Key Insights

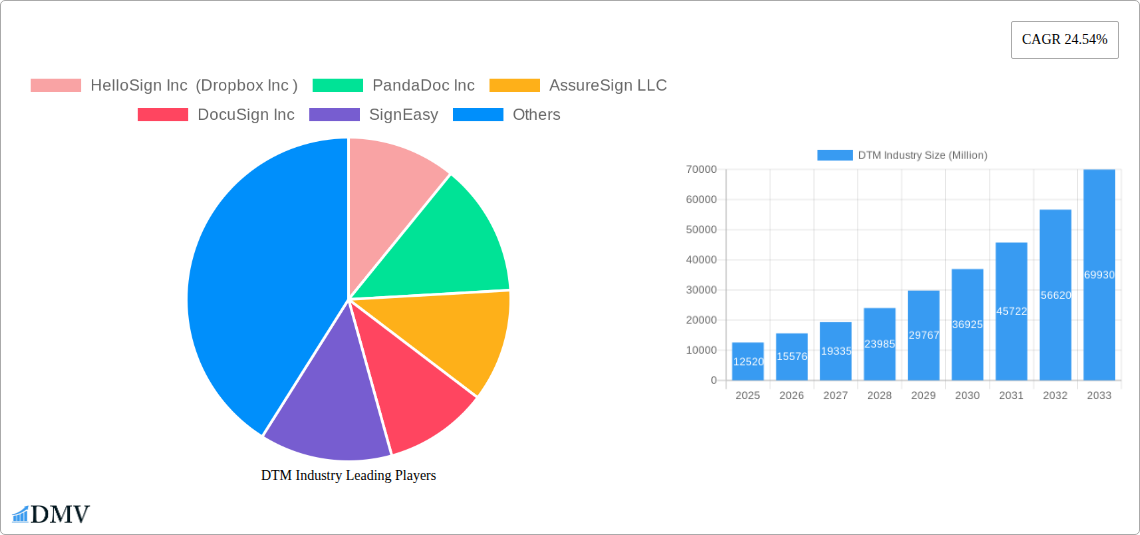

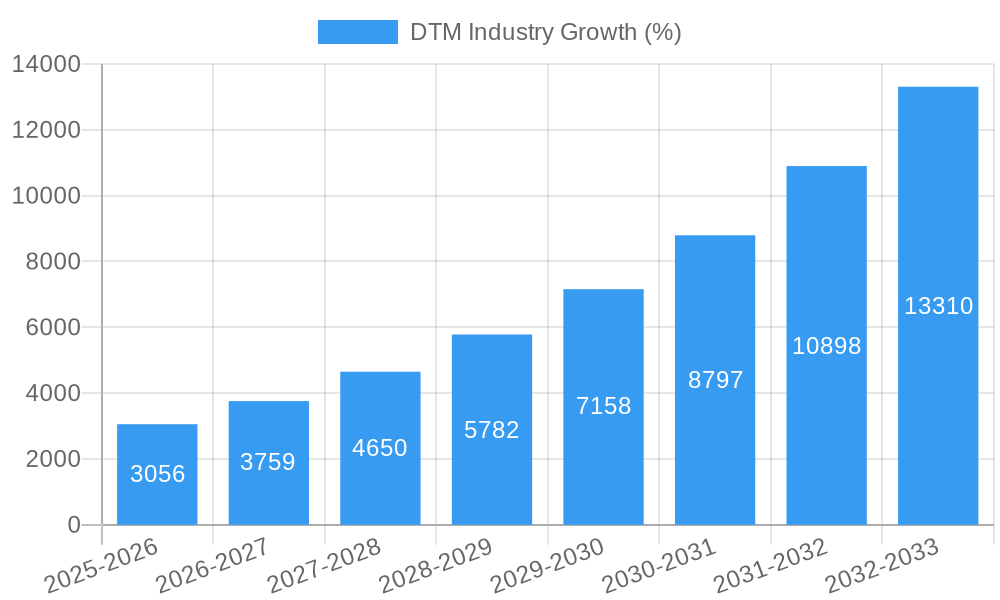

The Digital Transaction Management (DTM) market is experiencing robust growth, projected to reach \$12.52 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 24.54% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing need for secure and efficient document workflows across various industries, coupled with the rising adoption of cloud-based solutions and the shift towards digital transformation initiatives, are significantly propelling market growth. Furthermore, stringent regulatory compliance requirements and the inherent advantages of automated processes, such as reduced operational costs and enhanced productivity, contribute to the widespread adoption of DTM solutions. The BFSI (Banking, Financial Services, and Insurance) sector is a major contributor to this growth, followed by healthcare and retail, driven by their need for secure and compliant document handling. The solution component holds a larger market share compared to services, reflecting the significant initial investment in software and platforms. Competition within the market is intense, with established players like DocuSign and Adobe competing with emerging specialized providers.

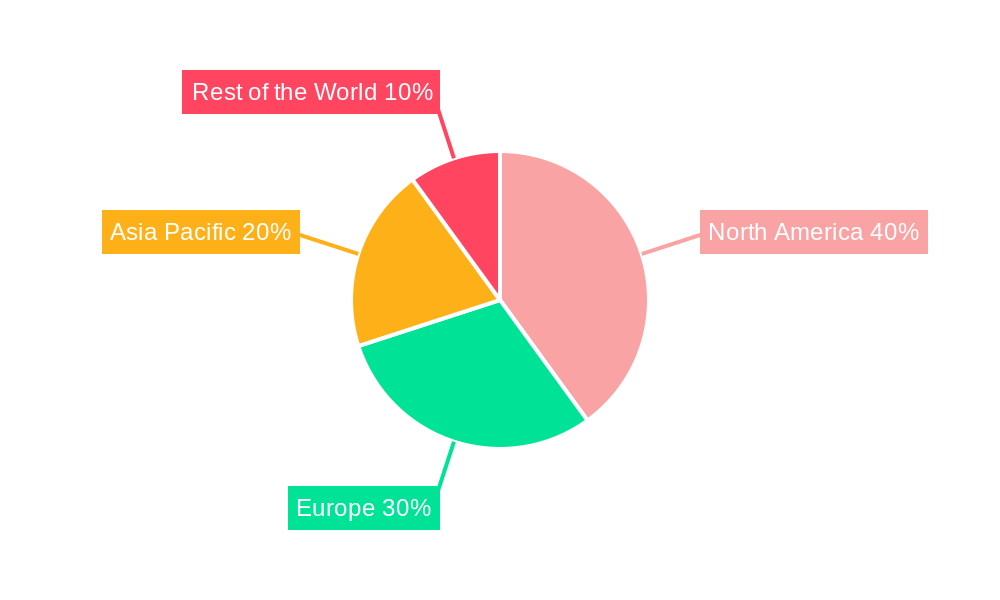

The market segmentation reveals considerable opportunities. Large enterprises currently dominate the market share due to their higher investment capacity and complex document management needs. However, small and medium-sized enterprises (SMEs) are increasingly adopting DTM solutions, driven by cost-effectiveness and scalability. Geographical growth is expected to be uneven, with North America maintaining a significant lead due to early adoption and technological advancements. However, regions like Asia-Pacific are projected to witness the fastest growth due to rising digital literacy and increasing business activity. While challenges such as data security concerns and integration complexities exist, ongoing innovation in areas like AI-powered automation and improved user experience is mitigating these obstacles, leading to a sustained period of market expansion.

Digital Transaction Management (DTM) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Digital Transaction Management (DTM) industry, projecting a market valuation of $XX Million by 2033. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape within this rapidly evolving sector.

DTM Industry Market Composition & Trends

The global DTM market, valued at $XX Million in 2024, is experiencing robust growth driven by increasing digitalization and the need for efficient document workflows. Market concentration is moderate, with key players like DocuSign holding significant market share, yet a vibrant competitive landscape fosters innovation. The regulatory landscape, while evolving, generally supports the adoption of DTM solutions, particularly in sectors with stringent compliance requirements. Substitute products, primarily manual processes, are losing ground due to their inefficiency and vulnerability to errors.

- Market Share Distribution (2024): DocuSign (XX%), Adobe (XX%), HelloSign (XX%), Others (XX%).

- M&A Activity (2019-2024): Total deal value exceeding $XX Million, reflecting the industry's consolidation and expansion.

- End-User Profiles: Businesses across all sizes are adopting DTM, driven by enhanced security and compliance needs. The BFSI, Healthcare, and Retail sectors are leading adopters.

DTM Industry Industry Evolution

The DTM industry has witnessed a significant evolution since 2019, characterized by accelerated growth and technological advancements. The market expanded at a CAGR of XX% from 2019 to 2024, driven by the increasing preference for digital solutions and the need for streamlined document management across various industries. Technological innovations, including AI-powered automation and enhanced security features, are fueling market expansion. Consumer demands are shifting towards more user-friendly interfaces, seamless integration with existing systems, and robust security protocols. The adoption rate of DTM solutions is increasing rapidly, particularly amongst SMEs and large enterprises. The forecast period (2025-2033) projects continued growth, exceeding $XX Million by 2033. This growth is fueled by further technological advancements, including the integration of blockchain technology for enhanced security and improved interoperability between systems.

Leading Regions, Countries, or Segments in DTM Industry

The North American region currently holds the largest market share, followed by Europe. Within these regions, the BFSI and Healthcare sectors demonstrate the highest adoption rates due to stringent regulatory compliance needs and high volumes of documentation. The Small and Medium Enterprise (SME) segment is experiencing significant growth driven by the availability of affordable and user-friendly DTM solutions.

- Key Drivers:

- North America: High technological adoption, strong regulatory support, and a large number of early adopters.

- Europe: Growing awareness of the benefits of DTM solutions and increasing regulatory pressure to adopt digital processes.

- BFSI: High demand for secure and compliant document management solutions, coupled with increasing regulatory scrutiny.

- Healthcare: Growing need for efficient patient record management and compliance with HIPAA regulations.

- Large Enterprises: Need for scalable and integrated solutions for managing complex transaction workflows.

- Solution Component: Dominated by the solution component due to the increasing demand for comprehensive platforms.

DTM Industry Product Innovations

Recent product innovations focus on enhanced security features, seamless integrations with existing enterprise systems, and improved user experience. AI-powered features, such as automated document extraction and intelligent routing, are gaining traction. Unique selling propositions include superior security, faster transaction times, and reduced administrative costs. These advancements improve efficiency, accuracy, and compliance, creating a highly competitive market.

Propelling Factors for DTM Industry Growth

Several factors are driving the growth of the DTM industry. Technological advancements, such as cloud-based platforms and AI-powered automation, are improving efficiency and accessibility. Favorable economic conditions are fueling investments in digital transformation initiatives. Stringent regulatory compliance requirements are pushing businesses to adopt DTM solutions for enhanced security and audit trails. For instance, the GDPR in Europe has accelerated the adoption of secure digital signature solutions.

Obstacles in the DTM Industry Market

The DTM industry faces challenges, including the high initial investment costs for businesses adopting these solutions. Supply chain disruptions can impact the availability of certain hardware and software components. Intense competition amongst established players and new entrants can lead to price wars and margin compression. Furthermore, regulatory uncertainty in certain regions can create obstacles to market expansion.

Future Opportunities in DTM Industry

Emerging opportunities include the integration of blockchain technology for increased security and transparency. Expansion into new, underserved markets, such as emerging economies in Asia and Africa, presents significant potential. The increasing adoption of mobile-first solutions and the growing demand for customized DTM solutions will also create new opportunities.

Major Players in the DTM Industry Ecosystem

- HelloSign Inc (Dropbox Inc)

- PandaDoc Inc

- AssureSign LLC

- DocuSign Inc

- SignEasy

- ZorroSign Inc

- Adobe Inc

- Nintex Group Pty Ltd

- InfoCert

- Mitratech Holdings Inc

- OneSpan Inc

- PactSafe Inc

- Topaz Systems Inc

- Namirial SpA

- eOriginal Inc

Key Developments in DTM Industry Industry

- December 2022: Skyslope partnered with Weichert, Realtors, expanding its reach to thousands of agents in the USA and Canada. This significantly boosted Skyslope's market share in the real estate sector.

- September 2022: DocuSign's partnership with Zavvie enhanced its fully digital transaction management program, improving workflow integration for real estate agents. This strengthened DocuSign's position in the market by offering a more comprehensive and user-friendly solution.

Strategic DTM Industry Market Forecast

The DTM market is poised for sustained growth over the forecast period (2025-2033), driven by increasing digitalization, regulatory pressures, and technological advancements. The continued development of AI-powered features and the expansion into new geographic markets will further fuel this expansion. The market is expected to reach $XX Million by 2033, presenting significant opportunities for both established players and new entrants.

DTM Industry Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Service

-

2. Organization Size

- 2.1. Small and Medium Enterprise

- 2.2. Large Enterprise

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. IT and Telecommunication

- 3.5. Other End-user Industries

DTM Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

DTM Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-signatures and Adoption of Cloud Services; Focus on Business Automation; BFSI Industry is Expected to Hold a Significant Market Share

- 3.3. Market Restrains

- 3.3.1. Geopolitical Situation and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. BFSI Industry is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DTM Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprise

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. IT and Telecommunication

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America DTM Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium Enterprise

- 6.2.2. Large Enterprise

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Retail

- 6.3.4. IT and Telecommunication

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium Enterprise

- 7.2.2. Large Enterprise

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Retail

- 7.3.4. IT and Telecommunication

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific DTM Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium Enterprise

- 8.2.2. Large Enterprise

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Retail

- 8.3.4. IT and Telecommunication

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World DTM Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium Enterprise

- 9.2.2. Large Enterprise

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Retail

- 9.3.4. IT and Telecommunication

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. North America DTM Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific DTM Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World DTM Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 HelloSign Inc (Dropbox Inc )

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 PandaDoc Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 AssureSign LLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 DocuSign Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 SignEasy

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 ZorroSign Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Adobe Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Nintex Group Pty Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 InfoCert

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mitratech Holdings Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 OneSpan Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 PactSafe Inc

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Topaz Systems Inc

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Namirial SpA

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 eOriginal Inc

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.1 HelloSign Inc (Dropbox Inc )

List of Figures

- Figure 1: Global DTM Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America DTM Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe DTM Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific DTM Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World DTM Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America DTM Industry Revenue (Million), by Component 2024 & 2032

- Figure 11: North America DTM Industry Revenue Share (%), by Component 2024 & 2032

- Figure 12: North America DTM Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 13: North America DTM Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 14: North America DTM Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America DTM Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America DTM Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe DTM Industry Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe DTM Industry Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe DTM Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 21: Europe DTM Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 22: Europe DTM Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe DTM Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe DTM Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific DTM Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Pacific DTM Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Pacific DTM Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 29: Asia Pacific DTM Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 30: Asia Pacific DTM Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Asia Pacific DTM Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Asia Pacific DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific DTM Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World DTM Industry Revenue (Million), by Component 2024 & 2032

- Figure 35: Rest of the World DTM Industry Revenue Share (%), by Component 2024 & 2032

- Figure 36: Rest of the World DTM Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 37: Rest of the World DTM Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 38: Rest of the World DTM Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Rest of the World DTM Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Rest of the World DTM Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World DTM Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global DTM Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global DTM Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global DTM Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Global DTM Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global DTM Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global DTM Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 15: Global DTM Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 16: Global DTM Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global DTM Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global DTM Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 20: Global DTM Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global DTM Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 23: Global DTM Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 24: Global DTM Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 25: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global DTM Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 27: Global DTM Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 28: Global DTM Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global DTM Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DTM Industry?

The projected CAGR is approximately 24.54%.

2. Which companies are prominent players in the DTM Industry?

Key companies in the market include HelloSign Inc (Dropbox Inc ), PandaDoc Inc, AssureSign LLC, DocuSign Inc, SignEasy, ZorroSign Inc, Adobe Inc, Nintex Group Pty Ltd, InfoCert, Mitratech Holdings Inc, OneSpan Inc, PactSafe Inc, Topaz Systems Inc, Namirial SpA, eOriginal Inc.

3. What are the main segments of the DTM Industry?

The market segments include Component, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-signatures and Adoption of Cloud Services; Focus on Business Automation; BFSI Industry is Expected to Hold a Significant Market Share.

6. What are the notable trends driving market growth?

BFSI Industry is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Geopolitical Situation and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

December 2022 - Skyslope announced a new partnership with Weichert, Realtors for its innovative digital transaction management to Weichert's over 7,000 corporate associates. This innovative partnership expands Skyslope's capability by adding several thousands of agents to the current members in the USA and Canada. In addition to the core transaction platform, Skyslope offers a prominent digital signature solution to send real estate documents out for e-signature.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DTM Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DTM Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DTM Industry?

To stay informed about further developments, trends, and reports in the DTM Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence