Key Insights

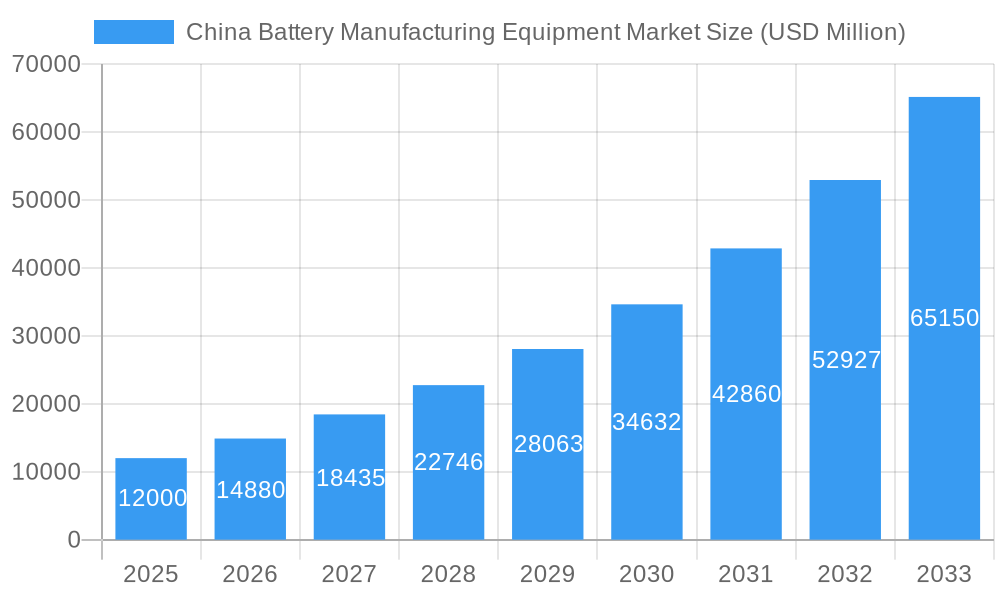

The China battery manufacturing equipment market is experiencing robust growth, projected to reach a substantial size driven by the nation's burgeoning electric vehicle (EV) sector and the increasing demand for energy storage solutions. With a current market size of $12,000 million USD (2025) and a Compound Annual Growth Rate (CAGR) exceeding 24%, the market demonstrates significant potential for expansion through 2033. Key drivers include government initiatives promoting EV adoption, substantial investments in battery research and development, and the continuous improvement of battery technology itself, leading to higher production volumes. The market is segmented by machine type, encompassing coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, and formation & testing equipment. End-user segments include the automotive industry, which is the primary driver, industrial applications, and other emerging sectors. While specific restraints are not detailed, potential challenges could include supply chain complexities, competition among manufacturers, and the need for continuous technological advancements to keep pace with evolving battery chemistries. Leading players like Xiamen TOB, Xiamen Lith Machine, Hitachi, Schuler, and Durr are actively shaping this dynamic market landscape.

China Battery Manufacturing Equipment Market Market Size (In Billion)

The forecast period (2025-2033) promises continued expansion, fueled by consistent growth in EV sales and broader adoption of energy storage technologies. This growth trajectory is anticipated to create lucrative opportunities for equipment manufacturers. However, success hinges on adapting to rapid technological advancements, effectively managing supply chains, and strategically navigating the competitive landscape. The concentration of the market within China underscores the importance of understanding local regulations and market dynamics for companies aiming to participate in this rapidly evolving sector. Further research into specific technological advancements and regulatory shifts will be critical for more precise forecasting and strategic planning.

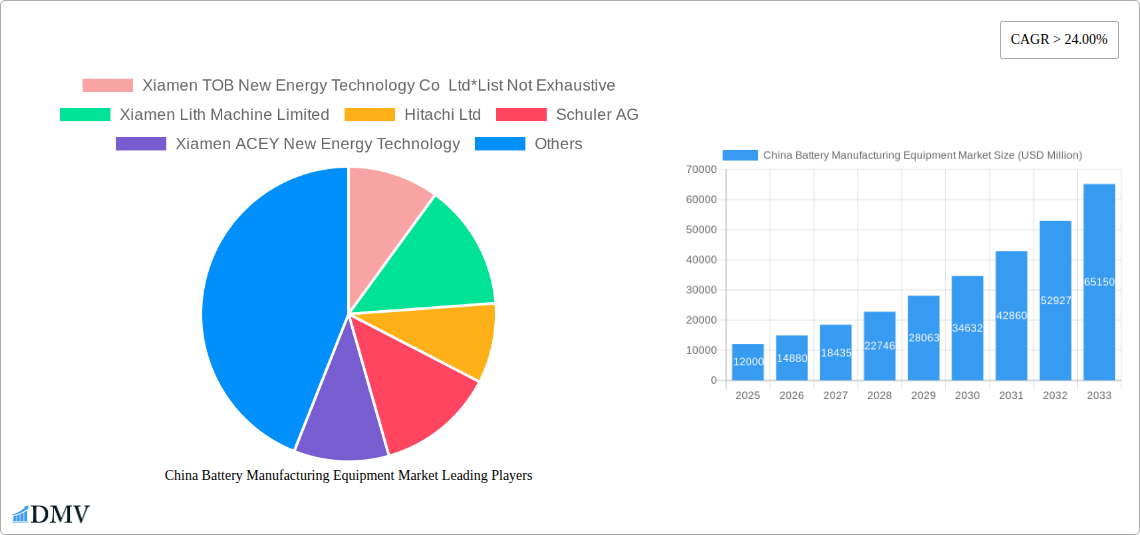

China Battery Manufacturing Equipment Market Company Market Share

China Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning China Battery Manufacturing Equipment Market, offering a comprehensive overview of its current state, future trajectory, and key players. The market is experiencing explosive growth fueled by the global surge in electric vehicle (EV) adoption and the expansion of energy storage solutions. This report covers the period 2019-2033, with a focus on the forecast period 2025-2033 (Base Year: 2025, Estimated Year: 2025). Expect detailed market sizing in USD Million throughout.

China Battery Manufacturing Equipment Market Composition & Trends

This section delves into the intricate dynamics shaping the Chinese battery manufacturing equipment market. We analyze market concentration, revealing the dominance of key players and identifying emerging competitors. Innovation is a key driver, with continuous advancements in automation, precision, and efficiency propelling market expansion. The regulatory landscape, including government incentives and environmental regulations, significantly influences market growth. We explore the presence and impact of substitute products and analyze the evolving profiles of end-users, with a focus on the automotive and industrial sectors. Furthermore, the report details significant mergers and acquisitions (M&A) activities, providing an analysis of deal values and their impact on market consolidation.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Precise market share data for each company is xx%.

- Innovation Catalysts: Technological advancements, particularly in automation and AI-driven processes, are driving efficiency and productivity gains within the industry.

- Regulatory Landscape: Government policies supporting EV adoption and renewable energy significantly influence market demand.

- Substitute Products: The emergence of alternative technologies presents potential competition.

- End-User Profiles: Automotive manufacturers constitute the largest end-user segment, followed by the industrial sector.

- M&A Activity: xx M&A deals were recorded in the last five years, with a total deal value estimated at xx USD Million, signifying industry consolidation.

China Battery Manufacturing Equipment Market Industry Evolution

This section delves into the dynamic evolution of the China Battery Manufacturing Equipment Market, offering a comprehensive historical overview and robust future projections. We meticulously trace the market's growth trajectory from 2019 to 2024, identifying pivotal milestones and analyzing the fluctuations in growth rates. Subsequently, the report forecasts market expansion for the period of 2025-2033. This foresight is informed by an in-depth consideration of ongoing technological advancements, the escalating consumer demand for batteries with enhanced performance characteristics, and the pervasive influence of evolving government regulations. Key data points, including projected compound annual growth rates (CAGR) and the adoption rates of cutting-edge manufacturing technologies, are presented with precision. Furthermore, the transformative impact of increasing automation and the strategic implementation of Industry 4.0 principles on production efficiency and overall market expansion is thoroughly examined. A critical focal point of this analysis is the burgeoning demand for lithium-ion batteries, largely fueled by the unprecedented growth of the electric vehicle (EV) sector and the expanding energy storage systems market.

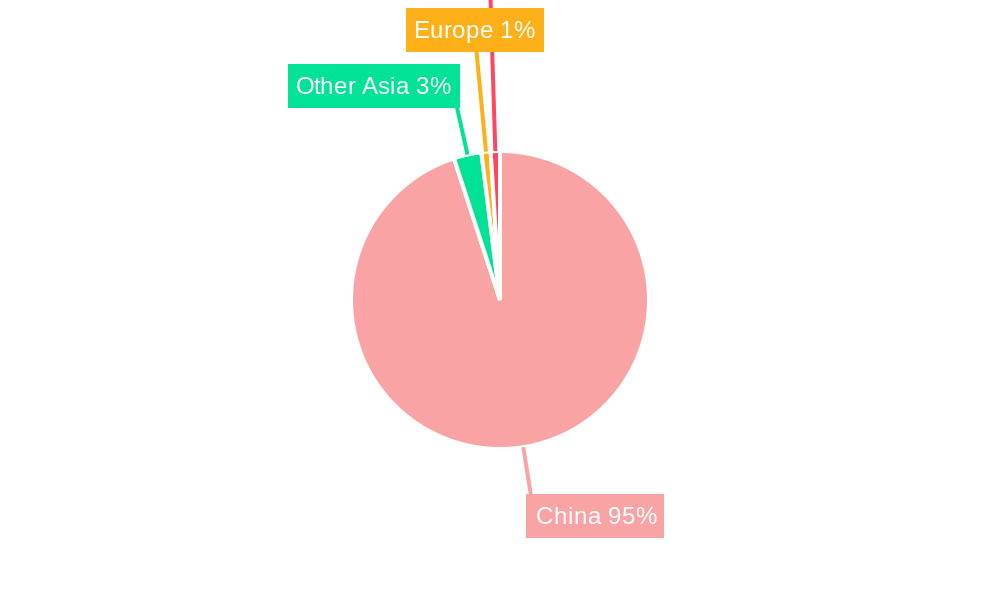

Leading Regions, Countries, or Segments in China Battery Manufacturing Equipment Market

This section provides a granular breakdown of the leading regions, countries, and specific market segments within the expansive Chinese battery manufacturing equipment landscape. We conduct a thorough analysis to identify the dominant machine types, including Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, and Formation & Testing Machines, as well as the primary end-user sectors such as Automotive, Industrial, and Other End Users. The underlying factors contributing to the prominence of these segments are elucidated below:

Dominant Segments:

- Machine Type: The Assembly & Handling Machines segment is anticipated to command the largest market share by 2025. This dominance is underpinned by the substantial and ongoing demand for highly automated and efficient battery assembly lines, essential for meeting large-scale production targets.

- End User: The Automotive sector unequivocally stands as the leading end-user. This position is directly attributable to the accelerated and widespread expansion of the EV industry across China, creating an immense and sustained need for related manufacturing equipment.

Key Drivers of Segment Dominance:

- Automotive Expansion: Monumental investments in enhancing EV production capacity throughout China are a primary catalyst, directly stimulating an insatiable demand for advanced battery manufacturing equipment.

- Automation in Assembly & Handling: The imperative for high levels of automation in large-scale battery production facilities is a critical growth engine for the Assembly & Handling Machines segment.

- Governmental Agendas and Support: Proactive government incentives, subsidies, and supportive policies specifically targeted at the EV industry are instrumental in cultivating and sustaining robust demand for the requisite manufacturing equipment.

- Technological Innovation Pipeline: Continuous and rapid innovation in battery manufacturing techniques and processes is a constant spur, driving the industry's adoption of more sophisticated and efficient equipment solutions.

China Battery Manufacturing Equipment Market Product Innovations

Recent advancements in battery manufacturing equipment focus on enhanced automation, increased throughput, improved precision, and reduced production costs. New machine designs incorporating AI and advanced robotics enhance production efficiency. Unique selling propositions often include superior quality control, reduced energy consumption, and enhanced safety features. The adoption of these innovations significantly impacts the overall market growth.

Propelling Factors for China Battery Manufacturing Equipment Market Growth

The China battery manufacturing equipment market is experiencing robust growth, propelled by a synergistic combination of powerful market forces. The exponential expansion of the electric vehicle (EV) sector, significantly bolstered by proactive government support and a growing global emphasis on environmental sustainability, stands as a paramount driver. Concurrently, ongoing technological advancements are continuously refining battery production efficiency, reducing manufacturing costs, and enabling the creation of higher-performing batteries, thereby fostering sustained market expansion. Furthermore, a supportive regulatory framework and attractive investment incentives enacted by the government are actively nurturing and accelerating this growth trajectory.

Obstacles in the China Battery Manufacturing Equipment Market

While the China battery manufacturing equipment market demonstrates considerable growth potential, it is not without its impediments. Intensified competition among both domestic and international equipment manufacturers is exerting significant price pressures on market participants. Moreover, recurrent supply chain disruptions, particularly concerning the availability and cost of critical raw materials and essential components, pose a tangible risk to uninterrupted production schedules. The implementation and adherence to increasingly stringent environmental regulations can also lead to higher compliance costs for manufacturers, presenting another challenge to navigate.

Future Opportunities in China Battery Manufacturing Equipment Market

Emerging opportunities exist in developing next-generation battery technologies, such as solid-state batteries. The expansion of energy storage solutions beyond EVs, including grid-scale energy storage, presents new avenues for growth. Further innovation in automation and AI will unlock greater production efficiency and cost reduction.

Major Players in the China Battery Manufacturing Equipment Market Ecosystem

- Hitachi Ltd

- Schuler AG

- Durr AG

- Andritz AG

- Manz AG

- Xiamen TOB New Energy Technology Co Ltd

- Xiamen Lith Machine Limited

- Xiamen ACEY New Energy Technology

- Wuxi Lead Intelligent Equipment Co Ltd

- Xiamen Tmax Battery Equipments Limited

Key Developments in China Battery Manufacturing Equipment Market Industry

- December 2022: GAC announces USD 1.561 billion investment in a new EV battery production facility in Guangzhou, with a planned annual capacity of 6 GWh, slated for operation in March 2024.

- November 2022: BYD announces a new battery plant in Wenzhou, Zhejiang province, with a 20 GWh annual capacity, scheduled to commence production in 2024.

These developments underscore the substantial investment in China's EV battery production sector, driving significant demand for manufacturing equipment.

Strategic China Battery Manufacturing Equipment Market Forecast

The China battery manufacturing equipment market is poised for continued robust growth, driven by increasing EV adoption, government support, and ongoing technological advancements. The expanding energy storage sector presents a significant opportunity for market expansion. Continued innovation and automation will further enhance production efficiency and drive market growth in the coming years. The market is projected to reach xx USD Million by 2033.

China Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

China Battery Manufacturing Equipment Market Segmentation By Geography

- 1. China

China Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of China Battery Manufacturing Equipment Market

China Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Lith Machine Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xiamen ACEY New Energy Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andritz AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Xiamen Tmax Battery Equipments Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Manz AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: China Battery Manufacturing Equipment Market Revenue Breakdown (USD Million, %) by Product 2025 & 2033

- Figure 2: China Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 2: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 3: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 4: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 5: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Region 2020 & 2033

- Table 6: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 8: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 9: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 10: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 11: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Country 2020 & 2033

- Table 12: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Battery Manufacturing Equipment Market?

The projected CAGR is approximately > 24.00%.

2. Which companies are prominent players in the China Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive, Xiamen Lith Machine Limited, Hitachi Ltd, Schuler AG, Xiamen ACEY New Energy Technology, Durr AG, Wuxi Lead Intelligent Equipment Co Ltd, Andritz AG, Xiamen Tmax Battery Equipments Limited, Manz AG.

3. What are the main segments of the China Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12000 USD Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

In December 2022, the Chinese car company GAC announced that they had started building a production facility for electric car batteries in Guangzhou. With a total investment of USD 1.561 billion, the new factory is scheduled to operate in March 2024 with an annual production capacity of 6 GWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the China Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence