Key Insights

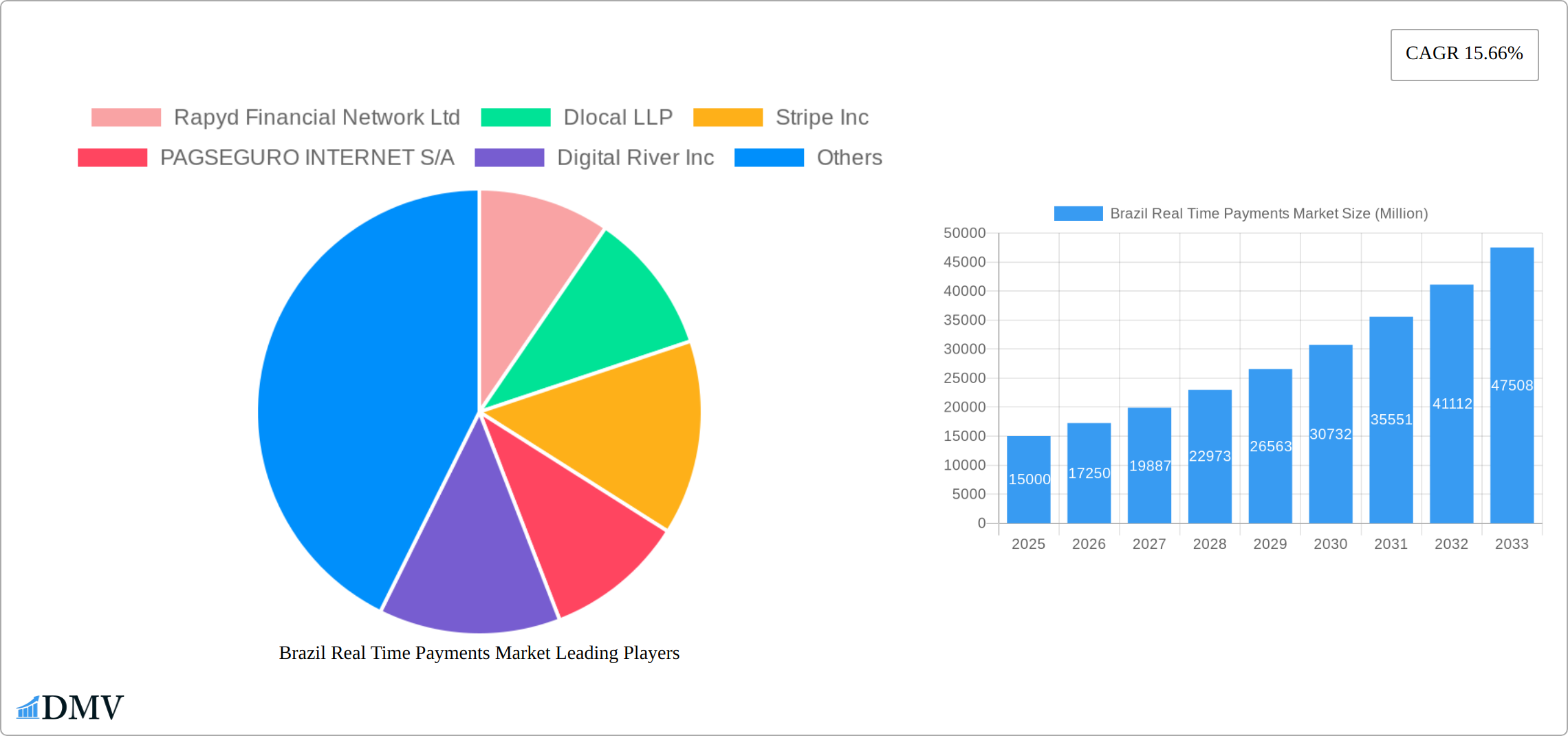

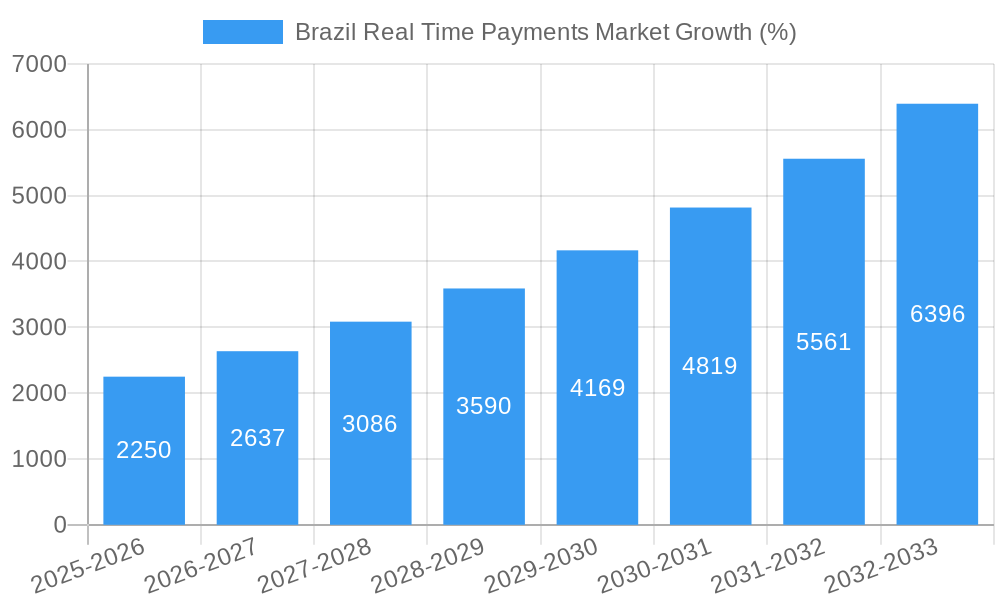

The Brazilian real-time payments (RTP) market is experiencing robust growth, driven by increasing smartphone penetration, rising e-commerce adoption, and government initiatives promoting financial inclusion. The market's Compound Annual Growth Rate (CAGR) of 15.66% from 2019 to 2024 suggests a significant expansion, and this momentum is projected to continue through 2033. Key growth drivers include the expanding usage of mobile wallets and the increasing preference for faster, more efficient payment methods among both consumers and businesses. The market is segmented by payment type, primarily Person-to-Person (P2P) and Person-to-Business (P2B) transactions, with P2P currently dominating due to the widespread adoption of social media-integrated payment solutions and mobile money transfer apps. However, the P2B segment is expected to witness significant growth, fueled by the expanding e-commerce sector and increasing demand for streamlined business-to-consumer payment options. While challenges such as cybersecurity concerns and regulatory complexities exist, the overall market outlook remains positive. Leading players like PayPal, MercadoLibre, and local companies like EBANX and Braspag are vying for market share, driving innovation and competition. The Brazilian RTP market's success hinges on continued technological advancements, enhanced security measures, and sustained government support for digital financial services.

The competitive landscape is marked by a mix of global giants and established domestic players. International companies bring advanced technologies and global expertise, while local players possess a deep understanding of the Brazilian market and its unique regulatory environment. This dynamic competition fosters innovation and ensures the continuous improvement of RTP services. Future growth will likely be influenced by the expansion of open banking initiatives, which promise to further integrate RTP systems with other financial services. The increasing integration of RTP systems with other financial technology solutions, such as lending platforms and investment apps, will further enhance their utility and broaden their appeal. This interconnectedness is poised to drive further market expansion and accelerate the adoption of real-time payments across various sectors of the Brazilian economy.

Brazil Real Time Payments Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Brazil Real Time Payments market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delivers a robust understanding of past trends, current dynamics, and future projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Brazil Real Time Payments Market Market Composition & Trends

This section delves into the intricate structure of the Brazilian real-time payments market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. We analyze the market share distribution amongst key players, revealing a competitive landscape shaped by both established financial institutions and agile fintech disruptors. For example, MercadoLibre SRL and PayPal Payments Private Limited hold significant market share, while newer entrants like Rapyd are making rapid inroads. The analysis also explores the impact of M&A activity, with deal values totaling xx Million in the historical period (2019-2024). Innovation is driven by the adoption of advanced technologies like AI and blockchain, while regulatory changes, particularly those surrounding Pix, significantly influence market growth. The prevalence of substitute payment methods and the diverse end-user profiles across various demographics and industries further contribute to the market's complexity.

- Market Concentration: High concentration among a few major players, with emerging players rapidly gaining traction.

- Innovation Catalysts: Adoption of AI, Blockchain, and improved API integrations.

- Regulatory Landscape: Significant influence of the Central Bank of Brazil and evolving regulations around data privacy and security.

- Substitute Products: Traditional banking transfers and other online payment methods.

- End-User Profiles: Businesses (P2B), individuals (P2P), and diverse industry verticals.

- M&A Activity: xx Million in deal values during 2019-2024; increased activity expected in the forecast period.

Brazil Real Time Payments Market Industry Evolution

This section provides a detailed analysis of the market's growth trajectory, technological advancements, and evolving consumer preferences from 2019 to 2024. We examine the rapid adoption of real-time payments fueled by the introduction of Pix, leading to significant growth rates and increased transaction volumes. The integration of innovative technologies has enhanced security and efficiency. The increasing demand for seamless, 24/7 payment solutions and the preference for digital channels are driving the market's evolution. Analysis of consumer behavior reveals a strong preference for user-friendly interfaces and secure payment options. The market has experienced a dramatic shift from traditional banking systems to modern, technology-driven solutions. This transition is particularly evident in the rapid adoption of mobile wallets and other digital payment methods. Growth rates averaged xx% annually from 2019-2024, with an expected acceleration in the forecast period.

Leading Regions, Countries, or Segments in Brazil Real Time Payments Market

The Brazilian real-time payment market shows significant dominance in urban centers and areas with high internet penetration. This section focuses on the dominant segment by payment type (P2P and P2B). P2P transactions, propelled by the ease and speed of Pix, demonstrate substantial growth, exceeding P2B in volume. However, P2B transactions show considerable value, indicating higher average transaction sizes in business-to-business interactions.

Key Drivers for P2P Dominance:

- Ease of Use: Pix offers an incredibly user-friendly platform, leading to widespread adoption among individuals.

- Low Cost: The low transaction fees associated with Pix make it an attractive option for consumers.

- Government Support: The Central Bank of Brazil actively promotes the use of Pix.

Key Drivers for P2B Growth:

- Efficiency Improvements: P2B transactions using real-time payments increase business efficiency.

- Reduced Costs: Lower transaction costs compared to traditional banking methods.

- Enhanced Security: Improved security protocols make P2B payments safer.

The dominance of these segments is largely driven by favorable regulatory environments and increasing consumer preference for faster, more convenient payment methods.

Brazil Real Time Payments Market Product Innovations

Recent product innovations focus on enhancing security, improving user experience, and integrating with existing financial systems. New features such as biometric authentication and advanced fraud detection systems are becoming increasingly common. There is a significant emphasis on developing APIs that allow seamless integration with various platforms and applications. These innovations aim to increase the accessibility and utility of real-time payment systems, boosting overall market adoption.

Propelling Factors for Brazil Real Time Payments Market Growth

Several factors contribute to the market's growth: the government's strong support for digital finance initiatives, the increasing smartphone penetration in Brazil, and the rising adoption of e-commerce. Technological advancements, like improved mobile payment infrastructure, also accelerate growth. The expanding middle class and increasing financial inclusion are further key drivers. The convenience and speed offered by real-time payments make it increasingly appealing to both consumers and businesses.

Obstacles in the Brazil Real Time Payments Market Market

Despite the promising growth outlook, challenges remain. Concerns about data security and privacy are paramount. Competition from existing payment providers and the potential for technological disruptions pose significant obstacles. Furthermore, infrastructure limitations, particularly in remote areas, can hinder wider adoption. The complexity of integrating with existing systems also represents a barrier for some businesses.

Future Opportunities in Brazil Real Time Payments Market

Future opportunities lie in expanding into underserved markets and integrating with emerging technologies like blockchain. Developing innovative solutions tailored to specific industry needs, such as micropayments for the gig economy, will create new revenue streams. Furthermore, expanding cross-border payment capabilities will unlock significant growth potential.

Major Players in the Brazil Real Time Payments Market Ecosystem

- Rapyd Financial Network Ltd

- Dlocal LLP

- Stripe Inc

- PAGSEGURO INTERNET S/A

- Digital River Inc

- MercadoLibre SRL

- PayPal Payments Private Limited

- EBANX Ltda

- Adyen

- Braspag Tecnologia em Pagamento Ltda

Key Developments in Brazil Real Time Payments Market Industry

- March 2022: Payment, a global payment platform, expands money transfer services in Brazil through Pix.

- November 2021: Volt, a UK-based open payments gateway, expands operations in Brazil, introducing real-time payments, foreign exchange, and currency exports.

Strategic Brazil Real Time Payments Market Market Forecast

The Brazilian real-time payments market is poised for continued expansion, driven by technological advancements, increasing digital adoption, and supportive government policies. The market's future potential is significant, with further growth anticipated as adoption rates continue to increase and innovative solutions emerge. The ongoing expansion of Pix and the increasing integration of real-time payments into various sectors will be crucial drivers of future growth.

Brazil Real Time Payments Market Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

-

2. Industry

- 2.1. Retail

- 2.2. E-commerce

- 2.3. Financial services

- 2.4. Healthcare

- 2.5. Government

Brazil Real Time Payments Market Segmentation By Geography

- 1. Brazil

Brazil Real Time Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience

- 3.3. Market Restrains

- 3.3.1. Privacy and Security Issues and Standardization concerns

- 3.4. Market Trends

- 3.4.1. P2P Real Time Payment is expected to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Real Time Payments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Retail

- 5.2.2. E-commerce

- 5.2.3. Financial services

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rapyd Financial Network Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dlocal LLP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stripe Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PAGSEGURO INTERNET S/A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Digital River Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MercadoLibre SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PayPal Payments Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EBANX Ltda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adyen

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Braspag Tecnologia em Pagamento Ltda

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rapyd Financial Network Ltd

List of Figures

- Figure 1: Brazil Real Time Payments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Real Time Payments Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Real Time Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Real Time Payments Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Brazil Real Time Payments Market Revenue Million Forecast, by Type of Payment 2019 & 2032

- Table 4: Brazil Real Time Payments Market Volume K Unit Forecast, by Type of Payment 2019 & 2032

- Table 5: Brazil Real Time Payments Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 6: Brazil Real Time Payments Market Volume K Unit Forecast, by Industry 2019 & 2032

- Table 7: Brazil Real Time Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Real Time Payments Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Brazil Real Time Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Real Time Payments Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Brazil Real Time Payments Market Revenue Million Forecast, by Type of Payment 2019 & 2032

- Table 12: Brazil Real Time Payments Market Volume K Unit Forecast, by Type of Payment 2019 & 2032

- Table 13: Brazil Real Time Payments Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 14: Brazil Real Time Payments Market Volume K Unit Forecast, by Industry 2019 & 2032

- Table 15: Brazil Real Time Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Real Time Payments Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Real Time Payments Market?

The projected CAGR is approximately 15.66%.

2. Which companies are prominent players in the Brazil Real Time Payments Market?

Key companies in the market include Rapyd Financial Network Ltd, Dlocal LLP, Stripe Inc, PAGSEGURO INTERNET S/A, Digital River Inc, MercadoLibre SRL, PayPal Payments Private Limited, EBANX Ltda, Adyen, Braspag Tecnologia em Pagamento Ltda.

3. What are the main segments of the Brazil Real Time Payments Market?

The market segments include Type of Payment, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience.

6. What are the notable trends driving market growth?

P2P Real Time Payment is expected to Drive Market Growth.

7. Are there any restraints impacting market growth?

Privacy and Security Issues and Standardization concerns.

8. Can you provide examples of recent developments in the market?

In March 2022, Payment, a Global payment platform, announced that it had expanded its money transfer services in Brazil through Pix, the instant payment platform developed and handled by the Central Bank of Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Real Time Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Real Time Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Real Time Payments Market?

To stay informed about further developments, trends, and reports in the Brazil Real Time Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence