Key Insights

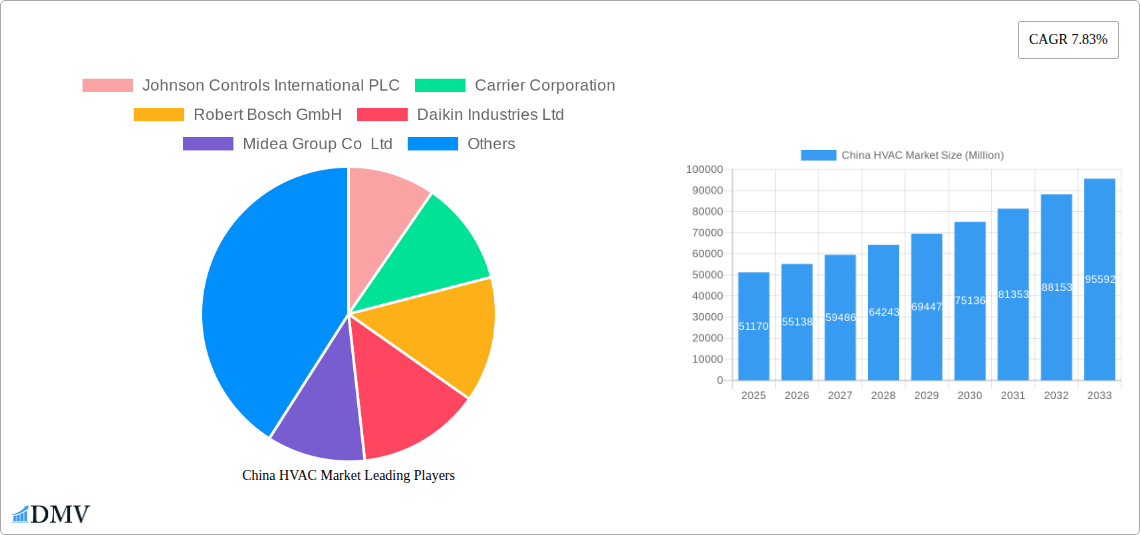

The China HVAC market, valued at $51.17 billion in 2025, is projected to experience robust growth, driven by several key factors. Rapid urbanization and industrialization are fueling significant demand for climate control solutions in both residential and commercial sectors. Stringent government regulations promoting energy efficiency and reducing carbon emissions are also stimulating the adoption of advanced, energy-saving HVAC technologies. Furthermore, rising disposable incomes and improved living standards are increasing consumer spending on home comfort, leading to higher adoption rates of sophisticated HVAC systems. Growing awareness of indoor air quality (IAQ) and the health benefits of controlled environments further contribute to market expansion.

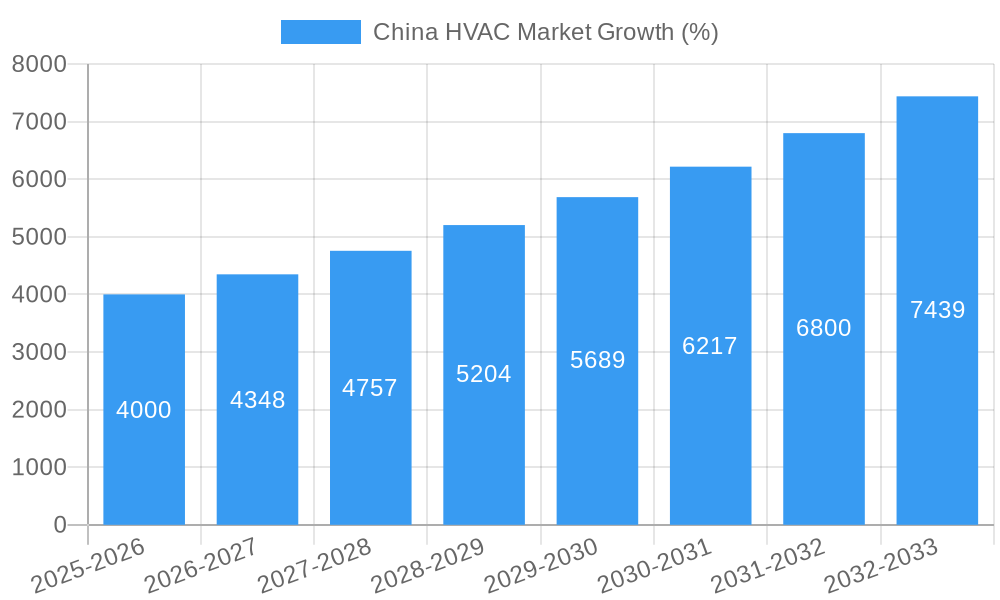

However, challenges remain. Fluctuations in raw material prices, particularly metals used in manufacturing, can impact production costs and profitability. Supply chain disruptions and logistical complexities, particularly felt during periods of global uncertainty, could pose constraints on market growth. Competition from both established international players and rapidly growing domestic companies necessitates continuous innovation and competitive pricing strategies. Despite these challenges, the long-term outlook for the China HVAC market remains positive, with a projected Compound Annual Growth Rate (CAGR) of 7.83% from 2025 to 2033. This growth trajectory is expected to be supported by sustained infrastructure development and continuous technological advancements in the sector. The market's segmentation, encompassing residential, commercial, and industrial applications, alongside various technological advancements, will play a critical role in shaping future market dynamics.

China HVAC Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic China HVAC market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a meticulous study period spanning from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report is an invaluable resource for stakeholders seeking to understand and capitalize on the immense opportunities within this thriving market. The report is meticulously researched and data-driven, presenting a clear and concise picture of the market's composition, trends, and future potential. Market values are expressed in Millions.

China HVAC Market Market Composition & Trends

This section evaluates the competitive landscape of the China HVAC market, analyzing market concentration, innovation drivers, regulatory influences, substitute product pressures, end-user profiles, and merger & acquisition (M&A) activities. The report delves into the market share distribution among key players, revealing the dominance of specific companies and the competitive intensity within various segments. Furthermore, it quantifies the financial aspects of M&A activities, providing insights into deal values and their impact on market dynamics. The analysis covers the impact of government regulations on market growth, the emergence of substitute technologies, and the evolving needs of diverse end-user segments.

- Market Concentration: XX% of the market is controlled by the top 5 players.

- M&A Activity: Total deal value in the last 5 years: $XX Million. Average deal size: $XX Million.

- Innovation Catalysts: Stringent environmental regulations and rising consumer demand for energy-efficient solutions are driving innovation.

- Regulatory Landscape: Stringent energy efficiency standards and environmental regulations are shaping market dynamics.

- Substitute Products: Growing adoption of alternative heating and cooling technologies such as geothermal systems.

- End-User Profiles: Residential, commercial, and industrial sectors, with a focus on the growth potential of each segment.

China HVAC Market Industry Evolution

This section analyzes the evolution of the China HVAC market, examining growth trajectories, technological advancements, and shifting consumer preferences. The report presents detailed data points, including historical and projected growth rates, market size by segment, and adoption metrics for new technologies. It explores the impact of technological innovations on market dynamics, examining the shift towards energy-efficient solutions, smart HVAC systems, and the integration of renewable energy sources. Furthermore, the analysis considers the evolving consumer preferences for sustainable, cost-effective, and comfortable climate control solutions. Specific data points like growth rates and adoption metrics are included. Growth rates (2019-2024): XX%. Projected growth (2025-2033): XX%.

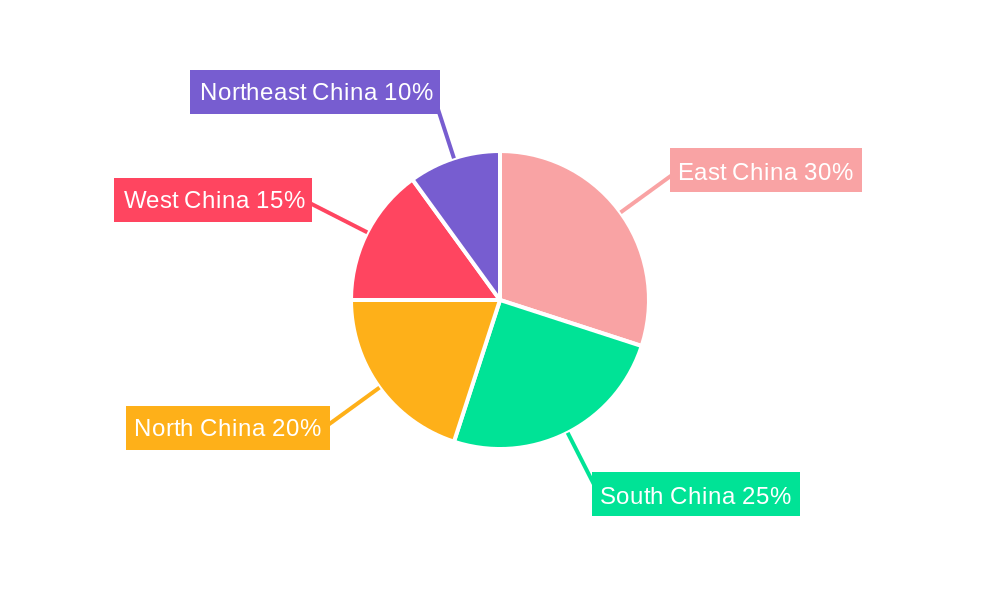

Leading Regions, Countries, or Segments in China HVAC Market

This section identifies the dominant regions, countries, or segments within the China HVAC market. A detailed analysis will dissect the factors contributing to their prominence. Key drivers, such as investment trends, government support, and regional economic conditions, will be examined using bullet points for clarity. Further detailed analysis will explain the factors determining market leadership within the dominant areas.

- Key Drivers for Dominant Region/Segment:

- Robust infrastructure development.

- Favorable government policies.

- High levels of private sector investment.

- Strong consumer demand for modern and energy efficient HVAC systems.

China HVAC Market Product Innovations

This section highlights recent product innovations, detailing their applications and performance metrics. The focus will be on unique selling propositions and technological advancements, emphasizing their impact on market competitiveness. The analysis covers recent advances in heat pump technology, smart home integration, and energy-efficient designs. Examples include advancements in compressor technology, improved refrigerant efficiency, and the integration of AI-powered controls.

Propelling Factors for China HVAC Market Growth

This section identifies the key growth drivers for the China HVAC market. It will focus on technological, economic, and regulatory factors, providing specific examples. The analysis will cover increasing urbanization, rising disposable incomes, government incentives for energy efficiency, and technological advancements such as the development of heat pumps and smart HVAC systems.

Obstacles in the China HVAC Market Market

This section discusses the challenges and barriers hindering growth in the China HVAC market. It addresses regulatory hurdles, supply chain disruptions, and intense competition, quantifying their impact whenever possible. This could include tariffs or import restrictions, material shortages, and price wars.

Future Opportunities in China HVAC Market

This section highlights potential future opportunities, such as the expansion into new market segments (e.g., data centers, cold chain logistics), the development of new technologies (e.g., next-generation refrigerants), or shifts in consumer trends (e.g., increased demand for smart and sustainable solutions).

Major Players in the China HVAC Market Ecosystem

- Johnson Controls International PLC

- Carrier Corporation

- Robert Bosch GmbH

- Daikin Industries Ltd

- Midea Group Co Ltd

- System Air AB

- LG Electronics Inc

- Mitsubishi Electric Corporation

- Danfoss A/S

- Lennox International Inc

- Hitachi Ltd

- Panasonic Corporation

Key Developments in China HVAC Market Industry

- November 2023: Mitsubishi Electric Corporation announced the development of an aluminum vertical flat tube (VFT) heat exchanger design, improving heat pump performance by up to 40% and reducing refrigerant charge by up to 20%.

- March 2024: Panasonic Corporation unveiled plans to launch three new commercial air-to-water (A2W) heat pumps utilizing environmentally friendly natural refrigerants, expanding its product offerings for light commercial properties.

Strategic China HVAC Market Market Forecast

This section summarizes the key growth catalysts and the overall market potential. It projects the future market size and growth, emphasizing opportunities for expansion and innovation within the China HVAC market. The analysis highlights the continuous growth fueled by government initiatives, technological advancements and increasing demand for energy-efficient and environmentally friendly HVAC solutions.

China HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning /Ventilation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

China HVAC Market Segmentation By Geography

- 1. China

China HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand

- 3.3. Market Restrains

- 3.3.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand

- 3.4. Market Trends

- 3.4.1. HVAC Equipment Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China HVAC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning /Ventilation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robert Bosch GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daikin Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Midea Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 System Air AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Danfoss A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lennox International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hitachi Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Panasonic Corporatio

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: China HVAC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China HVAC Market Share (%) by Company 2024

List of Tables

- Table 1: China HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: China HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 4: China HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 5: China HVAC Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: China HVAC Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: China HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: China HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 10: China HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 11: China HVAC Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: China HVAC Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: China HVAC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China HVAC Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China HVAC Market?

The projected CAGR is approximately 7.83%.

2. Which companies are prominent players in the China HVAC Market?

Key companies in the market include Johnson Controls International PLC, Carrier Corporation, Robert Bosch GmbH, Daikin Industries Ltd, Midea Group Co Ltd, System Air AB, LG Electronics Inc, Mitsubishi Electric Corporation, Danfoss A/S, Lennox International Inc, Hitachi Ltd, Panasonic Corporatio.

3. What are the main segments of the China HVAC Market?

The market segments include Type of Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand.

6. What are the notable trends driving market growth?

HVAC Equipment Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand.

8. Can you provide examples of recent developments in the market?

March 2024: Panasonic Corporation announced that its Heating & Ventilation A/C Company (HVAC) plans to launch three new commercial air-to-water (A2W) heat pumps that utilize environmentally friendly natural refrigerants. These models are designed for use in multi-dwelling units, stores, offices, and other light commercial properties. With their compact designs, they are positioned at the top of the industry and will expand the company's lineup of models for standalone homes to fulfill a broad range of consumer needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China HVAC Market?

To stay informed about further developments, trends, and reports in the China HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence