Key Insights

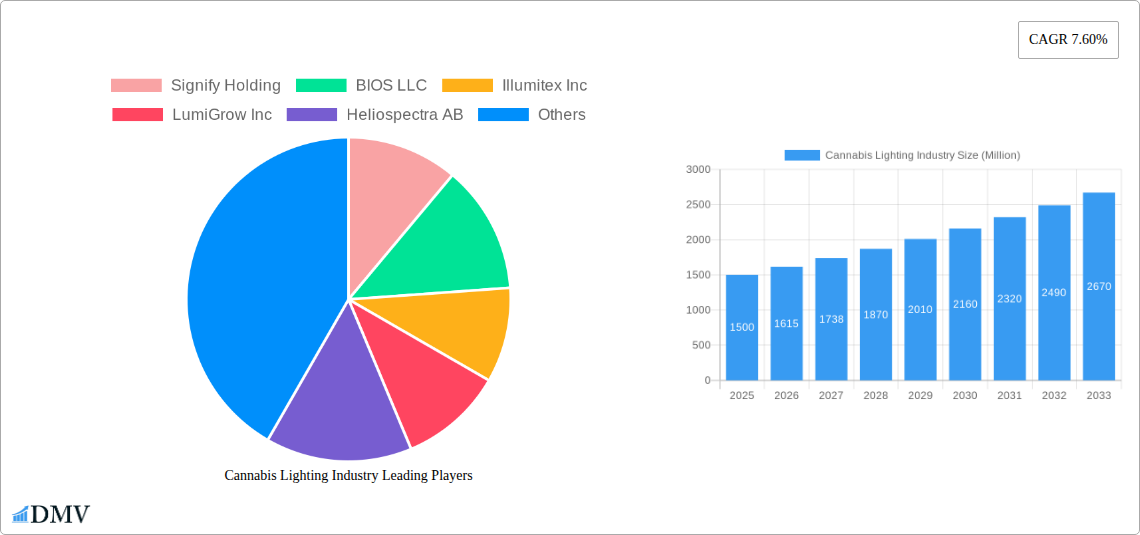

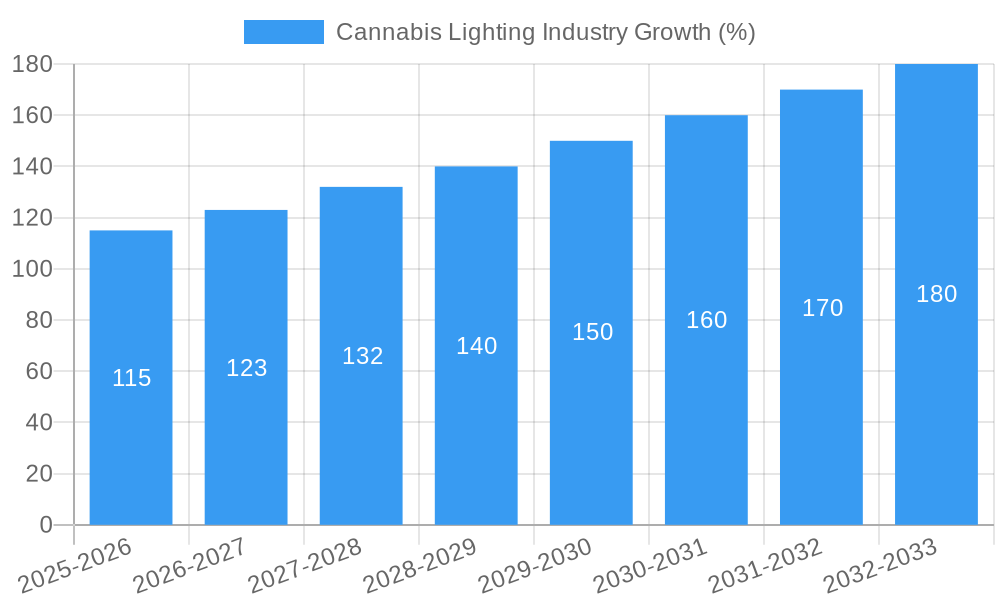

The cannabis lighting market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.60% from 2025 to 2033. This expansion is driven by several key factors. The increasing legalization and acceptance of cannabis for both medicinal and recreational purposes globally fuels demand for high-quality cultivation techniques, making advanced lighting systems crucial. Furthermore, the trend towards indoor and vertical farming, offering greater control over environmental factors and year-round harvests, is significantly boosting market growth. Technological advancements in LED lighting, offering energy efficiency and spectral customization tailored to cannabis growth stages, are further driving adoption. However, the market faces challenges such as high initial investment costs for advanced lighting systems and regulatory hurdles in certain regions. The market segmentation reveals a strong preference for LEDs, owing to their energy efficiency and cost-effectiveness over the long term, particularly amongst large-scale commercial growers. The indoor and greenhouse application segments are expected to dominate, reflecting the growing trend towards controlled environment agriculture for optimal yield and quality.

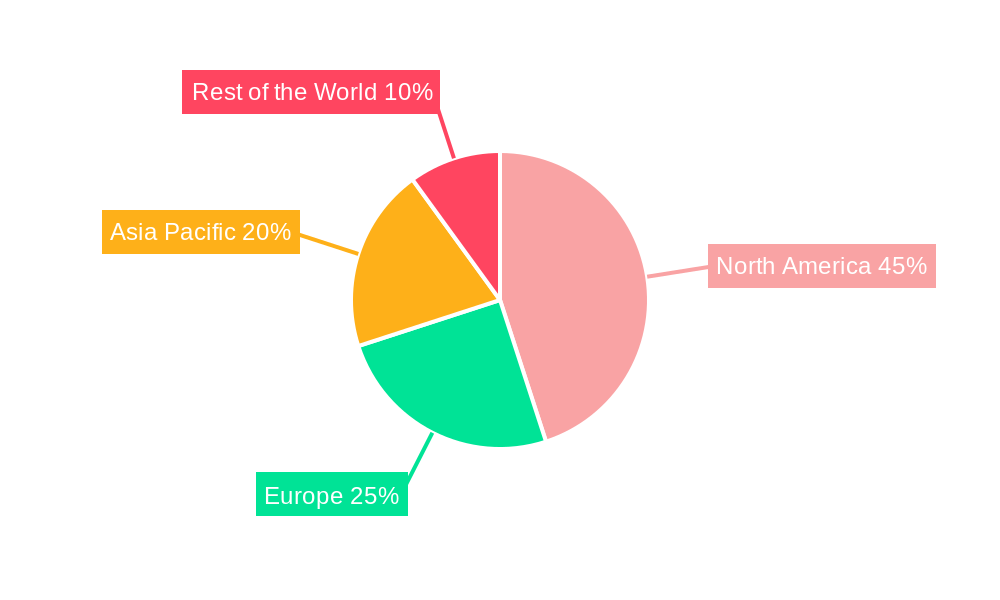

Competition in the cannabis lighting market is intense, with established players like Signify Holding and OSRAM Licht AG vying for market share alongside specialized companies like LumiGrow Inc and Heliospectra AB. These companies are continually innovating, focusing on developing advanced lighting solutions with optimized spectral output and smart controls for enhanced plant growth and yield. Future growth hinges on the continued expansion of the legal cannabis industry, further technological advancements in lighting efficiency and control, and the increasing adoption of data-driven precision agriculture techniques within cannabis cultivation. The Asia-Pacific region is predicted to show significant growth due to increasing legalization efforts and the rising popularity of cannabis-related products in the region. While North America maintains a leading position, Europe and the Asia-Pacific region present lucrative emerging markets for cannabis lighting technology providers.

Cannabis Lighting Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global cannabis lighting industry, projecting a market value exceeding $XX Million by 2033. It covers market composition, technological advancements, leading players, and future growth opportunities, offering crucial insights for stakeholders across the cannabis cultivation and lighting sectors. The report leverages data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033) to present a robust and reliable forecast.

Cannabis Lighting Industry Market Composition & Trends

The cannabis lighting market is experiencing significant growth, driven by the expanding legal cannabis industry globally. Market concentration is moderate, with several key players holding substantial shares, but a fragmented landscape of smaller firms also exists. Innovation is primarily focused on improving LED technology, increasing energy efficiency, and optimizing light spectrums for various cannabis strains. Regulatory landscapes vary widely across jurisdictions, impacting market growth and adoption rates. Substitute products, such as high-pressure sodium (HPS) lamps, are being rapidly replaced by more efficient LED solutions. The end-user profile consists mainly of commercial cannabis cultivators, both large-scale and smaller operations, alongside a growing segment of vertical farms. M&A activity has been moderate, with deal values reaching $XX Million in recent years.

- Market Share Distribution (2024): Signify Holding (15%), OSRAM Licht AG (12%), LumiGrow Inc (8%), Others (65%)

- M&A Deal Value (2019-2024): $XX Million

- Key Innovation Catalysts: Improved LED efficacy, spectrum tuning, smart lighting controls.

- Regulatory Landscape: Highly variable across regions, impacting market access and growth.

Cannabis Lighting Industry Evolution

The cannabis lighting market has undergone a dramatic transformation since 2019. The initial dominance of traditional lighting technologies like High-Pressure Sodium (HPS) and Metal Halide has been steadily eroded by the rapid adoption of Light Emitting Diodes (LEDs). This shift is fueled by LEDs’ superior energy efficiency, longer lifespan, and improved control over light spectrum, leading to increased yields and reduced operating costs for cultivators. Between 2019 and 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of XX%, driven primarily by the legalization of cannabis in several regions. This trend is expected to continue throughout the forecast period, with a projected CAGR of XX% between 2025 and 2033. Consumer demand for higher-quality cannabis, achievable with optimized lighting solutions, further fuels market expansion. The integration of smart technologies like IoT sensors and data analytics further enhances the efficiency and profitability of cultivation. The increasing adoption of vertical farming also contributes to the rising demand for specialized lighting solutions.

Leading Regions, Countries, or Segments in Cannabis Lighting Industry

The North American market, particularly the United States and Canada, currently dominates the cannabis lighting industry, driven by robust legal cannabis markets and significant investments in cultivation infrastructure. Within lighting technologies, LEDs hold the largest market share, exceeding XX Million in revenue in 2024 due to their superior efficiency and versatility.

Key Drivers for North American Dominance:

- Legalization of cannabis in several states/provinces.

- High investment in commercial cannabis cultivation.

- Early adoption of advanced LED lighting technologies.

Dominant Lighting Technology: Light Emitting Diodes (LEDs) - owing to superior energy efficiency, control over spectrum, and longevity. This segment is projected to reach $XX Million by 2033.

Dominant Application: Indoor Cultivation - due to its controlled environment allowing for year-round production and optimized lighting conditions. This segment is expected to reach $XX Million by 2033.

Cannabis Lighting Industry Product Innovations

Recent innovations include LED fixtures with advanced spectrum control, enabling cultivators to precisely tailor light to different growth stages, resulting in higher yields and improved quality. Smart lighting systems with integrated sensors and data analytics are gaining traction, offering real-time monitoring and automated control of light intensity and spectrum. This enhances efficiency, reduces energy waste, and optimizes crop yield. Furthermore, the development of compact and modular lighting solutions caters to the needs of smaller-scale cultivators and vertical farming operations. These innovations are underpinned by advancements in chip technology, leading to greater efficiency and reduced costs.

Propelling Factors for Cannabis Lighting Industry Growth

Several factors drive market expansion. Technological advancements in LED technology, such as improved efficiency and spectral control, significantly reduce operating costs and improve yields. The favorable regulatory environment in several jurisdictions encourages investment in cannabis cultivation, boosting demand for advanced lighting solutions. Economic incentives, such as tax breaks and subsidies for energy-efficient technologies, also play a crucial role.

Obstacles in the Cannabis Lighting Industry Market

The cannabis lighting industry faces various challenges. Strict regulations and licensing requirements in some regions restrict market access and increase operational costs. Supply chain disruptions, particularly concerning semiconductor components crucial for LED manufacturing, can impact production and availability. Intense competition among established players and new entrants puts downward pressure on prices.

Future Opportunities in Cannabis Lighting Industry

Emerging opportunities include the integration of artificial intelligence (AI) and machine learning (ML) for improved light control and yield optimization. The expanding vertical farming sector creates a significant market for specialized lighting systems optimized for high-density cultivation. The increasing demand for organically grown cannabis may fuel the adoption of LED lighting solutions that minimize the environmental impact.

Major Players in the Cannabis Lighting Industry Ecosystem

- Signify Holding

- BIOS LLC

- Illumitex Inc

- LumiGrow Inc

- Heliospectra AB

- Cultilux

- OSRAM Licht AG

- Gavita Holland BV

- General Electric Company

- Vivosun

- Sun System

Key Developments in Cannabis Lighting Industry Industry

- May 2022: OSRAM launched the OSLON Optimal family of LEDs for horticulture lighting, boasting high efficiency and dependable performance. This launch signifies a significant advancement in LED technology for the cannabis cultivation sector.

Strategic Cannabis Lighting Industry Market Forecast

The cannabis lighting market is poised for substantial growth, driven by ongoing technological advancements, increasing legalization efforts globally, and the expansion of the vertical farming sector. The continued adoption of energy-efficient and high-performance LED solutions will be a major catalyst for future expansion. The market is expected to reach $XX Million by 2033, presenting significant opportunities for established players and new entrants alike.

Cannabis Lighting Industry Segmentation

-

1. Lighting Technology

- 1.1. Light Emitting Diodes (LEDs)

- 1.2. T5 High Output Fluorescent Light

- 1.3. Ceramic Metal Halide Light

- 1.4. Compact Fluorescent Light

- 1.5. Magnetic Induction Light

- 1.6. Other Lighting Preferences

-

2. Application

- 2.1. Greenhouse

- 2.2. Indoor

- 2.3. Vertical Farming

Cannabis Lighting Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Cannabis Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Legalization of Medical Cannabis in Various Countries

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth

- 3.4. Market Trends

- 3.4.1. LED Light is Expected to Occupy Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 5.1.1. Light Emitting Diodes (LEDs)

- 5.1.2. T5 High Output Fluorescent Light

- 5.1.3. Ceramic Metal Halide Light

- 5.1.4. Compact Fluorescent Light

- 5.1.5. Magnetic Induction Light

- 5.1.6. Other Lighting Preferences

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Greenhouse

- 5.2.2. Indoor

- 5.2.3. Vertical Farming

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 6. North America Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 6.1.1. Light Emitting Diodes (LEDs)

- 6.1.2. T5 High Output Fluorescent Light

- 6.1.3. Ceramic Metal Halide Light

- 6.1.4. Compact Fluorescent Light

- 6.1.5. Magnetic Induction Light

- 6.1.6. Other Lighting Preferences

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Greenhouse

- 6.2.2. Indoor

- 6.2.3. Vertical Farming

- 6.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 7. Europe Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 7.1.1. Light Emitting Diodes (LEDs)

- 7.1.2. T5 High Output Fluorescent Light

- 7.1.3. Ceramic Metal Halide Light

- 7.1.4. Compact Fluorescent Light

- 7.1.5. Magnetic Induction Light

- 7.1.6. Other Lighting Preferences

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Greenhouse

- 7.2.2. Indoor

- 7.2.3. Vertical Farming

- 7.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 8. Asia Pacific Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 8.1.1. Light Emitting Diodes (LEDs)

- 8.1.2. T5 High Output Fluorescent Light

- 8.1.3. Ceramic Metal Halide Light

- 8.1.4. Compact Fluorescent Light

- 8.1.5. Magnetic Induction Light

- 8.1.6. Other Lighting Preferences

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Greenhouse

- 8.2.2. Indoor

- 8.2.3. Vertical Farming

- 8.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 9. Rest of the World Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 9.1.1. Light Emitting Diodes (LEDs)

- 9.1.2. T5 High Output Fluorescent Light

- 9.1.3. Ceramic Metal Halide Light

- 9.1.4. Compact Fluorescent Light

- 9.1.5. Magnetic Induction Light

- 9.1.6. Other Lighting Preferences

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Greenhouse

- 9.2.2. Indoor

- 9.2.3. Vertical Farming

- 9.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 10. North America Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Signify Holding

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 BIOS LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Illumitex Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 LumiGrow Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Heliospectra AB

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cultilux

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 OSRAM Licht AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Gavita Holland BV

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 General Electric Company

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Vivosun

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Sun System*List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Signify Holding

List of Figures

- Figure 1: Global Cannabis Lighting Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 11: North America Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 12: North America Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 17: Europe Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 18: Europe Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 23: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 24: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 29: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 30: Rest of the World Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Rest of the World Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cannabis Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 3: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Cannabis Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 14: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 17: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 20: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 23: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cannabis Lighting Industry?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Cannabis Lighting Industry?

Key companies in the market include Signify Holding, BIOS LLC, Illumitex Inc, LumiGrow Inc, Heliospectra AB, Cultilux, OSRAM Licht AG, Gavita Holland BV, General Electric Company, Vivosun, Sun System*List Not Exhaustive.

3. What are the main segments of the Cannabis Lighting Industry?

The market segments include Lighting Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Legalization of Medical Cannabis in Various Countries.

6. What are the notable trends driving market growth?

LED Light is Expected to Occupy Significant Share.

7. Are there any restraints impacting market growth?

Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth.

8. Can you provide examples of recent developments in the market?

May 2022 - OSRM, a global leader in optical solutions, announced the launch of the OSLON Optimal family of LEDs for horticulture lighting, based on the latest ams OSRAM 1mm2 chip, which offers an outstanding combination of high efficiency, dependable performance, and great value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cannabis Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cannabis Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cannabis Lighting Industry?

To stay informed about further developments, trends, and reports in the Cannabis Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence