Key Insights

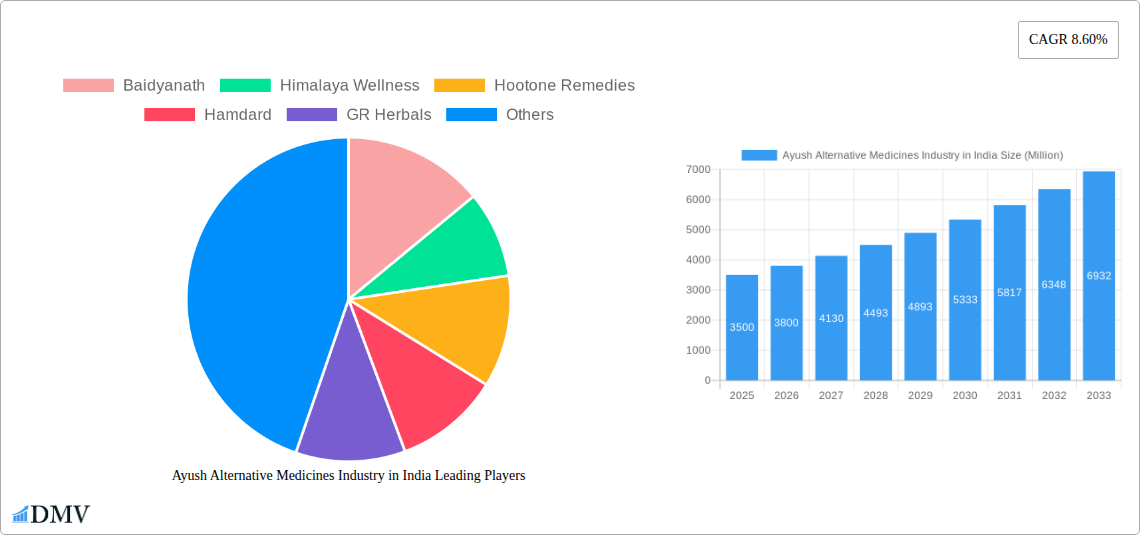

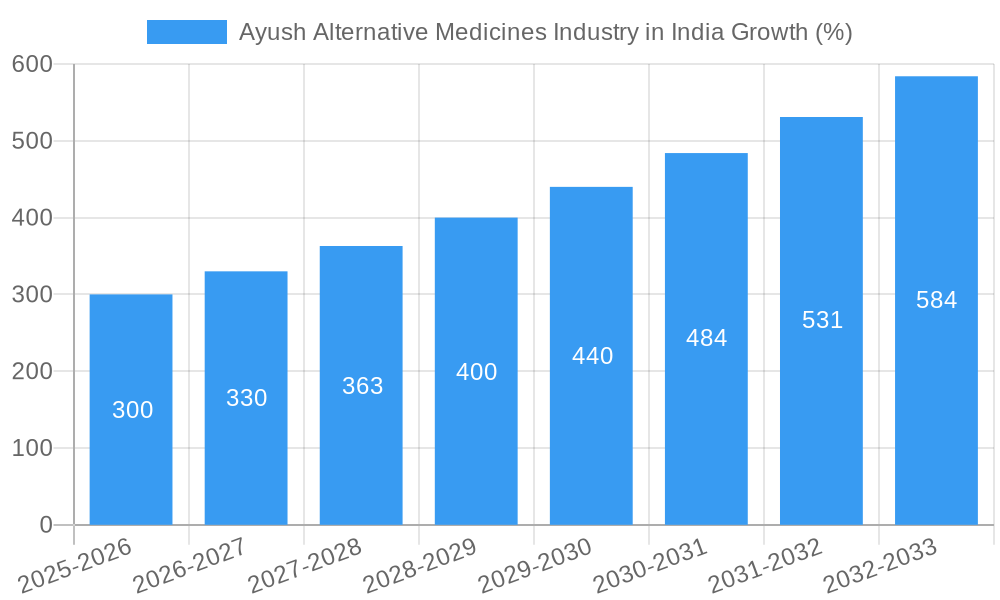

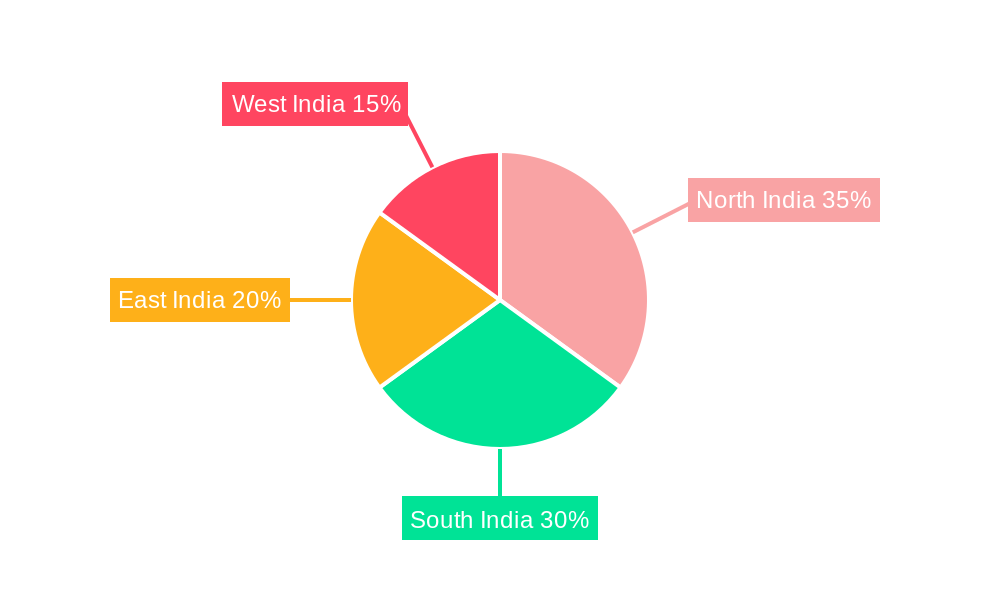

The Indian Ayush Alternative Medicines market, encompassing Ayurvedic, Herbal, Aroma Therapy, Homeopathy, and Acupuncture, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 8.60% from 2025 to 2033. This expansion is driven by several factors: a rising awareness of the efficacy and safety of traditional medicine, increasing consumer preference for natural and holistic healthcare solutions, and government initiatives promoting Ayush practices. The growing prevalence of chronic diseases, coupled with dissatisfaction with conventional treatments' side effects, further fuels the market's ascent. While the exact 2025 market size is not provided, considering the 8.60% CAGR and a logical extrapolation from previous years, a reasonable estimate would place the 2025 market value in the range of several billion dollars. Segmentation analysis reveals a strong demand across all types of Ayush medicines, with Ayurvedic and Herbal medicines commanding significant market share. Regional variations exist, with North and South India exhibiting potentially higher growth rates due to factors such as established herbal traditions and increased disposable incomes in certain areas. However, the market faces certain restraints, including the need for improved standardization and quality control within the industry, along with challenges in integrating Ayush practices into mainstream healthcare systems.

Leading players like Baidyanath, Himalaya Wellness, and Dabur India dominate the market landscape, benefiting from strong brand recognition and extensive distribution networks. However, the market also exhibits opportunities for smaller, specialized companies catering to niche segments and emerging therapeutic areas. The growth trajectory is projected to continue strongly throughout the forecast period (2025-2033), making strategic investments in research and development, product innovation, and robust supply chains increasingly crucial for sustained success in this dynamic market. The increasing popularity of online platforms for purchasing and accessing Ayush products is also contributing to market expansion.

Ayush Alternative Medicines Industry in India Market Composition & Trends

This comprehensive report analyzes the dynamic Ayush Alternative Medicines industry in India, covering the period 2019-2033. The study delves into the market's composition, revealing key trends and growth drivers. We examine the competitive landscape, assessing market share distribution among leading players such as Patanjali Ayurved Limited, Dabur India, Himalaya Wellness, Baidyanath, and others. The report meticulously documents mergers and acquisitions (M&A) activities, providing insights into deal values (estimated at xx Million for the period 2019-2024) and their impact on market consolidation. Furthermore, we explore the regulatory environment, the influence of substitute products, the evolving end-user profiles, and the role of innovation in shaping the industry's future. The Base Year for this analysis is 2025, with the Estimated Year also set at 2025. The Forecast Period extends from 2025 to 2033, building upon the Historical Period of 2019-2024.

- Market Concentration: The Indian Ayush market exhibits a mix of large established players and smaller niche companies, with the top 5 players holding an estimated xx% market share in 2024.

- Innovation Catalysts: Growing consumer awareness of natural and holistic health solutions fuels innovation in product formulations, delivery systems, and personalized medicine approaches.

- Regulatory Landscape: The report analyzes the impact of government initiatives, including the AYUSH mark, on market growth and standardization.

- Substitute Products: The report assesses the competitive pressures from conventional pharmaceuticals and other alternative medicine modalities.

- End-User Profiles: We segment the market by demographics, lifestyle choices, and health needs, identifying key customer segments.

- M&A Activities: The report tracks M&A activity, estimating deal values and analyzing their impact on market structure and competitive dynamics. Total M&A deal value is estimated at xx Million between 2019 and 2024.

Ayush Alternative Medicines Industry in India Industry Evolution

The Indian Ayush alternative medicines market has experienced significant evolution during the period 2019-2024, characterized by robust growth driven by increasing consumer preference for natural healthcare options. This growth trajectory is expected to continue, with the market anticipated to reach xx Million by 2033. Several factors have fueled this expansion, including rising disposable incomes, increased health consciousness, and a growing preference for holistic wellness solutions. Technological advancements, such as improved extraction techniques, quality control measures, and the rise of e-commerce, have further propelled market growth. Consumer demand is shifting towards personalized and specialized Ayurvedic, herbal, and homeopathic products, leading to product diversification and innovation. The adoption rate of online platforms for purchasing Ayush products has increased significantly, further accelerating market expansion. Government initiatives, such as the launch of the AYUSH mark, are bolstering consumer confidence and ensuring product authenticity, contributing positively to market growth. This has resulted in a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in Ayush Alternative Medicines Industry in India

The Ayurvedic Medicine segment dominates the Indian Ayush market, driven by its deep-rooted cultural significance and widespread acceptance.

- Key Drivers for Ayurvedic Medicine Dominance:

- Strong cultural acceptance and historical usage.

- Government support through initiatives like the AYUSH mark and increased funding for research.

- Significant investment in Ayurvedic research and development by both public and private entities.

- Growing awareness of the efficacy of Ayurvedic treatments for various ailments.

- Availability of a wide range of Ayurvedic products across different price points, catering to diverse consumer segments.

The dominance of Ayurvedic medicine stems from its long-standing presence in Indian culture, coupled with the increasing recognition of its therapeutic potential. Regulatory support, growing consumer preference for natural healthcare, and the development of new and improved Ayurvedic formulations have all contributed to this segment's leading position in the market. Other segments, such as herbal medicine and homeopathy, also show significant potential for growth but lag behind the dominance of Ayurveda due to factors such as lower awareness and limited research.

Ayush Alternative Medicines Industry in India Product Innovations

Recent years have witnessed a surge in product innovation within the Indian Ayush market. Companies are focusing on developing convenient, efficacious, and safe formulations. This includes advancements in herbal extraction methods, resulting in higher concentration of active compounds and improved bioavailability. There's a growing trend toward personalized Ayush products, tailored to specific health needs and individual constitutions. Furthermore, innovative delivery systems, such as liposomes and nanotechnology, are being explored to enhance product absorption and efficacy. Unique selling propositions often center on the use of organic ingredients, sustainable sourcing, and rigorous quality control, building consumer trust.

Propelling Factors for Ayush Alternative Medicines Industry in India Growth

The growth of the Indian Ayush market is propelled by several intertwined factors. Increasing disposable incomes and health consciousness among consumers are driving demand for premium and specialized Ayush products. Government initiatives, including the AYUSH mark and increased funding for research and development, are boosting the sector's credibility and fostering innovation. Technological advancements, such as improved extraction techniques and online sales platforms, further enhance market access and efficiency. Moreover, the growing global interest in traditional medicine systems also contributes to the expanding market.

Obstacles in the Ayush Alternative Medicines Industry in India Market

The Ayush market faces challenges such as inconsistent product quality, a lack of standardization across manufacturers, and concerns about the efficacy of some products. Supply chain disruptions can impact availability and pricing. Competition from conventional pharmaceuticals and other alternative medicine systems creates pressure. Regulatory hurdles and the need for improved clinical evidence to support claims hinder market growth. These factors, if not addressed, could limit the market’s full potential.

Future Opportunities in Ayush Alternative Medicines Industry in India

The Indian Ayush market presents significant future opportunities. Expanding into new international markets, leveraging technological advancements for personalized medicine, and capitalizing on the growing demand for preventative healthcare are key avenues for growth. The development of innovative product formulations, focusing on specific health conditions, and strengthening the supply chain will also drive expansion. Greater collaboration between researchers, manufacturers, and healthcare professionals will be vital for ensuring product quality and building consumer trust.

Major Players in the Ayush Alternative Medicines Industry in India Ecosystem

- Baidyanath

- Himalaya Wellness

- Hootone Remedies

- Hamdard

- GR Herbals

- Sydler India Pvt Ltd

- Ganga Pharmaceuticals

- Dabur India

- Lotus Herbal

- Patanjali Ayurved Limited

Key Developments in Ayush Alternative Medicines Industry in India Industry

- April 2022: Prime Minister Narendra Modi launched the AYUSH mark, enhancing product authenticity and quality. This initiative significantly boosted consumer trust and market growth.

- May 2022: The Ayurveda Company (T.A.C) launched its T.A.C Junior baby care range, expanding its product portfolio and tapping into a new consumer segment.

Strategic Ayush Alternative Medicines Industry in India Market Forecast

- April 2022: Prime Minister Narendra Modi launched the AYUSH mark, enhancing product authenticity and quality. This initiative significantly boosted consumer trust and market growth.

- May 2022: The Ayurveda Company (T.A.C) launched its T.A.C Junior baby care range, expanding its product portfolio and tapping into a new consumer segment.

Strategic Ayush Alternative Medicines Industry in India Market Forecast

The Ayush alternative medicines market in India is poised for sustained growth, driven by a confluence of factors: increasing health consciousness, favorable government policies, technological advancements, and a rising global interest in traditional medicine. The market is expected to experience significant expansion in the coming years, with opportunities for innovation and market diversification in both domestic and international markets. The forecast period (2025-2033) promises a robust expansion, driven by continued consumer demand and proactive industry developments.

Ayush Alternative Medicines Industry in India Segmentation

-

1. Type

- 1.1. Ayurvedic Medicine

- 1.2. Herbal Medicine

- 1.3. Aroma Therapy

- 1.4. Homeopathy

- 1.5. Acupuncture

- 1.6. Other Types

Ayush Alternative Medicines Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ayush Alternative Medicines Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Initiatives; Growing Awareness About the Effectiveness and Efficacy of Traditional Systems of Medicine; Increase in the R&D Activities

- 3.3. Market Restrains

- 3.3.1. Lack of World-class Treatment Centers; Lack of Health Insurance Approval and Scientific Validation

- 3.4. Market Trends

- 3.4.1. Ayurveda Segment is Hold Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ayurvedic Medicine

- 5.1.2. Herbal Medicine

- 5.1.3. Aroma Therapy

- 5.1.4. Homeopathy

- 5.1.5. Acupuncture

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ayurvedic Medicine

- 6.1.2. Herbal Medicine

- 6.1.3. Aroma Therapy

- 6.1.4. Homeopathy

- 6.1.5. Acupuncture

- 6.1.6. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ayurvedic Medicine

- 7.1.2. Herbal Medicine

- 7.1.3. Aroma Therapy

- 7.1.4. Homeopathy

- 7.1.5. Acupuncture

- 7.1.6. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ayurvedic Medicine

- 8.1.2. Herbal Medicine

- 8.1.3. Aroma Therapy

- 8.1.4. Homeopathy

- 8.1.5. Acupuncture

- 8.1.6. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ayurvedic Medicine

- 9.1.2. Herbal Medicine

- 9.1.3. Aroma Therapy

- 9.1.4. Homeopathy

- 9.1.5. Acupuncture

- 9.1.6. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ayurvedic Medicine

- 10.1.2. Herbal Medicine

- 10.1.3. Aroma Therapy

- 10.1.4. Homeopathy

- 10.1.5. Acupuncture

- 10.1.6. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North India Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Baidyanath

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Himalaya Wellness

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Hootone Remedies

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Hamdard

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 GR Herbals

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Sydler India Pvt Ltd*List Not Exhaustive

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Ganga Pharmaceuticals

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Dabur India

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Lotus Herbal

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Patanjali Ayurved Limited

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Baidyanath

List of Figures

- Figure 1: Global Ayush Alternative Medicines Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Ayush Alternative Medicines Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Ayush Alternative Medicines Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 5: North America Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ayush Alternative Medicines Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ayush Alternative Medicines Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 9: South America Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Ayush Alternative Medicines Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Ayush Alternative Medicines Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 13: Europe Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe Ayush Alternative Medicines Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 17: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 18: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Ayush Alternative Medicines Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Ayush Alternative Medicines Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Argentina Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Ayush Alternative Medicines Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Korea Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: ASEAN Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Oceania Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Ayush Alternative Medicines Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ayush Alternative Medicines Industry in India?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Ayush Alternative Medicines Industry in India?

Key companies in the market include Baidyanath, Himalaya Wellness, Hootone Remedies, Hamdard, GR Herbals, Sydler India Pvt Ltd*List Not Exhaustive, Ganga Pharmaceuticals, Dabur India, Lotus Herbal, Patanjali Ayurved Limited.

3. What are the main segments of the Ayush Alternative Medicines Industry in India?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Initiatives; Growing Awareness About the Effectiveness and Efficacy of Traditional Systems of Medicine; Increase in the R&D Activities.

6. What are the notable trends driving market growth?

Ayurveda Segment is Hold Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of World-class Treatment Centers; Lack of Health Insurance Approval and Scientific Validation.

8. Can you provide examples of recent developments in the market?

May 2022: The Ayurveda Company (T.A.C) expanded its product portfolio with the launch of an exclusive baby care range, T.A.C Junior, which comprises 100% Ayurvedic products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ayush Alternative Medicines Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ayush Alternative Medicines Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ayush Alternative Medicines Industry in India?

To stay informed about further developments, trends, and reports in the Ayush Alternative Medicines Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence