Key Insights

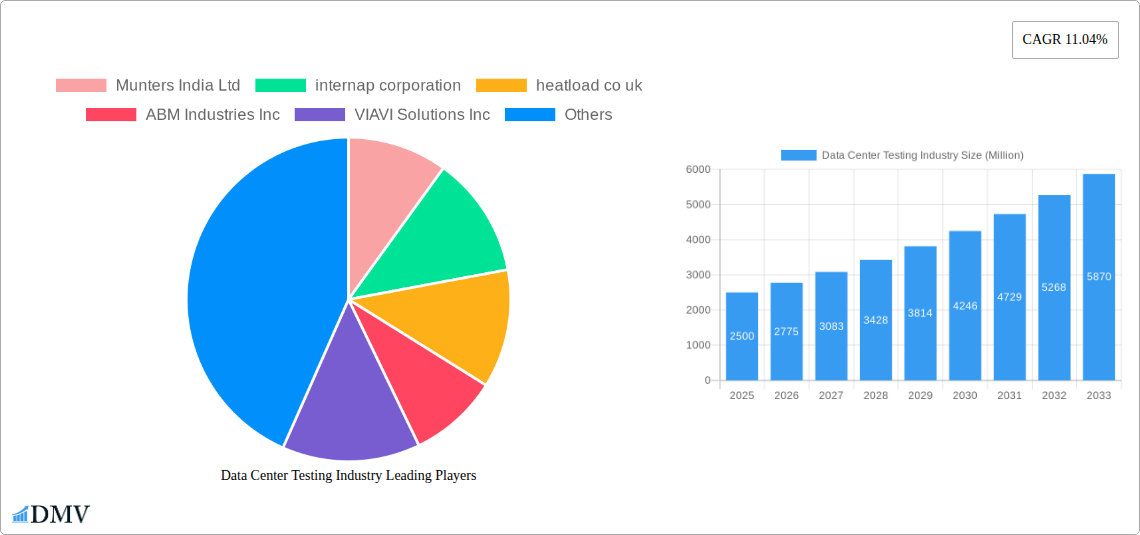

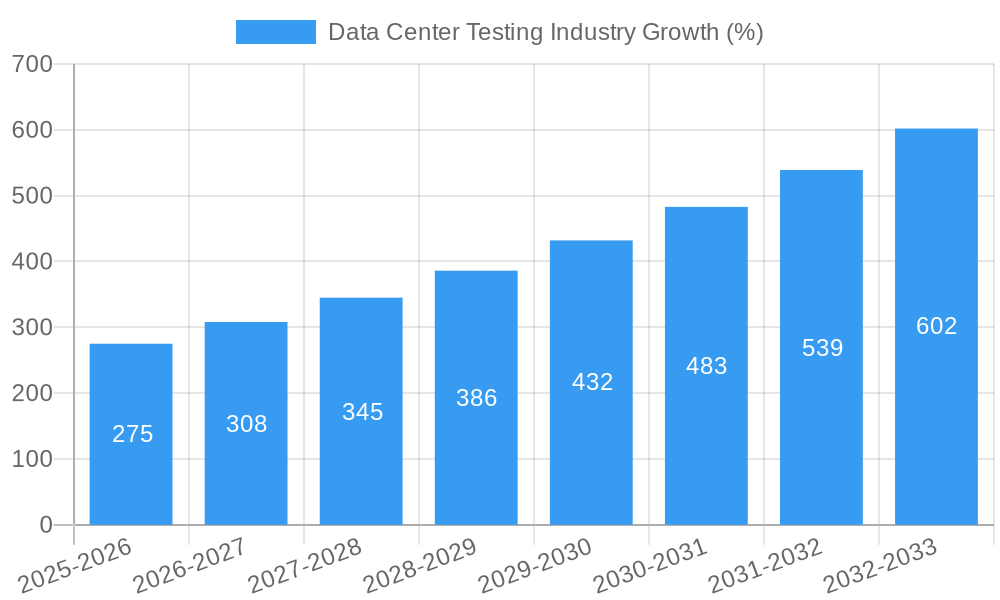

The Data Center Testing market is experiencing robust growth, fueled by the escalating demand for high-availability and resilient data center infrastructure globally. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11.04% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud computing and edge computing necessitates rigorous testing to ensure optimal performance and reliability. Furthermore, the growing complexity of data center architectures, including virtualization, containerization, and the integration of AI/ML, requires sophisticated testing methodologies to identify and resolve potential bottlenecks. Stringent regulatory compliance requirements and the need for minimizing downtime further contribute to the market's growth trajectory. The market is segmented by type into solutions and services, with both experiencing significant growth driven by the diverse testing needs within the data center ecosystem.

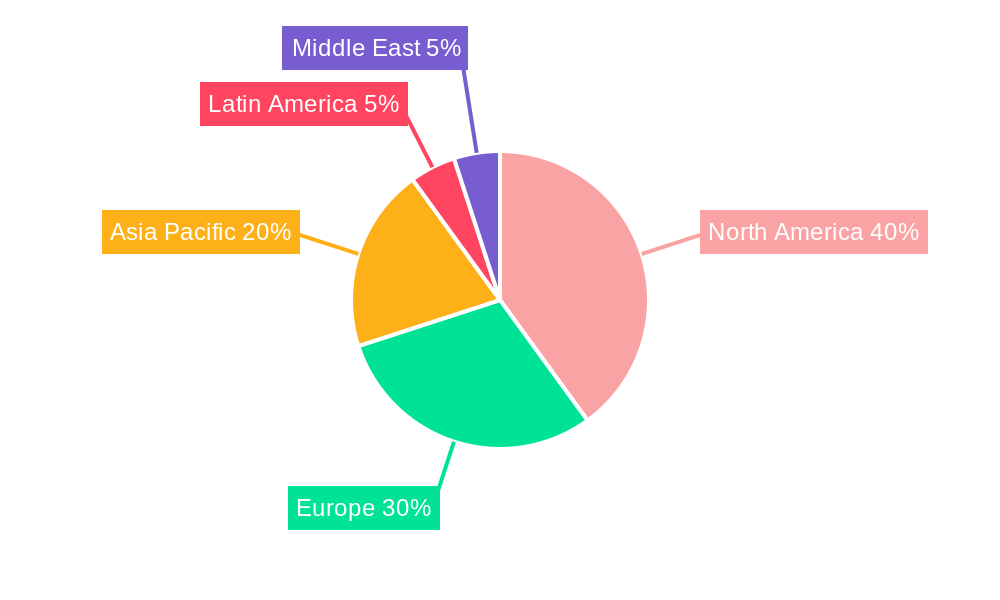

Major players like Munters India Ltd, Internap Corporation, and others are actively shaping the market landscape through innovative solutions and strategic partnerships. Geographic expansion is also a key aspect of the market's growth, with North America and Europe currently holding significant market shares, while the Asia-Pacific region is poised for substantial growth driven by increasing investments in data center infrastructure and digital transformation initiatives. However, factors such as the high initial investment costs associated with implementing comprehensive data center testing solutions and the need for specialized expertise could potentially restrain market growth to some extent. Despite these challenges, the long-term outlook for the Data Center Testing market remains positive, driven by the relentless growth of the data center industry and the increasing importance of ensuring high performance and reliability.

Data Center Testing Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Data Center Testing industry, projecting a market valuation exceeding $XX Million by 2033. The study covers the period 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. Key players analyzed include Munters India Ltd, Internap Corporation, Heatload Co UK, ABM Industries Inc, VIAVI Solutions Inc, Veryx Technologies, 365 Operating Company LLC, Spirent Communications plc, EXFO Inc, Atlassian Corporation Plc, and AT TOKYO Corporation. This report is crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions.

Data Center Testing Industry Market Composition & Trends

This section delves into the competitive landscape, analyzing market concentration, innovation drivers, and regulatory influences within the $XX Million Data Center Testing market. We examine the interplay of solutions and services offered, alongside the evolving end-user profiles.

- Market Share Distribution: The market is currently moderately concentrated, with the top 5 players holding approximately XX% of the market share in 2025. This is projected to slightly decrease to XX% by 2033 due to increased competition and market fragmentation.

- Innovation Catalysts: The increasing adoption of cloud computing, edge computing, and 5G technologies are driving innovation in data center testing solutions. Advancements in AI and machine learning are also enhancing testing capabilities and automation.

- Regulatory Landscape: Stringent data privacy regulations and compliance requirements are influencing the demand for robust data center testing solutions that ensure data security and reliability.

- Substitute Products: While direct substitutes are limited, alternative approaches to testing, such as simulations, pose a competitive pressure, although it is expected to be minimal due to the demand for accurate and reliable testing in data centers.

- End-User Profiles: The primary end-users include data center operators, cloud service providers, telecommunication companies, and enterprises. Growth is driven by increasing data center deployments and expanding digital infrastructure across various industries.

- M&A Activities: The past five years have witnessed significant M&A activity, with a total deal value exceeding $XX Million. These acquisitions are driven by the need for enhanced technological capabilities and expanded market reach. For instance, the acquisition of Company X by Company Y in 2022 significantly altered the market dynamics.

Data Center Testing Industry Evolution

The Data Center Testing market exhibits a robust growth trajectory, projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period. This growth is fueled by the exponential increase in data center deployments globally, driven by the proliferation of big data, IoT devices, and cloud adoption. Technological advancements, such as the development of more sophisticated testing tools and automated testing solutions, are further accelerating market expansion. The shift towards agile methodologies and DevOps practices in data center management also contributes significantly. The demand for enhanced security and reliability within data centers is creating opportunities for specialized testing solutions that address specific security vulnerabilities and performance bottlenecks. The rising adoption of advanced analytics and AI-driven testing platforms is revolutionizing the way data centers are tested, enabling proactive identification and resolution of potential issues. Furthermore, increasing awareness of the importance of data center uptime and the financial implications of downtime is fostering a market environment that values proactive testing and preventive maintenance.

Leading Regions, Countries, or Segments in Data Center Testing Industry

North America currently dominates the Data Center Testing market, accounting for approximately XX% of the global revenue in 2025. This dominance is primarily attributed to the high concentration of data centers, robust IT infrastructure, and early adoption of advanced technologies.

Key Drivers for North American Dominance:

- High Investment in Data Center Infrastructure: Significant investments in data center construction and modernization are driving the demand for advanced testing solutions.

- Stringent Regulatory Compliance: Strict data privacy and security regulations necessitate rigorous testing procedures, fueling market growth.

- Presence of Major Technology Companies: The presence of numerous technology giants in the region creates a substantial demand for data center testing services.

Analysis of Dominance Factors:

North America's early adoption of cloud computing and the substantial presence of hyperscale data centers have established it as the leading region. The region’s robust technological advancements, coupled with substantial government investments in digital infrastructure, further cement its leadership position. However, the Asia-Pacific region is expected to witness significant growth in the coming years due to rapid digitalization and increasing investments in data center infrastructure.

By Type: Solutions Segment Analysis: This segment is projected to hold the largest market share (XX%) in 2025, driven by increasing demand for comprehensive testing solutions addressing diverse data center needs.

By Type: Services Segment Analysis: The services segment is expected to experience significant growth during the forecast period, driven by the increasing need for expertise in data center testing methodologies and the adoption of managed testing services.

Data Center Testing Industry Product Innovations

Recent innovations include AI-powered test automation platforms that significantly reduce testing time and improve accuracy. These platforms utilize machine learning algorithms to identify potential issues and optimize testing processes. Further advancements encompass automated performance testing tools that simulate real-world conditions and help identify bottlenecks and optimize data center configurations, along with solutions emphasizing network security testing to prevent potential cyber threats. These innovations offer unique selling propositions by improving efficiency, reducing costs, and ensuring higher reliability and security of data center operations.

Propelling Factors for Data Center Testing Industry Growth

The Data Center Testing industry is propelled by several key factors: the explosive growth of data and the need for high-performance, secure data centers; increasing adoption of cloud computing and edge computing; advancements in network technologies (5G, IoT); stringent data privacy regulations; and the growing need for proactive testing and preventive maintenance to minimize downtime. The shift towards DevOps and agile methodologies in data center management further accelerates the adoption of automated testing solutions.

Obstacles in the Data Center Testing Industry Market

The industry faces challenges such as the high cost of advanced testing tools and skilled labor shortages, potentially hindering widespread adoption. Supply chain disruptions can impact the availability of testing equipment, leading to project delays. Intense competition among vendors, with some offering similar solutions at varying price points, also poses a significant hurdle.

Future Opportunities in Data Center Testing Industry

Emerging opportunities lie in the expansion into new markets, such as developing economies, and the development of specialized testing solutions for specific technologies, such as quantum computing and blockchain. The integration of AI and machine learning into testing platforms will continue to drive innovation and improve testing efficiency. Further growth is expected from increasing demand for data center testing solutions in edge computing and IoT deployments.

Major Players in the Data Center Testing Industry Ecosystem

- Munters India Ltd

- Internap Corporation

- Heatload Co UK

- ABM Industries Inc

- VIAVI Solutions Inc

- Veryx Technologies

- 365 Operating Company LLC

- Spirent Communications plc

- EXFO Inc

- Atlassian Corporation Plc

- AT TOKYO Corporation

Key Developments in Data Center Testing Industry

- January 2023: VIAVI Solutions launched a new AI-powered test automation platform.

- March 2022: Spirent Communications acquired a smaller competitor, expanding its market share.

- October 2021: ABM Industries announced a strategic partnership to offer enhanced data center testing services. (Further specific developments to be added based on actual data).

Strategic Data Center Testing Industry Market Forecast

The Data Center Testing market is poised for significant growth, driven by the increasing demand for reliable and secure data centers, technological advancements, and expanding data center infrastructure globally. The market is expected to continue its upward trajectory, with continued innovation in testing technologies and methodologies playing a critical role in shaping the future of the industry. The emergence of new technologies and the expansion into new geographic markets will further fuel market expansion.

Data Center Testing Industry Segmentation

-

1. Type

- 1.1. Solutions

- 1.2. Services

Data Center Testing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Data Center Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Deployment of Data Center Facilities; Advent of 5G

- 3.3. Market Restrains

- 3.3.1. ; Concerns Relating to Data Privacy

- 3.4. Market Trends

- 3.4.1. E-Commerce is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.2. Services

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.2. Services

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.2. Services

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.2. Services

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solutions

- 10.1.2. Services

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Data Center Testing Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Munters India Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 internap corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 heatload co uk

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 ABM Industries Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 VIAVI Solutions Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Veryx Technologies

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 365 Operating Company LLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Spirent Communications plc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 EXFO Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Atlassian Corporation Plc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 AT TOKYO Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Munters India Ltd

List of Figures

- Figure 1: Global Data Center Testing Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Data Center Testing Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Data Center Testing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Data Center Testing Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Data Center Testing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Data Center Testing Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific Data Center Testing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Data Center Testing Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Latin America Data Center Testing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Latin America Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East Data Center Testing Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East Data Center Testing Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East Data Center Testing Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East Data Center Testing Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Data Center Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Data Center Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Data Center Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Data Center Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Data Center Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Data Center Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Data Center Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Data Center Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Data Center Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Data Center Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Data Center Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Data Center Testing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Testing Industry?

The projected CAGR is approximately 11.04%.

2. Which companies are prominent players in the Data Center Testing Industry?

Key companies in the market include Munters India Ltd, internap corporation, heatload co uk, ABM Industries Inc, VIAVI Solutions Inc, Veryx Technologies, 365 Operating Company LLC, Spirent Communications plc, EXFO Inc, Atlassian Corporation Plc, AT TOKYO Corporation.

3. What are the main segments of the Data Center Testing Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Deployment of Data Center Facilities; Advent of 5G.

6. What are the notable trends driving market growth?

E-Commerce is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Concerns Relating to Data Privacy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Testing Industry?

To stay informed about further developments, trends, and reports in the Data Center Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence