Key Insights

The global coal trading market, valued at $9.73 billion in 2025, is projected to experience robust growth, driven by consistent demand from energy-intensive industries like power generation and steel manufacturing, particularly in developing economies undergoing rapid industrialization. The market's Compound Annual Growth Rate (CAGR) of 4.68% from 2025 to 2033 indicates a steady expansion, although this growth is expected to be influenced by fluctuating energy prices, environmental regulations increasingly targeting coal consumption, and the growing adoption of renewable energy sources. The market segmentation reveals a significant reliance on steam coal, which constitutes a substantial portion of global coal trade due to its prevalent use in power plants. Key players, such as Glencore PLC, Trafigura Group Pte Ltd, and Mercuria Energy Group, dominate the market landscape, leveraging their extensive global networks and logistical capabilities. The Asia-Pacific region, especially China and India, represent substantial market segments due to their massive energy demands and significant coal-fired power generation capacity. While North America and Europe show a slower growth trajectory influenced by stricter environmental policies favoring cleaner energy alternatives, the sustained growth in developing nations offsets this trend to some degree.

Coal Trading Market Market Size (In Billion)

The competitive landscape is characterized by intense rivalry among major trading companies, pushing them to optimize operational efficiency, explore new markets, and diversify their portfolio to mitigate risks associated with price volatility and environmental regulations. Furthermore, increasing investments in coal transportation infrastructure, particularly in emerging markets, support market expansion. However, the industry faces significant headwinds, including stricter environmental regulations, carbon pricing mechanisms, and increasing investments in renewable energy, all impacting the long-term outlook for coal trading. The market's future trajectory will depend on the balance between sustained demand from developing economies and the global push for a cleaner energy future. Diversification within the coal types traded, exploring newer and cleaner coal technologies, and strategic partnerships to improve logistics and sustainability may be key elements for sustained success in this evolving market.

Coal Trading Market Company Market Share

Coal Trading Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global coal trading market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). We delve deep into market dynamics, identifying key players, growth drivers, and potential challenges to provide stakeholders with a clear understanding of this dynamic sector. The report meticulously examines various coal types (steam coal, coking coal, lignite) and trader types (importer, exporter), offering a granular view of the market's intricate structure. With a focus on crucial industry developments and strategic forecasts, this report is an invaluable resource for investors, businesses, and policymakers navigating the complexities of the coal trading landscape.

Coal Trading Market Composition & Trends

This section offers a comprehensive overview of the coal trading market's current state, analyzing market concentration, innovation, regulation, and competitive dynamics. The report examines the market share distribution among key players, including Centennial Coal Company Limited, Hind Energy and Coal Beneficiary India limited, Mercuria Energy Group, China Coal Energy Company Limited, China Shenhua Energy Company Limited, Glencore PLC, Trafigura Group Pte Ltd, Borneo Coal Trading, Vitol Holding BV, and Mitsubishi Corporation RtM Japan Ltd. We detail mergers and acquisitions (M&A) activities, analyzing deal values and their impact on market structure. The analysis also explores the influence of substitute products, evolving end-user profiles, and the regulatory landscape's impact on market behavior. The report incorporates detailed data illustrating market concentration (e.g., the top 5 players hold xx% of market share), providing a clear picture of the competitive intensity. The impact of technological advancements on market innovation and the prevalence of sustainable practices are thoroughly assessed.

- Market Concentration: Top 5 players hold xx% of market share in 2025, with a predicted xx% by 2033.

- M&A Activity: Total M&A deal value in 2024 reached approximately $xx Million, with a projected increase to $xx Million by 2033.

- Regulatory Landscape: Analysis of key regulations impacting coal trading in major regions.

- Substitute Products: Examination of alternative energy sources and their impact on coal demand.

- End-User Profiles: Detailed analysis of the end-user segments (power generation, steel production, etc.) and their evolving needs.

Coal Trading Market Industry Evolution

This section provides a comprehensive analysis of the coal trading market's growth trajectory from 2019 to 2033, examining historical growth rates and forecasting future trends. Our analysis considers a multitude of factors influencing market dynamics, including: technological advancements such as improved logistics and transportation efficiency (e.g., the adoption of automated rail systems and optimized shipping routes); evolving consumer demands shaped by stringent environmental regulations and the global push for energy diversification; the volatility of energy prices and their correlation with geopolitical instability; and the increasing pressure to transition towards cleaner energy sources. We present detailed data points, including compound annual growth rates (CAGRs) for various segments and geographical regions, offering a granular understanding of market performance. The analysis delves into the long-term implications of the energy transition on coal demand, assessing its impact on market stability and future growth potential. Furthermore, we explore the evolution of trading strategies, highlighting the increasing adoption of digital platforms, blockchain technology, and advanced analytics to enhance transparency, efficiency, and risk management within the supply chain.

Leading Regions, Countries, or Segments in Coal Trading Market

This section identifies the leading regions, countries, and segments within the coal trading market, examining both the coal type (steam coal, coking coal, lignite) and trader type (importer, exporter) segments. The dominance of specific regions or countries is explained through detailed analysis of relevant factors, such as favorable government policies, established infrastructure, and proximity to key markets.

Key Drivers for Dominant Regions/Countries:

- Investment Trends: Significant investments in coal mining and infrastructure projects.

- Regulatory Support: Favorable government policies encouraging coal production and trade.

- Geographic Proximity: Strategic location facilitating efficient transportation and trade.

In-depth Analysis of Dominance Factors: This section will provide a detailed examination of the factors contributing to the dominance of specific regions, countries, and segments. For example, the Asia-Pacific region's strong demand for coal, driven by rapid industrialization and economic growth, will be analyzed in detail.

Coal Trading Market Product Innovations

This section details recent advancements in coal handling, processing, and transportation technologies. We focus on innovations designed to enhance efficiency, minimize environmental impact, improve safety protocols, and optimize resource utilization. This includes exploring new techniques in coal beneficiation to improve coal quality, reduce waste generation, and increase overall yield. We also highlight the integration of advanced analytics and predictive modeling tools to refine trading strategies, optimize supply chain management, and enhance decision-making processes across the entire coal value chain. The exploration of sustainable coal mining practices and carbon capture technologies are also addressed, reflecting the industry's evolving commitment to environmental responsibility.

Propelling Factors for Coal Trading Market Growth

Several factors drive the growth of the coal trading market. Technological advancements, such as improved mining techniques and transportation infrastructure, significantly enhance efficiency and reduce costs. The robust economic growth in several key regions, particularly in Asia, fuels the demand for coal as a primary energy source. Favorable government policies and supportive regulatory frameworks in certain countries further bolster market expansion.

Obstacles in the Coal Trading Market

Despite its growth potential, the coal trading market faces significant challenges. Stringent environmental regulations and increasing pressure to transition to cleaner energy sources pose a major threat. Supply chain disruptions, due to geopolitical instability or extreme weather events, can significantly impact market stability. Intense competition among major players also creates pressure on profit margins. These factors need to be carefully considered for successful market navigation.

Future Opportunities in Coal Trading Market

The coal trading market presents several promising opportunities for future growth. Emerging economies in Africa and South America are experiencing significant energy demand growth, presenting lucrative export markets for coal producers. Technological advancements in coal gasification and liquefaction open up new avenues for value-added products and enhanced efficiency. The development of carbon capture and storage technologies could mitigate the environmental concerns associated with coal use, extending its lifespan in the energy mix.

Major Players in the Coal Trading Market Ecosystem

- Centennial Coal Company Limited

- Hind Energy and Coal Beneficiary India Limited

- Mercuria Energy Group

- China Coal Energy Company Limited

- China Shenhua Energy Company Limited

- Glencore PLC

- Trafigura Group Pte Ltd

- Borneo Coal Trading

- Vitol Holding BV

- Mitsubishi Corporation RtM Japan Ltd

- BHP

- Peabody Energy

- Arch Resources

Key Developments in Coal Trading Market Industry

- February 2022: The intergovernmental agreement between Russia and China to supply 100 million tons of coal underscored the Asia-Pacific region's substantial reliance on coal, projecting significant demand until at least 2030. This agreement highlighted the geopolitical factors influencing coal trade and the ongoing competition for resources.

- January 2022: Adani's contract to supply 1 million tons of coal to NTPC, India's state-owned electricity generator, exemplifies the continued importance of coal in powering national grids, even amidst the global energy transition. This demonstrates the sustained demand for coal in specific regions and the ongoing need for reliable supply chains.

- [Insert more recent key developments with dates and brief descriptions. Aim for at least 3-5 more bullet points to make the section more comprehensive and current.] For example, include details on any major mergers and acquisitions, new regulations impacting the industry, significant price fluctuations, or the emergence of new technologies or trading platforms.

Strategic Coal Trading Market Forecast

The coal trading market is projected to experience continued growth over the forecast period (2025-2033), driven by robust demand from emerging economies and ongoing industrialization. While challenges related to environmental regulations and energy transitions persist, opportunities exist in technological advancements and the development of sustainable coal practices. Strategic partnerships, technological innovation, and effective risk management will be key to success in this dynamic market.

Coal Trading Market Segmentation

-

1. Coal Type

- 1.1. Steam Coal

- 1.2. Coaking Coal

- 1.3. Lignite

-

2. Traders Type

- 2.1. Importer

- 2.2. Exporter

Coal Trading Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

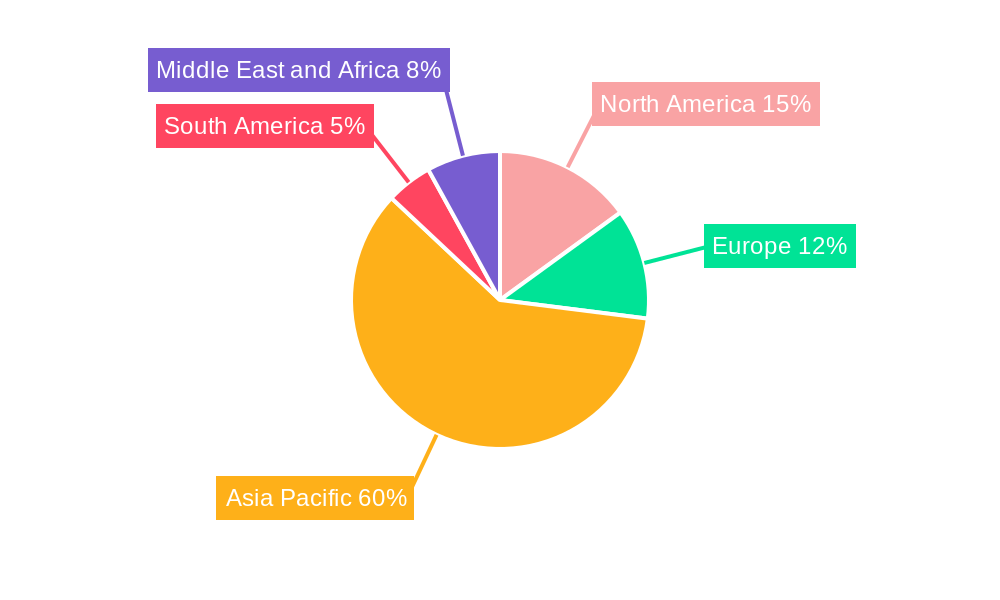

Coal Trading Market Regional Market Share

Geographic Coverage of Coal Trading Market

Coal Trading Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors

- 3.2.2 Such as Transport

- 3.2.3 Residential

- 3.2.4 Commercial and Others

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Importer and Exporter to Maintain an Equal Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coal Type

- 5.1.1. Steam Coal

- 5.1.2. Coaking Coal

- 5.1.3. Lignite

- 5.2. Market Analysis, Insights and Forecast - by Traders Type

- 5.2.1. Importer

- 5.2.2. Exporter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Coal Type

- 6. North America Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coal Type

- 6.1.1. Steam Coal

- 6.1.2. Coaking Coal

- 6.1.3. Lignite

- 6.2. Market Analysis, Insights and Forecast - by Traders Type

- 6.2.1. Importer

- 6.2.2. Exporter

- 6.1. Market Analysis, Insights and Forecast - by Coal Type

- 7. Europe Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coal Type

- 7.1.1. Steam Coal

- 7.1.2. Coaking Coal

- 7.1.3. Lignite

- 7.2. Market Analysis, Insights and Forecast - by Traders Type

- 7.2.1. Importer

- 7.2.2. Exporter

- 7.1. Market Analysis, Insights and Forecast - by Coal Type

- 8. Asia Pacific Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coal Type

- 8.1.1. Steam Coal

- 8.1.2. Coaking Coal

- 8.1.3. Lignite

- 8.2. Market Analysis, Insights and Forecast - by Traders Type

- 8.2.1. Importer

- 8.2.2. Exporter

- 8.1. Market Analysis, Insights and Forecast - by Coal Type

- 9. South America Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coal Type

- 9.1.1. Steam Coal

- 9.1.2. Coaking Coal

- 9.1.3. Lignite

- 9.2. Market Analysis, Insights and Forecast - by Traders Type

- 9.2.1. Importer

- 9.2.2. Exporter

- 9.1. Market Analysis, Insights and Forecast - by Coal Type

- 10. Middle East and Africa Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coal Type

- 10.1.1. Steam Coal

- 10.1.2. Coaking Coal

- 10.1.3. Lignite

- 10.2. Market Analysis, Insights and Forecast - by Traders Type

- 10.2.1. Importer

- 10.2.2. Exporter

- 10.1. Market Analysis, Insights and Forecast - by Coal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Centennial Coal Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hind Energy and Coal Beneficiary India limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mercuria Energy Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Coal Energy Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Shenhua Energy Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glencore PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trafigura Group Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Borneo Coal Trading

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vitol Holding BV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Corporation RtM Japan Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Centennial Coal Company Limited

List of Figures

- Figure 1: Global Coal Trading Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 3: North America Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 4: North America Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 5: North America Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 6: North America Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 9: Europe Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 10: Europe Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 11: Europe Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 12: Europe Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 15: Asia Pacific Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 16: Asia Pacific Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 17: Asia Pacific Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 18: Asia Pacific Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 21: South America Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 22: South America Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 23: South America Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 24: South America Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 27: Middle East and Africa Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 28: Middle East and Africa Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 29: Middle East and Africa Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 30: Middle East and Africa Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Coal Trading Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 2: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 3: Global Coal Trading Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 5: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 6: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 11: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 12: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 18: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 19: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 26: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 27: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 32: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 33: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coal Trading Market?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Coal Trading Market?

Key companies in the market include Centennial Coal Company Limited, Hind Energy and Coal Beneficiary India limited, Mercuria Energy Group, China Coal Energy Company Limited, China Shenhua Energy Company Limited, Glencore PLC, Trafigura Group Pte Ltd, Borneo Coal Trading, Vitol Holding BV, Mitsubishi Corporation RtM Japan Ltd.

3. What are the main segments of the Coal Trading Market?

The market segments include Coal Type, Traders Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.73 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors. Such as Transport. Residential. Commercial and Others.

6. What are the notable trends driving market growth?

Importer and Exporter to Maintain an Equal Share in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

February 2022: Russia and China announced the development of an intergovernmental agreement on the supply of coal in the amount of 100 million tons. According to the government of Russia, the Asia-Pacific region has a significant market for coal till 2030. The countries have started working on the agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coal Trading Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coal Trading Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coal Trading Market?

To stay informed about further developments, trends, and reports in the Coal Trading Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence