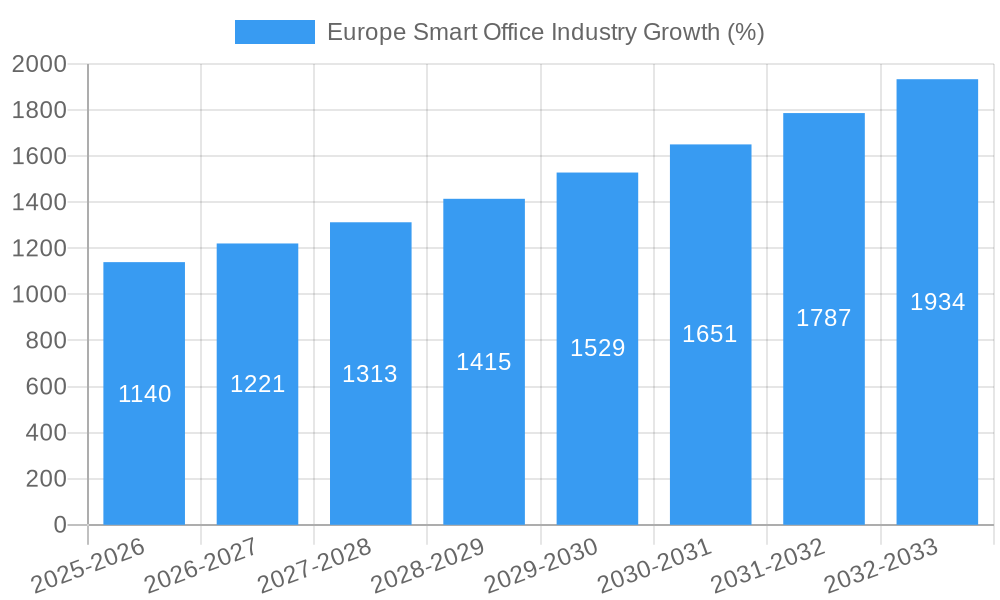

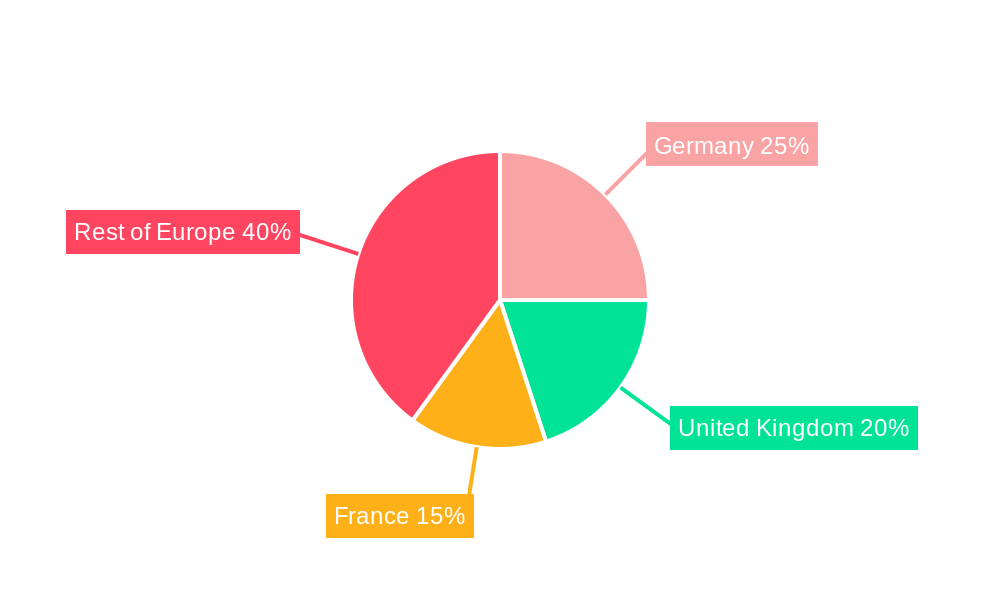

The European smart office market is experiencing robust growth, driven by the increasing adoption of smart technologies to enhance operational efficiency, employee productivity, and sustainability. With a current market size (2025 estimated) of approximately €15 billion (assuming a logical extrapolation based on the provided 7.60% CAGR and a reasonably sized initial market), and a projected CAGR of 7.60%, the market is poised for significant expansion throughout the forecast period (2025-2033). Key drivers include the rising demand for improved workplace experiences, the growing need for energy-efficient solutions, and the increasing adoption of cloud-based platforms for seamless integration of smart office technologies. The retrofitting of existing buildings represents a substantial segment of the market, alongside growth in new construction projects incorporating smart technologies from the outset. Germany, the United Kingdom, and France constitute the largest national markets within Europe, benefiting from established technological infrastructure and a higher concentration of businesses adopting smart office solutions. However, the market is experiencing some restraints including the high initial investment costs associated with smart office installations, concerns over data security and privacy, and a lack of awareness among some businesses regarding the long-term benefits of smart office technology. Despite these challenges, the ongoing advancements in technology, coupled with increasing government support for sustainable building practices, are expected to fuel market expansion in the coming years. The market segmentation by product reveals strong demand for security and access control systems, energy management systems, and smart HVAC control systems, reflecting priorities for workplace safety, cost optimization, and environmental responsibility.

The competitive landscape is highly fragmented, with a mix of established multinational corporations like Honeywell International Inc., ABB Ltd., and Schneider Electric SA, alongside specialized technology providers such as Lutron Electronics Co Inc. and Crestron Electronics Inc. These companies are actively engaged in product innovation, strategic partnerships, and mergers and acquisitions to gain a competitive edge. Future growth will be influenced by factors like technological advancements in areas such as artificial intelligence (AI) and the Internet of Things (IoT), the development of more user-friendly interfaces, and the increasing focus on integrating smart office technologies with broader sustainability initiatives. The expanding adoption of flexible work models also contributes to the market's growth, as companies seek to optimize their office spaces for both in-person and remote work scenarios. The continued penetration of smart office solutions across various building types and geographical locations in Europe is expected to drive substantial market growth through 2033.

This comprehensive report delivers an in-depth analysis of the Europe Smart Office Industry market, projecting robust growth from 2025 to 2033. It provides invaluable insights for stakeholders, investors, and industry professionals seeking to navigate this dynamic sector. With a focus on key segments, leading players, and emerging trends, this report is an essential resource for informed decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year.

Europe Smart Office Industry Market Composition & Trends

This section dissects the competitive landscape of the Europe smart office market (estimated at €XX Million in 2025), analyzing market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and M&A activities. We evaluate the market share distribution amongst key players like Honeywell International Inc, ABB Ltd, United Technologies Corporation, Schneider Electric SA, and others, revealing the level of market fragmentation. The report also explores the impact of regulatory changes, such as the EU's energy efficiency directives, on market dynamics. Furthermore, we examine the influence of substitute products and emerging technologies, along with prevalent M&A activities, quantifying deal values in Millions of Euros where possible (e.g., a recent merger valued at €XX Million).

- Market Share Distribution: Detailed breakdown of market share held by top players (Honeywell: xx%, ABB: xx%, etc.).

- M&A Activity: Analysis of recent mergers and acquisitions, including deal values (e.g., €XX Million deal between Company A and Company B in 2024).

- Regulatory Landscape: Impact of EU directives on market growth and investment.

- Substitute Products: Assessment of alternative solutions and their market impact.

- End-User Profiles: Detailed overview of key end-user segments and their requirements.

Europe Smart Office Industry Industry Evolution

This section details the evolution of the European smart office industry from 2019 to 2033. We analyze market growth trajectories, technological advancements, and shifting consumer preferences, supported by specific data points. The report showcases compound annual growth rates (CAGR) for the historical period (2019-2024) and projects future growth rates (2025-2033), highlighting the influence of factors such as the increasing adoption of smart technologies in office spaces, the growing need for energy efficiency, and evolving work styles. We also examine the impact of the COVID-19 pandemic and the subsequent shift to hybrid work models on market dynamics. Specific examples of technological advancements, such as the integration of AI and IoT in smart office solutions, are presented, along with their implications for the market. Adoption metrics, including the percentage of smart office installations in various European countries, are also provided.

Leading Regions, Countries, or Segments in Europe Smart Office Industry

This section identifies the leading regions, countries, and segments within the Europe smart office market. We analyze dominant segments by building type (retrofits vs. new buildings), country (Germany, UK, France, Spain, Rest of Europe), and product (security and access control systems, energy management systems, etc.). Our analysis delves into the factors contributing to this dominance, such as:

Key Drivers (Bullet Points):

- Germany: Strong government support for energy efficiency initiatives, high adoption rates of smart technologies.

- UK: Significant investments in smart building infrastructure, presence of major technology companies.

- France: Growing demand for enhanced security and access control systems.

- Retrofits: Large existing building stock presents a significant retrofit market opportunity.

- Energy Management Systems: Increasing focus on energy efficiency drives demand.

In-depth Analysis (Paragraphs): Detailed examination of specific factors driving the dominance of each region, country, and segment, using data and insights to support the findings. For example, the paragraph for Germany would expand on their energy-saving regulations and their impact on the market.

Europe Smart Office Industry Product Innovations

The European smart office market witnesses continuous product innovation. New products and applications are emerging, incorporating advanced technologies like AI, IoT, and cloud computing for enhanced security, energy efficiency, and overall user experience. These innovations offer unique selling propositions, such as improved building automation, predictive maintenance capabilities, and data-driven insights into building performance. Key performance metrics, such as energy savings achieved through smart HVAC control systems, are quantified.

Propelling Factors for Europe Smart Office Industry Growth

Several factors fuel the growth of the Europe smart office industry. Technological advancements, such as the development of more sophisticated and integrated smart building solutions, are driving market expansion. Economic factors, including the increasing willingness of businesses to invest in productivity-enhancing technologies, also play a role. Furthermore, supportive regulatory policies, such as the EU's focus on energy efficiency and sustainability, are fostering market growth. For example, tax incentives and grants aimed at encouraging the adoption of energy-efficient building technologies are stimulating market demand.

Obstacles in the Europe Smart Office Industry Market

Despite strong growth potential, several obstacles challenge the Europe smart office market. High initial investment costs associated with smart office implementations can deter some businesses. Supply chain disruptions, particularly those experienced post-pandemic, can cause delays and increase costs. Furthermore, intense competition among numerous vendors in the market creates pricing pressures and impacts profit margins. These challenges, along with any regulatory hurdles, need to be addressed for sustained market growth. Quantifiable impacts, such as the percentage increase in project costs due to supply chain issues, are presented where data is available.

Future Opportunities in Europe Smart Office Industry

The Europe smart office market presents several promising future opportunities. Expansion into underserved markets within Europe, particularly in Eastern Europe, offers significant growth potential. The adoption of new technologies, such as 5G and edge computing, will further enhance smart office capabilities. Moreover, emerging trends, such as the increasing demand for flexible and hybrid workspaces, will drive innovation and create new market segments.

Major Players in the Europe Smart Office Industry Ecosystem

- Honeywell International Inc

- ABB Ltd

- United Technologies Corporation

- Schneider Electric SA

- Koninklijke Philips N V

- Cisco Systems Inc

- Lutron Electronics Co Inc

- Siemens AG

- Raytheon Technologies

- Johnson Controls Inc

- Crestron Electronics Inc

Key Developments in Europe Smart Office Industry Industry

- October 2022: The European Union mandates energy efficiency labels for blockchains, reflecting broader efforts to reduce ICT sector energy consumption. This includes energy labeling for data centers and computers.

- October 2022: Germany advances its energy-saving regulation (EED), aiming for a 500 TWh reduction (9% of current consumption) by 2030, aligning with, but exceeding, the EU's original ambition level in light of the Ukraine conflict.

Strategic Europe Smart Office Industry Market Forecast

The Europe smart office market is poised for substantial growth driven by technological advancements, increasing energy efficiency mandates, and the evolving needs of modern workplaces. The market is expected to witness significant expansion in the forecast period (2025-2033), driven by continued investment in smart building technologies, a growing emphasis on sustainability, and the rising adoption of flexible work models. Emerging technologies, such as AI and IoT, will further shape market dynamics, offering opportunities for enhanced productivity, energy efficiency, and improved workplace experiences. The projected market size in 2033 is estimated at €XX Million.

Europe Smart Office Industry Segmentation

-

1. Product

- 1.1. Security and Access Control System

- 1.2. Energy Management System

- 1.3. Smart HVAC Control System

- 1.4. Audio-Video Conferencing System

- 1.5. Fire and Safety Control System

- 1.6. Other Products

-

2. Building Type

- 2.1. Retrofits

- 2.2. New Buildings

Europe Smart Office Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Smart Office Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Energy Efficient Solutions; Growing Need for Automation of Security Systems

- 3.3. Market Restrains

- 3.3.1. High Cost of Connected Systems

- 3.4. Market Trends

- 3.4.1. Power and Energy in Energy Management Systems to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Security and Access Control System

- 5.1.2. Energy Management System

- 5.1.3. Smart HVAC Control System

- 5.1.4. Audio-Video Conferencing System

- 5.1.5. Fire and Safety Control System

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Building Type

- 5.2.1. Retrofits

- 5.2.2. New Buildings

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Smart Office Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 United Technologies Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Schneider Electric SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Koninklijke Philips N V

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cisco Systems Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Lutron Electronics Co Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Siemens AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Raytheon Technologies*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Johnson Controls Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Crestron Electronics Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Smart Office Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Smart Office Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Smart Office Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Smart Office Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Smart Office Industry Revenue Million Forecast, by Building Type 2019 & 2032

- Table 4: Europe Smart Office Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Smart Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Smart Office Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Europe Smart Office Industry Revenue Million Forecast, by Building Type 2019 & 2032

- Table 15: Europe Smart Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Smart Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Office Industry?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Europe Smart Office Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, United Technologies Corporation, Schneider Electric SA, Koninklijke Philips N V, Cisco Systems Inc, Lutron Electronics Co Inc, Siemens AG, Raytheon Technologies*List Not Exhaustive, Johnson Controls Inc, Crestron Electronics Inc.

3. What are the main segments of the Europe Smart Office Industry?

The market segments include Product, Building Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Energy Efficient Solutions; Growing Need for Automation of Security Systems.

6. What are the notable trends driving market growth?

Power and Energy in Energy Management Systems to Show Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Connected Systems.

8. Can you provide examples of recent developments in the market?

October 2022 - Blockchains will soon have an energy efficiency label owing to the European Union. The European Commission implemented these policies as part of more extensive plans to reduce the ICT sector's energy consumption, including measures to make it more straightforward how much energy telecom services use, an environmental labeling program for data centers, and an energy label for computers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Office Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Office Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Office Industry?

To stay informed about further developments, trends, and reports in the Europe Smart Office Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence