Key Insights

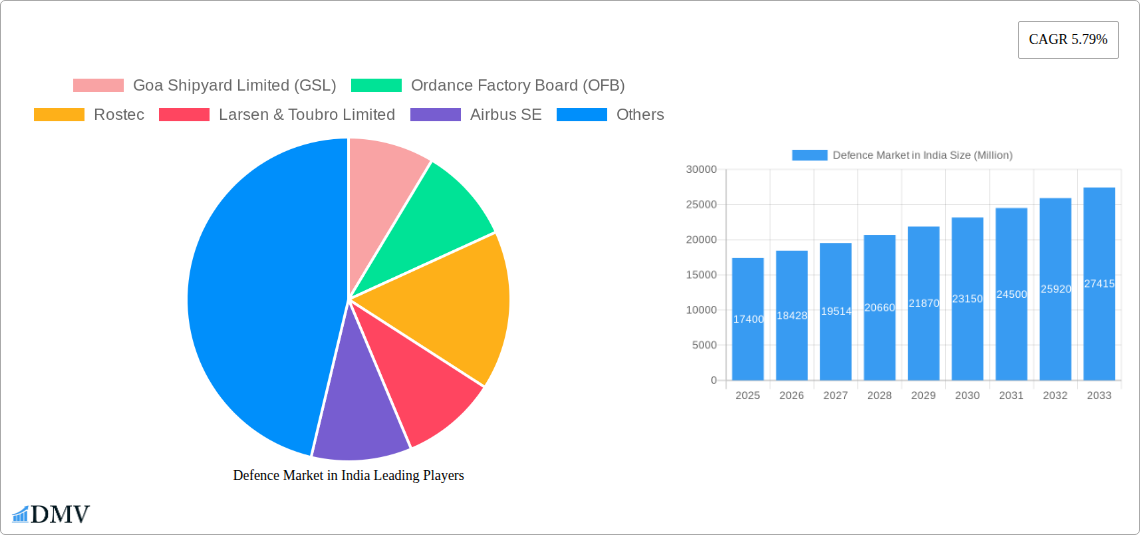

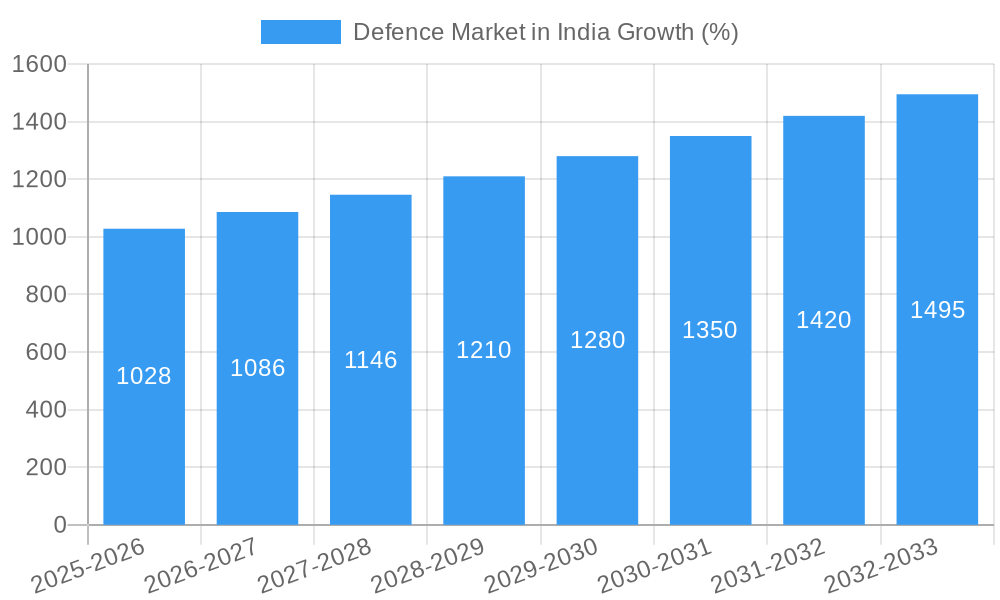

The Indian defense market, valued at $17.4 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, modernization of armed forces, and increasing domestic manufacturing initiatives under the "Make in India" program. A Compound Annual Growth Rate (CAGR) of 5.79% from 2025 to 2033 forecasts a significant market expansion. Key growth drivers include the urgent need to upgrade aging equipment across all branches of the military (Army, Navy, Air Force), a surge in demand for advanced technologies like C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems and unmanned aerial vehicles (UAVs), and a heightened focus on enhancing cybersecurity capabilities. The market is segmented into various equipment categories, with fixed-wing aircraft, rotorcraft, and ground vehicles representing significant portions. The growing private sector participation, exemplified by companies like Tata Sons, Reliance Group, and Mahindra & Mahindra, alongside established players like HAL and BEL, is further fueling this expansion. However, budgetary constraints and complex procurement processes continue to pose challenges to the market's full potential.

The regional distribution within India suggests a relatively balanced market share across North, South, East, and West regions, although specific data on regional breakdown requires further investigation. The government's increased emphasis on self-reliance in defense manufacturing is fostering domestic production and attracting foreign direct investment (FDI), leading to a more competitive and innovative landscape. While challenges remain, the long-term outlook for the Indian defense market remains overwhelmingly positive, particularly considering the nation's strategic geopolitical position and commitment to strengthening its defense capabilities. The forecast period of 2025-2033 promises substantial opportunities for both domestic and international players in the defense sector.

Defence Market in India: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning Defence Market in India, offering a detailed examination of market trends, key players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The Indian defence market, valued at xx Million in 2025, is poised for significant expansion, driven by escalating geopolitical tensions and a commitment to modernizing its armed forces.

Defence Market in India Market Composition & Trends

This section delves into the intricate composition of the Indian defence market, analyzing its concentration, innovation drivers, regulatory environment, and competitive dynamics. We examine the interplay of substitute products, end-user profiles (Army, Navy, Air Force), and the impact of mergers and acquisitions (M&A) activities. The report provides a granular view of market share distribution among key players, including Larsen & Toubro Limited, Hindustan Aeronautics Limited (HAL), Tata Sons Private Limited, and others. We also quantify the value of significant M&A deals concluded during the historical period (2019-2024) and project future M&A activity based on current market trends. The regulatory landscape, including its impact on innovation and market entry, is thoroughly assessed.

- Market Concentration: Analysis of market share held by top 5 players (xx%).

- Innovation Catalysts: Government initiatives promoting indigenous defence manufacturing (e.g., "Make in India").

- Regulatory Landscape: Impact of Defence Acquisition Procedure (DAP) on market access and competition.

- Substitute Products: Analysis of substitute technologies and their market impact.

- End-User Profiles: Detailed analysis of procurement priorities of Army, Navy, and Air Force.

- M&A Activities: Review of major M&A deals (2019-2024) with deal values (xx Million).

Defence Market in India Industry Evolution

This section provides a detailed trajectory of the Indian defence industry's evolution from 2019 to 2033. We analyze market growth trajectories, pinpointing key growth rates and adoption metrics for various segments (e.g., C4ISR, Unmanned Systems). The report examines technological advancements driving market transformation, such as the integration of AI and autonomous systems into defence platforms. Furthermore, we analyze shifting consumer demands – reflecting changing geopolitical landscape and modernization priorities of the armed forces. Growth rates are projected for key segments, highlighting the influence of technological advancements and evolving defence strategies.

Leading Regions, Countries, or Segments in Defence Market in India

This section identifies the dominant regions, countries, or segments within the Indian defence market. We analyze the key drivers behind this dominance, examining investment trends, regulatory support, and unique market characteristics. The analysis encompasses all segments: Armed Forces (Army, Navy, Air Force), and product types (Fixed-wing Aircraft, Rotorcraft, Ground Vehicles, Naval Vessels, C4ISR, Weapons and Ammunition, Protection and Training Equipment, Unmanned Systems).

- Key Drivers:

- Army: Focus on modernization of land-based systems.

- Navy: Investment in indigenous warship construction.

- Air Force: Emphasis on advanced fighter jets and air defence systems.

- Fixed-wing Aircraft: High demand driven by modernization programmes.

- Rotorcraft: Increasing focus on indigenous helicopter development.

- Ground Vehicles: Focus on armored vehicles and artillery systems.

- Naval Vessels: Significant investments in submarine and aircraft carrier programmes.

- C4ISR: Growing demand for advanced command, control, communications, computers, intelligence, surveillance, and reconnaissance systems.

- Weapons and Ammunition: Continuous requirement for advanced munitions and weapon systems.

- Protection and Training Equipment: Expanding market driven by force modernization.

- Unmanned Systems: Rapid adoption of drones and unmanned aerial vehicles (UAVs).

Defence Market in India Product Innovations

This section highlights significant product innovations, outlining their applications and performance metrics. We showcase unique selling propositions and technological advancements shaping the market landscape. For example, the development of indigenous fifth-generation fighter jets and advanced missile systems represent significant technological leaps that are reshaping competitive dynamics.

Propelling Factors for Defence Market in India Growth

Several factors are propelling the growth of the Indian defence market. These include increased defence budgets, modernization programs across the armed forces, the "Make in India" initiative stimulating domestic production, and strategic partnerships with global defence companies. The strategic imperative to enhance national security further fuels market expansion.

Obstacles in the Defence Market in India Market

Despite significant growth potential, the Indian defence market faces challenges. These include complex procurement procedures, dependence on foreign technology in some areas, and the need for stronger domestic supply chains. Competition from established global players poses a challenge for indigenous manufacturers. These obstacles could impact the rate of market growth.

Future Opportunities in Defence Market in India

The Indian defence market presents significant future opportunities. The rising adoption of advanced technologies like AI, UAVs, and cyber warfare capabilities creates avenues for innovation and growth. Increasing private sector participation and the government's focus on self-reliance in defence manufacturing promise immense potential for both domestic and international players.

Major Players in the Defence Market in India Ecosystem

- Goa Shipyard Limited (GSL)

- Ordnance Factory Board (OFB)

- Rostec

- Larsen & Toubro Limited

- Airbus SE

- Kalyani Group

- The Boeing Company

- Tata Sons Private Limited

- Rafael Advanced Defense Systems Ltd

- Hindustan Aeronautics Limited (HAL)

- Hinduja Group

- Defence Research and Development Organisation (DRDO)

- IAI Group

- Mahindra & Mahindra Ltd

- Reliance Group

- Bharat Electronics Limited (BEL)

Key Developments in Defence Market in India Industry

- 2022-Oct: Launch of the indigenous Tejas Mark-1A fighter jet.

- 2023-Mar: Announcement of a major acquisition deal for advanced air defence systems.

- 2024-Jun: Partnership between an Indian and foreign defence company for joint production of armoured vehicles. (Further details will be added as available)

Strategic Defence Market in India Market Forecast

The Indian defence market is projected to experience robust growth over the forecast period (2025-2033), driven by continuous modernization efforts, technological advancements, and rising geopolitical uncertainties. The increasing focus on indigenous defence manufacturing, coupled with strategic partnerships, will further accelerate market expansion. Opportunities in advanced technologies such as AI, UAVs, and cyber security will be key growth drivers.

Defence Market in India Segmentation

-

1. Armed Forces

- 1.1. Army

- 1.2. Navy

- 1.3. Air Force

-

2. Type

- 2.1. Fixed-wing Aircraft

- 2.2. Rotorcraft

- 2.3. Ground Vehicles

- 2.4. Naval Vessels

- 2.5. C4ISR

- 2.6. Weapons and Ammunition

- 2.7. Protection and Training Equipment

- 2.8. Unmanned Systems

Defence Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Defence Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Air Force Segment is Expected to Hold the Highest Shares in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Army

- 5.1.2. Navy

- 5.1.3. Air Force

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed-wing Aircraft

- 5.2.2. Rotorcraft

- 5.2.3. Ground Vehicles

- 5.2.4. Naval Vessels

- 5.2.5. C4ISR

- 5.2.6. Weapons and Ammunition

- 5.2.7. Protection and Training Equipment

- 5.2.8. Unmanned Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. North America Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6.1.1. Army

- 6.1.2. Navy

- 6.1.3. Air Force

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fixed-wing Aircraft

- 6.2.2. Rotorcraft

- 6.2.3. Ground Vehicles

- 6.2.4. Naval Vessels

- 6.2.5. C4ISR

- 6.2.6. Weapons and Ammunition

- 6.2.7. Protection and Training Equipment

- 6.2.8. Unmanned Systems

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7. South America Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7.1.1. Army

- 7.1.2. Navy

- 7.1.3. Air Force

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fixed-wing Aircraft

- 7.2.2. Rotorcraft

- 7.2.3. Ground Vehicles

- 7.2.4. Naval Vessels

- 7.2.5. C4ISR

- 7.2.6. Weapons and Ammunition

- 7.2.7. Protection and Training Equipment

- 7.2.8. Unmanned Systems

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8. Europe Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8.1.1. Army

- 8.1.2. Navy

- 8.1.3. Air Force

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fixed-wing Aircraft

- 8.2.2. Rotorcraft

- 8.2.3. Ground Vehicles

- 8.2.4. Naval Vessels

- 8.2.5. C4ISR

- 8.2.6. Weapons and Ammunition

- 8.2.7. Protection and Training Equipment

- 8.2.8. Unmanned Systems

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9. Middle East & Africa Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9.1.1. Army

- 9.1.2. Navy

- 9.1.3. Air Force

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fixed-wing Aircraft

- 9.2.2. Rotorcraft

- 9.2.3. Ground Vehicles

- 9.2.4. Naval Vessels

- 9.2.5. C4ISR

- 9.2.6. Weapons and Ammunition

- 9.2.7. Protection and Training Equipment

- 9.2.8. Unmanned Systems

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10. Asia Pacific Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10.1.1. Army

- 10.1.2. Navy

- 10.1.3. Air Force

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fixed-wing Aircraft

- 10.2.2. Rotorcraft

- 10.2.3. Ground Vehicles

- 10.2.4. Naval Vessels

- 10.2.5. C4ISR

- 10.2.6. Weapons and Ammunition

- 10.2.7. Protection and Training Equipment

- 10.2.8. Unmanned Systems

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 11. North India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Goa Shipyard Limited (GSL)

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Ordance Factory Board (OFB)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Rostec

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Larsen & Toubro Limited

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Airbus SE

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Kalyani Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 The Boeing Compan

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Tata Sons Private Limited

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Rafael Advanced Defense Systems Ltd

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Hindustan Aeronautics Limited (HAL)

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Hinduja Group

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Defense Research and Development Organisation (DRDO)

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 IAI Group

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Mahindra & Mahindra Ltd

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Reliance Group

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.16 Bharat Electronics Limited (BEL)

- 15.2.16.1. Overview

- 15.2.16.2. Products

- 15.2.16.3. SWOT Analysis

- 15.2.16.4. Recent Developments

- 15.2.16.5. Financials (Based on Availability)

- 15.2.1 Goa Shipyard Limited (GSL)

List of Figures

- Figure 1: Global Defence Market in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 5: North America Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 6: North America Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 7: North America Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 11: South America Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 12: South America Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 13: South America Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 17: Europe Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 18: Europe Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 23: Middle East & Africa Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 24: Middle East & Africa Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 25: Middle East & Africa Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 26: Middle East & Africa Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 29: Asia Pacific Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 30: Asia Pacific Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Defence Market in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Defence Market in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 3: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Defence Market in India Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 11: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 17: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 23: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 35: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 44: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defence Market in India?

The projected CAGR is approximately 5.79%.

2. Which companies are prominent players in the Defence Market in India?

Key companies in the market include Goa Shipyard Limited (GSL), Ordance Factory Board (OFB), Rostec, Larsen & Toubro Limited, Airbus SE, Kalyani Group, The Boeing Compan, Tata Sons Private Limited, Rafael Advanced Defense Systems Ltd, Hindustan Aeronautics Limited (HAL), Hinduja Group, Defense Research and Development Organisation (DRDO), IAI Group, Mahindra & Mahindra Ltd, Reliance Group, Bharat Electronics Limited (BEL).

3. What are the main segments of the Defence Market in India?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.40 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Air Force Segment is Expected to Hold the Highest Shares in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defence Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defence Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defence Market in India?

To stay informed about further developments, trends, and reports in the Defence Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence