Key Insights

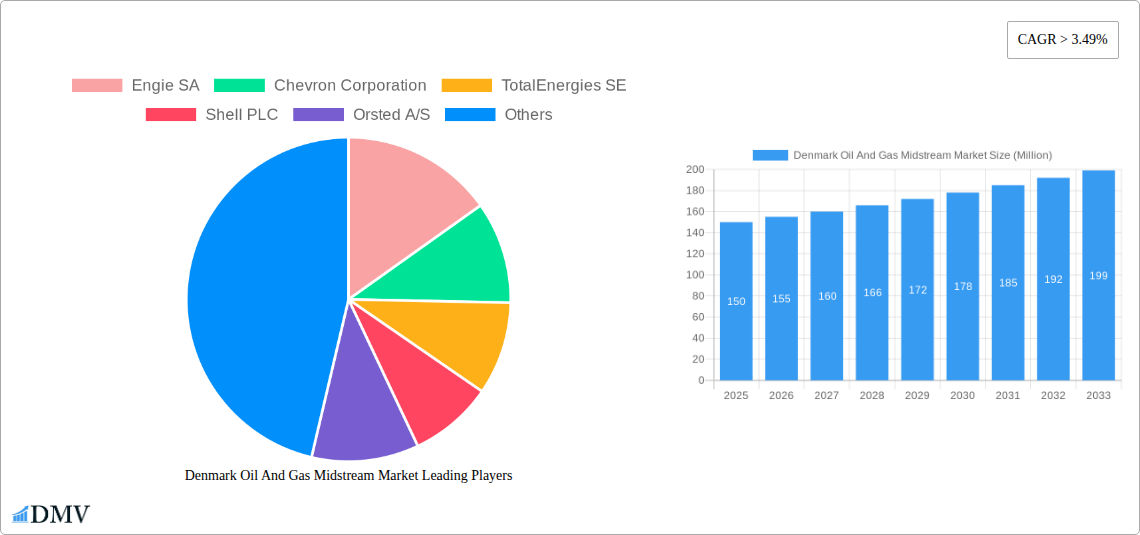

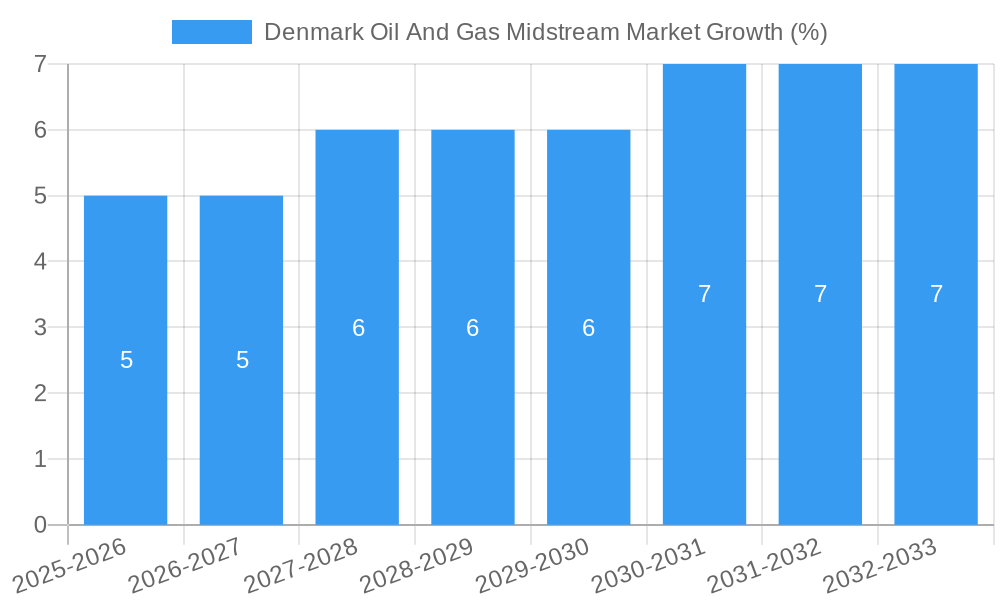

The Denmark Oil and Gas Midstream market, while smaller in overall size compared to global giants, exhibits robust growth potential fueled by increasing energy demands and a strategic focus on energy security. While precise market size data for Denmark isn't provided, considering a global CAGR of >3.49% and the relatively stable energy consumption in Denmark, we can project a moderate growth trajectory. Drivers include aging infrastructure requiring upgrades and maintenance, necessitating significant investments in midstream assets. Further growth is propelled by government incentives for renewable energy integration and efforts to decarbonize the energy sector. However, environmental concerns and regulatory pressures around emissions, alongside potential shifts towards renewable energy sources, pose constraints to market expansion. The market is primarily segmented by product type, encompassing oil, gas, and condensate. Key players, while not exclusively focused on the Danish market, include international giants such as Engie SA, Chevron Corporation, TotalEnergies SE, Shell PLC, and Orsted A/S, suggesting a level of established market participation and investment. The focus on efficient transportation and processing of hydrocarbons will be a key element of the Danish energy landscape in the coming years, ensuring that the midstream sector adapts to the evolving demands of energy security.

Despite the challenges, the Denmark Oil and Gas Midstream market is projected for stable growth through 2033. The presence of major international players indicates a degree of confidence in the market's long-term prospects. The ongoing transition to renewable energy will undoubtedly influence the market's trajectory, requiring a strategic shift towards integration with greener energy solutions. This integration may lead to new opportunities for midstream companies focused on energy storage and distribution of renewable resources, transforming the sector beyond traditional oil and gas operations. The forecast period (2025-2033) represents a crucial period of adaptation and innovation within the market.

Denmark Oil and Gas Midstream Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Denmark oil and gas midstream market, offering a comprehensive overview of its current state, future trends, and key players. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this study equips stakeholders with the crucial data and insights needed to navigate this dynamic market. The report leverages extensive market research and data analysis to deliver actionable intelligence on market size, growth projections, competitive landscape, and emerging opportunities. Key segments analyzed include Product Oil, Gas, and Condensate.

Denmark Oil and Gas Midstream Market Market Composition & Trends

This section delves into the intricate composition of the Denmark oil and gas midstream market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We analyze the impact of mergers and acquisitions (M&A) activity, including deal values and their influence on market share distribution.

- Market Concentration: The Danish midstream market exhibits a [Describe level of concentration - e.g., moderately concentrated] structure with [xx]% market share controlled by the top three players.

- Innovation Catalysts: Government incentives for renewable energy transition are creating a dynamic shift, driving innovation in carbon capture and storage and pipeline optimization technologies.

- Regulatory Landscape: The relatively stable regulatory environment fosters investment, although stricter environmental regulations are influencing operational strategies and capital expenditure.

- Substitute Products: The increasing adoption of renewable energy sources, including wind and solar power, presents a competitive threat, leading to a reduction in demand for traditional fossil fuels. This shift is impacting midstream infrastructure demand.

- End-User Profiles: The primary end-users are power generation companies, industrial facilities, and residential consumers. The relative demand from each segment is analyzed in detail.

- M&A Activities: Over the historical period (2019-2024), the total value of M&A deals in the Danish midstream sector was approximately xx Million. [Describe significant M&A deals and their impact on market dynamics].

Denmark Oil and Gas Midstream Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the Danish oil and gas midstream market. We examine market growth trajectories, technological advancements, and shifts in consumer demand from 2019 to 2033.

The Danish oil and gas midstream market witnessed [Describe growth pattern – e.g., moderate growth] during the historical period (2019-2024), with an average annual growth rate (AAGR) of xx%. The forecast period (2025-2033) projects a [Describe projected growth pattern and AAGR] driven by [Describe factors driving growth, e.g., increased demand for natural gas, strategic investments in infrastructure]. Technological advancements such as the implementation of smart pipelines and digitalization efforts are enhancing efficiency and operational safety. The increasing focus on sustainability and the growing adoption of cleaner energy sources are influencing the demand for midstream services. [Include further detail on technological advancements, specific adoption metrics, and consumer demand shifts.]

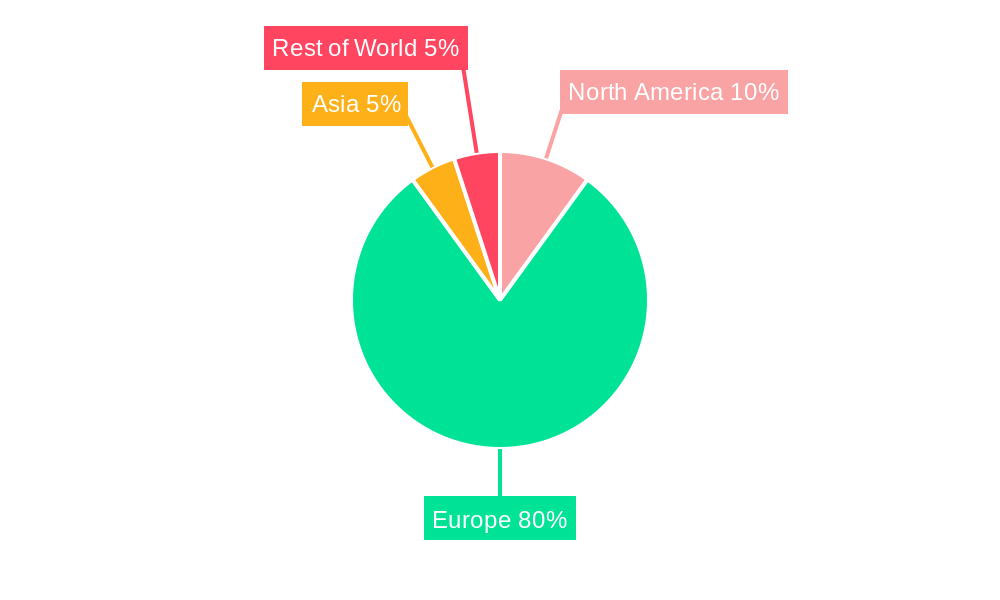

Leading Regions, Countries, or Segments in Denmark Oil and Gas Midstream Market

This section identifies the leading region, country, or segment within the Product Oil, Gas, and Condensate categories.

- Dominant Segment: [Identify the dominant segment – e.g., Natural Gas] is the leading segment, accounting for [xx]% of the market share in 2025.

Key Drivers for Dominance:

- Significant Investment in Infrastructure: [Details on investments in pipelines, storage facilities, etc.]

- Strong Regulatory Support: [Details on governmental policies and incentives]

- Increasing Domestic Demand: [Analysis of factors driving demand]

[Provide an in-depth analysis of the factors contributing to the dominance of this segment, including market size, growth rate, and future potential.]

Denmark Oil and Gas Midstream Market Product Innovations

The Danish oil and gas midstream market is witnessing innovations in pipeline technologies, focusing on improved efficiency, safety, and environmental sustainability. These innovations include smart pipeline monitoring systems, advanced leak detection technologies, and the implementation of digital twins for predictive maintenance. These advancements lead to reduced operational costs, minimized environmental impact, and improved overall reliability of the midstream infrastructure.

Propelling Factors for Denmark Oil and Gas Midstream Market Growth

Several factors are driving the growth of the Danish oil and gas midstream market. Increased domestic demand for natural gas, coupled with strategic investments in infrastructure modernization and expansion, are key contributors. Furthermore, government initiatives aimed at improving energy security are further supporting market expansion. Technological advancements, such as digitalization and automation, are also enhancing efficiency and reducing operational costs.

Obstacles in the Denmark Oil and Gas Midstream Market Market

The Danish oil and gas midstream market faces challenges such as stringent environmental regulations leading to increased compliance costs. Supply chain disruptions caused by geopolitical instability can affect the availability and cost of materials and equipment. Intense competition from renewable energy sources also poses a significant challenge, pressuring margins and potentially reducing demand for traditional fossil fuels. These factors can cumulatively impact the overall growth trajectory of the market.

Future Opportunities in Denmark Oil and Gas Midstream Market

The future holds opportunities for growth in areas such as carbon capture and storage (CCS) technologies, as the focus on environmental sustainability intensifies. Expanding pipeline infrastructure to support the integration of renewable energy sources into the existing grid presents significant potential. Moreover, investments in advanced analytics and digitalization can further optimize operations and reduce costs. Exploring new export markets and partnerships with regional players could also contribute to market expansion.

Major Players in the Denmark Oil and Gas Midstream Market Ecosystem

Key Developments in Denmark Oil and Gas Midstream Market Industry

- November 2022: The Baltic Pipe LNG receiving terminal in Nybro near Varde in Western Jutland, Denmark, was operated at half its total capacity (6,700 MWh/h), highlighting challenges in initial operational phases and potential bottlenecks in LNG infrastructure.

- November 2022: GAZ-SYSTEM signed an agreement with Rambøll Danmark A/S to design the marine infrastructure for the construction of the FSRU floating terminal, indicating significant investment and future expansion in LNG import capacity.

Strategic Denmark Oil and Gas Midstream Market Market Forecast

The Danish oil and gas midstream market is poised for continued growth, driven by strategic investments in infrastructure upgrades, technological advancements, and the increasing demand for natural gas. While facing challenges from the energy transition, the market's future prospects are optimistic, particularly within the context of the evolving energy mix and the nation's commitment to energy security. Strategic partnerships and the adoption of innovative technologies will be pivotal in shaping the market's future trajectory.

Denmark Oil And Gas Midstream Market Segmentation

- 1. Transportation

- 2. Storage

- 3. LNG Terminals

Denmark Oil And Gas Midstream Market Segmentation By Geography

- 1. Denmark

Denmark Oil And Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Transportation Sector is expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. United States Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Engie SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chevron Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 TotalEnergies SE

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Shell PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Orsted A/S

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 Engie SA

List of Figures

- Figure 1: Denmark Oil And Gas Midstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Oil And Gas Midstream Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 4: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 5: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 6: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 7: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 8: Denmark Oil And Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 9: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: United States Denmark Oil And Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Denmark Oil And Gas Midstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Denmark Oil And Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Denmark Oil And Gas Midstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Denmark Oil And Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Denmark Oil And Gas Midstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 20: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 21: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 22: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 23: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 24: Denmark Oil And Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 25: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Oil And Gas Midstream Market?

The projected CAGR is approximately > 3.49%.

2. Which companies are prominent players in the Denmark Oil And Gas Midstream Market?

Key companies in the market include Engie SA, Chevron Corporation, TotalEnergies SE, Shell PLC, Orsted A/S.

3. What are the main segments of the Denmark Oil And Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Transportation Sector is expected to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

November 2022: The Baltic Pipe LNG receiving terminal in Nybro near Varde in Western Jutland, Denmark, was operated at half the total capacity (6,700 MWh/h).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Oil And Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Oil And Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Oil And Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Denmark Oil And Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence