Key Insights

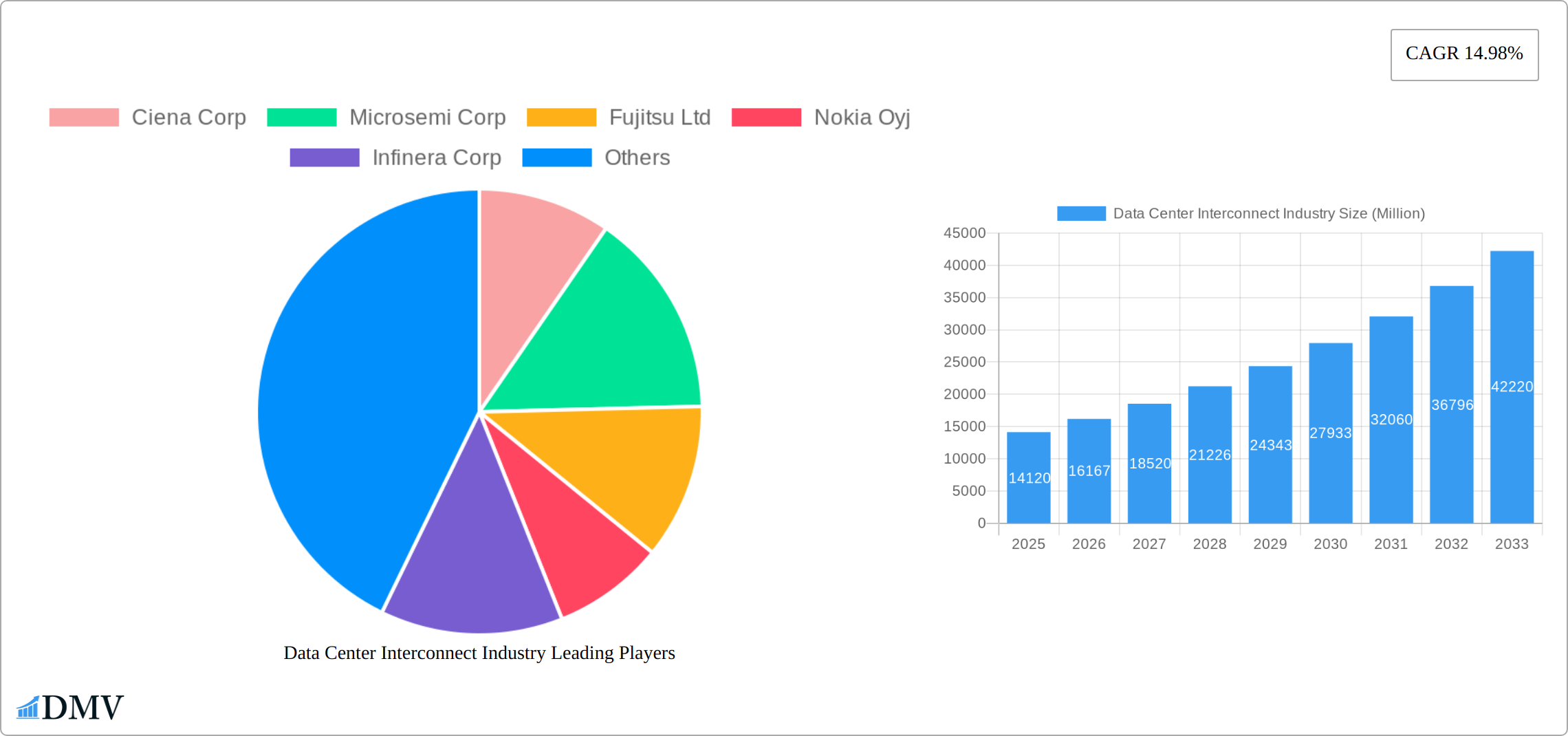

The Data Center Interconnect (DCI) market is experiencing robust growth, projected to reach \$14.12 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.98% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for cloud services and the proliferation of data centers necessitate high-bandwidth, low-latency connections between these facilities. The rise of 5G networks and the Internet of Things (IoT) further fuel this demand, requiring robust DCI solutions to manage the massive data flows. Furthermore, the growing adoption of hybrid and multi-cloud strategies compels businesses to establish seamless connectivity between their on-premises data centers and cloud environments, driving DCI adoption. The market is segmented by application (Disaster Recovery and Business Continuity, Shared Data and Resources, Data Mobility, and Other Applications) and end-user industry (Communications Service Providers (CSPs), Internet Content and Carrier-neutral Providers (ICPs/CNPs), Government/Research and Education (Government/R&E), and Other End-user Verticals). North America currently holds a significant market share due to the high concentration of data centers and early adoption of advanced technologies. However, regions like Asia-Pacific are witnessing rapid growth, fueled by increasing digitalization and infrastructure investments.

Major players like Ciena, Microsemi, Fujitsu, Nokia, Infinera, Pluribus Networks, Cisco, Juniper Networks, Huawei, and ADVA Optical Networking are actively shaping the market landscape through technological innovation and strategic partnerships. Competition is fierce, with companies focusing on developing high-capacity, cost-effective, and secure DCI solutions. The future growth of the DCI market will be influenced by advancements in technologies such as optical networking, software-defined networking (SDN), and network function virtualization (NFV). Addressing challenges related to security, network management complexity, and interoperability across different vendors will also play a crucial role in shaping the market's trajectory. The continued expansion of cloud computing, the escalating demand for data, and the growing need for high-speed connectivity will sustain the strong growth of the DCI market in the coming years.

Data Center Interconnect Industry Market Composition & Trends

The Data Center Interconnect (DCI) industry is characterized by a high level of market concentration, with leading players such as Cisco Systems Inc, Juniper Networks Inc, and Huawei Technologies Co Ltd holding significant market shares. The market share distribution indicates that Cisco holds approximately 30%, Juniper 20%, and Huawei 15% of the global market. Innovation is a key catalyst, driven by the need for higher bandwidth and lower latency solutions. Regulatory landscapes vary by region, with stringent data protection laws in the EU and more relaxed policies in Asia, influencing market dynamics. Substitute products like satellite communications pose minimal threat due to cost and performance limitations. End-user profiles include Communications Service Providers (CSPs), Internet Content and Carrier-neutral Providers (ICPs/CNPs), and Government/Research and Education sectors, each with unique demands for interconnect solutions.

Mergers and acquisitions (M&A) activities have been robust, with deal values reaching over 500 Million in 2022 alone. Notable M&A activities include:

- Acquisition of Pluribus Networks Inc by a larger tech conglomerate, enhancing their DCI capabilities.

- Strategic partnership between Ciena Corp and a leading cloud provider to develop next-generation interconnect solutions.

These trends underscore a dynamic market environment where innovation and strategic alliances are pivotal for maintaining competitive edge.

Data Center Interconnect Industry Industry Evolution

The Data Center Interconnect industry has undergone significant evolution, marked by rapid market growth and technological advancements. From 2019 to 2024, the historical period, the market grew at a CAGR of approximately 15%, driven by the increasing demand for cloud services and data mobility. Technological advancements, such as the adoption of 400G and 800G Ethernet, have been pivotal in meeting the rising bandwidth requirements. The shift towards software-defined networking (SDN) and network functions virtualization (NFV) has also played a crucial role in enhancing the flexibility and scalability of DCI solutions.

Consumer demands have shifted towards more robust disaster recovery and business continuity solutions, with a CAGR of 20% in this segment. Shared data and resources applications have seen steady growth at a 12% CAGR, reflecting the growing need for seamless data exchange across different locations. Data (storage) mobility, crucial for enterprises with global operations, has grown at a 18% CAGR, underscoring the importance of efficient data management in today's digital economy. These trends are expected to continue, with the forecast period from 2025 to 2033 projected to see a CAGR of 22%, fueled by further technological innovations and the expansion of end-user industries.

Leading Regions, Countries, or Segments in Data Center Interconnect Industry

North America stands out as the dominant region in the Data Center Interconnect industry, driven by significant investments in digital infrastructure and a high concentration of leading technology companies. The United States, in particular, leads with a market share of approximately 40%, attributed to robust regulatory support and a thriving ecosystem of CSPs and ICPs/CNPs.

- Investment Trends: The region has seen investments exceeding 10 Billion in the past five years, focusing on enhancing connectivity and data center capabilities.

- Regulatory Support: The Federal Communications Commission (FCC) and other regulatory bodies have facilitated the growth of DCI through policies promoting broadband expansion and data security.

In terms of segments, Disaster Recovery and Business Continuity remains the most dominant application, with a market share of 35%. This is driven by the critical need for uninterrupted service and data protection. Key factors include:

- Increased Frequency of Cyberattacks: Leading to higher demand for robust recovery solutions.

- Regulatory Requirements: Such as GDPR, compelling businesses to invest in reliable interconnect solutions.

Shared Data and Resources also hold a significant share at 25%, propelled by the need for seamless data exchange and collaboration across enterprises. Data (Storage) Mobility, with a 20% market share, is crucial for multinational corporations requiring efficient data management across global operations.

Data Center Interconnect Industry Product Innovations

Innovations in the Data Center Interconnect industry have focused on enhancing performance and reducing latency. Recent developments include the introduction of 400G and 800G Ethernet solutions by companies like Ciena Corp and Nokia Oyj, significantly boosting data transfer rates. These innovations offer unique selling propositions such as higher bandwidth and lower power consumption, making them ideal for applications requiring high-speed data interconnects. Additionally, the integration of AI and machine learning in DCI solutions has improved network optimization and predictive maintenance, further enhancing reliability and efficiency.

Propelling Factors for Data Center Interconnect Industry Growth

The growth of the Data Center Interconnect industry is propelled by several key factors. Technological advancements, such as the deployment of 5G networks, are increasing the demand for high-capacity interconnect solutions. Economically, the rise of cloud computing and big data analytics necessitates robust DCI infrastructure. Regulatory influences, including data sovereignty laws and cybersecurity mandates, are also driving investments in secure and compliant interconnect solutions. For instance, the GDPR has spurred demand for DCI solutions that ensure data protection across borders.

Obstacles in the Data Center Interconnect Industry Market

The Data Center Interconnect industry faces several obstacles. Regulatory challenges, such as varying data protection laws across regions, can complicate the deployment of global interconnect solutions. Supply chain disruptions, exacerbated by global events like pandemics, have led to delays and increased costs. Competitive pressures are intense, with major players constantly innovating to capture market share, resulting in price wars and margin compression. These factors have quantifiable impacts, such as a 10% increase in deployment costs due to supply chain issues and a 5% reduction in profit margins due to competitive pricing.

Future Opportunities in Data Center Interconnect Industry

Emerging opportunities in the Data Center Interconnect industry include the expansion into new markets like Africa and Southeast Asia, where digital infrastructure is rapidly developing. Technological advancements, such as the integration of edge computing and IoT, are opening new avenues for DCI solutions. Consumer trends towards remote work and digital transformation are also driving demand for more flexible and scalable interconnect solutions, creating significant growth potential in the coming years.

Major Players in the Data Center Interconnect Industry Ecosystem

- Ciena Corp

- Microsemi Corp

- Fujitsu Ltd

- Nokia Oyj

- Infinera Corp

- Pluribus Networks Inc

- Cisco Systems Inc

- Juniper Networks Inc

- Huawei Technologies Co Ltd

- ADVA Optical Networking SE

Key Developments in Data Center Interconnect Industry Industry

June 2022: Cologix extended its strategic partnership with Console Connect by PCCW Global, deploying the Console Connect Software-Defined Interconnection platform at its TOR1 data center in Toronto. This development enhances digital edge linkages for Canadian customers, offering fast and reliable connectivity to global partners and workers. It also provides an interconnection ecosystem with over 600 networks, 300 cloud providers, and 30 onramps across North America, positioning Cologix for future business opportunities.

November 2022: Equinix, Inc., and VMware, Inc., announced an extended partnership to launch VMware Cloud on Equinix Metal, a new distributed cloud service. This service integrates VMware-managed cloud infrastructure with Equinix's global Bare Metal as a Service, extending customers' cloud environments into metro areas to meet edge performance demands while ensuring enterprise workload integrity. This collaboration is poised to drive innovation in digital infrastructure and multi-cloud services.

Strategic Data Center Interconnect Industry Market Forecast

The future of the Data Center Interconnect industry looks promising, with significant growth catalysts on the horizon. The ongoing digital transformation across industries, coupled with the expansion of 5G networks and edge computing, will drive demand for advanced interconnect solutions. The forecast period from 2025 to 2033 is expected to see a robust CAGR of 22%, reflecting the market's potential to capitalize on emerging opportunities in new regions and technologies. As enterprises continue to prioritize data mobility, security, and efficiency, the DCI market is well-positioned for sustained growth and innovation.

Data Center Interconnect Industry Segmentation

-

1. Application

- 1.1. Disaster Recovery and Business Continuity

- 1.2. Shared Data and Resources

- 1.3. Data (Storage) Mobility

- 1.4. Other Applications

-

2. End-user Industry

- 2.1. Communications Service Providers (CSPs)

- 2.2. Internet

- 2.3. Government/Research and Education (Government/R&E)

- 2.4. Other End-user Verticals

Data Center Interconnect Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Data Center Interconnect Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Number of Data Centers (Edge and Hyperscale); Increasing Need for Ultra- broadband

- 3.2.2 Simplified

- 3.2.3 and Intelligent DCI Networks due to Applications

- 3.2.4 like AI and HPC

- 3.3. Market Restrains

- 3.3.1. Complex Manufacturing Process

- 3.4. Market Trends

- 3.4.1. Increasing Number of Data Centers to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Disaster Recovery and Business Continuity

- 5.1.2. Shared Data and Resources

- 5.1.3. Data (Storage) Mobility

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Communications Service Providers (CSPs)

- 5.2.2. Internet

- 5.2.3. Government/Research and Education (Government/R&E)

- 5.2.4. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Disaster Recovery and Business Continuity

- 6.1.2. Shared Data and Resources

- 6.1.3. Data (Storage) Mobility

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Communications Service Providers (CSPs)

- 6.2.2. Internet

- 6.2.3. Government/Research and Education (Government/R&E)

- 6.2.4. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Disaster Recovery and Business Continuity

- 7.1.2. Shared Data and Resources

- 7.1.3. Data (Storage) Mobility

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Communications Service Providers (CSPs)

- 7.2.2. Internet

- 7.2.3. Government/Research and Education (Government/R&E)

- 7.2.4. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Disaster Recovery and Business Continuity

- 8.1.2. Shared Data and Resources

- 8.1.3. Data (Storage) Mobility

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Communications Service Providers (CSPs)

- 8.2.2. Internet

- 8.2.3. Government/Research and Education (Government/R&E)

- 8.2.4. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Disaster Recovery and Business Continuity

- 9.1.2. Shared Data and Resources

- 9.1.3. Data (Storage) Mobility

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Communications Service Providers (CSPs)

- 9.2.2. Internet

- 9.2.3. Government/Research and Education (Government/R&E)

- 9.2.4. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Italy

- 11.1.6 Spain

- 11.1.7 Belgium

- 11.1.8 Netherland

- 11.1.9 Nordics

- 11.1.10 Rest of Europe

- 12. Asia Pacific Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Southeast Asia

- 12.1.6 Australia

- 12.1.7 Indonesia

- 12.1.8 Phillipes

- 12.1.9 Singapore

- 12.1.10 Thailandc

- 12.1.11 Rest of Asia Pacific

- 13. South America Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Argentina

- 13.1.3 Peru

- 13.1.4 Chile

- 13.1.5 Colombia

- 13.1.6 Ecuador

- 13.1.7 Venezuela

- 13.1.8 Rest of South America

- 14. North America Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United States

- 14.1.2 Canada

- 14.1.3 Mexico

- 15. MEA Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ciena Corp

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Microsemi Corp

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Fujitsu Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nokia Oyj

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Infinera Corp

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Pluribus Networks Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Cisco Systems Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Juniper Networks Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Huawei Technologies Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 ADVA Optical Networking SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Ciena Corp

List of Figures

- Figure 1: Global Data Center Interconnect Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Data Center Interconnect Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Data Center Interconnect Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Data Center Interconnect Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Data Center Interconnect Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Data Center Interconnect Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Data Center Interconnect Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Data Center Interconnect Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Data Center Interconnect Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Data Center Interconnect Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Asia Pacific Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Asia Pacific Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Rest of the World Data Center Interconnect Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Rest of the World Data Center Interconnect Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Rest of the World Data Center Interconnect Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Rest of the World Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Rest of the World Data Center Interconnect Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Rest of the World Data Center Interconnect Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center Interconnect Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Data Center Interconnect Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 55: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 58: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 60: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 61: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Interconnect Industry?

The projected CAGR is approximately 14.98%.

2. Which companies are prominent players in the Data Center Interconnect Industry?

Key companies in the market include Ciena Corp, Microsemi Corp, Fujitsu Ltd, Nokia Oyj, Infinera Corp, Pluribus Networks Inc, Cisco Systems Inc, Juniper Networks Inc, Huawei Technologies Co Ltd, ADVA Optical Networking SE.

3. What are the main segments of the Data Center Interconnect Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Data Centers (Edge and Hyperscale); Increasing Need for Ultra- broadband. Simplified. and Intelligent DCI Networks due to Applications. like AI and HPC.

6. What are the notable trends driving market growth?

Increasing Number of Data Centers to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Complex Manufacturing Process.

8. Can you provide examples of recent developments in the market?

June 2022: Cologix, one of North America's leading network-neutral interconnection and hyperscale edge data center providers, announced that it had extended its strategic partnership with Console Connect by PCCW Global by deploying the Console Connect Software-Defined Interconnection platform at its TOR1 data center in Toronto. Cologix, in conjunction with Console Connect, now provides Canadian customers with extra fast and reliable digital edge linkages to connect with their customers, partners, and workers globally. Furthermore, Cologix offers clients choice and flexibility through an interconnection ecosystem of 600+ networks, 300+ cloud providers, and 30+ onramps across the United States and Canada. Cologix is looking forward to future business opportunities with Console Connect.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Interconnect Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Interconnect Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Interconnect Industry?

To stay informed about further developments, trends, and reports in the Data Center Interconnect Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence