Key Insights

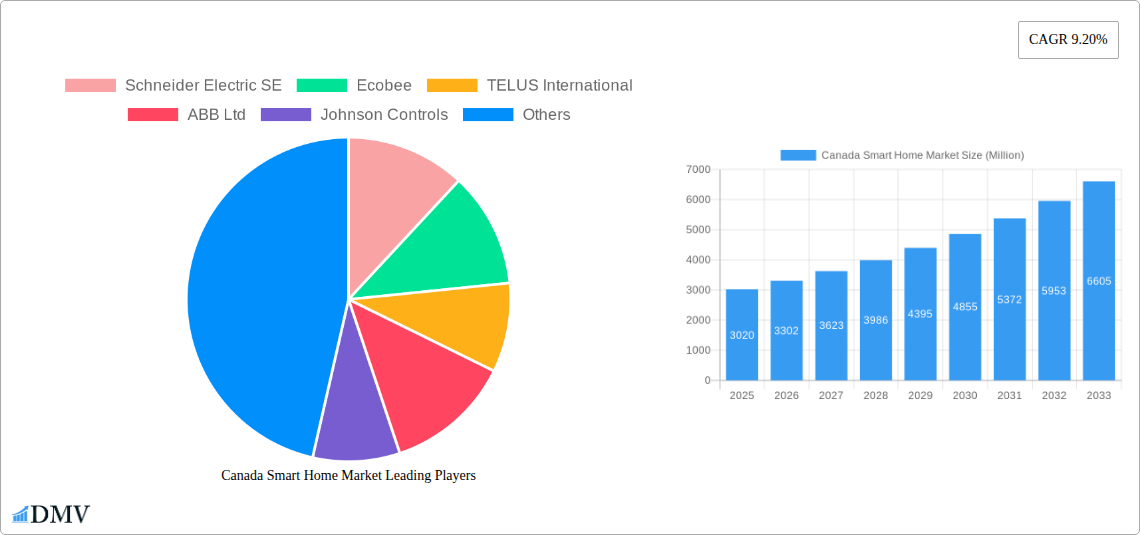

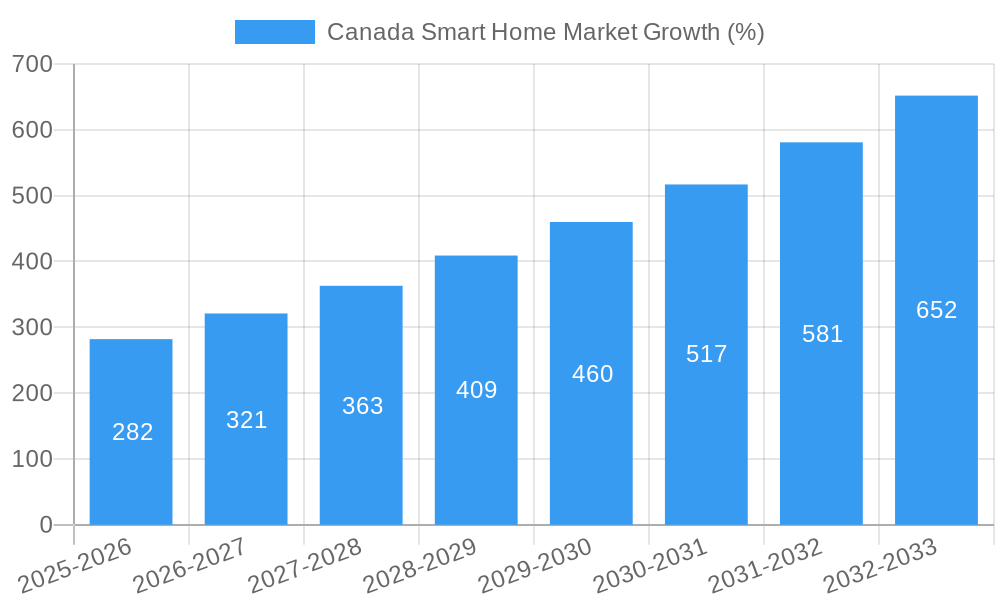

The Canadian smart home market is experiencing robust growth, projected to reach a market size of $3.02 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.20% from 2019 to 2033. This expansion is driven by several key factors. Increasing consumer adoption of smart home devices like smart speakers, security systems, and energy management solutions reflects a growing desire for convenience, enhanced security, and energy efficiency. Furthermore, the rising affordability of smart home technology and the improved integration of devices through various platforms contribute significantly to market growth. Government initiatives promoting energy conservation and smart city development also provide a supportive regulatory environment. The market is segmented based on device type (security systems, lighting, thermostats, etc.), technology (IoT, AI, Cloud Computing), and end-user (residential, commercial). Key players like Schneider Electric, Ecobee, and Honeywell International are driving innovation and competition, offering a wide array of integrated solutions to meet diverse consumer needs. Challenges include concerns about data privacy and security, the need for robust internet connectivity, and the potential for high initial investment costs, which may restrain market penetration in certain demographic groups. However, ongoing technological advancements are addressing these issues, improving affordability, and strengthening user confidence.

Looking ahead, the Canadian smart home market is poised for continued expansion throughout the forecast period (2025-2033). The integration of Artificial Intelligence (AI) and machine learning will likely lead to more personalized and proactive smart home experiences, while the rise of 5G technology will facilitate seamless connectivity and improved device performance. The ongoing development of smart home ecosystems and interoperability standards will further fuel growth by simplifying device integration and enhancing user experience. The continued focus on energy efficiency and sustainability initiatives will also contribute to the adoption of smart home technologies, making it an attractive proposition for environmentally conscious consumers. Competitive landscape will remain dynamic, with established players and emerging technology companies vying for market share through product innovation, strategic partnerships, and expansion into new segments.

Canada Smart Home Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Canada smart home market, offering invaluable insights for stakeholders seeking to understand its current state and future trajectory. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report meticulously examines market trends, technological advancements, key players, and emerging opportunities, presenting a comprehensive overview crucial for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting robust growth throughout the forecast period (2025-2033).

Canada Smart Home Market Market Composition & Trends

This section delves into the intricate composition of the Canadian smart home market, analyzing its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a relatively fragmented landscape with several key players competing for market share. However, significant consolidation is expected in the coming years through strategic M&A activities.

- Market Share Distribution (2024 Estimate): The top five players – Schneider Electric SE, Honeywell International Inc, Johnson Controls, ABB Ltd, and Ecobee – collectively hold approximately xx% of the market share. Smaller players, including Siemens AG and Signify Holding, contribute significantly to the market's dynamism.

- Innovation Catalysts: Government initiatives promoting energy efficiency and smart city development are driving innovation, alongside increasing consumer demand for enhanced home security and convenience.

- Regulatory Landscape: The Canadian government's focus on data privacy and cybersecurity is shaping the market, requiring companies to adhere to stringent regulations regarding data collection and protection.

- Substitute Products: Traditional home automation systems and DIY solutions present a degree of competition, but the increasing sophistication and affordability of smart home devices are widening the market.

- End-User Profiles: Homeowners, particularly millennials and Gen Z, are the primary drivers of growth. Increasingly, smart home technology is being adopted in rental properties and multi-family dwellings.

- M&A Activities (2019-2024): While precise deal values are confidential in many cases, the period saw a significant number of acquisitions of smaller smart home technology companies by larger players seeking to expand their product portfolios and market reach. Total M&A deal value for the period is estimated at xx Million.

Canada Smart Home Market Industry Evolution

This section analyzes the dynamic evolution of the Canadian smart home market, examining its growth trajectories, technological progress, and evolving consumer preferences. The market has shown consistent growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This positive trend is anticipated to continue throughout the forecast period, fueled by several key factors.

The widespread adoption of smart speakers, coupled with increased integration among different smart home devices, signifies a pivotal shift towards seamless home automation. Rising consumer awareness of energy efficiency and the associated cost savings further enhances market attractiveness. Government incentives and initiatives aimed at promoting smart home technology are also fueling market expansion. The increasing integration of AI and machine learning in smart home systems is expected to drive further growth, delivering improved functionalities and personalized user experiences. Specifically, the integration of smart home systems with renewable energy solutions is showing significant promise, creating new revenue streams for manufacturers and installers.

Leading Regions, Countries, or Segments in Canada Smart Home Market

This section identifies the dominant regions and segments within the Canadian smart home market, providing a nuanced understanding of the factors driving their success. Currently, Ontario and British Columbia represent the largest markets, driven by higher disposable incomes and a greater concentration of tech-savvy consumers.

- Key Drivers of Dominance:

- High Disposable Incomes: These provinces boast relatively higher disposable incomes compared to other regions, allowing consumers to invest more readily in premium smart home technologies.

- Technological Infrastructure: Strong broadband penetration and reliable internet connectivity are essential for the seamless operation of smart home devices, and these provinces lead in this area.

- Government Support: Provincial government incentives and initiatives focused on energy efficiency and technological advancement further stimulate growth.

- Early Adoption of Technology: A higher concentration of early adopters and tech-savvy consumers in these provinces fuels early market penetration.

- In-depth Analysis: Market maturity and widespread adoption of smart home technology in urban areas continue to drive demand. The rapid expansion of smart home solutions in newly constructed homes and the increasing retrofitting of older homes in these regions also contribute substantially to overall market growth.

Canada Smart Home Market Product Innovations

Recent innovations in the Canadian smart home market have witnessed the emergence of increasingly sophisticated products that offer greater ease of use and improved functionalities. For instance, several manufacturers are now producing smart home devices with enhanced voice control features and enhanced integration across multiple platforms and devices. The introduction of more intuitive user interfaces and advanced automation features significantly enhances user experience and adoption rates. Furthermore, improvements in energy efficiency and security are driving greater consumer interest in these innovative products. This shift towards seamless integration and enhanced security features underpins the steady growth of the market.

Propelling Factors for Canada Smart Home Market Growth

Several factors contribute to the substantial growth of the Canadian smart home market. Firstly, technological advancements continue to provide more sophisticated and user-friendly smart home solutions. This is complemented by increasingly affordable pricing, making them accessible to a broader range of consumers. Government initiatives supporting energy efficiency and smart city development are further catalysts, creating incentives for adoption. Furthermore, a growing awareness of the enhanced security and convenience these systems offer significantly boosts market demand.

Obstacles in the Canada Smart Home Market Market

Despite the promising growth trajectory, the Canadian smart home market faces several challenges. One primary concern is the prevalence of cybersecurity risks associated with interconnected devices. This necessitates robust security measures to mitigate potential vulnerabilities. Another obstacle is the cost barrier for some consumers, particularly those with lower incomes. Supply chain disruptions occasionally cause delays and increased costs, creating uncertainty in the market. Finally, intense competition among numerous players can also impact profitability for individual companies.

Future Opportunities in Canada Smart Home Market

The future of the Canadian smart home market holds significant potential. The growing adoption of smart home devices in the commercial sector presents immense opportunities. Expansion into new markets, such as rural areas, remains untapped and offers significant potential for future growth. The development of advanced features integrating AI, machine learning, and improved energy management tools will further enhance market appeal and drive future demand.

Major Players in the Canada Smart Home Market Ecosystem

- Schneider Electric SE

- Ecobee

- TELUS International

- ABB Ltd

- Johnson Controls

- Honeywell International Inc

- Seimens AG

- Signify Holding

- Microsoft Corporation

- Google Inc

- Cisco Systems Inc

- General Electric Company

- Dahua Technology

- Emerson Electric Co

Key Developments in Canada Smart Home Market Industry

- December 2023: Ecobee launched a new integration feature, allowing all its smart thermostats to seamlessly pair with Generac's 4G LTE Cellular Propane Tank Monitors. This collaboration enhances home energy management and user convenience.

- February 2024: The Government of Canada introduced a Smart Home initiative in Montréal for young adults with intellectual disabilities, showcasing the technology's potential for assistive living and community integration. This initiative underscores the growing recognition of smart home technology's broader societal benefits.

Strategic Canada Smart Home Market Market Forecast

The Canadian smart home market is poised for significant expansion in the coming years. Continued technological innovation, coupled with government support and increasing consumer awareness, will drive substantial market growth. The integration of smart home systems with broader smart city initiatives, along with the expansion into new demographics and geographic areas, presents compelling opportunities for continued market expansion. The market is expected to demonstrate consistent growth, reaching xx Million by 2033, indicating a robust and promising future.

Canada Smart Home Market Segmentation

-

1. Product Type

- 1.1. Comfort and Lighting

- 1.2. Control and Connectivity

- 1.3. Energy Management

- 1.4. Home Entertainment

- 1.5. Security

- 1.6. Smart Appliances

- 1.7. HVAC Control

-

2. Technology

- 2.1. Wi-Fi

- 2.2. Bluetooth

- 2.3. Other Technologies

Canada Smart Home Market Segmentation By Geography

- 1. Canada

Canada Smart Home Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Concerns about Home Security and Safety; Advances in Technology

- 3.2.2 such as IoT

- 3.2.3 Artificial Intelligence

- 3.2.4 and Voice Controlled Assistants

- 3.3. Market Restrains

- 3.3.1 Rising Concerns about Home Security and Safety; Advances in Technology

- 3.3.2 such as IoT

- 3.3.3 Artificial Intelligence

- 3.3.4 and Voice Controlled Assistants

- 3.4. Market Trends

- 3.4.1. The Energy Management Segment is Expected to Hold a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Smart Home Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Comfort and Lighting

- 5.1.2. Control and Connectivity

- 5.1.3. Energy Management

- 5.1.4. Home Entertainment

- 5.1.5. Security

- 5.1.6. Smart Appliances

- 5.1.7. HVAC Control

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Wi-Fi

- 5.2.2. Bluetooth

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Schneider Electric SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecobee

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TELUS International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ABB Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Controls

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Seimens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Signify Holding

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Microsoft Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Google Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cisco Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 General Electric Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dahua Technology

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Emerson Electric Co *List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Schneider Electric SE

List of Figures

- Figure 1: Canada Smart Home Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Smart Home Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Smart Home Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Smart Home Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Canada Smart Home Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Canada Smart Home Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Canada Smart Home Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Canada Smart Home Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 7: Canada Smart Home Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Smart Home Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Canada Smart Home Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Canada Smart Home Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Canada Smart Home Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: Canada Smart Home Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 13: Canada Smart Home Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Canada Smart Home Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Smart Home Market?

The projected CAGR is approximately 9.20%.

2. Which companies are prominent players in the Canada Smart Home Market?

Key companies in the market include Schneider Electric SE, Ecobee, TELUS International, ABB Ltd, Johnson Controls, Honeywell International Inc, Seimens AG, Signify Holding, Microsoft Corporation, Google Inc, Cisco Systems Inc, General Electric Company, Dahua Technology, Emerson Electric Co *List Not Exhaustive.

3. What are the main segments of the Canada Smart Home Market?

The market segments include Product Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Concerns about Home Security and Safety; Advances in Technology. such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

6. What are the notable trends driving market growth?

The Energy Management Segment is Expected to Hold a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Rising Concerns about Home Security and Safety; Advances in Technology. such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

8. Can you provide examples of recent developments in the market?

February 2024: The Government of Canada introduced a Smart Home initiative in Montréal, designed for young adults with intellectual disabilities, including those on the autism spectrum. This project aims to enhance the daily lives of individuals with intellectual challenges by providing a safe environment that promotes continuous learning, self-esteem, and independence. The Smart Home features advanced technologies such as smart mirrors, interactive learning screens, and multi-sensory rooms, all intended to assist residents with routine tasks, ensuring they maintain their progress and integrate into the community. Researchers from universities in Quebec have significantly contributed to this initiative, advancing knowledge in this specialized field.December 2023: Ecobee launched a new integration feature, allowing all its smart thermostats to seamlessly pair with Generac's 4G LTE Cellular Propane Tank Monitors. This collaboration lets users conveniently track their propane tank's fuel levels directly from the smart thermostat's display. The move underscores Ecobee and its parent company, Generac's, ongoing commitment to enhancing home energy systems for greater comfort, security, and efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Smart Home Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Smart Home Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Smart Home Market?

To stay informed about further developments, trends, and reports in the Canada Smart Home Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence