Key Insights

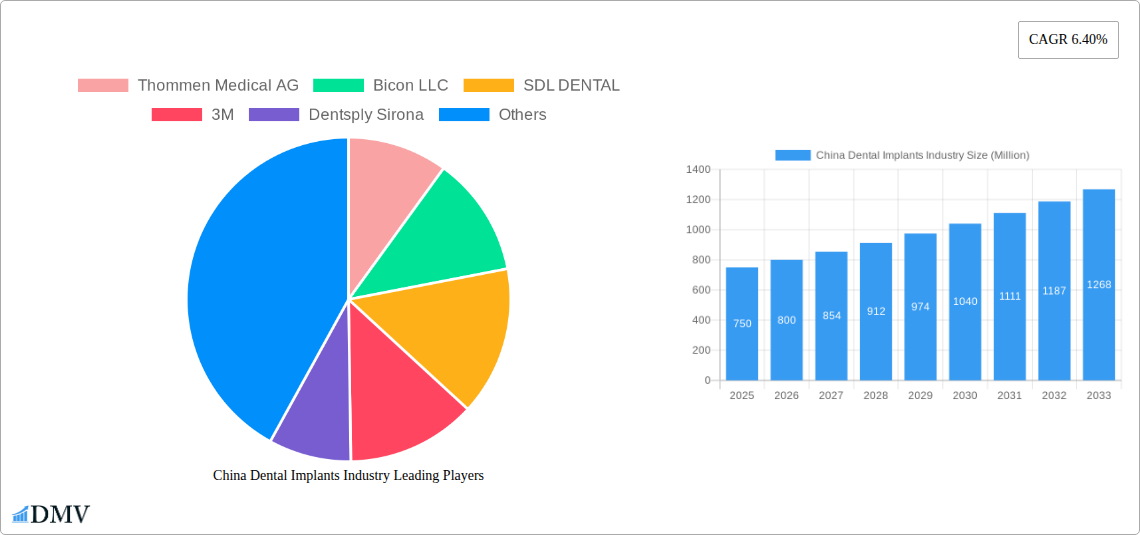

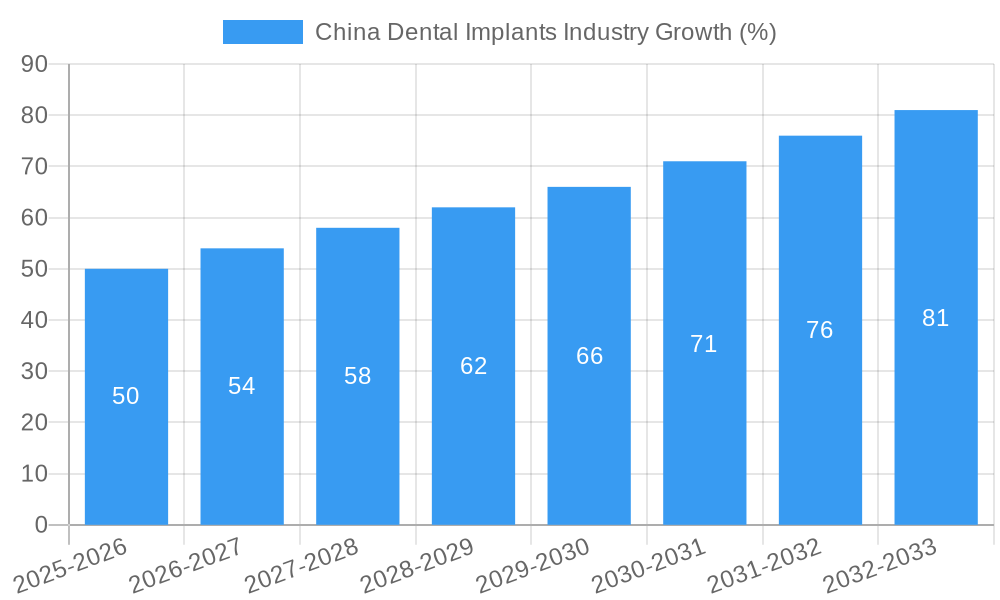

The China dental implants market, valued at $750 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.40% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a rising middle class with increased disposable income is fueling demand for aesthetic and functional dental enhancements. Secondly, an aging population necessitates more restorative dental procedures, including implants. Technological advancements in implant materials, such as the increasing adoption of Zirconium implants alongside Titanium, are improving implant success rates and patient outcomes, further stimulating market growth. Government initiatives promoting oral healthcare accessibility and the expansion of dental insurance coverage also contribute to this positive trajectory. While the market faces challenges, such as price sensitivity among some consumers and potential regional disparities in access to advanced dental care, the overall outlook remains highly positive.

The market segmentation reveals a significant contribution from both fixture and abutment components. Titanium implants currently dominate the material segment, but the increasing adoption of Zirconium implants, owing to their biocompatibility and aesthetic advantages, signifies a notable emerging trend. Key players like Thommen Medical AG, Bicon LLC, and Dentsply Sirona are fiercely competing in this dynamic market, investing in research and development, strategic partnerships, and expanding their distribution networks to capture market share. The competitive landscape is characterized by both established international players and emerging domestic companies, reflecting a market that is both mature and experiencing significant innovation. This signifies opportunities for both established players and new entrants focused on innovation and cost-effective solutions. The focus on improving patient experience and outcomes, alongside technological advancements, will be crucial for continued success in the Chinese dental implant market.

China Dental Implants Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning China dental implants market, offering a comprehensive overview of its current state and future trajectory. From market size and segmentation to key players and growth drivers, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market value is expressed in Millions.

China Dental Implants Industry Market Composition & Trends

This section delves into the competitive landscape of the Chinese dental implants market, analyzing market concentration, innovation, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The report evaluates market share distribution among key players and analyzes the financial implications of significant M&A deals, providing valuable insights into market dynamics. The total market size in 2025 is estimated at xx Million.

- Market Concentration: The report assesses the level of market concentration, identifying the dominant players and analyzing their market share. The Herfindahl-Hirschman Index (HHI) will be calculated to quantify market concentration.

- Innovation Catalysts: Analysis of technological advancements driving innovation in materials (Titanium Implants, Zirconium Implants), design, and manufacturing processes within the industry.

- Regulatory Landscape: A detailed examination of Chinese regulatory policies impacting the dental implants market, including licensing, safety standards, and reimbursement policies.

- Substitute Products: Evaluation of alternative treatments for dental issues, their market share, and potential impact on the dental implants market.

- End-User Profiles: Profiling key end-users, including dental clinics, hospitals, and individual patients, and their influence on market demand.

- M&A Activity: Analysis of significant mergers and acquisitions in the Chinese dental implants market during the historical period (2019-2024), including deal values and strategic implications. Examples include the January 2022 acquisition of Legend Life Tech by Neoss Group, establishing Neoss China. The total value of M&A deals during the period is estimated at xx Million.

China Dental Implants Industry Industry Evolution

This section provides a detailed analysis of the China dental implants market's evolutionary trajectory. It examines market growth trends, technological advancements, and evolving consumer preferences, offering a comprehensive understanding of the industry's transformation. The analysis encompasses the historical period (2019-2024) and extends into the future, forecasting market growth rates and adoption metrics for various technologies.

The report will detail the compound annual growth rate (CAGR) from 2019 to 2024, and project the CAGR for 2025-2033. Specific data points on market penetration rates for different implant types (titanium and zirconium) will be provided. The impact of technological innovations, such as improved implant designs and surface treatments, on market growth will be thoroughly analyzed. Further, the report will explore the shift in consumer preferences towards minimally invasive procedures and advanced aesthetic outcomes. The increasing demand for dental implants fueled by rising disposable incomes and improved awareness of oral health will be discussed.

Leading Regions, Countries, or Segments in China Dental Implants Industry

This section pinpoints the dominant regions, countries, or segments within the Chinese dental implants market, focusing on the breakdown by Part (Fixture, Abutment) and Material (Titanium Implants, Zirconium Implants). The analysis will highlight key drivers contributing to the dominance of specific segments.

Key Drivers for Dominant Segments:

- Investment Trends: Analysis of investment patterns in research and development, manufacturing, and distribution within the leading segments.

- Regulatory Support: Examination of government policies and initiatives supporting the growth of dominant segments.

- Market Access: Assessment of ease of market entry and distribution channels for dominant segments.

- Pricing and Reimbursement: Analysis of pricing strategies and healthcare reimbursement policies influencing market share.

In-depth Analysis of Dominance Factors: Paragraphs will provide in-depth explanations for the factors driving the dominance of specific segments, including economic factors, technological advancements, and consumer preferences. For example, the increasing preference for zirconium implants due to their aesthetic properties will be discussed.

China Dental Implants Industry Product Innovations

This section examines recent product innovations, applications, and performance metrics within the Chinese dental implants market. The report will showcase unique selling propositions (USPs) and cutting-edge technological advancements shaping the industry.

The section will highlight the introduction of new implant materials, designs, and surface treatments that improve osseointegration, durability, and aesthetic outcomes. It will also analyze the growing use of digital technologies in implant planning and placement, as well as the adoption of minimally invasive surgical techniques. Performance metrics, such as implant survival rates and patient satisfaction, will be presented.

Propelling Factors for China Dental Implants Industry Growth

This section identifies the key factors driving the growth of the China dental implants market. The analysis will focus on technological, economic, and regulatory influences, providing specific examples to illustrate their impact.

Growth is primarily driven by factors such as rising disposable incomes leading to increased healthcare expenditure, an aging population with greater demand for dental care, and government initiatives promoting oral health awareness and access to dental services. Advancements in implant technology, particularly in biomaterials and surgical techniques, also play a key role. Finally, favorable regulatory policies supporting the adoption of dental implants contribute to market expansion.

Obstacles in the China Dental Implants Industry Market

This section explores barriers and constraints hindering the growth of the China dental implants market. The analysis includes regulatory challenges, supply chain disruptions, and competitive pressures. Quantifiable impacts will be highlighted wherever possible.

Key challenges include high costs, potential supply chain disruptions related to raw materials and manufacturing, and the intensity of competition from both domestic and international players. Furthermore, regulatory complexities and varying reimbursement policies across different regions within China can pose significant challenges.

Future Opportunities in China Dental Implants Industry

This section identifies emerging opportunities within the China dental implants market. The analysis focuses on new markets, technologies, and consumer trends that will shape future growth.

Significant opportunities exist in expanding market penetration in underserved regions, developing innovative implant designs for specific patient needs, and leveraging technological advancements such as artificial intelligence (AI) and 3D printing to enhance implant manufacturing and surgical procedures. Increased focus on minimally invasive procedures and personalized treatment plans will also contribute to market growth.

Major Players in the China Dental Implants Industry Ecosystem

- Thommen Medical AG

- Bicon LLC

- SDL DENTAL

- 3M (3M)

- Dentsply Sirona (Dentsply Sirona)

- Dentium

- AB Dental Devices Ltd

- Ivoclar Vivadent (Ivoclar Vivadent)

- Nobel Biocare Services AG (Nobel Biocare)

- Zimmer Biomet (Zimmer Biomet)

Key Developments in China Dental Implants Industry Industry

- February 2022: Inclusion of dental implants in China's bulk-buy program for drugs and medical consumables, significantly impacting market access and affordability.

- January 2022: Establishment of Neoss China by Neoss Group through the acquisition of Legend Life Tech, expanding the presence of a key international player in the market.

Strategic China Dental Implants Industry Market Forecast

The China dental implants market is poised for sustained growth driven by several factors. These include rising disposable incomes, an aging population, technological advancements, and supportive government policies. The market is expected to witness significant expansion in the forecast period (2025-2033), presenting substantial opportunities for established players and new entrants alike. Further, the increasing adoption of digital technologies and minimally invasive procedures will shape the future trajectory of the market. The report provides detailed forecasts for market size, segment growth, and technological adoption.

China Dental Implants Industry Segmentation

-

1. Part

- 1.1. Fixture

- 1.2. Abutment

-

2. Material

- 2.1. Titanium Implants

- 2.2. Zirconium Implants

China Dental Implants Industry Segmentation By Geography

- 1. China

China Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Dental Diseases and Geriatric Population; Increasing Application of CAD/CAM Technologies

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues and High Cost of Dental Implants

- 3.4. Market Trends

- 3.4.1. Titanium Implants Segment is Expected to have Largest Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Part

- 5.1.1. Fixture

- 5.1.2. Abutment

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Titanium Implants

- 5.2.2. Zirconium Implants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Part

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Thommen Medical AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bicon LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SDL DENTAL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3M

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dentsply Sirona

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dentium

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AB Dental Devices Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ivoclar Vivadent

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nobel Biocare Services AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zimmer Biomet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Thommen Medical AG

List of Figures

- Figure 1: China Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: China Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Dental Implants Industry Revenue Million Forecast, by Part 2019 & 2032

- Table 3: China Dental Implants Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 4: China Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Dental Implants Industry Revenue Million Forecast, by Part 2019 & 2032

- Table 7: China Dental Implants Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 8: China Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Dental Implants Industry?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the China Dental Implants Industry?

Key companies in the market include Thommen Medical AG, Bicon LLC, SDL DENTAL, 3M, Dentsply Sirona, Dentium, AB Dental Devices Ltd, Ivoclar Vivadent, Nobel Biocare Services AG, Zimmer Biomet.

3. What are the main segments of the China Dental Implants Industry?

The market segments include Part, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Dental Diseases and Geriatric Population; Increasing Application of CAD/CAM Technologies.

6. What are the notable trends driving market growth?

Titanium Implants Segment is Expected to have Largest Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Reimbursement Issues and High Cost of Dental Implants.

8. Can you provide examples of recent developments in the market?

In February 2022, China expanded the list of drugs and medical consumables included in China's bulk-buy program and included dental implants in the list.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Dental Implants Industry?

To stay informed about further developments, trends, and reports in the China Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence