Key Insights

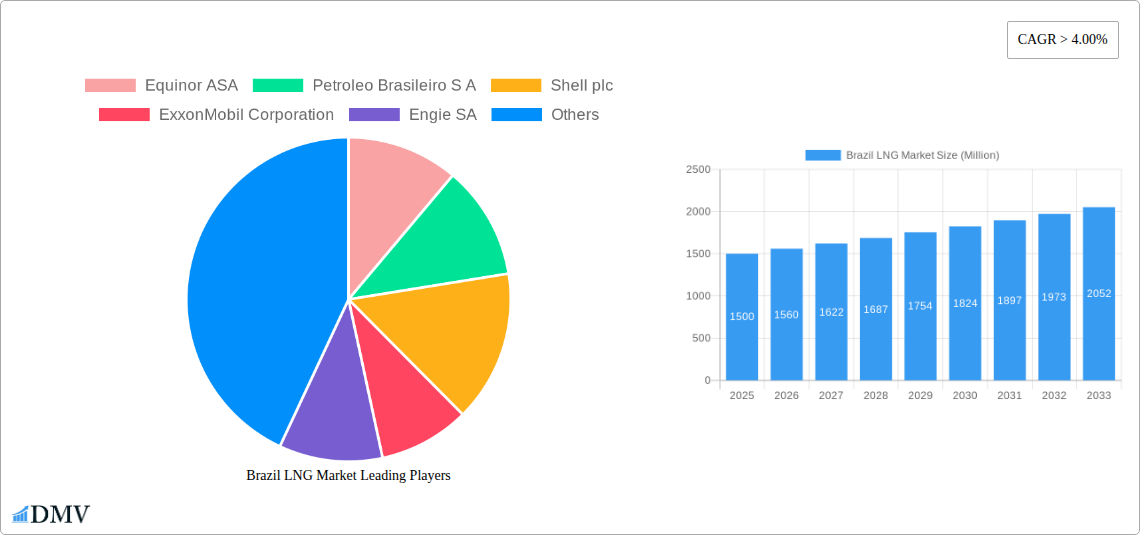

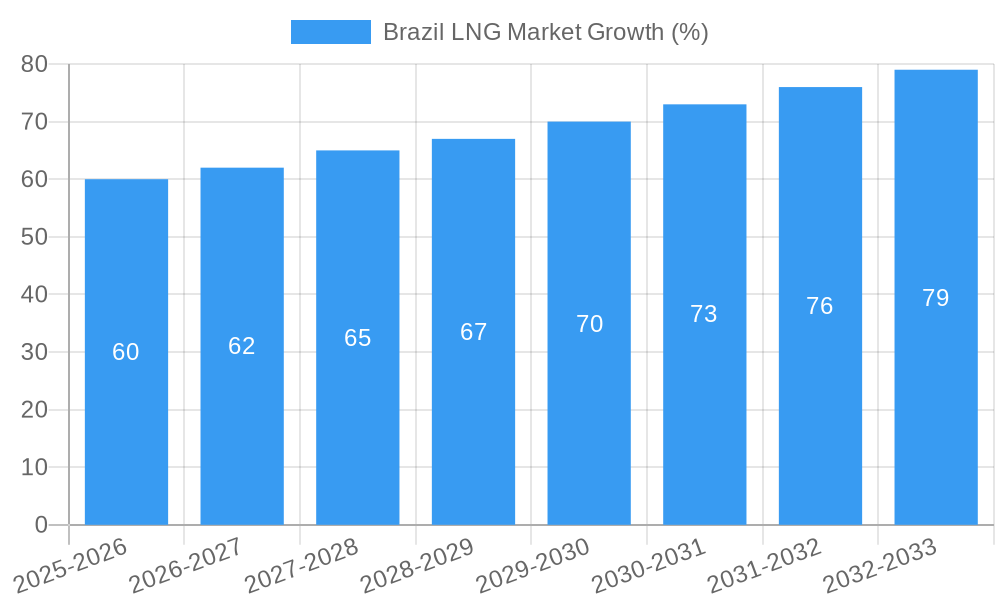

The Brazil LNG market is experiencing robust growth, driven by increasing energy demand, diversification away from reliance on hydropower, and government initiatives promoting cleaner energy sources. With a CAGR exceeding 4%, the market, valued at an estimated $X million in 2025 (assuming a logical extrapolation based on the provided 2019-2024 historical period and CAGR), is poised for significant expansion through 2033. Key drivers include the expansion of LNG infrastructure, particularly regasification terminals to meet growing domestic demand, and the increasing adoption of LNG as a transportation fuel, contributing to a reduction in greenhouse gas emissions compared to traditional fuels. Furthermore, the power generation sector represents a substantial market segment, with LNG providing a flexible and reliable alternative to meet peak demand. While regulatory hurdles and infrastructure development challenges remain as restraints, the long-term outlook is positive, fueled by Brazil's commitment to energy security and diversification.

The growth trajectory is segmented across LNG infrastructure (liquefaction plants, regasification facilities, and shipping) and applications (transportation fuel, power generation, and others). Major players like Equinor ASA, Petroleo Brasileiro S.A., Shell plc, and ExxonMobil Corporation are actively investing in this market, leveraging their expertise and resources to capitalize on Brazil's expanding LNG needs. While the initial investment costs associated with LNG infrastructure are significant, the long-term returns are attractive given the projected growth and Brazil's strategic importance in the South American energy landscape. The market will continue to evolve, driven by technological advancements, increasing environmental regulations, and strategic partnerships aimed at fostering sustainable and efficient LNG utilization within the Brazilian economy.

Brazil LNG Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning Brazil LNG market, offering a detailed forecast from 2025 to 2033. It meticulously examines market trends, key players, and future growth prospects, equipping stakeholders with critical insights for informed decision-making. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report features a detailed breakdown of market segments, including LNG infrastructure (liquefaction plants, regasification facilities, shipping), and applications (transportation fuel, power generation, others). Valuable data on market size, growth rates, and key developments are provided, offering a robust understanding of this dynamic market.

Brazil LNG Market Composition & Trends

This section delves into the competitive landscape of the Brazilian LNG market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and M&A activities. Market share distribution amongst key players like Petróleo Brasileiro S.A., Shell plc, and Equinor ASA will be detailed, alongside an assessment of the impact of recent mergers and acquisitions. The total value of M&A deals within the period 2019-2024 is estimated at $XX Million. This analysis will uncover emerging trends shaping the future of the Brazilian LNG sector.

- Market Concentration: Analysis of market share held by top players, identifying any dominant firms.

- Innovation Catalysts: Examination of technological advancements and R&D investments impacting the sector.

- Regulatory Landscape: Assessment of government policies and regulations influencing market dynamics.

- Substitute Products: Exploration of alternative energy sources and their potential impact on LNG demand.

- End-User Profiles: Characterization of key consumers of LNG in Brazil, including their needs and preferences.

- M&A Activities: Analysis of recent mergers and acquisitions, evaluating their impact on market consolidation.

Brazil LNG Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the Brazilian LNG market, tracing its growth trajectory from 2019 to 2033. We will explore technological advancements, shifting consumer demands, and the resultant impact on market growth rates. For example, the surge in LNG imports by Petrobras in 2021, reaching a record 23 Million cubic meters per day (a 200% increase from 2020), showcases the rapid expansion of the market. We project a Compound Annual Growth Rate (CAGR) of XX% for the forecast period (2025-2033). The adoption of FSRUs is expected to continue accelerating.

Leading Regions, Countries, or Segments in Brazil LNG Market

This section identifies the dominant regions, countries, and segments within the Brazilian LNG market. Analysis will focus on LNG Infrastructure (Liquefaction Plants, Regasification Facilities, Shipping) and Applications (Transportation Fuel, Power Generation, Others), pinpointing the key factors contributing to their market leadership.

- Power Generation: A significant driver due to growing energy demand and the increasing preference for natural gas as a cleaner fuel source.

- LNG Regasification Facilities: Expanding capacity, driven by rising LNG imports, as exemplified by Excelerate Energy's Bahia Regasification Terminal.

- Investment Trends: Analysis of capital expenditure in different segments, highlighting areas with significant investments.

- Regulatory Support: Evaluation of government policies and incentives aimed at promoting growth in specific segments.

Brazil LNG Market Product Innovations

This section will detail recent product innovations in LNG technology, applications, and performance metrics. We will showcase unique selling propositions and technological advancements driving efficiency and cost reductions, including developments in LNG storage, transportation, and regasification technologies.

Propelling Factors for Brazil LNG Market Growth

Several factors drive the growth of the Brazilian LNG market. These include increasing energy demand driven by economic growth, government initiatives promoting gas use, and technological advancements improving LNG efficiency and affordability. The strategic location of Brazil for LNG trading also contributes positively.

Obstacles in the Brazil LNG Market

Challenges facing the Brazilian LNG market include the volatility of global LNG prices, infrastructural limitations in some regions, and potential competition from renewable energy sources. Addressing these challenges is crucial for sustainable market growth.

Future Opportunities in Brazil LNG Market

Future opportunities lie in the expansion of LNG infrastructure, diversification of LNG sources, and exploration of new applications, such as the increased use of LNG as a transportation fuel. Moreover, technological advancements in LNG production and transportation will continue to shape the market's future.

Major Players in the Brazil LNG Market Ecosystem

- Equinor ASA (Equinor ASA)

- Petroleo Brasileiro S A (Petrobras)

- Shell plc (Shell plc)

- ExxonMobil Corporation (ExxonMobil)

- Engie SA (Engie)

- BP plc (BP)

- Enauta Participacoes SA

- Chevron Corporation (Chevron)

- Murphy Oil Corporation (Murphy Oil)

- TotalEnergies SE (TotalEnergies)

Key Developments in Brazil LNG Market Industry

- January 2022: Petrobras announced record LNG imports of 23 Million cubic meters per day in 2021, a 200% increase from 2020. This highlights the surge in domestic demand.

- December 2021: Excelerate Energy commenced natural gas deliveries at the Bahia Regasification Terminal (TR-BA), expanding regasification capacity and enhancing supply security.

Strategic Brazil LNG Market Forecast

The Brazilian LNG market is poised for significant growth, driven by robust domestic demand, supportive government policies, and strategic investments in infrastructure. The expanding power generation sector and transportation fuel applications will further propel market expansion. The forecast suggests a strong growth trajectory throughout the forecast period (2025-2033).

Brazil LNG Market Segmentation

-

1. LNG Infrastructure

- 1.1. LNG Liquefaction Plants

- 1.2. LNG Regasification Facilities

- 1.3. LNG Shipping

-

2. Application

- 2.1. Transportation Fuel

- 2.2. Power Generation

-

2.3. Others

- 2.3.1. `

Brazil LNG Market Segmentation By Geography

- 1. Brazil

Brazil LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Industrialization across the Globe; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Regasification Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil LNG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 5.1.1. LNG Liquefaction Plants

- 5.1.2. LNG Regasification Facilities

- 5.1.3. LNG Shipping

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Transportation Fuel

- 5.2.2. Power Generation

- 5.2.3. Others

- 5.2.3.1. `

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Petroleo Brasileiro S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shell plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ExxonMobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Engie SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BP plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Enauta Participacoes SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chevron Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Murphy Oil Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TotalEnergies SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Brazil LNG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil LNG Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil LNG Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: Brazil LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 4: Brazil LNG Market Volume metric tonnes Forecast, by LNG Infrastructure 2019 & 2032

- Table 5: Brazil LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Brazil LNG Market Volume metric tonnes Forecast, by Application 2019 & 2032

- Table 7: Brazil LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil LNG Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 9: Brazil LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil LNG Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 11: Brazil LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 12: Brazil LNG Market Volume metric tonnes Forecast, by LNG Infrastructure 2019 & 2032

- Table 13: Brazil LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Brazil LNG Market Volume metric tonnes Forecast, by Application 2019 & 2032

- Table 15: Brazil LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil LNG Market Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil LNG Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Brazil LNG Market?

Key companies in the market include Equinor ASA, Petroleo Brasileiro S A, Shell plc, ExxonMobil Corporation, Engie SA, BP plc, Enauta Participacoes SA, Chevron Corporation, Murphy Oil Corporation, TotalEnergies SE.

3. What are the main segments of the Brazil LNG Market?

The market segments include LNG Infrastructure, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Industrialization across the Globe; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Regasification Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

In January 2022, Brazilian state-run oil company Petrobras announced that it imported a record 23 million cubic meters per day of liquefied natural gas (LNG) in 2021, a volume about 200% higher than the one recorded in the previous year (2020). The company imports LNG from countries such as the United States, Trinidad & Tobago, and Qatar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil LNG Market?

To stay informed about further developments, trends, and reports in the Brazil LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence