Key Insights

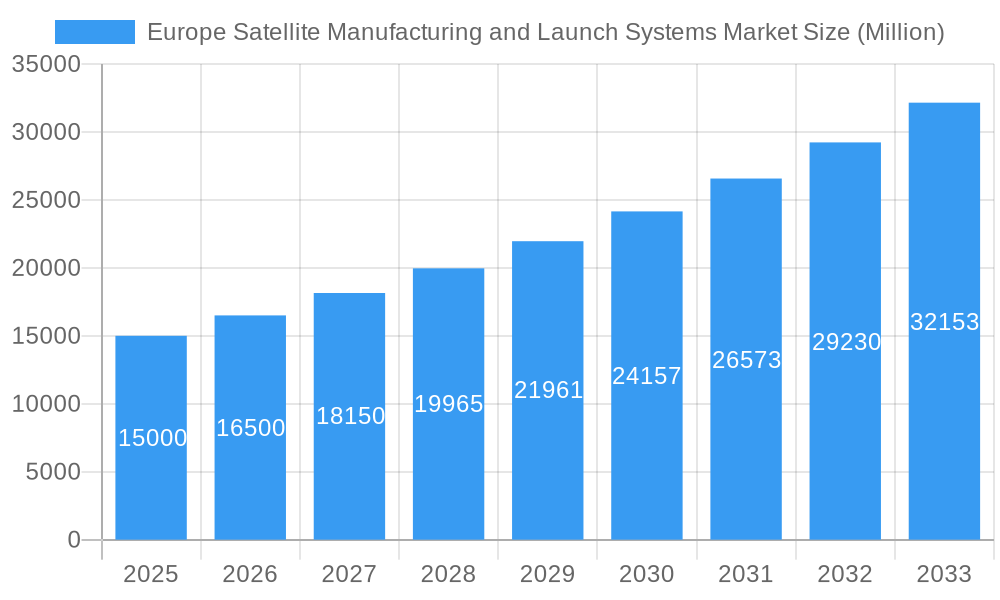

The European satellite manufacturing and launch systems market is experiencing robust growth, driven by increasing demand for satellite-based services across civil, commercial, and military sectors. A compound annual growth rate (CAGR) exceeding 10% from 2019 to 2024 suggests a significant market expansion. This growth is fueled by several factors: the rising adoption of satellite communication for various applications like broadband internet access, Earth observation for environmental monitoring and resource management, and navigation systems; the miniaturization and cost reduction of satellite technology, making it more accessible to smaller companies and nations; and the increasing investments in space exploration initiatives by both governmental and private entities within Europe. Key market segments include satellite manufacturing (covering diverse types like communication, Earth observation, and navigation satellites) and launch systems, encompassing both expendable and reusable launch vehicles. Germany, France, and the United Kingdom are major contributors, benefiting from established space industries and government support. However, competitive pressures from emerging space players and the high cost of developing and launching satellites remain constraints on market expansion. The forecast period (2025-2033) anticipates continued growth, driven by the aforementioned factors and potentially accelerated by advancements in areas like in-space servicing, satellite constellations, and the development of new launch technologies.

Europe Satellite Manufacturing and Launch Systems Market Market Size (In Billion)

Looking ahead to 2033, the European market will likely see a consolidation among existing players as well as entry by innovative startups. The focus on sustainability and the reduction of space debris are emerging trends impacting the sector. This necessitates advancements in both environmentally friendly launch systems and technologies for end-of-life satellite disposal. The continued investment in research and development across Europe will be critical in maintaining the region's competitive edge in the global space market. The growth trajectory suggests significant opportunities for businesses involved in satellite manufacturing, launch services, ground segment infrastructure, and related supporting technologies. However, market participants must navigate the regulatory environment and address the challenges posed by competition and technological advancements. Strategic partnerships and collaborations will become increasingly important to capitalize on emerging opportunities within this dynamic market.

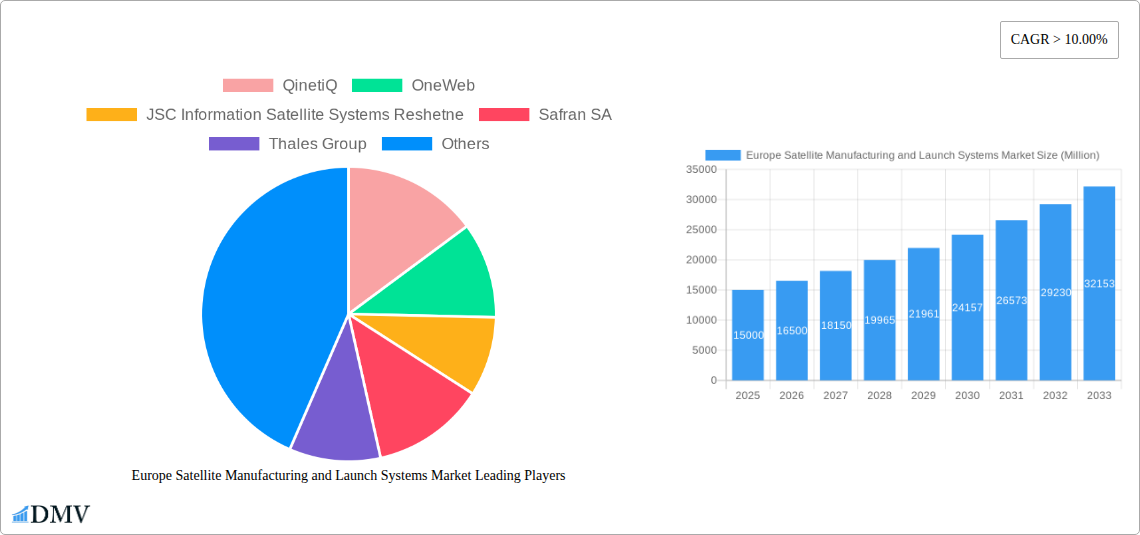

Europe Satellite Manufacturing and Launch Systems Market Company Market Share

Europe Satellite Manufacturing and Launch Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic landscape of the European satellite manufacturing and launch systems market, offering a comprehensive analysis of market trends, technological advancements, and future growth prospects. Spanning the study period of 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

Europe Satellite Manufacturing and Launch Systems Market Composition & Trends

This section examines the competitive landscape, innovation drivers, and regulatory environment impacting the European satellite manufacturing and launch systems market. We analyze market concentration, revealing the market share distribution amongst key players like ArianeGroup, Thales Group, and OHB SE. The report also explores the influence of technological advancements, including miniaturization and improved propulsion systems, on market dynamics. Furthermore, we delve into the regulatory landscape, assessing its impact on market growth and investment. The role of M&A activities is also scrutinized, with an assessment of deal values and their implications for market consolidation. Substitute products and their competitive threat are also evaluated. Finally, end-user profiles (civil, commercial, military) are profiled, revealing their specific needs and driving forces within the market.

- Market Concentration: Highly concentrated with top 5 players holding approximately xx% market share in 2024.

- M&A Activity: Analysis of significant mergers and acquisitions (M&A) deals in the period 2019-2024, with total deal values estimated at xx Million.

- Innovation Catalysts: Focus on miniaturization, reusable launch vehicles, and advanced satellite technologies driving market innovation.

- Regulatory Landscape: Assessment of European Space Agency (ESA) regulations and their influence on market access and investment.

- Substitute Products: Evaluation of alternative technologies and their potential impact on market growth.

- End-User Profiles: Detailed analysis of market demands from civil, commercial, and military end-users.

Europe Satellite Manufacturing and Launch Systems Market Industry Evolution

This section details the historical and projected evolution of the European satellite manufacturing and launch systems market. We analyze market growth trajectories from 2019 to 2024, highlighting key milestones and technological advancements that have shaped the industry's development. The report meticulously examines shifting consumer demands, identifying emerging trends and their impact on market segmentation. Growth rates are presented for each segment (Satellite, Launch Systems), alongside adoption metrics for new technologies. The analysis also explores the impact of geopolitical factors and evolving space policies on market growth and technological development. Detailed data points illustrating growth rates and adoption trends are provided for the historical period (2019-2024) and the forecast period (2025-2033).

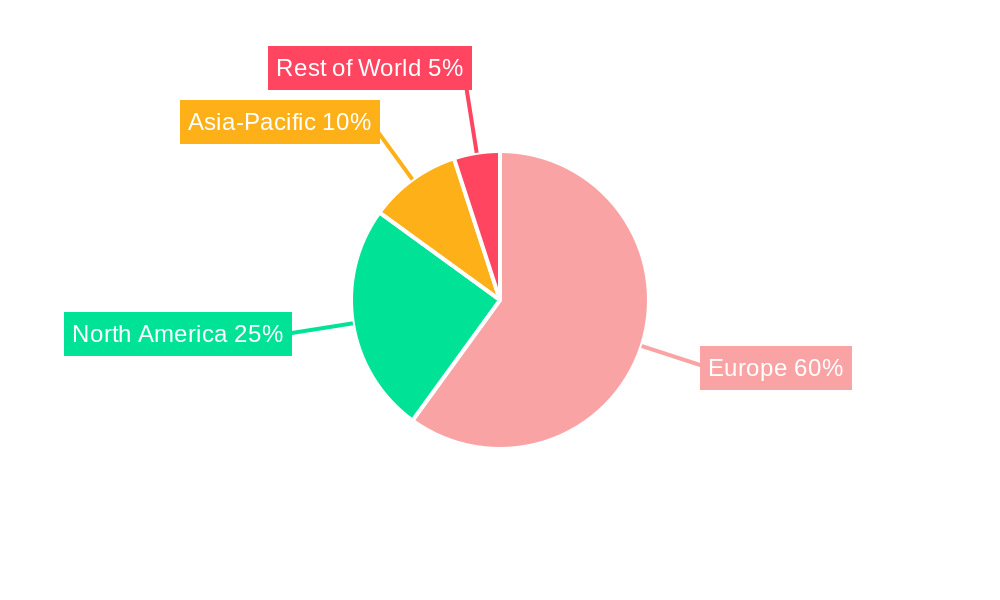

Leading Regions, Countries, or Segments in Europe Satellite Manufacturing and Launch Systems Market

This section pinpoints the dominant regions, countries, and segments within the European satellite manufacturing and launch systems market. Detailed analysis identifies the leading segment, whether it be Satellite manufacturing, Launch Systems, or a specific end-user category (Civil, Commercial, or Military).

- Key Drivers:

- Investment Trends: Analysis of government funding and private investment in the leading region/segment.

- Regulatory Support: Assessment of favorable policies and regulations stimulating growth in the dominant region/segment.

- Technological Advancements: Focus on the specific technologies driving dominance in the identified region/segment.

- Infrastructure Development: Evaluation of existing infrastructure and its impact on market leadership.

Dominance factors are analyzed in detail, providing a granular understanding of the reasons behind the market leadership of the identified region, country, or segment. This analysis utilizes both qualitative and quantitative data, drawing on market share data, industry reports, and expert interviews.

Europe Satellite Manufacturing and Launch Systems Market Product Innovations

Recent years have witnessed significant advancements in satellite technology and launch systems. Miniaturized satellites, offering increased affordability and flexibility, are gaining traction, alongside reusable launch vehicles aiming to reduce the cost of access to space. Advanced materials and propulsion systems are further enhancing satellite performance and longevity. These innovations are directly impacting the cost-effectiveness and operational efficiency of satellite deployments, thereby driving market growth.

Propelling Factors for Europe Satellite Manufacturing and Launch Systems Market Growth

The European satellite manufacturing and launch systems market is propelled by several key factors. Firstly, increasing demand for Earth observation data from both government and commercial entities fuels market growth. Secondly, the rise of the NewSpace industry, characterized by private investment and innovation, is significantly impacting the market. Finally, supportive government policies and regulatory frameworks within Europe, fostering technological advancements, are vital in driving market expansion.

Obstacles in the Europe Satellite Manufacturing and Launch Systems Market

Several challenges hinder the growth of the European satellite manufacturing and launch systems market. Stringent regulatory compliance requirements increase operational costs and complexities. Supply chain vulnerabilities, exacerbated by geopolitical factors, can disrupt production and increase lead times. Furthermore, intense competition from established players and new entrants presents a significant obstacle. These challenges collectively impede market growth and increase the operational risks for businesses in this sector.

Future Opportunities in Europe Satellite Manufacturing and Launch Systems Market

Emerging opportunities abound for the European satellite manufacturing and launch systems market. The expanding use of satellite constellations for broadband internet access presents substantial growth potential. Further advancements in miniaturization and reusable launch technologies are set to lower costs and increase accessibility. Finally, the increasing demand for satellite-based services in emerging sectors, such as IoT and autonomous vehicles, offers untapped potential.

Major Players in the Europe Satellite Manufacturing and Launch Systems Market Ecosystem

- QinetiQ

- OneWeb

- JSC Information Satellite Systems Reshetnev

- Safran SA

- Thales Group

- ArianeGroup

- OHB SE

- Surrey Satellite Technology Ltd

- GomSpace

- Berlin Space Technologies GmbH

- Avio SpA

- EnduroSat

- AAC Clyde Space

Key Developments in Europe Satellite Manufacturing and Launch Systems Market Industry

- January 2023: ArianeGroup successfully launches a new generation of launch vehicle, significantly enhancing payload capacity.

- June 2022: OHB SE announces a major contract for the production of Earth observation satellites.

- October 2021: Thales Alenia Space and OHB SE merge their space transportation activities, creating a larger entity.

- Further key developments will be detailed in the full report.

Strategic Europe Satellite Manufacturing and Launch Systems Market Forecast

The European satellite manufacturing and launch systems market is poised for robust growth driven by escalating demand for satellite-based services, technological innovations like miniaturization and reusability, and supportive government policies. Continued investment in research and development, combined with strategic partnerships and mergers, will further fuel market expansion. The market's potential is immense, with significant opportunities across various sectors, ensuring sustained growth throughout the forecast period.

Europe Satellite Manufacturing and Launch Systems Market Segmentation

-

1. Type

- 1.1. Satellite

- 1.2. Launch Systems

-

2. End-user

- 2.1. Civil

- 2.2. Commercial

- 2.3. Military

Europe Satellite Manufacturing and Launch Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Rest of Europe

Europe Satellite Manufacturing and Launch Systems Market Regional Market Share

Geographic Coverage of Europe Satellite Manufacturing and Launch Systems Market

Europe Satellite Manufacturing and Launch Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Segment Held the Largest Market Share in 2019

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Satellite Manufacturing and Launch Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satellite

- 5.1.2. Launch Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Civil

- 5.2.2. Commercial

- 5.2.3. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 QinetiQ

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OneWeb

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JSC Information Satellite Systems Reshetne

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thales Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ArianeGroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OHB SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Surrey Satellite Technology Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GomSpace

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berlin Space Technologies GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Avio SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 EnduroSat

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AAC Clyde Space

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 QinetiQ

List of Figures

- Figure 1: Europe Satellite Manufacturing and Launch Systems Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Satellite Manufacturing and Launch Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 3: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 6: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Italy Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Satellite Manufacturing and Launch Systems Market?

The projected CAGR is approximately 16.1%.

2. Which companies are prominent players in the Europe Satellite Manufacturing and Launch Systems Market?

Key companies in the market include QinetiQ, OneWeb, JSC Information Satellite Systems Reshetne, Safran SA, Thales Group, ArianeGroup, OHB SE, Surrey Satellite Technology Ltd, GomSpace, Berlin Space Technologies GmbH, Avio SpA, EnduroSat, AAC Clyde Space.

3. What are the main segments of the Europe Satellite Manufacturing and Launch Systems Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Segment Held the Largest Market Share in 2019.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Satellite Manufacturing and Launch Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Satellite Manufacturing and Launch Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Satellite Manufacturing and Launch Systems Market?

To stay informed about further developments, trends, and reports in the Europe Satellite Manufacturing and Launch Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence