Key Insights

The European Autonomous Underwater Vehicle (AUV) and Remotely Operated Vehicle (ROV) market is experiencing robust growth, driven by increasing offshore energy exploration and production activities, particularly within the oil and gas sector. The market's expansion is further fueled by rising demand for subsea infrastructure inspection, repair, and maintenance (IRM), as well as the growing adoption of AUVs and ROVs in defense applications, such as underwater surveillance and mine countermeasures. The market segmentation reveals a strong preference for work-class vehicles due to their enhanced capabilities for complex subsea operations. While ROVs currently dominate the market share due to their established presence and operational flexibility, AUVs are gaining traction, particularly in applications requiring extended operational endurance and autonomous navigation. The market is witnessing technological advancements such as improved sensor technology, enhanced navigation systems, and the integration of AI for improved efficiency and operational safety. This, in turn, is driving down operational costs and expanding the potential applications of these technologies across various sectors.

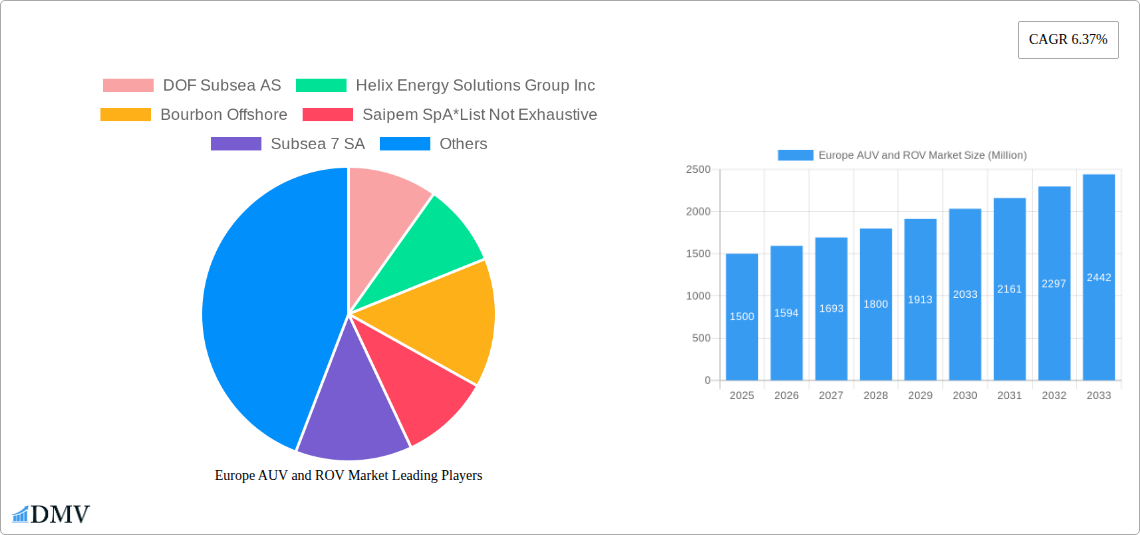

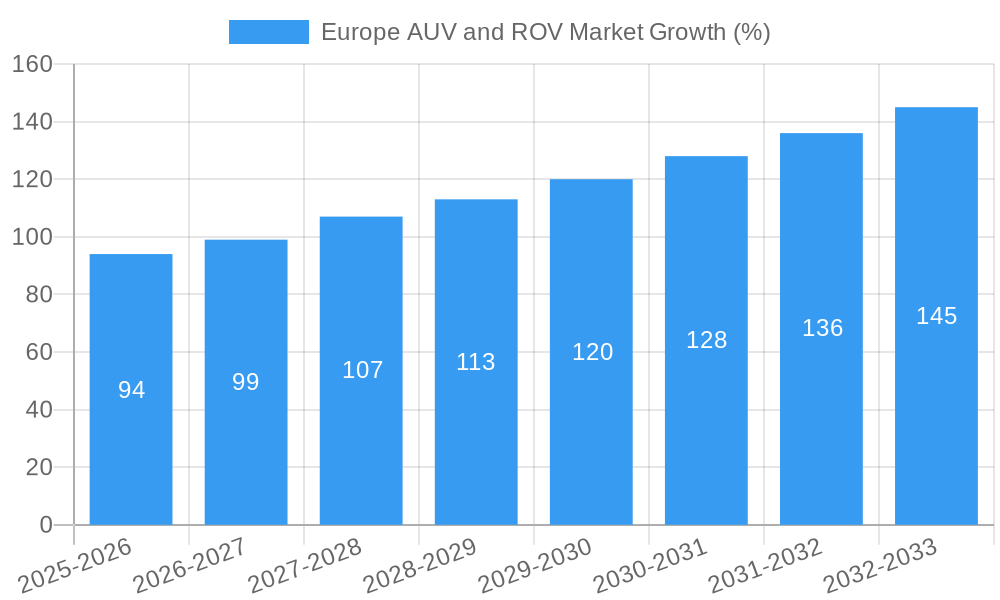

Despite the positive growth trajectory, several factors are likely to present challenges. These include the high initial investment costs associated with AUV and ROV procurement and maintenance, alongside stringent regulatory compliance requirements within the marine environment. The market's future growth will depend on overcoming these challenges, which includes fostering industry collaboration to standardize operational procedures and developing more cost-effective and sustainable solutions. The continued development and deployment of advanced technologies, coupled with supportive government policies, will play a crucial role in unlocking the full potential of the European AUV and ROV market. Germany, the UK, France, and Italy are expected to remain key market contributors due to their established offshore energy infrastructure and active research and development activities in underwater robotics. The projected CAGR of 6.37% indicates a significant expansion of the market through 2033, with consistent growth expected across all segments.

Europe AUV and ROV Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the European AUV and ROV market, offering a comprehensive overview of market dynamics, technological advancements, and future growth prospects. Valued at xx Million in 2025, the market is poised for significant expansion, reaching xx Million by 2033. This in-depth study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering stakeholders a complete understanding of this rapidly evolving sector.

Europe AUV and ROV Market Composition & Trends

This section delves into the competitive landscape of the European AUV and ROV market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The report analyzes market share distribution among key players, including DOF Subsea AS, Helix Energy Solutions Group Inc, Bourbon Offshore, Saipem SpA, Subsea 7 SA, and TechnipFMC PLC (list not exhaustive), providing a granular understanding of their respective positions. The analysis also explores the impact of M&A activities, quantifying deal values where available (xx Million) and assessing their influence on market consolidation and technological advancements. The study assesses the impact of substitute technologies and regulatory changes on market growth and player strategies. Finally, the report examines the varying end-user profiles and their unique needs within the diverse applications of AUVs and ROVs in Europe.

- Market Concentration: High (xx%), driven by a few major players.

- Innovation Catalysts: Increasing demand for efficient subsea operations, technological advancements in sensor technology, and autonomous navigation.

- Regulatory Landscape: Stringent safety regulations and environmental protection standards influencing operations.

- Substitute Products: Limited direct substitutes but competition from alternative subsea inspection methods.

- End-User Profiles: Oil & Gas, Defense, Renewable Energy, and Research Institutions.

- M&A Activities: xx Million in total deal value recorded between 2019-2024 (with potential for significant future activity).

Europe AUV and ROV Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the European AUV and ROV market from 2019 to 2033. It explores market growth trajectories, technological innovations, and shifting consumer demands, providing specific data points like growth rates and adoption metrics. The analysis focuses on the impact of emerging technologies, such as artificial intelligence (AI) and machine learning (ML), on enhancing the capabilities of AUVs and ROVs. It also examines changes in consumer preferences and the market's response to these evolving needs. Further, the report studies the impact of external factors like geopolitical events and economic fluctuations on the overall market performance. The report further explores the increasing demand for specialized AUV and ROV applications for specific subsea tasks across various industry sectors.

- CAGR (2025-2033): xx%

- Market Penetration Rate (2025): xx%

- Key Technological Advancements: Improved sensor technologies, AI-powered autonomy, enhanced maneuverability, and miniaturization.

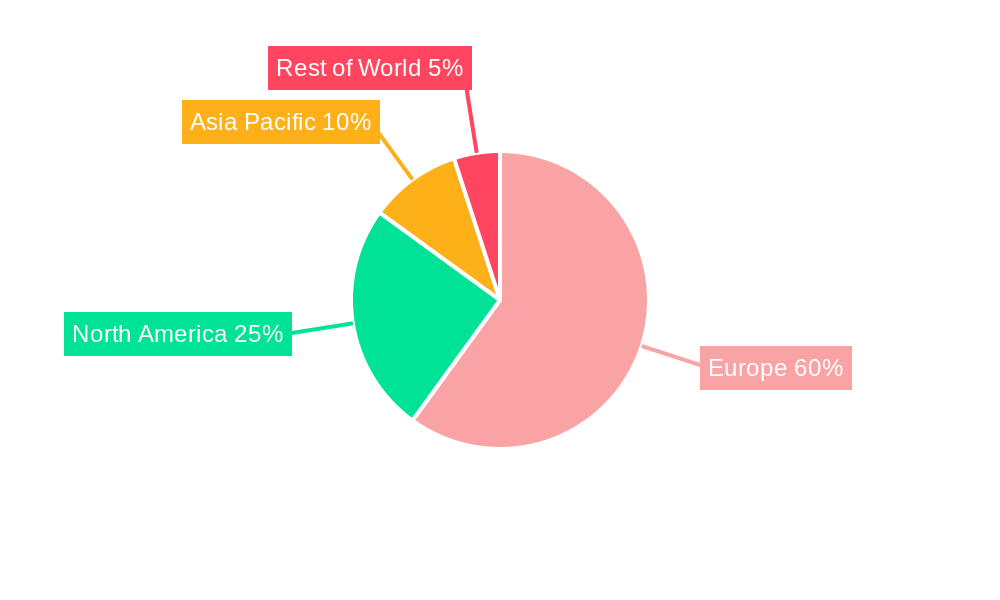

Leading Regions, Countries, or Segments in Europe AUV and ROV Market

This section identifies the leading regions, countries, and segments within the European AUV and ROV market. The analysis considers various segmentation parameters, including activity type, vehicle type, vehicle class, and application. The report highlights the key factors driving the dominance of specific regions, countries, or segments, including investment trends, regulatory support, and infrastructure development.

- By Activity: Inspection, Repair, and Maintenance (IRM) holds the largest market share, driven by the aging offshore infrastructure and increasing need for regular maintenance.

- By Vehicle Type: ROVs currently dominate, but AUVs are experiencing significant growth due to their increasing autonomy and efficiency.

- By Vehicle Class: Work-class vehicles are prevalent, catering to complex tasks; Observatory-class vehicles are gaining traction for scientific research.

- By Application: The Oil and Gas sector remains the largest end-user, but increasing investments in offshore wind energy are driving demand from the renewable energy sector.

- Key Drivers: Government incentives for offshore renewable energy projects, significant investments in subsea infrastructure upgrades, and robust research and development initiatives in underwater technologies.

Europe AUV and ROV Market Product Innovations

Recent years have witnessed significant product innovation in the AUV and ROV market, characterized by improved sensors, enhanced maneuverability, and advanced control systems. The incorporation of AI and ML algorithms allows for greater autonomy and improved data analysis capabilities. Several manufacturers have introduced compact and cost-effective designs, targeting niche applications and broadening market access. These innovations enhance operational efficiency, reduce operational costs, and extend the potential applications of AUVs and ROVs across various industries.

Propelling Factors for Europe AUV and ROV Market Growth

Several key factors drive the growth of the European AUV and ROV market. Technological advancements, like enhanced autonomy and improved sensor technology, are paramount. The increasing demand for efficient subsea operations within the offshore oil and gas sector remains a significant driver. Additionally, rising investments in offshore renewable energy infrastructure, particularly offshore wind farms, fuel market expansion. Favorable government policies and regulatory frameworks supporting subsea exploration and development also contribute to this growth.

Obstacles in the Europe AUV and ROV Market

Despite significant growth potential, several obstacles hinder the market's development. Regulatory complexities surrounding subsea operations, coupled with stringent safety standards, pose significant challenges. Supply chain disruptions and the availability of specialized components can impact production and deployment schedules. Furthermore, intense competition among established players and the emergence of new entrants create price pressures and intensify the struggle for market share.

Future Opportunities in Europe AUV and ROV Market

The European AUV and ROV market presents numerous future opportunities. Expanding applications in offshore wind energy, oceanographic research, and subsea mining offer significant growth potential. The development of more sophisticated AI-powered autonomous systems and improved battery technologies will further enhance operational efficiency and expand capabilities. The exploration of deeper waters and harsher environments presents new technological challenges and opportunities for innovation.

Major Players in the Europe AUV and ROV Market Ecosystem

- DOF Subsea AS

- Helix Energy Solutions Group Inc

- Bourbon Offshore

- Saipem SpA

- Subsea 7 SA

- TechnipFMC PLC

Key Developments in Europe AUV and ROV Market Industry

- January 2022: Fugro secures a contract from Denmark's Energinet for cable route surveys in the North Sea Energy Island project, showcasing the expanding role of AUVs and ROVs in the renewable energy sector.

- March 2022: Kongsberg Maritime launches the HUGIN Edge AUV, highlighting advancements in AUV design and deployment flexibility.

Strategic Europe AUV and ROV Market Forecast

The European AUV and ROV market is expected to experience robust growth driven by technological advancements, increasing demand from various sectors, and supportive government policies. Future opportunities lie in expanding applications within renewable energy, enhanced autonomous operations, and the development of specialized solutions for complex subsea tasks. The market's growth potential is significant, driven by continuous technological innovation and increasing investment in subsea infrastructure.

Europe AUV and ROV Market Segmentation

-

1. Vehicle Type

- 1.1. ROV

- 1.2. AUV

-

2. Vehicle Class

- 2.1. Work Class Vehicle

- 2.2. Observatory Class Vehicle

-

3. Application

- 3.1. Oil and Gas

- 3.2. Defense

- 3.3. Other Application Types

-

4. Activity

- 4.1. Drilling and Development

- 4.2. Construction

- 4.3. Inspection, Repair, and Maintenance

- 4.4. Decommisioning

- 4.5. Other Activity Types

Europe AUV and ROV Market Segmentation By Geography

- 1. United Kingdom

- 2. Norway

- 3. Denmark

- 4. Rest of Europe

Europe AUV and ROV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. 4.; The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. ROV Vehicle Type Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. ROV

- 5.1.2. AUV

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 5.2.1. Work Class Vehicle

- 5.2.2. Observatory Class Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oil and Gas

- 5.3.2. Defense

- 5.3.3. Other Application Types

- 5.4. Market Analysis, Insights and Forecast - by Activity

- 5.4.1. Drilling and Development

- 5.4.2. Construction

- 5.4.3. Inspection, Repair, and Maintenance

- 5.4.4. Decommisioning

- 5.4.5. Other Activity Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. Norway

- 5.5.3. Denmark

- 5.5.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United Kingdom Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. ROV

- 6.1.2. AUV

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 6.2.1. Work Class Vehicle

- 6.2.2. Observatory Class Vehicle

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Oil and Gas

- 6.3.2. Defense

- 6.3.3. Other Application Types

- 6.4. Market Analysis, Insights and Forecast - by Activity

- 6.4.1. Drilling and Development

- 6.4.2. Construction

- 6.4.3. Inspection, Repair, and Maintenance

- 6.4.4. Decommisioning

- 6.4.5. Other Activity Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Norway Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. ROV

- 7.1.2. AUV

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 7.2.1. Work Class Vehicle

- 7.2.2. Observatory Class Vehicle

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Oil and Gas

- 7.3.2. Defense

- 7.3.3. Other Application Types

- 7.4. Market Analysis, Insights and Forecast - by Activity

- 7.4.1. Drilling and Development

- 7.4.2. Construction

- 7.4.3. Inspection, Repair, and Maintenance

- 7.4.4. Decommisioning

- 7.4.5. Other Activity Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Denmark Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. ROV

- 8.1.2. AUV

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 8.2.1. Work Class Vehicle

- 8.2.2. Observatory Class Vehicle

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Oil and Gas

- 8.3.2. Defense

- 8.3.3. Other Application Types

- 8.4. Market Analysis, Insights and Forecast - by Activity

- 8.4.1. Drilling and Development

- 8.4.2. Construction

- 8.4.3. Inspection, Repair, and Maintenance

- 8.4.4. Decommisioning

- 8.4.5. Other Activity Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of Europe Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. ROV

- 9.1.2. AUV

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 9.2.1. Work Class Vehicle

- 9.2.2. Observatory Class Vehicle

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Oil and Gas

- 9.3.2. Defense

- 9.3.3. Other Application Types

- 9.4. Market Analysis, Insights and Forecast - by Activity

- 9.4.1. Drilling and Development

- 9.4.2. Construction

- 9.4.3. Inspection, Repair, and Maintenance

- 9.4.4. Decommisioning

- 9.4.5. Other Activity Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Germany Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 11. France Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 DOF Subsea AS

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Helix Energy Solutions Group Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Bourbon Offshore

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Saipem SpA*List Not Exhaustive

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Subsea 7 SA

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 TechnipFMC PLC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.1 DOF Subsea AS

List of Figures

- Figure 1: Europe AUV and ROV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe AUV and ROV Market Share (%) by Company 2024

List of Tables

- Table 1: Europe AUV and ROV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe AUV and ROV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 5: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 6: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 7: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 10: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 11: Europe AUV and ROV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Europe AUV and ROV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Germany Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: France Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Netherlands Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Sweden Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Rest of Europe Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 30: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 31: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 32: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 33: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 35: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 36: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 37: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 40: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 41: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 42: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 43: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 45: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 46: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 47: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 49: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 51: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 52: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 53: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 55: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 56: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 57: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 59: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 60: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 61: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 62: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 63: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 65: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 66: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 67: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe AUV and ROV Market?

The projected CAGR is approximately 6.37%.

2. Which companies are prominent players in the Europe AUV and ROV Market?

Key companies in the market include DOF Subsea AS, Helix Energy Solutions Group Inc, Bourbon Offshore, Saipem SpA*List Not Exhaustive, Subsea 7 SA, TechnipFMC PLC.

3. What are the main segments of the Europe AUV and ROV Market?

The market segments include Vehicle Type, Vehicle Class, Application, Activity.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

ROV Vehicle Type Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

January 2022: Fugro won a contract from Denmark's Energinet to undertake cable route surveys for the North Sea Energy Island project, which will serve as a power plant distributing up to 10 GW of offshore wind to Denmark and other neighboring markets. Fugro will conduct a combination of geophysical, geotechnical services, and laboratory testing using ROV inspections and other geotechnical survey systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe AUV and ROV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe AUV and ROV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe AUV and ROV Market?

To stay informed about further developments, trends, and reports in the Europe AUV and ROV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence