Key Insights

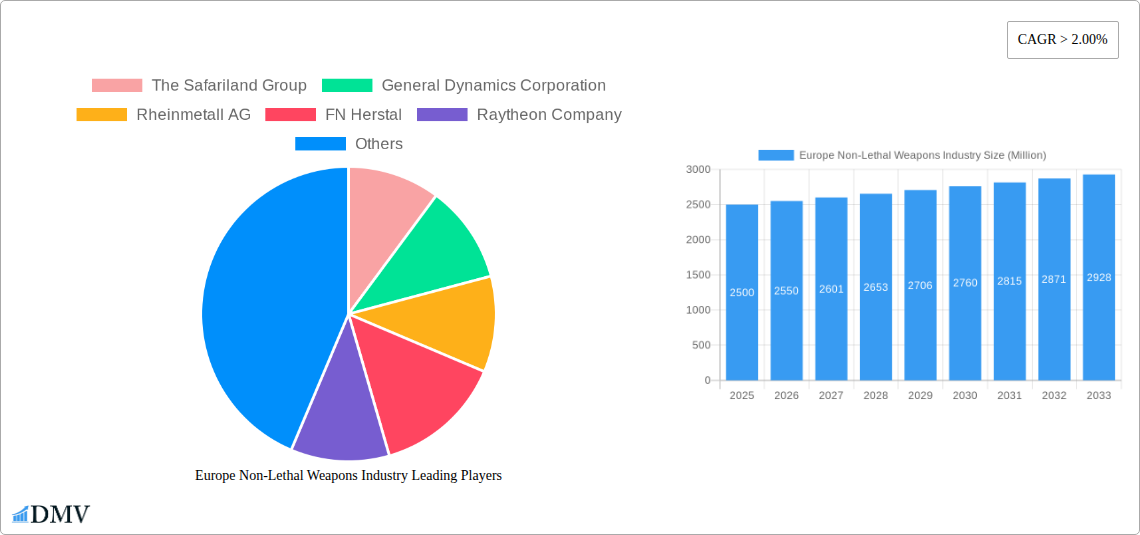

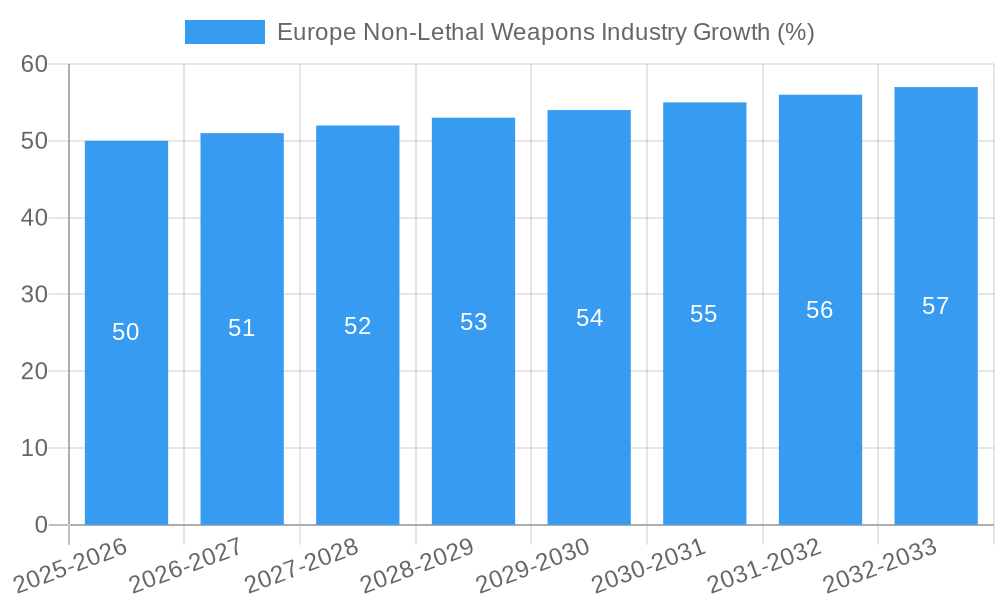

The European non-lethal weapons market, valued at approximately €2.5 billion in 2025, is projected to experience robust growth, driven by increasing demand from law enforcement agencies and militaries across the region. A Compound Annual Growth Rate (CAGR) exceeding 2% signifies a steady expansion through 2033. Key drivers include escalating civil unrest in certain areas, a rising need for crowd control measures, and the increasing adoption of less-lethal technologies by security forces aiming to minimize collateral damage. Significant growth is anticipated within the area denial systems and directed energy weapons segments, reflecting advancements in technology and their effectiveness in various scenarios. While regulatory hurdles and ethical concerns surrounding the use of non-lethal weapons present some restraints, the overall market outlook remains positive, fueled by continuous technological improvements and evolving operational needs.

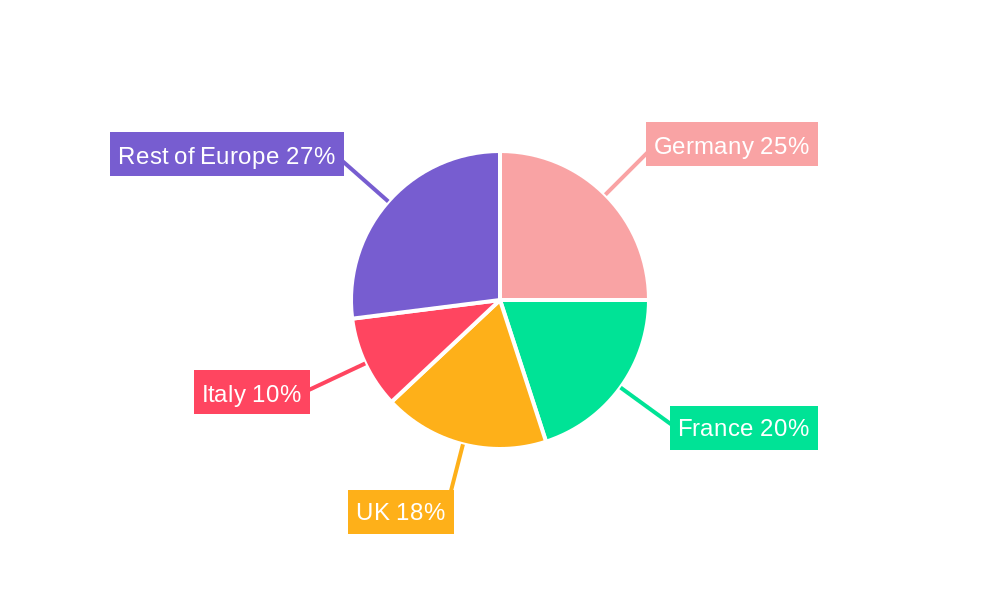

Market segmentation reveals a significant contribution from Law Enforcement applications, which consistently seek updated equipment to manage public order and respond to threats effectively. The Military segment, while smaller, demonstrates significant growth potential given the ongoing exploration of advanced non-lethal technologies for operations requiring minimal harm to civilians or combatants. Germany, France, and the United Kingdom represent the largest national markets within Europe, reflecting their relatively larger defense budgets and more developed security infrastructure. However, consistent growth is also projected across other European nations as they upgrade their non-lethal weaponry arsenals to match evolving security challenges. The competitive landscape includes established defense contractors and specialized non-lethal weapon manufacturers, with intense competition expected as companies strive for market share and technological advancements.

Europe Non-Lethal Weapons Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European non-lethal weapons market, offering invaluable insights for stakeholders seeking to understand its current state and future trajectory. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, technological advancements, and key players shaping this dynamic sector. The report utilizes a robust methodology incorporating both historical data (2019-2024) and projections (2025-2033) to deliver precise forecasts and actionable intelligence. The market size in 2025 is estimated at XX Million, with a projected growth to XX Million by 2033.

Europe Non-Lethal Weapons Industry Market Composition & Trends

This section examines the competitive landscape of the European non-lethal weapons market, focusing on market concentration, innovation, regulatory factors, and market dynamics. The market is characterized by a moderately concentrated structure, with key players holding significant market share. The Safariland Group, General Dynamics Corporation, Rheinmetall AG, and BAE Systems PLC are among the prominent companies contributing to the overall market value. The estimated market share distribution in 2025 is as follows: The Safariland Group (XX%), General Dynamics Corporation (XX%), Rheinmetall AG (XX%), and others (XX%). Innovation in non-lethal technologies is a major driver, with continuous advancements in directed energy weapons and electroshock devices. Strict regulatory frameworks across European nations significantly impact market growth and product development. The presence of substitute products, such as less-lethal chemical agents, influences market competition. Furthermore, the report analyzes mergers and acquisitions (M&A) activities, estimating the total deal value during the historical period (2019-2024) at approximately XX Million. Key M&A activities involved companies focusing on expanding their product portfolios and geographical reach. End-user analysis reveals significant demand from law enforcement and military sectors, with growing interest from private security companies.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation: Continuous advancements in directed energy weapons and electroshock devices.

- Regulatory Landscape: Stringent regulations influencing market growth and product development.

- Substitute Products: Presence of less-lethal alternatives impacting market competition.

- M&A Activity: Total deal value (2019-2024) estimated at XX Million.

- End-User Profile: Predominantly law enforcement and military, with growing private security interest.

Europe Non-Lethal Weapons Industry Industry Evolution

The European non-lethal weapons market has witnessed significant evolution since 2019. Market growth has been driven by increasing demand from law enforcement agencies seeking to minimize collateral damage during operations, coupled with rising military adoption of non-lethal technologies for crowd control and peacekeeping missions. Technological advancements, particularly in directed energy weapons and less-lethal ammunition, have expanded the market's capabilities and applications. The market experienced a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024), and is projected to maintain a CAGR of XX% during the forecast period (2025-2033). The adoption rate of new technologies, especially in advanced electroshock weapons and area denial systems, is increasing steadily, driven by technological improvements and evolving tactical requirements. Changing consumer demands are also shaping the market, with a growing emphasis on precision, reduced collateral damage, and improved human rights compliance. This has fostered the development of more sophisticated and effective non-lethal weaponry.

Leading Regions, Countries, or Segments in Europe Non-Lethal Weapons Industry

Germany and the UK represent the leading markets within Europe, owing to robust defense budgets, active participation in international peacekeeping operations, and a strong focus on internal security. The Area Denial and Ammunition segments show the most significant growth, fueled by continuous demand from military and law enforcement applications.

Key Drivers:

- Germany: Strong defense budget, technological advancements, and proactive law enforcement policies.

- UK: High defense expenditure, ongoing military engagements, and robust internal security needs.

- Area Denial Systems: Increasing demand for perimeter security and crowd control solutions.

- Ammunition: Consistent demand for less-lethal projectiles across law enforcement and military applications.

Dominance Factors:

Germany and the UK's dominance is primarily driven by their considerable defense spending, the presence of established manufacturers, and a receptive regulatory environment. Further analysis indicates that the Area Denial and Ammunition segments are leading due to their wide-ranging applications and continuous technological advancements.

Europe Non-Lethal Weapons Industry Product Innovations

Recent innovations focus on enhanced precision, reduced collateral damage, and improved user safety. New materials and technologies have led to more effective and reliable products. Directed energy weapons are experiencing rapid development, with advancements in accuracy and range. Electroshock weapons are becoming more sophisticated, incorporating features for improved control and reduced risk of injury. These improvements are continuously driving market expansion and adoption.

Propelling Factors for Europe Non-Lethal Weapons Industry Growth

Technological advancements are the primary driver, with continuous improvements in precision, effectiveness, and safety of non-lethal weapons. The growing demand from law enforcement agencies for safer alternatives to lethal force contributes significantly to market expansion. Furthermore, increasing military investments in non-lethal technologies for peacekeeping and crowd control operations further fuel market growth. Favorable regulatory environments in some European nations also support industry development.

Obstacles in the Europe Non-Lethal Weapons Industry Market

Strict regulatory frameworks in certain European countries pose significant barriers to entry and product innovation. Supply chain disruptions, particularly related to the sourcing of critical components, can impact production and delivery timelines. Intense competition from established players limits the market share of new entrants. These factors, taken together, may restrain market expansion at certain rates.

Future Opportunities in Europe Non-Lethal Weapons Industry

The increasing adoption of non-lethal weapons by private security companies presents a significant opportunity for market expansion. Technological advancements in directed energy weapons and AI-powered systems offer considerable potential for future growth. The exploration of new markets, particularly in emerging economies, presents untapped potential for industry players.

Major Players in the Europe Non-Lethal Weapons Industry Ecosystem

- The Safariland Group

- General Dynamics Corporation

- Rheinmetall AG

- FN Herstal

- Raytheon Company

- RUAG Group

- Fiocchi Munizioni SpA

- BAE Systems PLC

- AARDVAR

Key Developments in Europe Non-Lethal Weapons Industry Industry

- 2022-Q4: Rheinmetall AG announced a significant investment in the development of advanced directed energy weapons.

- 2023-Q1: The Safariland Group launched a new line of less-lethal ammunition with improved accuracy.

- 2023-Q3: A merger between two smaller companies specializing in electroshock weapons led to the creation of a larger market player. (Further specific details require more information)

Strategic Europe Non-Lethal Weapons Industry Market Forecast

The European non-lethal weapons market is poised for sustained growth, driven by continuous technological innovation, increasing demand from both military and law enforcement sectors, and expanding applications across various industries. The forecast period of 2025-2033 predicts significant expansion, largely attributed to the increasing adoption of advanced technologies and the growing global focus on minimizing collateral damage during conflict and security operations. This trend will continue to shape the market's trajectory and present considerable opportunities for existing players and new entrants.

Europe Non-Lethal Weapons Industry Segmentation

-

1. Type

- 1.1. Area Denial

- 1.2. Ammunition

- 1.3. Explosives

- 1.4. Gases and Sprays

- 1.5. Directed Energy Weapons

- 1.6. Electroshock Weapons

-

2. Application

- 2.1. Law Enforcement

- 2.2. Military

Europe Non-Lethal Weapons Industry Segmentation By Geography

-

1. By Country

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Non-Lethal Weapons Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Area Denial

- 5.1.2. Ammunition

- 5.1.3. Explosives

- 5.1.4. Gases and Sprays

- 5.1.5. Directed Energy Weapons

- 5.1.6. Electroshock Weapons

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Law Enforcement

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. By Country

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 The Safariland Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 General Dynamics Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Rheinmetall AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 FN Herstal

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Raytheon Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 RUAG Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fiocchi Munizioni SpA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BAE Systems PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AARDVAR

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 The Safariland Group

List of Figures

- Figure 1: Europe Non-Lethal Weapons Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Non-Lethal Weapons Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Non-Lethal Weapons Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Europe Non-Lethal Weapons Industry?

Key companies in the market include The Safariland Group, General Dynamics Corporation, Rheinmetall AG, FN Herstal, Raytheon Company, RUAG Group, Fiocchi Munizioni SpA, BAE Systems PLC, AARDVAR.

3. What are the main segments of the Europe Non-Lethal Weapons Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Non-Lethal Weapons Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Non-Lethal Weapons Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Non-Lethal Weapons Industry?

To stay informed about further developments, trends, and reports in the Europe Non-Lethal Weapons Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence