Key Insights

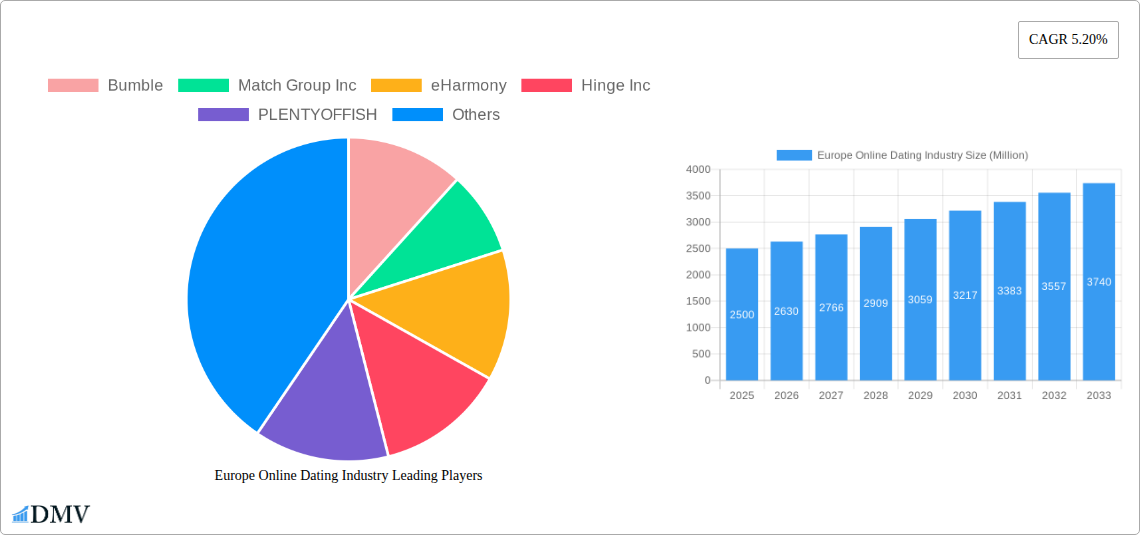

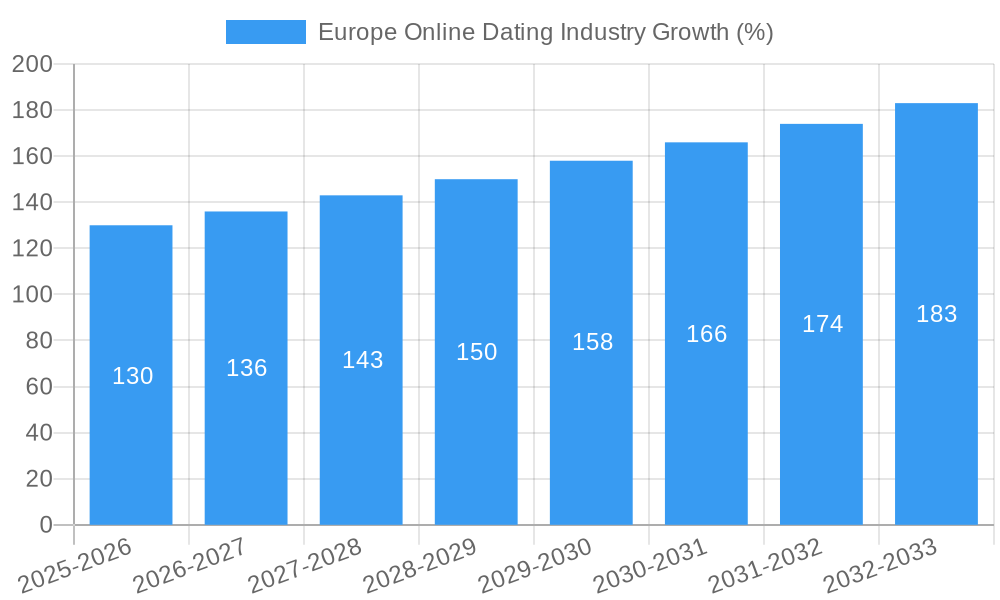

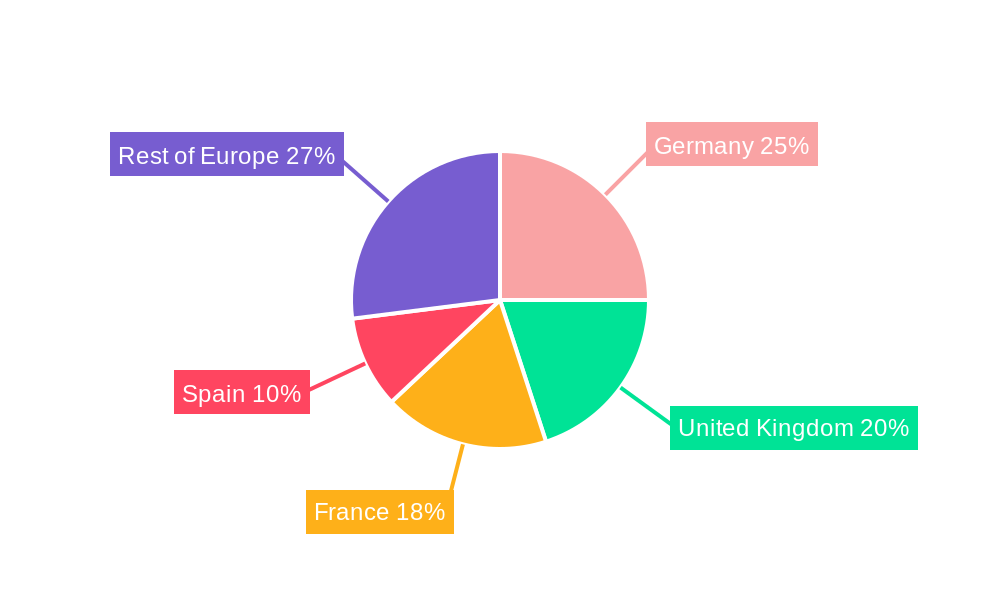

The European online dating market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.20%, is poised for significant expansion throughout the forecast period (2025-2033). Driven by increasing smartphone penetration, evolving social norms around online dating, and a growing preference for convenience in finding romantic partners, the market is witnessing a surge in both paying and non-paying users. Germany, the United Kingdom, and France represent the largest national markets within Europe, contributing significantly to the overall market value. The segmentation reveals a dynamic landscape with substantial growth projected in the paying online dating segment, driven by premium features and enhanced user experiences offered by platforms like Bumble, Tinder, and Match Group Inc. Competition among established players and emerging newcomers continues to fuel innovation, with features like advanced matching algorithms and improved safety measures attracting and retaining users. While data privacy concerns and potential for scams present challenges, the overall positive trend suggests sustained growth for the foreseeable future. The rising adoption of dating apps across various age demographics further bolsters the market's promising trajectory.

Factors contributing to this growth include the increasing digital literacy of the population, particularly among younger demographics, making online interactions commonplace. The convenience of online platforms, offering efficient searching and filtering based on user preferences, makes it an attractive alternative to traditional methods of finding partners. Moreover, the continuous development of app features such as enhanced safety protocols and improved user interfaces enhances user engagement. However, competition remains intense, demanding constant innovation and adaptation from existing market participants. This necessitates a focus on user experience, data security, and the creation of engaging features that address diverse needs and preferences within the user base. The continued expansion across the European landscape, with countries beyond the major markets contributing to the overall growth, is a key factor in the positive forecast for this dynamic industry.

Europe Online Dating Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Europe online dating industry, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report analyzes a market valued at xx Million in 2025, projected to reach xx Million by 2033, showcasing significant growth potential.

Europe Online Dating Industry Market Composition & Trends

This section delves into the competitive landscape of the European online dating market, analyzing market concentration, innovation drivers, regulatory factors, substitute products, user demographics, and merger and acquisition (M&A) activities. We examine the market share distribution amongst key players, including Bumble, Match Group Inc, eHarmony, Hinge Inc, PLENTYOFFISH, LOVOO GmbH, Meetic, Badoo, Tinder, happn, and OkCupid, amongst others. The report further analyzes the impact of M&A activities, including deal values and their influence on market dynamics, with a particular focus on the acquisition of Fruitz by Bumble in 2022.

- Market Concentration: Analysis of market share held by top players, identifying dominant players and emerging competitors. The report quantifies market concentration using appropriate metrics like the Herfindahl-Hirschman Index (HHI).

- Innovation Catalysts: Examination of technological advancements driving innovation within the industry, such as AI-powered matching algorithms and enhanced user experience features.

- Regulatory Landscape: Assessment of the regulatory environment across different European countries, including data privacy regulations (GDPR) and their impact on industry practices.

- Substitute Products: Identification and analysis of substitute products and services that compete with online dating platforms, such as social media platforms and traditional dating methods.

- End-User Profiles: Segmentation of the user base based on demographics, preferences, and usage patterns, providing insights into the evolving needs of online daters.

- M&A Activities: Detailed analysis of recent mergers and acquisitions, including deal values and their strategic implications for the market landscape. For example, the Bumble/Fruitz acquisition is analyzed in detail, highlighting the strategic rationale and potential impact.

Europe Online Dating Industry Industry Evolution

This section provides a comprehensive analysis of the evolution of the European online dating industry, exploring market growth trajectories, technological advancements, and shifts in consumer preferences. We examine the historical period (2019-2024) and project future growth (2025-2033), providing detailed data points on growth rates and adoption metrics across different segments. The analysis includes the impact of mobile technology, social media integration, and evolving user expectations on market dynamics. This section also looks at how changes in societal attitudes toward online dating and relationships have influenced industry growth and trends.

Leading Regions, Countries, or Segments in Europe Online Dating Industry

This section identifies the dominant regions, countries, and segments within the European online dating market. We provide a detailed analysis of the key drivers behind the dominance of specific regions and segments, including investment trends, regulatory support, and cultural factors. This analysis will include data on the number of users and penetration rates for both paying and non-paying online dating services in Germany, the United Kingdom, France, Spain, and the Rest of Europe.

- By Type: A comparative analysis of the growth and user base of paying and non-paying online dating services, identifying trends and factors influencing user choices. This includes the penetration rates for each segment.

- By Country: A detailed analysis of the market performance across key European countries (Germany, UK, France, Spain), including market size, growth rates, and user demographics. The "Rest of Europe" segment will also be analyzed.

- Key Drivers (Bullet Points): Specific examples of investment trends, regulatory support, and cultural influences that drive market leadership in specific regions or segments.

Europe Online Dating Industry Product Innovations

This section details recent product innovations, application features, and key performance metrics within the online dating industry. The analysis highlights the unique selling propositions of different platforms and the role of technological advancements in driving user engagement and market differentiation. Examples include AI-powered matching algorithms, enhanced safety features, and virtual dating experiences.

Propelling Factors for Europe Online Dating Industry Growth

This section identifies and analyzes the key growth drivers of the European online dating industry. These drivers include technological advancements (e.g., improved matching algorithms, mobile accessibility), evolving social and cultural norms (e.g., increased acceptance of online dating), and economic factors (e.g., rising disposable incomes).

Obstacles in the Europe Online Dating Industry Market

This section outlines the challenges and barriers facing the European online dating industry. This includes regulatory hurdles (e.g., data privacy regulations), competitive pressures (e.g., intense competition among numerous platforms), and the potential for supply chain disruptions. Quantifiable impacts of these challenges will be included whenever possible (e.g., market share loss due to regulatory changes).

Future Opportunities in Europe Online Dating Industry

This section explores emerging opportunities for growth within the European online dating industry. This includes new market segments (e.g., niche dating apps), technological innovations (e.g., metaverse integration), and changing consumer preferences (e.g., demand for greater authenticity and transparency).

Major Players in the Europe Online Dating Industry Ecosystem

- Bumble

- Match Group Inc

- eHarmony

- Hinge Inc

- PLENTYOFFISH

- LOVOO GmbH

- Meetic

- Badoo

- Tinder

- happn

- OkCupid

- List Not Exhaustive

Key Developments in Europe Online Dating Industry Industry

- February 2022: Bumble Inc. announced the acquisition of Fruitz, a fast-growing dating app popular with Gen Z.

Strategic Europe Online Dating Industry Market Forecast

This section summarizes the key growth catalysts for the European online dating industry, providing a concise overview of the future market potential. It will reiterate the key findings from previous sections, highlighting the most promising opportunities for growth and investment. The predicted market value for 2033 will be restated, along with a summary of the major trends shaping the future of the industry.

Europe Online Dating Industry Segmentation

-

1. Type

- 1.1. Non- paying online dating

- 1.2. Paying Online Dating

Europe Online Dating Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Dating Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices

- 3.3. Market Restrains

- 3.3.1. Rising fake accounts is set to create hurdles for the Online Dating Services Market.

- 3.4. Market Trends

- 3.4.1. Non Paying Online Dating to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Non- paying online dating

- 5.1.2. Paying Online Dating

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Bumble

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Match Group Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 eHarmony

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hinge Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PLENTYOFFISH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 LOVOO GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Meetic

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Badoo

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Tinder

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 happn

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ok Cupid*List Not Exhaustive

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Bumble

List of Figures

- Figure 1: Europe Online Dating Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Online Dating Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Online Dating Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Online Dating Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Online Dating Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Online Dating Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Online Dating Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Online Dating Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Dating Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Europe Online Dating Industry?

Key companies in the market include Bumble, Match Group Inc, eHarmony, Hinge Inc, PLENTYOFFISH, LOVOO GmbH, Meetic, Badoo, Tinder, happn, Ok Cupid*List Not Exhaustive.

3. What are the main segments of the Europe Online Dating Industry?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices.

6. What are the notable trends driving market growth?

Non Paying Online Dating to Show Significant Growth.

7. Are there any restraints impacting market growth?

Rising fake accounts is set to create hurdles for the Online Dating Services Market..

8. Can you provide examples of recent developments in the market?

February 2022 - Bumble Inc announced the acquisition of Fruitz, one of Europe's fastest-growing dating apps. The dating app is popular with Gen Z, a growing segment of online dating consumers. Such acquisitions by the major players in the region are promoting the growth of inline dating app services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Dating Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Dating Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Dating Industry?

To stay informed about further developments, trends, and reports in the Europe Online Dating Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence