Key Insights

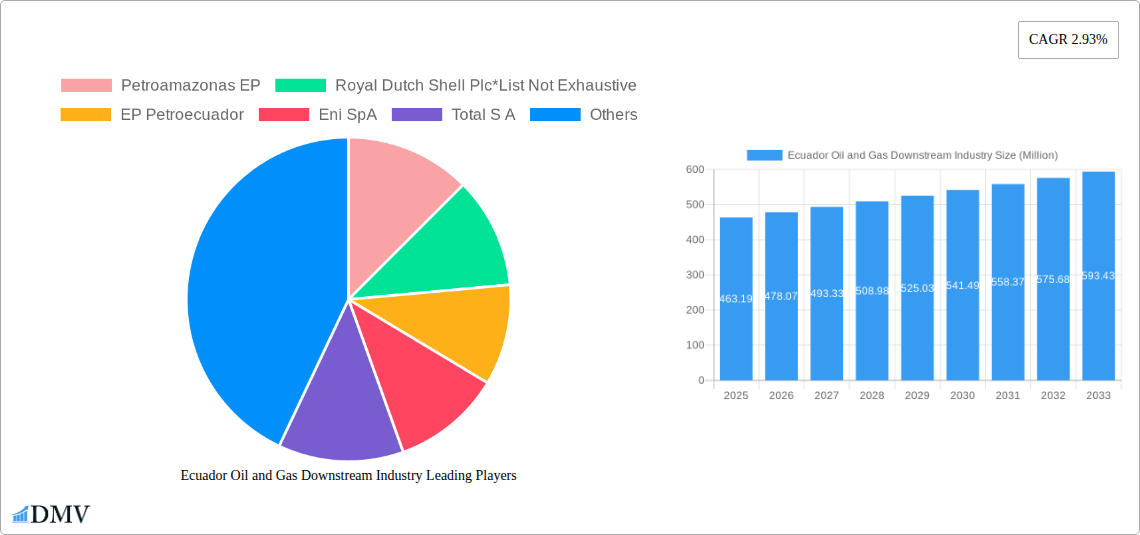

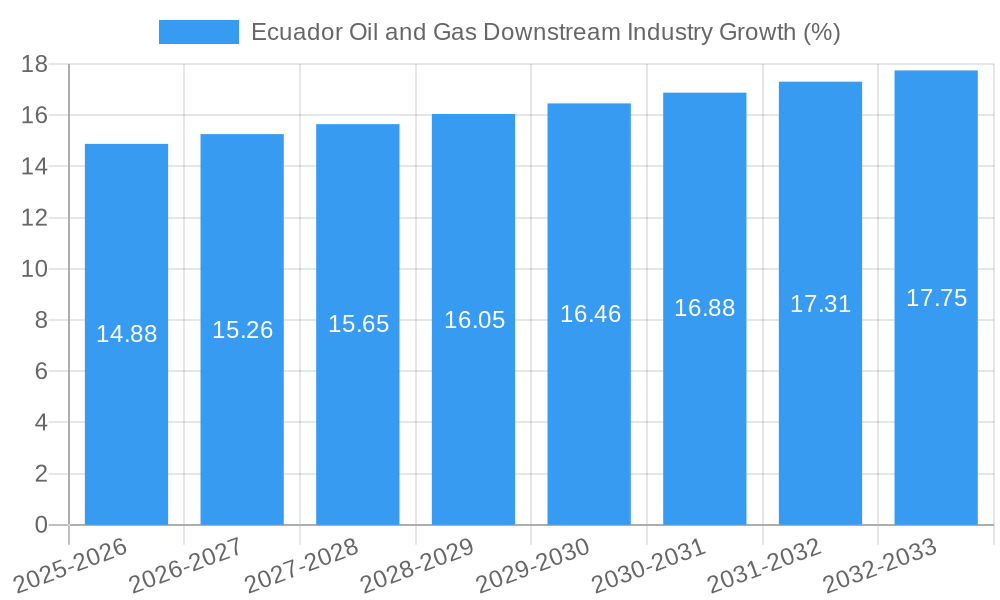

The Ecuadorian oil and gas downstream industry, valued at $463.19 million in 2025, is projected to experience moderate growth, driven primarily by increasing domestic fuel demand and potential for petrochemical expansion. The 2.93% Compound Annual Growth Rate (CAGR) from 2025-2033 suggests a steady, albeit not explosive, trajectory. Key players like Petroamazonas EP, Royal Dutch Shell, and others are actively shaping the market, with refineries and petrochemical plants being the dominant process types. However, constraints like fluctuating global oil prices, potential environmental regulations, and the need for infrastructure upgrades could influence future growth. The focus will likely remain on meeting domestic needs, with limited potential for significant export-oriented expansion given current infrastructure limitations. Growth projections will depend heavily on government investment in infrastructure, the successful implementation of energy policies focused on diversification and sustainability, and the overall stability of the global oil market.

The Ecuadorian market’s relatively small size and concentration within its borders limits its vulnerability to severe external shocks, although its susceptibility to global price fluctuations remains. Strategic partnerships and investment in technological advancements to enhance operational efficiency and environmental sustainability are likely to be key competitive factors. Given the industry's focus on refining and petrochemicals, future growth could be influenced by the expansion of petrochemical downstream industries and integration with regional markets. Long-term prospects depend on balancing domestic energy demands, attracting foreign investment, and adopting a sustainable development approach. This will require a detailed consideration of environmental, social, and governance (ESG) factors, which are increasingly influencing investor decisions in the energy sector.

This insightful report provides a detailed analysis of Ecuador's oil and gas downstream industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is essential for stakeholders seeking to understand the current landscape and navigate future opportunities in this dynamic sector. The report projects a market value of XXX Million by 2033.

Ecuador Oil and Gas Downstream Industry Market Composition & Trends

This section analyzes the competitive landscape of Ecuador's oil and gas downstream sector, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The report provides a granular understanding of market share distribution among key players and details the financial implications of significant M&A deals.

- Market Concentration: The Ecuadorian downstream market exhibits a moderately concentrated structure, with Petroecuador holding a significant market share. However, the presence of international players like Chevron Corporation, Eni SpA, and Repsol S.A. adds to the complexity. The report quantifies market share for key players and analyzes the competitive intensity.

- Innovation Catalysts: Government initiatives promoting refinery modernization and technological advancements in fuel production drive innovation. The report identifies specific technological advancements and their impact on market efficiency and product quality.

- Regulatory Landscape: Ecuador's regulatory environment significantly impacts industry operations. The report analyzes existing regulations, their effect on market access, and their influence on investment decisions. Changes in environmental regulations and their potential influence on market players are also considered.

- Substitute Products: The availability of biofuels and alternative energy sources presents challenges to traditional petroleum products. This report assesses the market share and growth potential of substitute products.

- End-User Profiles: The report segments end-users (e.g., transportation, industrial, residential) and analyzes their consumption patterns, influencing market demand forecasts.

- M&A Activities: The report meticulously tracks M&A activities within the sector, providing details on deal values and their implications for market consolidation. An analysis of the XX Million invested in M&A deals in the last 5 years is included.

Ecuador Oil and Gas Downstream Industry Industry Evolution

This section delves into the historical evolution (2019-2024) and projected future (2025-2033) of Ecuador's oil and gas downstream sector. It explores the market's growth trajectory, technological advancements, and evolving consumer preferences. Specific data points, including growth rates and adoption metrics for new technologies, will be provided. The report will examine the impact of fluctuating global oil prices and their influence on investment decisions and market expansion. The analysis encompasses government policies, environmental concerns, and technological innovation, as well as changes in consumer behavior driving transformations within the industry. The projected Compound Annual Growth Rate (CAGR) during the forecast period is estimated at XX%.

Leading Regions, Countries, or Segments in Ecuador Oil and Gas Downstream Industry

This section identifies the dominant regions and segments within Ecuador's oil and gas downstream industry, focusing on refineries and petrochemical plants. The analysis highlights key drivers such as investment trends and regulatory support, providing a detailed explanation of the factors contributing to the dominance of specific regions or segments.

- Refineries: The Esmeraldas refinery remains the dominant refinery, influencing a significant portion of the domestic market. Its modernization plans are analyzed in detail.

- Petrochemical Plants: The report will detail the current state of the petrochemical plants, assess their capacity, and identify any expansions planned.

- Key Drivers:

- Investment Trends: Government investment in infrastructure upgrades and modernization of existing refineries is a major driver.

- Regulatory Support: Government policies supporting domestic fuel production and refining capacity influence market development.

- Geographic Advantages: Proximity to ports and distribution networks is evaluated.

Ecuador Oil and Gas Downstream Industry Product Innovations

This section will showcase recent product innovations, applications, and performance metrics within Ecuador's downstream oil and gas industry. The emphasis is on unique selling propositions and the technological advancements driving the development of new and improved products. Examples include advancements in fuel efficiency, lower emission fuels, and specialized lubricants. The impact of these innovations on market competitiveness and consumer preferences is also analyzed.

Propelling Factors for Ecuador Oil and Gas Downstream Industry Growth

Several factors contribute to the growth of Ecuador's oil and gas downstream industry. These include increasing domestic energy demand, government support for infrastructure development, and the ongoing modernization of refining facilities. Furthermore, technological advancements in refining processes, enhancing efficiency and product quality, drive growth.

Obstacles in the Ecuador Oil and Gas Downstream Industry Market

The Ecuadorian oil and gas downstream industry faces several challenges. These include the volatility of global oil prices, regulatory hurdles hindering efficient operations, and limitations in refining capacity. Supply chain vulnerabilities and the need for significant investment in upgrading aging infrastructure also pose significant obstacles. These challenges are quantified with data on their impacts on production, profitability, and market expansion.

Future Opportunities in Ecuador Oil and Gas Downstream Industry

Ecuador's oil and gas downstream industry presents substantial future opportunities. These include leveraging increased domestic demand, pursuing refinery modernization projects, and investing in the production of higher-value petroleum products. Exploring the potential for integrating renewable energy sources into refining processes also represents a significant opportunity. The government's focus on attracting foreign investment further boosts the potential for growth.

Major Players in the Ecuador Oil and Gas Downstream Industry Ecosystem

- Petroamazonas EP

- Royal Dutch Shell Plc

- EP Petroecuador

- Eni SpA

- Total S A

- Repsol S.A.

- Enap Sipetrol

- Schlumberger Limited

- Halliburton Company

- Chevron Corporation

Key Developments in Ecuador Oil and Gas Downstream Industry Industry

- December 2023: Petroecuador's refinery segment exceeded 400,000 bpd crude oil output for the first time since January 2021, reaching 401,852 barrels of crude oil and 411,873 barrels of oil equivalent. This signifies a significant increase in production capacity and efficiency.

- October 2022: Ecuador launched a tender for modernizing its Esmeraldas refinery (110,000 bbl/day capacity), attracting potential investments and technological upgrades. This indicates a commitment to upgrading infrastructure and enhancing operational efficiency.

- February 2022: Petroecuador signed a 15-year contract with Abastecedora Ecuatoriana de Combustibles for petroleum product handling, securing logistical support and boosting distribution networks. This strengthens Petroecuador's downstream capabilities.

Strategic Ecuador Oil and Gas Downstream Industry Market Forecast

The Ecuadorian oil and gas downstream market is poised for significant growth driven by government initiatives to modernize refineries, increasing domestic demand, and strategic investments in upgrading infrastructure. The market is expected to benefit from the ongoing expansion of downstream activities, improved logistical networks, and technological advancements in refining processes, leading to a robust market expansion over the forecast period. The potential for attracting further foreign direct investment adds to the positive growth outlook.

Ecuador Oil and Gas Downstream Industry Segmentation

-

1. Process Type

- 1.1. Refineries

- 1.2. Petrochemical Plants

Ecuador Oil and Gas Downstream Industry Segmentation By Geography

- 1. Ecuador

Ecuador Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Refined Petroleum Products

- 3.2.2 Coupled with the Rise in Population

- 3.2.3 Urbanization

- 3.2.4 and Industrialization in Ecuador

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Share of Fuel-Efficient Vehicles and the Increasing Penetration of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Refining sector is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ecuador Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Refineries

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ecuador

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Petroamazonas EP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Royal Dutch Shell Plc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EP Petroecuador

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Repsol S.A.

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Enap Sipetrol

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schlumberger Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Halliburton Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chevron Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Petroamazonas EP

List of Figures

- Figure 1: Ecuador Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ecuador Oil and Gas Downstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Process Type 2019 & 2032

- Table 4: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Process Type 2019 & 2032

- Table 5: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 7: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 9: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Process Type 2019 & 2032

- Table 10: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Process Type 2019 & 2032

- Table 11: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ecuador Oil and Gas Downstream Industry?

The projected CAGR is approximately 2.93%.

2. Which companies are prominent players in the Ecuador Oil and Gas Downstream Industry?

Key companies in the market include Petroamazonas EP, Royal Dutch Shell Plc*List Not Exhaustive, EP Petroecuador, Eni SpA, Total S A, Repsol S.A. , Enap Sipetrol , Schlumberger Limited , Halliburton Company , Chevron Corporation.

3. What are the main segments of the Ecuador Oil and Gas Downstream Industry?

The market segments include Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 463.19 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Refined Petroleum Products. Coupled with the Rise in Population. Urbanization. and Industrialization in Ecuador.

6. What are the notable trends driving market growth?

Refining sector is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Growing Share of Fuel-Efficient Vehicles and the Increasing Penetration of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

December 2023: Ecuador's state oil company, Petroecuador, stated that in the company's refinery segment, crude oil output surpassed 400,000 bpd for the first time since January 2021. In a statement, Petroecuador said crude oil production reached 401,852 barrels while barrels of oil equivalent reached 411,873, including natural gas and associated gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ecuador Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ecuador Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ecuador Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Ecuador Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence