Key Insights

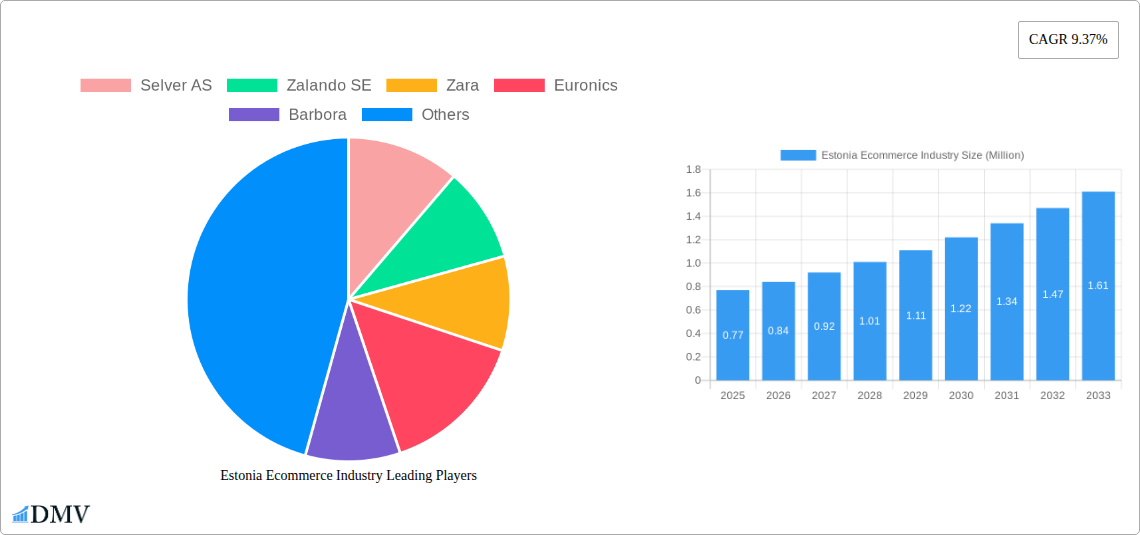

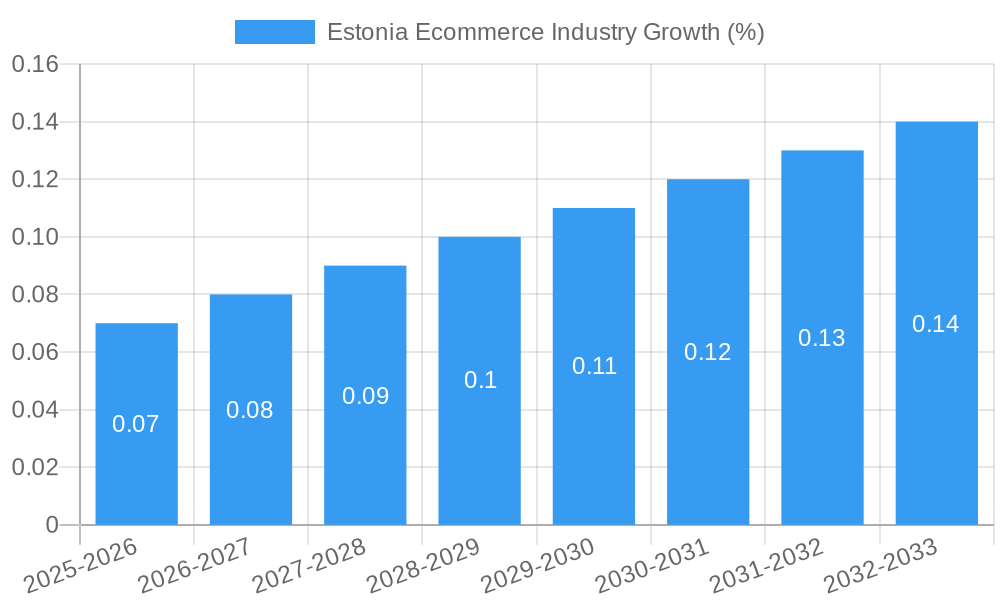

The Estonian e-commerce market, valued at €0.77 million in 2025, is projected to experience robust growth, fueled by increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for online shopping convenience. This expanding market is driven by factors such as improved logistics infrastructure, the rise of mobile commerce, and the increasing adoption of digital payment methods. Key players like Selver AS, Zalando SE, and Amazon are actively competing for market share, offering diverse product selections and enhancing customer experiences. The market segmentation, primarily by application (e.g., fashion, electronics, groceries), showcases varying growth rates, with segments like fashion and electronics likely exhibiting faster expansion due to consumer demand and established online retail presence. Challenges include relatively small market size compared to larger European economies, potential for increased competition from international players, and the need for further development of secure online payment systems to foster trust and encourage wider adoption.

Looking ahead to 2033, the Estonian e-commerce market is expected to benefit from continued technological advancements, including improved delivery services and personalized shopping experiences. Government initiatives to support digitalization and enhance the business environment will also play a crucial role in driving growth. However, the market might face potential restraints such as fluctuating economic conditions and the need to address concerns regarding data privacy and security. The consistent 9.37% CAGR suggests a trajectory of sustained, albeit moderate, growth, positioning Estonia as a developing but promising e-commerce market within the broader European context. Competition will intensify, requiring businesses to prioritize customer-centric strategies, agile operations, and innovative marketing techniques to secure a competitive advantage.

Estonia Ecommerce Industry: Market Analysis and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Estonian ecommerce market, covering its evolution, key players, growth drivers, and future prospects from 2019 to 2033. The study utilizes data from the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033) to deliver actionable insights for stakeholders. The Estonian ecommerce market, valued at xx Million in 2024, is projected to reach xx Million by 2033, demonstrating significant growth potential. This report is essential for businesses looking to enter or expand their operations within this dynamic market.

Estonia Ecommerce Industry Market Composition & Trends

This section delves into the competitive landscape of the Estonian ecommerce market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and consumer profiles. The analysis includes a detailed examination of mergers and acquisitions (M&A) activities, providing insights into deal values and their impact on market share.

- Market Concentration: The Estonian ecommerce market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Selver AS, for example, likely holds a considerable share in the grocery sector, while Zalando SE dominates fashion. However, numerous smaller players cater to niche segments.

- Innovation Catalysts: Technological advancements such as mobile commerce and improved logistics infrastructure drive innovation. The Estonian government's initiatives promoting digitalization also contribute significantly.

- Regulatory Landscape: Estonia's relatively streamlined regulatory environment supports ecommerce growth, although data privacy and consumer protection regulations continue to shape market practices.

- Substitute Products: Traditional brick-and-mortar retail remains a key competitor, but the increasing convenience and wider selection offered by ecommerce platforms are driving market share gains.

- End-User Profiles: Estonian consumers, particularly younger demographics, exhibit high levels of digital literacy and online shopping adoption, boosting the ecommerce sector.

- M&A Activities: While precise M&A deal values are not publicly available for all transactions in Estonia, analysis suggests a steady flow of consolidation activities, particularly within specific segments like grocery delivery (e.g., Barbora) and fashion retail (e.g., potential acquisitions among smaller brands). Deal values are predicted to have totaled xx Million during the historical period.

Estonia Ecommerce Industry Industry Evolution

This section examines the dynamic evolution of the Estonian ecommerce market, tracking market growth trajectories, technological progress, and shifts in consumer preferences over the study period.

The Estonian ecommerce market has witnessed considerable growth throughout 2019-2024, driven by increased internet and smartphone penetration and rising consumer confidence in online transactions. The pandemic further accelerated this trend, leading to a surge in online shopping across various product categories. Growth rates in the early years were approximately xx%, decelerating slightly to xx% in more recent years due to market saturation and economic factors. Technological advancements, including the rise of mobile commerce (m-commerce), improved logistics networks, and the adoption of AI-powered personalization tools have transformed the consumer experience, driving higher conversion rates. Consumer demands are shifting towards greater convenience, personalized offers, and faster delivery options, forcing ecommerce businesses to adapt and innovate continuously. The integration of omnichannel strategies, combining online and offline retail experiences, has also become increasingly prevalent, further enhancing customer engagement.

Leading Regions, Countries, or Segments in Estonia Ecommerce Industry

This section identifies the leading segments within the Estonian ecommerce market, focusing on the “Market Segmentation - by Application”.

- Dominant Segment: The dominant segment is likely general merchandise, encompassing a wide array of product categories, due to its broad appeal and accessibility. This sector benefits from economies of scale and diverse consumer base.

- Key Drivers:

- High Internet Penetration: Estonia boasts among the highest internet penetration rates globally, providing a large and digitally savvy consumer base.

- Government Support: Government initiatives to foster digitalization and innovation create a favorable environment for ecommerce businesses.

- Robust Logistics Infrastructure: A well-developed logistics network ensures efficient and reliable delivery services across the country.

The dominance of general merchandise is further fueled by the presence of major players like Selver AS, catering to a significant portion of consumer demand. The growth in this segment is also influenced by the increasing adoption of online grocery shopping.

Estonia Ecommerce Industry Product Innovations

Recent product innovations in the Estonian ecommerce industry have focused on enhancing the customer experience through personalized recommendations, improved search functionalities, and streamlined checkout processes. Technological advancements like augmented reality (AR) and virtual reality (VR) are being explored to offer immersive shopping experiences. The integration of innovative payment gateways, including mobile wallets and buy-now-pay-later options, has broadened payment choices, driving sales. These innovations differentiate players in the market, leading to higher customer satisfaction and increased sales.

Propelling Factors for Estonia Ecommerce Industry Growth

Several key factors drive the growth of the Estonian ecommerce industry. Technological advancements, such as mobile-optimized websites and mobile apps, and the expansion of reliable logistics infrastructure are pivotal for broader reach and accessibility. Favorable economic conditions and rising disposable incomes support greater consumer spending. Finally, the government's pro-digitalization policies and supportive regulatory environment foster market expansion.

Obstacles in the Estonia Ecommerce Industry Market

Despite the growth potential, several obstacles impede the Estonian ecommerce market's development. Maintaining competitiveness against established global players like Amazon and Alibaba represents a significant challenge. Supply chain disruptions and logistical complexities, particularly during peak seasons, may impact delivery times and customer satisfaction. Moreover, increasing cybersecurity threats and data privacy concerns necessitate significant investment in robust security measures.

Future Opportunities in Estonia Ecommerce Industry

The Estonian ecommerce market presents numerous future opportunities. The expansion of cross-border ecommerce, catering to consumers in neighboring countries, presents significant growth potential. The integration of emerging technologies like blockchain for secure transactions and artificial intelligence for personalized marketing campaigns offers further avenues for innovation. Growing focus on sustainability and ethical sourcing will also shape future market trends, creating opportunities for businesses embracing these values.

Major Players in the Estonia Ecommerce Industry Ecosystem

- Selver AS

- Zalando SE

- Zara

- Euronics

- Barbora

- Amazon com Inc

- Alibaba Group

- Next Germany GMBH

- Cellebes

- DenimDream

Key Developments in Estonia Ecommerce Industry Industry

- January 2023: Zalando introduced a new brand identity for Lounge by Zalando, enhancing its branding and customer experience. This reflects an ongoing trend of major players enhancing their brand presence and customer engagement.

Strategic Estonia Ecommerce Industry Market Forecast

The Estonian ecommerce market is poised for sustained growth, driven by technological advancements, increasing internet penetration, and favorable government policies. Future opportunities lie in leveraging emerging technologies, expanding cross-border operations, and catering to the evolving needs of digitally savvy consumers. The market's expansion is anticipated to attract further investment and competition, solidifying Estonia's position as a thriving ecommerce hub in Northern Europe.

Estonia Ecommerce Industry Segmentation

-

1. Application

- 1.1. Beauty & Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion & Apparel

- 1.4. Food & Beverage

- 1.5. Furniture & Home

- 1.6. Other Market Segments (Toys, DIY, Media, etc.)

Estonia Ecommerce Industry Segmentation By Geography

- 1. Estonia

Estonia Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased adoption of Digital Solutions; Adoption of Omnichannel Innovative Solutions

- 3.3. Market Restrains

- 3.3.1. High Dependence on External Source to Balance the Skill Deficit; Heavy Dependence on Oil and Gas Sector

- 3.4. Market Trends

- 3.4.1. Increased Adoption of Digital Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Estonia Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty & Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion & Apparel

- 5.1.4. Food & Beverage

- 5.1.5. Furniture & Home

- 5.1.6. Other Market Segments (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Estonia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Selver AS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zalando SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Euronics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Barbora

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon com Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alibaba Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Next Germany GMBH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cellebes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DenimDream

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Selver AS

List of Figures

- Figure 1: Estonia Ecommerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Estonia Ecommerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Estonia Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Estonia Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Estonia Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Estonia Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Estonia Ecommerce Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Estonia Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Estonia Ecommerce Industry?

The projected CAGR is approximately 9.37%.

2. Which companies are prominent players in the Estonia Ecommerce Industry?

Key companies in the market include Selver AS, Zalando SE, Zara, Euronics, Barbora, Amazon com Inc, Alibaba Group, Next Germany GMBH, Cellebes, DenimDream.

3. What are the main segments of the Estonia Ecommerce Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased adoption of Digital Solutions; Adoption of Omnichannel Innovative Solutions.

6. What are the notable trends driving market growth?

Increased Adoption of Digital Solutions.

7. Are there any restraints impacting market growth?

High Dependence on External Source to Balance the Skill Deficit; Heavy Dependence on Oil and Gas Sector.

8. Can you provide examples of recent developments in the market?

January 2023: Zalando introduced the new brand identity. The new look and feel of the website and app reflect the distinct proposition of Lounge by Zalando as a shopping club while bringing its brand closer to the Zalando Group; The new brand identity mirrors the joyful treasure hunt experience that Lounge by Zalando offers to members and makes a clear link to the Zalando brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Estonia Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Estonia Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Estonia Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Estonia Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence