Key Insights

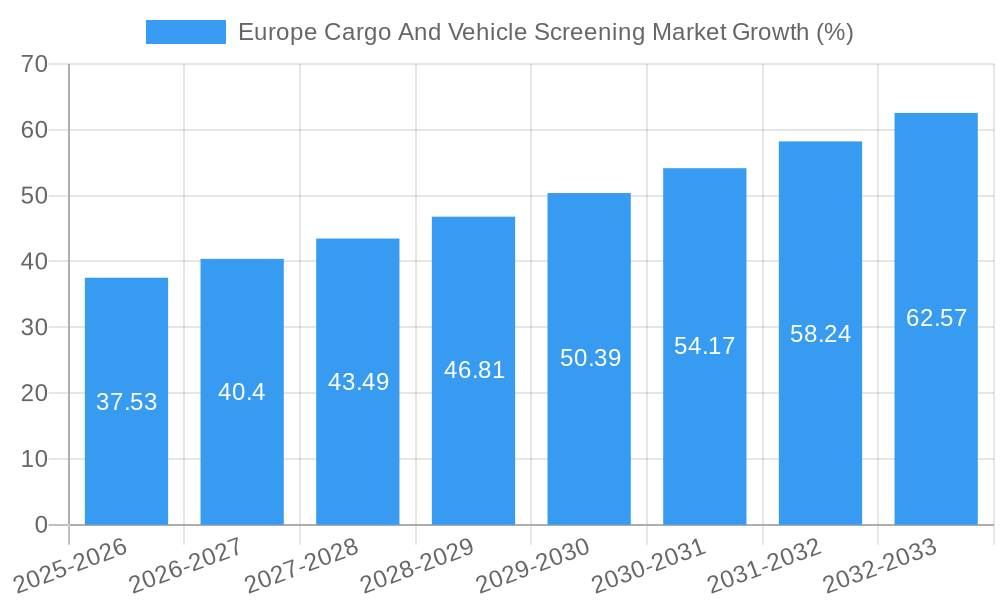

The Europe Cargo and Vehicle Screening Market is experiencing robust growth, projected to reach \$608.20 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This expansion is driven by several key factors. Increasing security concerns related to terrorism and organized crime are compelling governments and private entities to invest heavily in advanced screening technologies. The rise in e-commerce and global trade necessitates efficient and secure cargo screening processes to manage the increased volume of goods moving across borders. Furthermore, technological advancements in X-ray imaging, millimeter-wave scanners, and explosive detection systems are leading to more accurate, faster, and less intrusive screening methods, fueling market adoption. Regulations mandating enhanced security protocols at ports, airports, and border crossings further contribute to the market's growth trajectory.

Competitive landscape analysis reveals a mix of established players like Rapiscan Systems, Smiths Detection, and OSI Systems alongside emerging technology providers. These companies are constantly innovating to meet evolving security needs and cater to specific industry segments. While market growth is positive, potential restraints include high initial investment costs associated with deploying advanced screening equipment and the need for ongoing maintenance and skilled personnel to operate these systems. Furthermore, the market may face challenges from budgetary constraints in certain regions and the need for continuous adaptation to address evolving threats and technological advancements in bypassing security measures. This necessitates strategic partnerships, technological collaborations, and continuous R&D to ensure long-term market success. The market segmentation is likely diverse, encompassing various screening technologies (X-ray, millimeter-wave, etc.), application types (cargo, vehicles, passengers), and end-users (government agencies, transportation companies, private security firms).

Europe Cargo and Vehicle Screening Market: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Europe Cargo and Vehicle Screening Market, providing a detailed overview of market trends, key players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this dynamic market. The market size in 2025 is estimated at xx Million, and is projected to reach xx Million by 2033.

Europe Cargo and Vehicle Screening Market Market Composition & Trends

The Europe Cargo and Vehicle Screening Market is characterized by a moderately concentrated landscape, with several key players vying for market share. Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the total market share. Innovation is driven by advancements in imaging technology, AI-powered threat detection, and improved operational efficiency. The regulatory landscape, heavily influenced by EU directives on security and transportation, plays a significant role in shaping market dynamics. Substitute products are limited, primarily focusing on traditional manual inspection methods. End-users comprise airports, seaports, border control agencies, and logistics companies. M&A activity is moderate, with deal values averaging xx Million per transaction in the past five years. Notable recent transactions include [insert details of specific M&A activities if available, otherwise state "data unavailable"].

- Market Share Distribution: [Insert estimated market share data for top 5 companies if available. Otherwise, state "data unavailable."]

- M&A Activity: Average deal value: xx Million (2019-2024) – [Insert number of transactions if available, otherwise state "data unavailable."]

- Innovation Catalysts: AI-powered threat detection, advanced imaging technologies, improved data analytics.

- Regulatory Landscape: EU regulations on security and transportation heavily influence market adoption.

Europe Cargo and Vehicle Screening Market Industry Evolution

The Europe Cargo and Vehicle Screening Market has witnessed consistent growth over the historical period (2019-2024), driven by increasing security concerns and stricter regulatory compliance requirements. Technological advancements, particularly in X-ray imaging and radiation detection technologies, have significantly improved the accuracy and efficiency of screening processes. The market experienced an average annual growth rate (CAGR) of xx% during 2019-2024. The demand is projected to increase further, driven by rising passenger and cargo traffic, increased investment in airport infrastructure modernization, and the growing adoption of automated screening systems. The forecast period (2025-2033) anticipates a CAGR of xx%, with projected market size reaching xx Million by 2033. The adoption of new technologies such as AI-powered anomaly detection is accelerating, with xx% of major airports adopting these technologies by 2028. [Further expand on growth trajectories and adoption metrics with specific data points if available.]

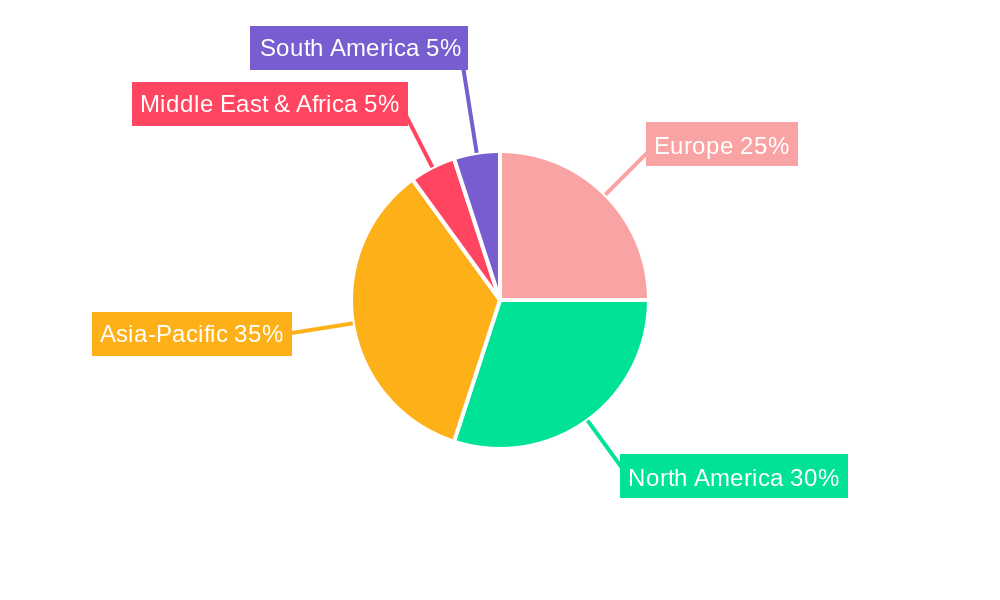

Leading Regions, Countries, or Segments in Europe Cargo and Vehicle Screening Market

The [Insert name of leading region/country, e.g., UK or Germany] segment currently holds the largest market share in the European Cargo and Vehicle Screening Market, representing approximately xx% of the total market.

- Key Drivers in Leading Region/Country:

- Significant investments in airport and port infrastructure upgrades.

- Stringent regulatory compliance requirements.

- High passenger and cargo traffic volume.

- [Add other key drivers specific to the leading region]

[Provide detailed analysis, explaining the factors contributing to the dominance of this specific region/country, expanding on the above bullet points with supporting data.]

Europe Cargo and Vehicle Screening Market Product Innovations

Recent product innovations focus on enhancing speed, accuracy, and efficiency of screening processes. This includes the development of advanced X-ray systems with improved image quality and automated threat detection capabilities. AI-powered algorithms analyze images in real-time, identifying potential threats more efficiently than traditional methods. Manufacturers are also focusing on reducing the environmental footprint of their equipment, utilizing energy-efficient components and reducing radiation output. Key selling propositions revolve around improved detection rates, faster processing times, reduced false alarms, and enhanced operational efficiency.

Propelling Factors for Europe Cargo and Vehicle Screening Market Growth

The market's growth is fueled by several key factors: Increased security concerns following major global events, stricter regulations mandating advanced screening technologies, rising passenger and cargo traffic at European airports and seaports, and advancements in imaging and detection technologies leading to more efficient and accurate screening. Furthermore, government investments in improving transportation infrastructure and the increasing adoption of AI-powered solutions are further driving growth.

Obstacles in the Europe Cargo and Vehicle Screening Market Market

Market growth faces challenges such as high initial investment costs associated with advanced screening equipment, supply chain disruptions impacting the availability of components, and intense competition among established players, leading to price pressure. Regulatory hurdles and variations across different European countries create complexities for market participants. The impact of these obstacles is estimated to reduce market growth by approximately xx% during the forecast period.

Future Opportunities in Europe Cargo and Vehicle Screening Market

Emerging opportunities lie in the expanding adoption of AI and machine learning for threat detection, the development of more efficient and environmentally friendly screening technologies, and the expansion into new market segments such as rail and road transport. Growth opportunities also exist in improving cybersecurity of screening systems and developing advanced data analytics capabilities to enhance situational awareness and intelligence gathering.

Major Players in the Europe Cargo and Vehicle Screening Market Ecosystem

- Rapiscan Systems

- 3DX-RAY

- LINEV Systems

- Nuctech Company Limited

- Westminster Group Plc

- Leidos Inc

- OSI Systems

- Braun & Co Limited

- Smiths Detection Group Ltd

- Vantage Security

- Intertek Group plc

- MION Technologies

- L3 Security & Detection Systems

- [List Not Exhaustive]

Key Developments in Europe Cargo and Vehicle Screening Market Industry

- September 2023: Leidos partnered with Sofia Airport in Bulgaria to enhance its hold baggage screening systems.

- March 2024: OSI Systems Inc. secured a USD 5 million contract for deploying 920CT baggage screening technology at a major European airport.

Strategic Europe Cargo and Vehicle Screening Market Market Forecast

The Europe Cargo and Vehicle Screening Market is poised for significant growth driven by continued investments in advanced technologies, stringent security regulations, and increasing passenger and cargo volumes. The market’s future trajectory is positive, with opportunities arising from technological advancements, expanding applications, and growing awareness of security concerns. This suggests strong potential for market expansion and attractive returns for investors and market participants.

Europe Cargo And Vehicle Screening Market Segmentation

-

1. Type of Screening System

- 1.1. Stationary Screening

- 1.2. Mobile Screening

-

2. End User Vertical

- 2.1. Airports

- 2.2. Ports and Borders

- 2.3. Government and Defense

- 2.4. Critical Infrastructure

- 2.5. Commercial

Europe Cargo And Vehicle Screening Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Cargo And Vehicle Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU

- 3.3. Market Restrains

- 3.3.1. Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU

- 3.4. Market Trends

- 3.4.1. Mobile Screening Devices to Witness Substantial Growth in Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cargo And Vehicle Screening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 5.1.1. Stationary Screening

- 5.1.2. Mobile Screening

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Airports

- 5.2.2. Ports and Borders

- 5.2.3. Government and Defense

- 5.2.4. Critical Infrastructure

- 5.2.5. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rapiscan Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3DX-RAY

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LINEV Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nuctech Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Westminster Group Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Leidos Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OSI Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Braun & Co Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Smiths Detection Group Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vantage Security

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Intertek Group plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MION Technologies

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 L3 Security & Detection Systems*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Rapiscan Systems

List of Figures

- Figure 1: Europe Cargo And Vehicle Screening Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Cargo And Vehicle Screening Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2019 & 2032

- Table 4: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Type of Screening System 2019 & 2032

- Table 5: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 6: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by End User Vertical 2019 & 2032

- Table 7: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2019 & 2032

- Table 10: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Type of Screening System 2019 & 2032

- Table 11: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 12: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by End User Vertical 2019 & 2032

- Table 13: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: France Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Italy Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Spain Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Netherlands Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Belgium Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Sweden Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Norway Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Norway Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 33: Poland Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Poland Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Denmark Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Denmark Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cargo And Vehicle Screening Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Europe Cargo And Vehicle Screening Market?

Key companies in the market include Rapiscan Systems, 3DX-RAY, LINEV Systems, Nuctech Company Limited, Westminster Group Plc, Leidos Inc, OSI Systems, Braun & Co Limited, Smiths Detection Group Ltd, Vantage Security, Intertek Group plc, MION Technologies, L3 Security & Detection Systems*List Not Exhaustive.

3. What are the main segments of the Europe Cargo And Vehicle Screening Market?

The market segments include Type of Screening System, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 608.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU.

6. What are the notable trends driving market growth?

Mobile Screening Devices to Witness Substantial Growth in Demand.

7. Are there any restraints impacting market growth?

Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU.

8. Can you provide examples of recent developments in the market?

March 2024 - OSI Systems Inc. announced a significant milestone as its Security division secured a USD 5 million contract. The deal entails deploying 920CT baggage screening technology at key passenger checkpoints within a prominent European international airport.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cargo And Vehicle Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cargo And Vehicle Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cargo And Vehicle Screening Market?

To stay informed about further developments, trends, and reports in the Europe Cargo And Vehicle Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence