Key Insights

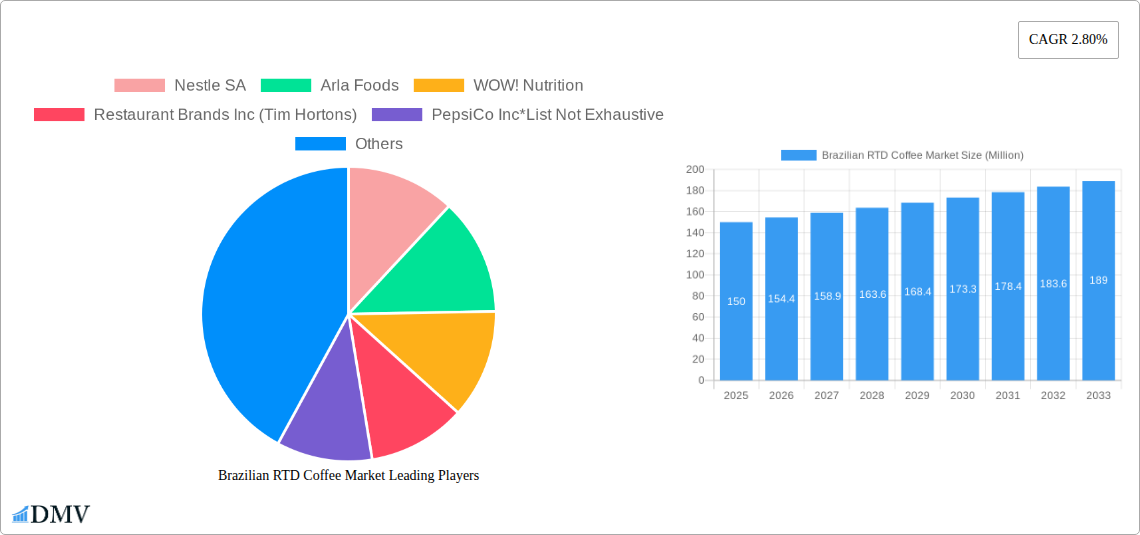

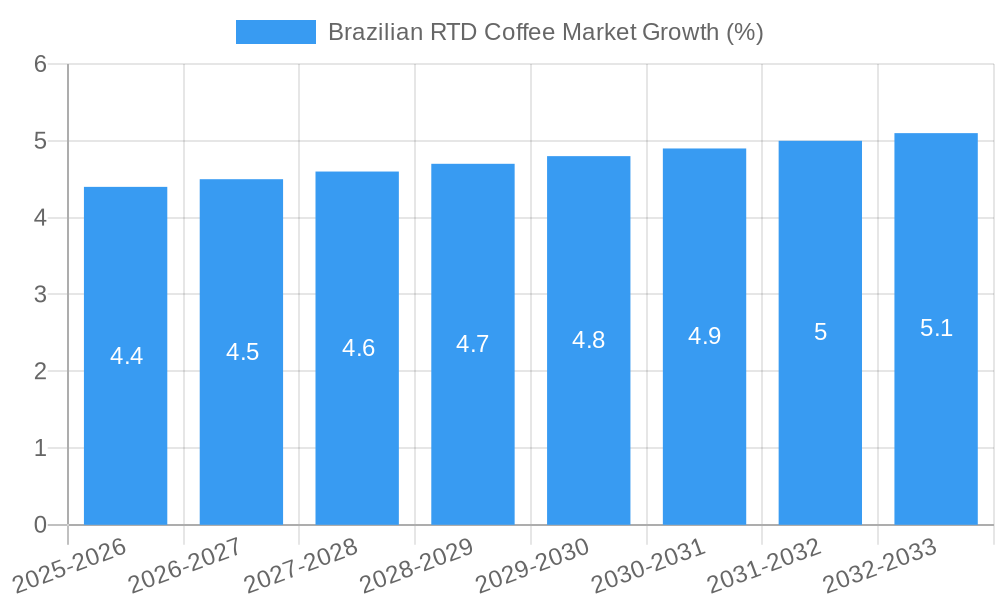

The Brazilian Ready-to-Drink (RTD) coffee market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.80% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing preference for convenient and on-the-go beverage options among Brazilian consumers, particularly within the younger demographics, significantly contributes to market growth. Furthermore, the rising disposable incomes and a growing middle class are boosting purchasing power, allowing consumers to afford premium RTD coffee options. The increasing popularity of cold brew coffee within the broader RTD segment also presents a significant opportunity, as consumers seek refreshing alternatives to traditional hot coffee. Successful marketing strategies emphasizing convenience, quality, and diverse flavors are proving effective in driving market penetration. However, the market faces challenges such as intense competition from established beverage giants and the fluctuating prices of coffee beans, which can impact profitability. The market segmentation reveals that bottled (PET/glass) coffee accounts for a significant share, followed by cans and other packaging types. Distribution channels are diversified across supermarkets/hypermarkets, specialty stores, and a rapidly growing online retail segment. Key players like Nestle SA, Arla Foods, and Coca-Cola are actively competing for market share, with their established distribution networks and brand recognition providing competitive advantages. The market's future growth will hinge on addressing consumer demand for innovative flavors, sustainable packaging, and maintaining competitive pricing strategies.

The Brazilian RTD coffee market's growth is expected to be driven primarily by strategic product innovation, targeting specific consumer preferences. Expanding distribution networks, particularly in less-saturated areas, will be vital for continued growth. The market's success will also depend on adapting to evolving consumer trends, like increasing health consciousness, and responding to these preferences with product lines that cater to a broader consumer base, such as organic and low-sugar options. The competitive landscape will remain dynamic, requiring companies to focus on brand building and effective marketing campaigns to stand out. A focus on sustainability within packaging and sourcing will appeal to the increasingly environmentally conscious consumer, further fueling market growth and shaping consumer choices. Analyzing the historical period from 2019-2024 will be crucial for accurately projecting the future and refining strategies accordingly.

Brazilian RTD Coffee Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Brazilian Ready-to-Drink (RTD) coffee market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The Brazilian RTD coffee market is projected to reach XX Million by 2033, driven by factors detailed within.

Brazilian RTD Coffee Market Composition & Trends

This section delves into the competitive landscape, innovation drivers, and regulatory environment of the Brazilian RTD coffee market. We analyze market concentration, revealing the share held by key players like Nestle SA, The Coca-Cola Company, and Starbucks Corporation, amongst others. The report also examines the influence of M&A activities, providing insights into deal values and their impact on market dynamics. Innovation is assessed through the lens of product diversification (Cold Brew Coffee, other RTD coffee variants), packaging innovation (bottles, cans, other packaging), and evolving consumer preferences. The regulatory landscape's influence on market growth and the role of substitute products are also explored.

- Market Share Distribution (2024): Nestle SA (XX%), The Coca-Cola Company (XX%), Starbucks Corporation (XX%), Others (XX%).

- M&A Activity (2019-2024): Total deal value estimated at XX Million. Significant deals included [mention specific deals if available, otherwise state "Data unavailable"].

- End-User Profiles: Detailed segmentation by demographics, purchasing behavior, and preferences.

- Substitute Products: Analysis of competing beverages and their market impact.

Brazilian RTD Coffee Market Industry Evolution

This section traces the evolution of the Brazilian RTD coffee market from 2019 to 2024, projecting its trajectory until 2033. We analyze market growth rates, highlighting periods of expansion and contraction. The impact of technological advancements, such as improved packaging and processing techniques, and shifting consumer demands (e.g., health-conscious options) are examined. Specific data points include year-on-year growth rates and adoption rates for innovative products and distribution channels. The influence of evolving consumer preferences towards organic, sustainable, and ethically sourced coffee is also considered. The report details how the market has adapted to these trends, forecasting future adjustments.

Leading Regions, Countries, or Segments in Brazilian RTD Coffee Market

This section identifies the dominant segments within the Brazilian RTD coffee market. We analyze leading regions, focusing on factors driving their success. This analysis covers:

- Packaging Type: Bottle (PET/Glass) is expected to dominate, followed by Cans and Other Packaging Types. Key drivers include cost-effectiveness, convenience, and recyclability.

- Product Type: Cold Brew Coffee is experiencing rapid growth due to its smoother taste and perceived health benefits. Other RTD coffee maintains a substantial market share.

- Distribution Channels: Supermarkets/Hypermarkets are the primary distribution channels, followed by specialty stores and online retail stores. Growth in e-commerce is expected to increase the significance of online retail channels.

Key Drivers:

- Investment in new production facilities and distribution networks.

- Government support for the coffee industry.

- Strategic partnerships between producers and retailers.

Brazilian RTD Coffee Market Product Innovations

This section showcases recent product innovations within the Brazilian RTD coffee market, highlighting unique selling propositions (USPs) and technological advancements. Recent examples include the introduction of new flavors, functional ingredients (e.g., added vitamins or antioxidants), and sustainable packaging options. The focus is on highlighting the features that drive consumer preference and market differentiation.

Propelling Factors for Brazilian RTD Coffee Market Growth

Several factors contribute to the growth of the Brazilian RTD coffee market. These include:

- Rising Disposable Incomes: Increased purchasing power fuels demand for premium RTD coffee options.

- Changing Consumer Lifestyles: Busy lifestyles encourage convenient consumption of RTD coffee.

- Technological Advancements: Innovations in packaging, processing, and flavor development enhance product appeal.

Obstacles in the Brazilian RTD Coffee Market

Challenges hindering growth include:

- Fluctuations in Coffee Bean Prices: Impacts production costs and profitability.

- Intense Competition: Established players and new entrants create a competitive market.

- Supply Chain Disruptions: Potential for delays and increased costs.

Future Opportunities in Brazilian RTD Coffee Market

Future opportunities include:

- Expansion into New Regions: Reaching underserved markets.

- Development of Niche Products: Catering to specific consumer segments.

- Adoption of Sustainable Practices: Meeting growing consumer demand for environmentally friendly products.

Major Players in the Brazilian RTD Coffee Market Ecosystem

- Nestle SA

- Arla Foods

- WOW! Nutrition

- Restaurant Brands Inc (Tim Hortons)

- PepsiCo Inc

- Lotte Corporation

- The Coca-Cola Company

- Starbucks Corporation

- Asahi Group Holdings

- Dunkin' Brands Group

Key Developments in Brazilian RTD Coffee Market Industry

- July 2021: Starbucks Corporation and Nestle launched ready-to-drink coffee products in Latin America.

- August 2022: Verve Coffee Roasters launched a new line of ready-to-drink flash brew oat milk lattes.

- February 2023: Starbucks Brazil opened three new stores.

Strategic Brazilian RTD Coffee Market Forecast

The Brazilian RTD coffee market is poised for continued growth, driven by increasing consumer demand, product innovation, and expanding distribution channels. The market's future success hinges on adapting to evolving consumer preferences, maintaining supply chain efficiency, and leveraging technological advancements. We project sustained growth throughout the forecast period (2025-2033), with significant opportunities for market expansion and penetration.

Brazilian RTD Coffee Market Segmentation

-

1. Packaging Type

- 1.1. Bottle (PET/Glass)

- 1.2. Cans

- 1.3. Other Packaging Types

-

2. Product Type

- 2.1. Cold Brew Coffee

- 2.2. Other RTD Coffee

-

3. Distribution Channles

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channles

Brazilian RTD Coffee Market Segmentation By Geography

- 1. Brazil

Brazilian RTD Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Growing Demand for Ready-to-Drink Beverages and Coffee

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian RTD Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Bottle (PET/Glass)

- 5.1.2. Cans

- 5.1.3. Other Packaging Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Cold Brew Coffee

- 5.2.2. Other RTD Coffee

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channles

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arla Foods

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WOW! Nutrition

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Restaurant Brands Inc (Tim Hortons)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PepsiCo Inc*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lotte Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Coca-Cola Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Starbucks Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Asahi Group Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dunkin' Brands Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: Brazilian RTD Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian RTD Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: Brazilian RTD Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian RTD Coffee Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 3: Brazilian RTD Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Brazilian RTD Coffee Market Revenue Million Forecast, by Distribution Channles 2019 & 2032

- Table 5: Brazilian RTD Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazilian RTD Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazilian RTD Coffee Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 8: Brazilian RTD Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 9: Brazilian RTD Coffee Market Revenue Million Forecast, by Distribution Channles 2019 & 2032

- Table 10: Brazilian RTD Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian RTD Coffee Market?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the Brazilian RTD Coffee Market?

Key companies in the market include Nestle SA, Arla Foods, WOW! Nutrition, Restaurant Brands Inc (Tim Hortons), PepsiCo Inc*List Not Exhaustive, Lotte Corporation, The Coca-Cola Company, Starbucks Corporation, Asahi Group Holdings, Dunkin' Brands Group.

3. What are the main segments of the Brazilian RTD Coffee Market?

The market segments include Packaging Type, Product Type, Distribution Channles.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Growing Demand for Ready-to-Drink Beverages and Coffee.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

February 2023: Starbucks Brazil opened three new stores in the Brazilian region. The stores are located at Fortaleza (Ceará), Goiânia and Alexânia (Goiás), and Recife (Pernambuco). Starbucks stores provide a wide range of coffee products, including ready-to-drink coffee beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian RTD Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian RTD Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian RTD Coffee Market?

To stay informed about further developments, trends, and reports in the Brazilian RTD Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence